-

ETH Trust Fund accused of a $2 million rug pull.

Developers transfers funds and close social media accounts.

As a seasoned crypto investor with several years of experience under my belt, I have seen my fair share of scams and rug pulls in this space. However, the recent incident involving Ethereum Trust Fund DAO has left me feeling particularly disheartened.

Once more, the crypto sphere is shrouded in controversy. Lately, there’s been a surge in illicit activities within the realm of cryptocurrencies. Not long ago, the Indian digital currency exchange WazirX fell victim to a hacking incident, resulting in the loss of approximately $230 million.

Within this worrying pattern, Ethereum [ETH] Trust Fund has rugged investors of $2 million.

ETH Trust Fund rug pull

The ETH Trust Fund DAO, which functions on the Ethereum network, has recently gained notoriety for allegedly misappropriating approximately $2 million.

According to 0ctoshi’s announcement on their X platform (previously known as Twitter), the program turned out to be a fraudulent scheme, intending to withdraw funds from unsuspecting investors. Their statement disclosed this information via their platform.

Yesterday, the ETHTrustFund project, previously active under the handle @ethtrustfund_now (since deleted), transferred approximately $2 million from its treasury to a newly identified wallet. After a prolonged period of inactivity by the developer, it appears that he has made the decision to misappropriate these funds.

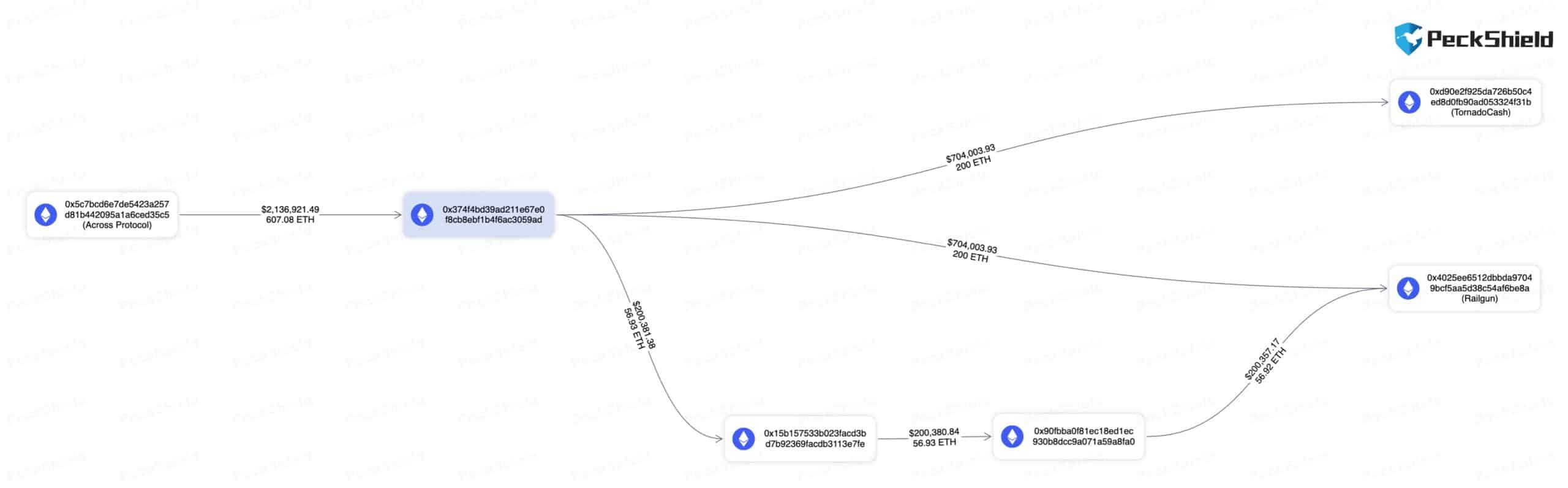

According to the security report from PeckShield, the developers initiated transactions to a newly created wallet.

Mixer apps were utilized by them to conceal their tracks, making it easier for them to carry out their theft activities. According to PeckShield’s report on their X page, this was the method they employed.

As a crypto investor, I’ve come to realize that my funds have unfortunately fallen into the wrong hands. The cunning scammers have managed to transfer the stolen assets to Ethereum’s network. Next, they employed two popular privacy solutions, Tornado.cash and Railgun, to launder the ill-gotten gains.

Following these transfers, the website went offline and deleted all social media accounts.

The details

The project portrayed itself to investors as being similar to OHM, leveraging the larger community of its base network to generate excitement.

From the outset, the initiative garnered significant financial backing from crypto enthusiasts due to their strong interest in memes and ETFs. At present, however, the project has disappeared without a trace.

As a researcher studying the development of this project over its operational phase, I’ve observed that it has pursued strategies similar to successful initiatives like Olympus and Wonderland. Based on available reports, investors are expected to receive ETF tokens as rewards for staking their assets via blockchain-bond investments.

This project aimed to distinguish itself from typical rebaseDAO models by adopting a unique strategy. Specifically, it involved debasing tokens, which in turn led to an expansion of the token supply and potentially yielded profits for investors.

Unfortunately, the project failed to achieve its objectives despite being overseen by Peng’s development team. Three months ago, they abruptly halted communication with the rest of the team.

Based on my extensive experience in the financial industry, I believe that the recent transfers and closure of all accounts represent the strategic goal developers had been striving for in their exit plan. This is a common tactic employed by those looking to leave a project or business under optimal conditions, allowing them to maximize their returns and minimize potential losses. It’s a calculated move, one that requires careful planning and execution – a skill I have witnessed firsthand throughout my career.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-07-23 16:07