-

BTC demand from retail declined to a three-year low despite the recent rally.

Bearish sentiment on the derivative market could derail the recent recovery.

As a seasoned researcher with extensive experience in the crypto market, I have closely observed the recent trends in Bitcoin (BTC) and its retail demand. Despite BTC’s impressive rally to hit a record high of $73K in March 2024, I am concerned that the lack of retail participation could hinder the expected explosive run.

Despite reaching an all-time high of $73,000 in March 2024, more than doubling its value from the previous year, Bitcoin [BTC] has yet to generate significant retail interest.

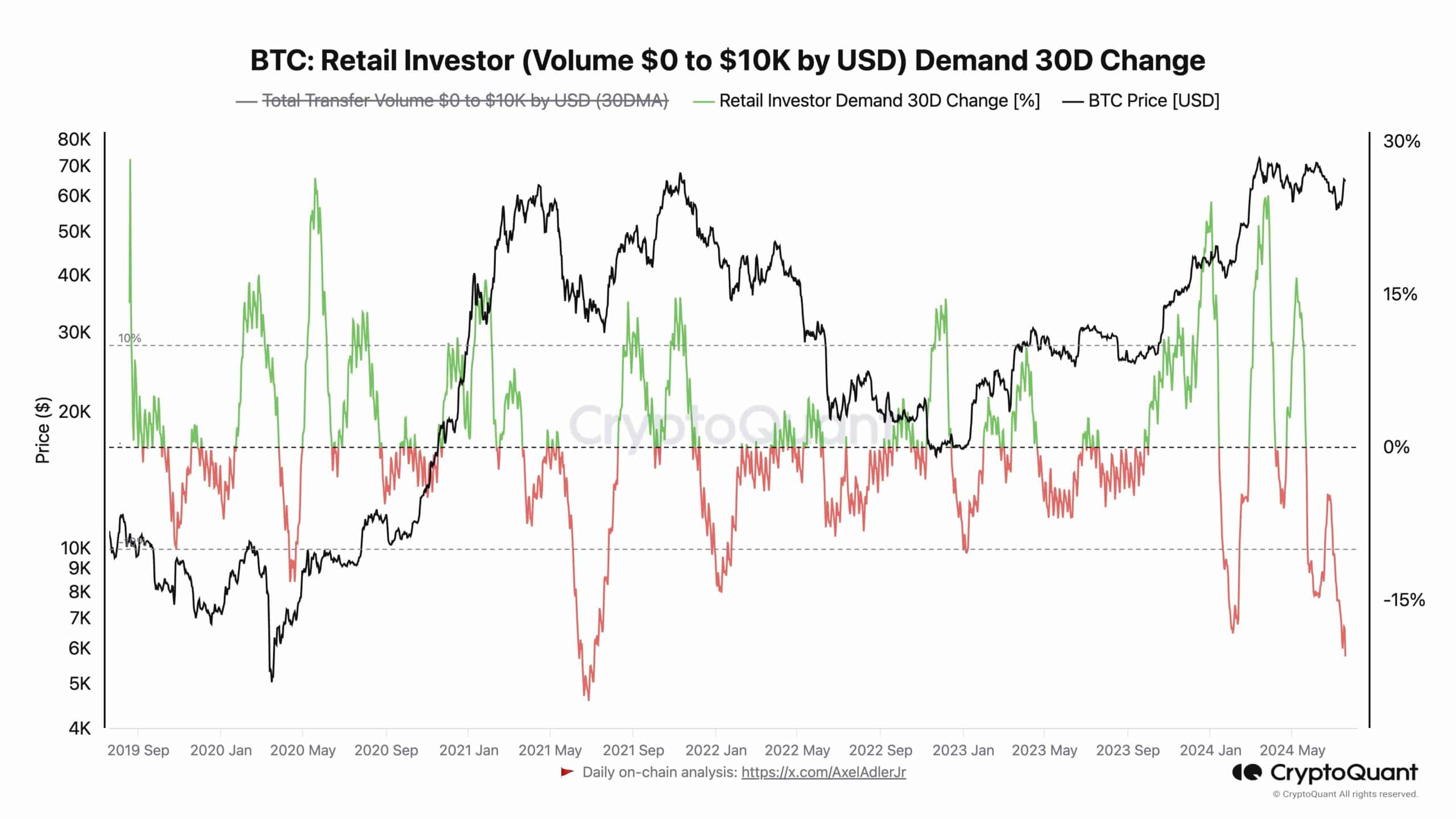

Based on the analysis conducted by CryptoQuant founder Ki Young Ju, I’ve discovered that the demand for Bitcoin (BTC) among retail investors has reached a three-year minimum.

The metric monitors the shift in Bitcoin’s small-value transfer activity within a 30-day span, reaching a record low of approximately 20% below average in early 2024, last observed in 2021.

As a researcher studying the cryptocurrency market, I’ve noticed some speculation among market observers that recent developments may have dampened the buying power of retail investors. This could potentially postpone the anticipated parabolic run for Bitcoin (BTC).

According to the graph’s data, the peak price of $69,000 for Bitcoin in 2021 was accompanied by a significant increase in retail investor participation, surpassing the 15% threshold.

During the early stages of the 2024 Bitcoin rally, a pattern akin to what had been seen before emerged when Bitcoins Exchange-Traded Funds (ETFs) became available. However, the absence of retail participation was a source of distress for Bitcoin optimists who had anticipated a spectacular price surge.

