- The crypto market is seeing mild recovery after prices across the board jumped higher on Tuesday.

- Aave has been an outlier this week, largely trading against the general market downtrend.

As a seasoned analyst with over a decade of experience navigating the volatile waters of the financial markets, I find myself intrigued by the resilience and agility displayed by Aave in these turbulent times. The crypto market’s recent recovery, while welcomed, has been a rollercoaster ride for many, but Aave seems to have mastered the art of staying afloat during stormy seas.

On the 5th of August, a widespread sell-off affected cryptocurrencies, but during the trading session that day, the price of Bitcoin [BTC] surpassed $56K.

Currently, Aave (AAVE) is being traded at $101, a slight dip from its daily peak of $106.92 as reported by CoinMarketCap.

After a turbulent week, crypto-linked stocks and international stock markets appear to be regaining their footing.

The revived optimism can be partly traced back to the renewed expectations of interest rate reductions by the Federal Reserve, following Monday’s worldwide market downturn that stirred worries about the American economy being under pressure from potential recession.

Aave protocol’s DeFi operational success

On August 5th, Stani Kulechov, a co-founder of Aave Labs, highlighted in a post on X platform that our protocol demonstrated resilience under market pressure across multiple Layer 1 and Layer 2 blockchain networks.

In a streamlined and decentralized manner, the lending system executed successful liquidations, generating an impressive $6 million for the Aave Treasury within a single night.

Circle cofounder Jeremy Allaire affirmed Stani’s take in a repost,

“DeFi always on, never sleeps, open networks, open-source protocols, auditable in real time.”