Could the expected late 2024 global easing and surge in liquidity drive back retail investors?

Perhaps, that could be a catalyst for retail, according to one market analyst, Coin Trader Nik.

As a crypto investor, I believe Nik was stating that exchange-traded funds (ETFs) significantly influenced the cryptocurrency market during the first half of 2024. However, for the second half, he anticipates global liquidity conditions to take the lead and drive market trends.

In simpler terms, the latter part of the discussion revolves around the expansion of global liquidity, while the trigger for mass participation in Bitcoin (BTC) is predicted to occur once its price surpasses the $100,000 mark.

Over the previous two months, more than 90% of interest rate forecasts from traders indicated an anticipated reduction in rates by September.

Should the Federal Reserve decide to reduce interest rates, it could lead to a surge in riskier investments such as Bitcoin. Several central banks have already taken this step, indicating a potential increase in global liquidity.

Based on the current market outlook, there is a predicted surge in Bitcoin’s value, potentially reaching between $80,000 and $100,000. According to data from prediction markets, the likelihood of Bitcoin reaching $100,000 by the end of 2024 is over 20%.

The odds of crossing the $80K level were higher at 57%, further reinforcing BTC’s bullish outlook.

Quinn Thompson, a cryptocurrency hedge fund manager at Lekker Capital, made an assertive prediction that the price of Bitcoin could reach $100,000 by November 2024.

All the above bullish targets are pegged on Trump winning the US presidential elections.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Meanwhile, BTC was up 11% on a weekly adjusted basis but traded below $64K as of press time.