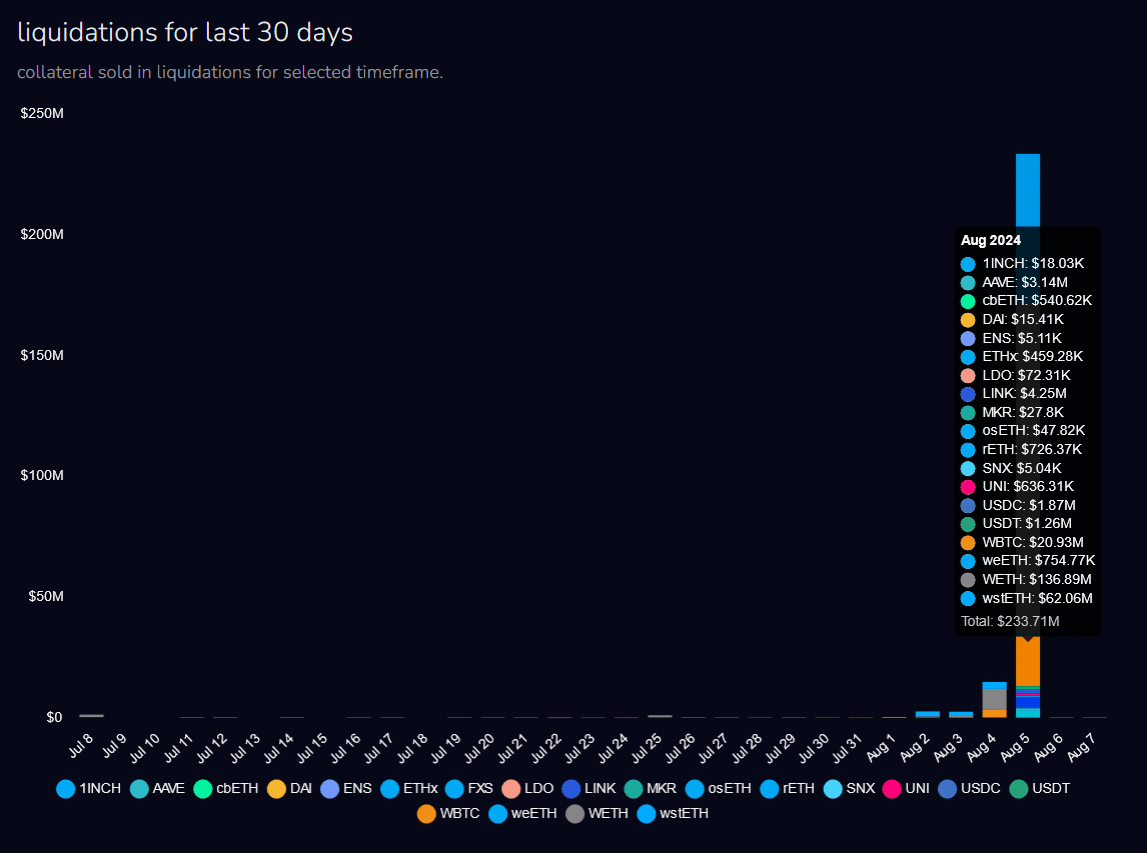

Over a span of three days from the 3rd of August up until the 5th, approximately $350 million in DeFi positions were forcibly sold off, as per information gathered by Parsec Finance.

On the 5th of August, Block Analitica’s decentralized finance (DeFi) risk intelligence platform reported a peak in liquidations on Aave amounting to approximately $234 million.

Presently, the Aave protocol is active on multiple platforms, such as the Ethereum primary network, Optimism, Arbitrum, Polygon, Base, Gnosis Chain, and BNB Chain.

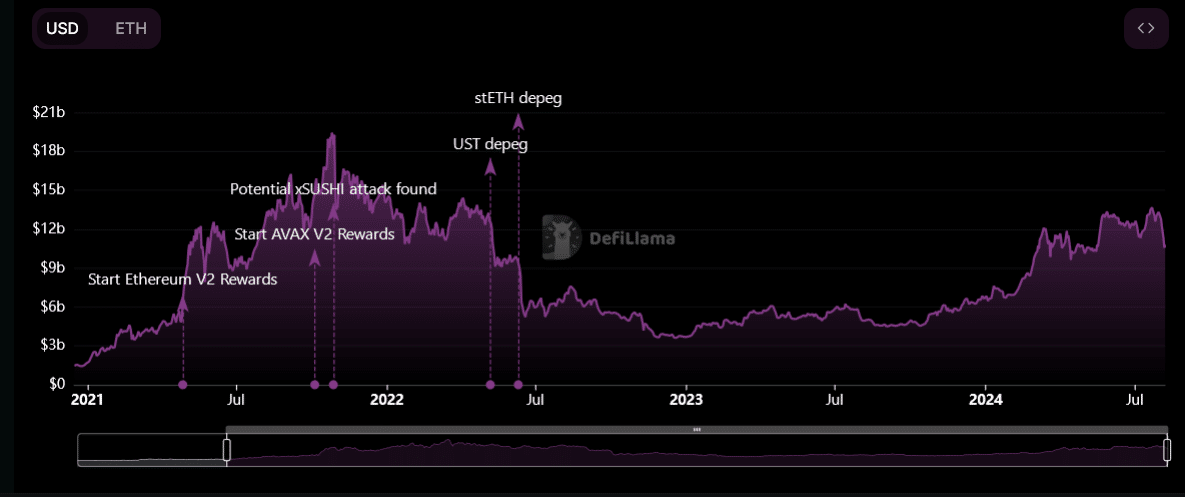

DeFiLlama data shows Aave had $10.8 billion in total value locked (TVL) at press time.

On Tuesday, the recovery of AAVE‘s governance token was particularly swift compared to many other tokens, thanks to these essential principles.

Milestones in July

On July 25th, the founder of Aave-chan Initiative, Marc Zeller, suggested implementing a ‘fee switch’ in the system as a method for redistributing fees to AAVE token holders. This would be done by purchasing AAVE tokens from the open market.

At the time of release, the newly introduced Lido V3 market – being the initial instance of custom deployment on Aave V3 – boasted a market value of approximately $250 million.

In a separate milestone, Aave Labs announced Aave V3.1 release going live on 31st July.

In April, BGD Labs proposed the update for Aave v3.1, discussing its activation on the community platform.

AAVE price outlook

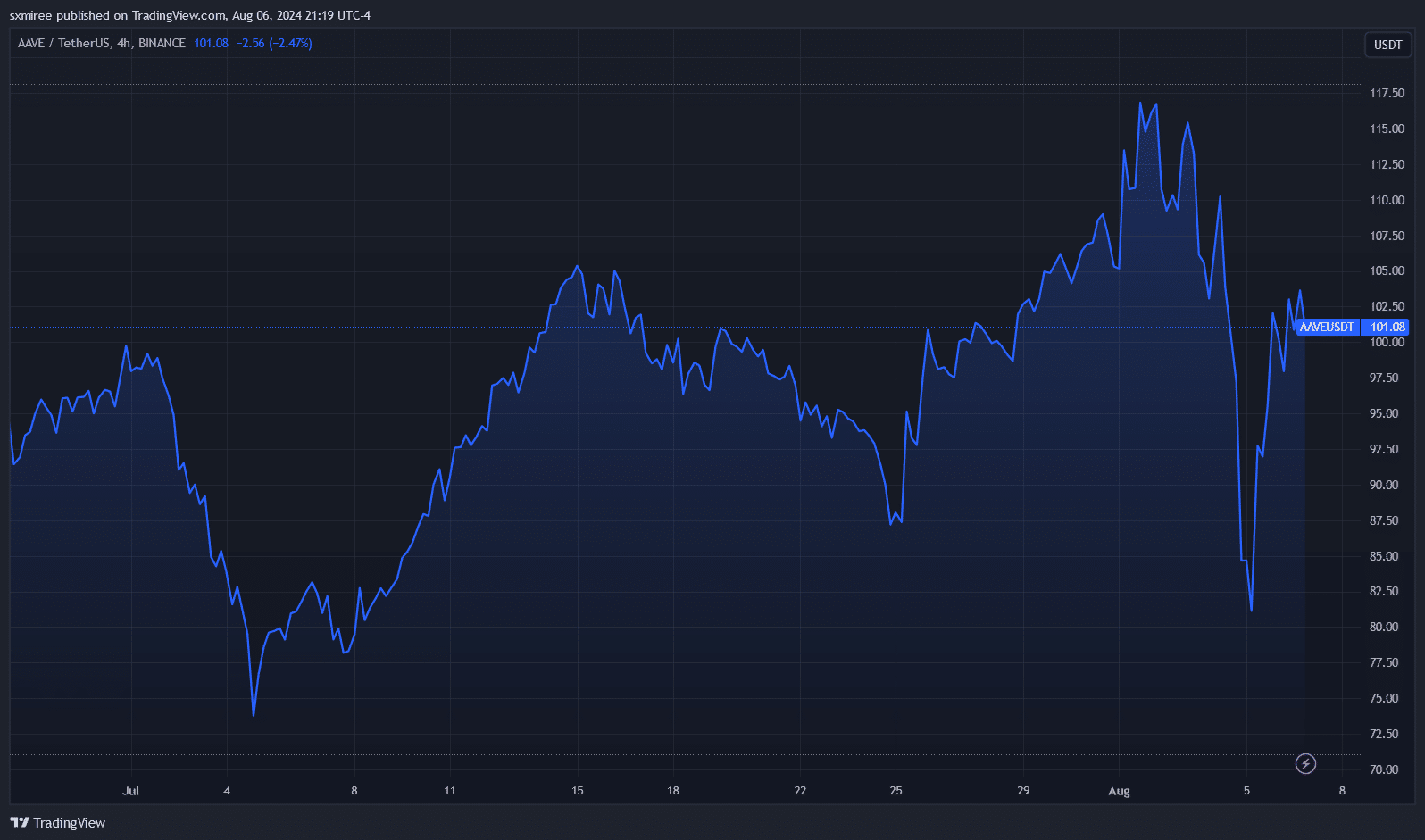

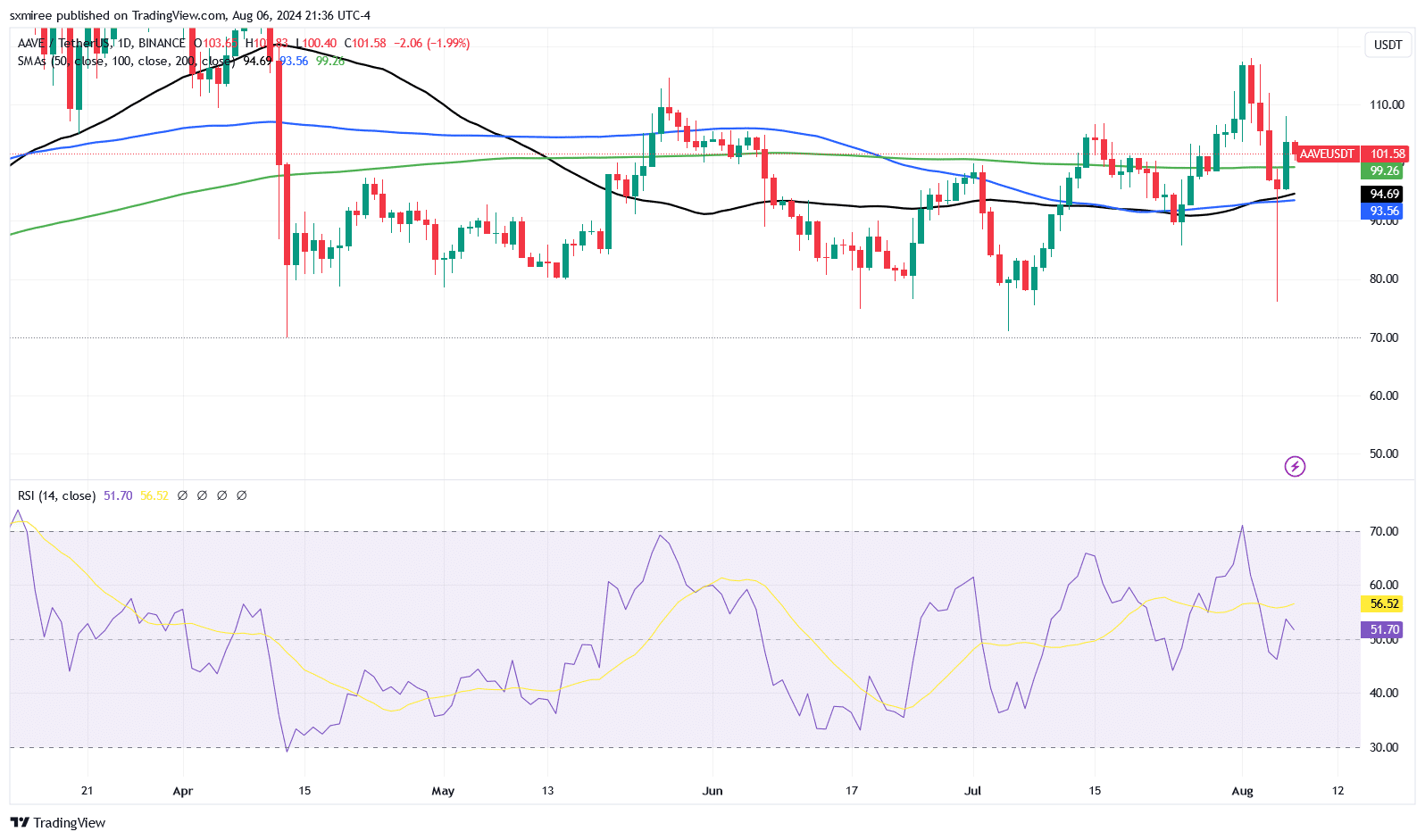

On the 3rd of August, AAVE dipped below $80, but by Monday, it regained the $100 level and has generally stayed above that mark since then. A rebound on Tuesday propelled the price past its 4-hour chart’s 50-, 100-, and 200-simple moving averages, but it could not sustain a position in the higher ranges.