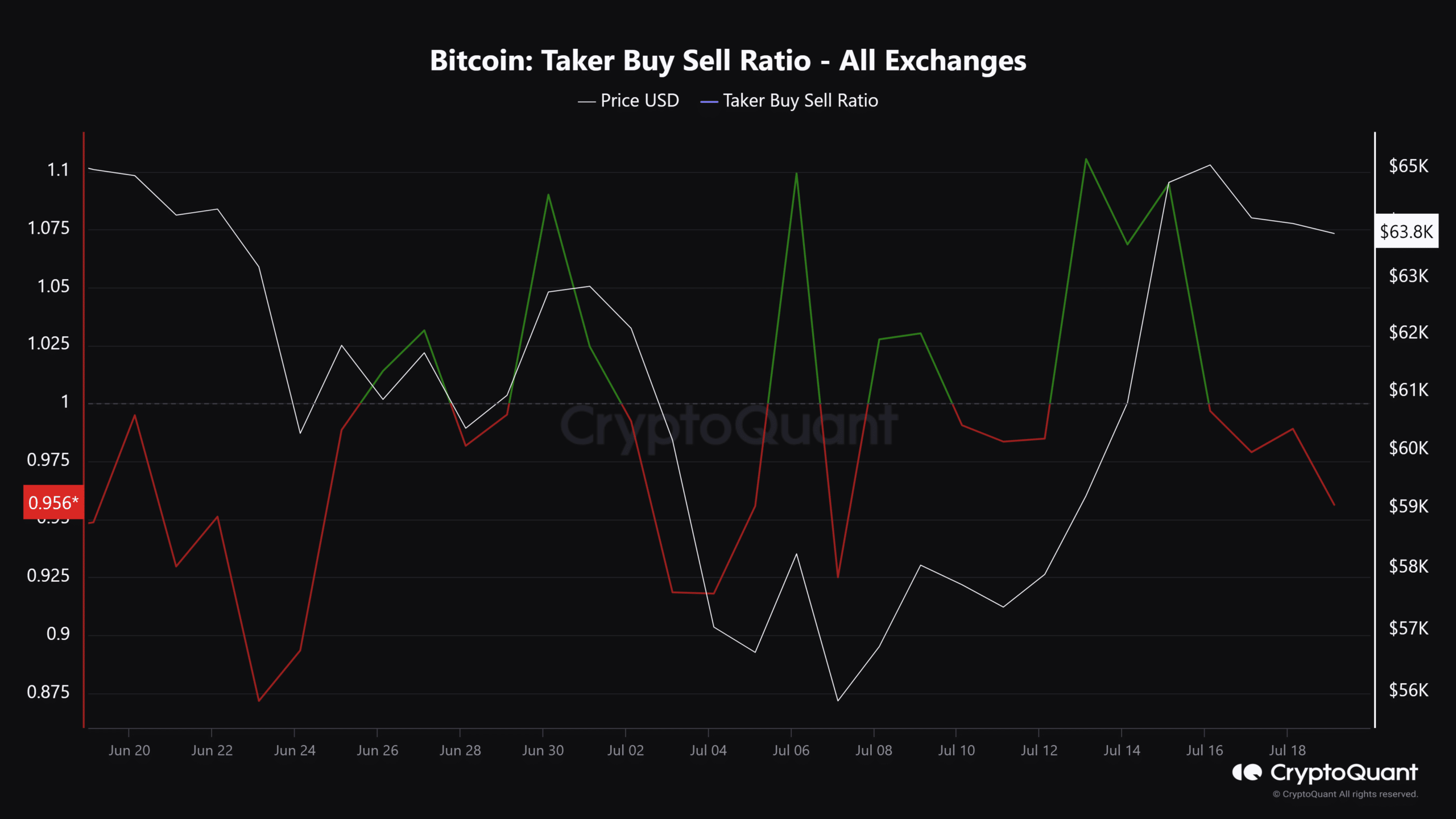

As a crypto investor, I’ve noticed the bearish atmosphere in the derivatives market, which is reflected in the negative Taker Buy Sell Ratio. This sign suggests that the price recovery above $60K might face more obstacles and could potentially halt or even reverse during the weekend.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- AUCTION/USD

- Kayla Nicole Raves About Travis Kelce: What She Thinks of the Chiefs Star!

- Shocking Truth Revealed: Is Cassandra Really Dead in Netflix’s Terrifying Mini-Series?

- `Tokyo Revengers Season 4 Release Date Speculation`

- How to Install & Use All New Mods in Schedule 1

- ETH/USD

- Solo Leveling Arise Amamiya Mirei Guide

- Jimmy Carr Reveals Hilarious Truth About Comedians’ Secret Competition on Last One Laughing!

2024-07-19 22:15