On the daily chart, however, AAVE/USDT is ranging below all three averages.

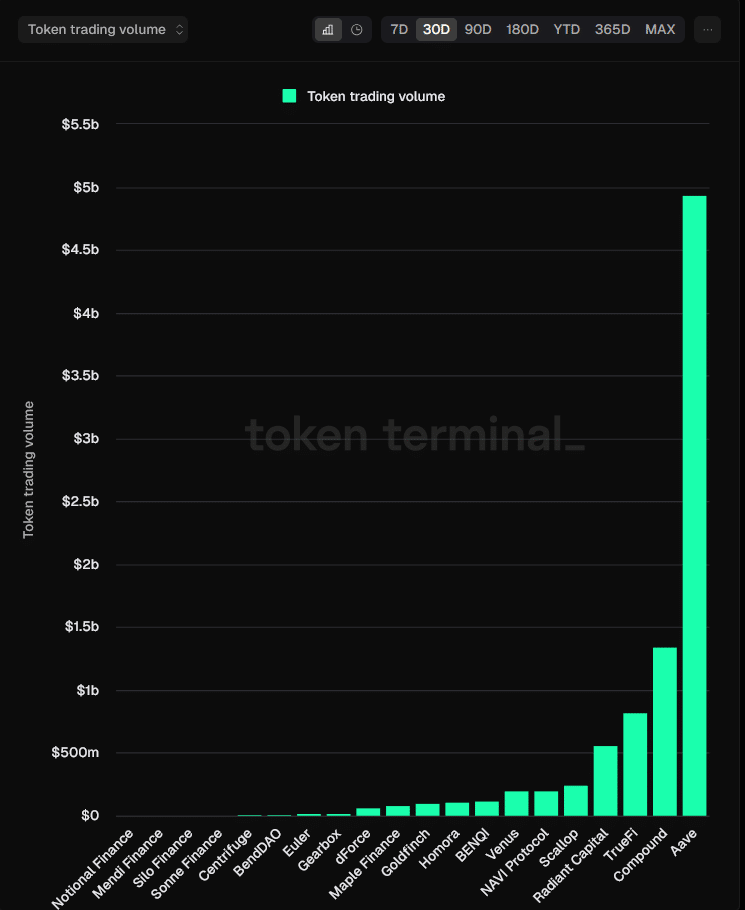

Data from Token Terminal indicates that Aave has been the most sought-after asset among market participants for the past month, boasting a substantial trading volume exceeding $4.9 billion within this timeframe.

As a crypto investor, I’m noticing that the Relative Strength Index (RSI) has returned to the 50-neutral mark, indicating a delicate equilibrium between buying and selling forces. This means it might be a good time to carefully consider my next moves in the market.

While it’s crucial to remember that cryptocurrency markets can be volatile due to cautious investor behaviors, any potential growth might be restrained by the widespread negativity currently present in the market.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- ETH/USD

- Shocking Truth Revealed: Is Cassandra Really Dead in Netflix’s Terrifying Mini-Series?

- Kanye West’s Wife Stuns Completely Naked at 2025 Grammys

- Disney’s Snow White Dwarfs Controversy: THR’s Shocking Edit Exposed!

- AUCTION/USD

- Solo Leveling Arise Amamiya Mirei Guide

- See Channing Tatum’s Amazing Weight Loss Transformation

- Fire Force Season 3: Release Date and Plot Revealed!

- How to Install & Use All New Mods in Schedule 1

2024-08-07 12:08