-

ETH faces sell-off fears after $2 billion in Ethereum transfer.

PlusToken ponzi scheme linked wallets have moved after 3 years

As a seasoned analyst with over two decades of experience in the financial industry, I have seen my fair share of market turbulence. However, the recent events surrounding Ethereum [ETH] have been particularly intriguing.

Over the past seven days, the crypto market has experienced some tough times. Just three days ago, it faced turbulence due to macroeconomic challenges, triggered by a market collapse in Japan and concerns about an economic downturn in the United States.

In the face of growing economic difficulties, Ethereum (ETH) has been particularly affected by external events like the surge of Jump Crypto and the PlusToken Ponzi scheme.

PlusToken’s $2b ETH transfer

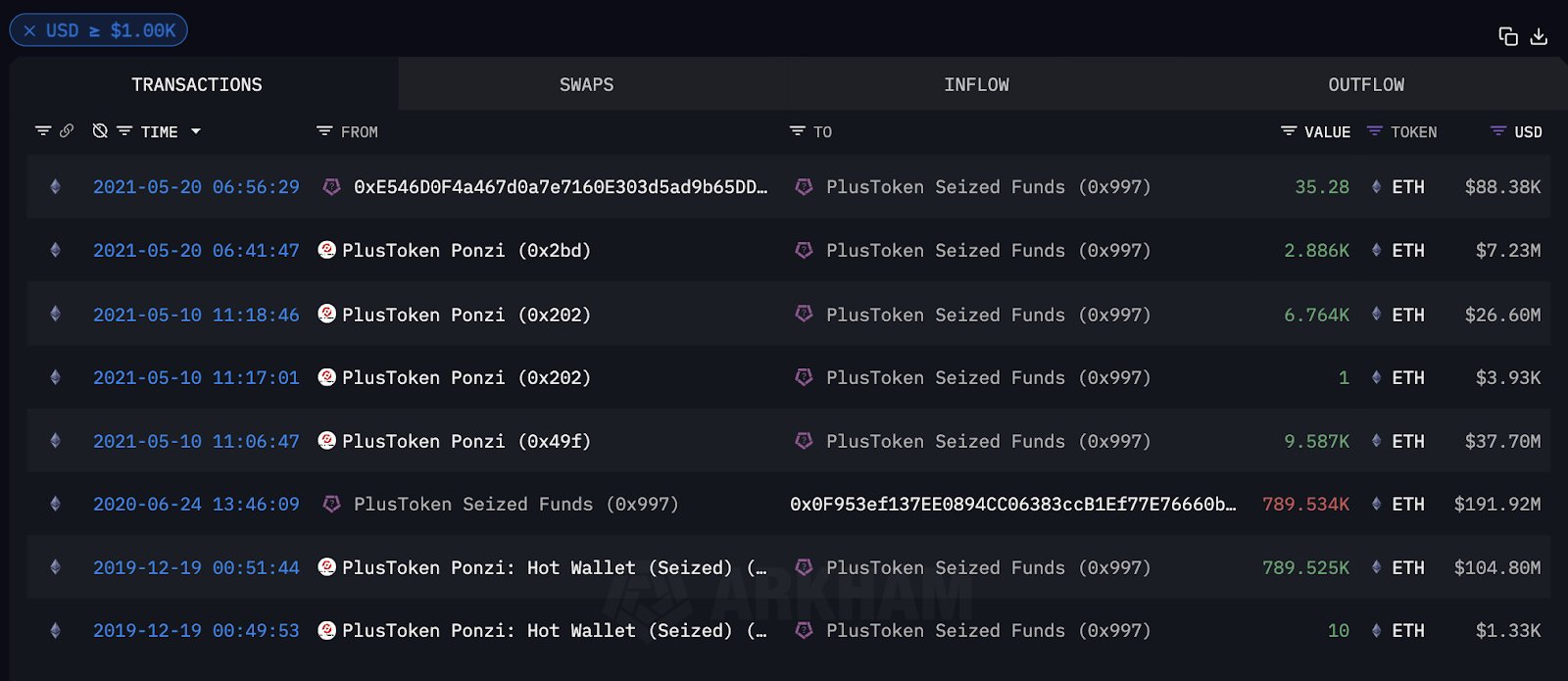

It’s been making news that Ethereum wallets linked to the PlusToken Ponzi scheme, active between 2018 and 2019 in China, are now reported to have been activated.

Authorities in China seized approximately $4 billion worth of cryptocurrency following the uncovering of a Ponzi scheme. After more than three years of inactivity, these digital wallets showed signs of movement for the first time.

Last year in 2020, Chinese authorities confiscated approximately 833,083 Ethereum (ETH), equivalent to around $2 billion based on current market values. This information was initially reported by Lookonchain, mentioning that numerous wallets linked to the PlusToken Ponzi scheme were found active. As a crypto investor, it’s essential to stay informed about such developments and exercise caution when investing in digital assets.

Instead, a different expert chose to address X to shed light on the matter, stating that the majority of the Ethereum (ETH) had been confiscated earlier. Now, approximately $63 Million in ETH is being transferred.

EmberCN clarified the reports through the X accounts, stating that,

Approximately located around 12 addresses that have received Plus Token-related ETH within the past 30 hours, accumulating a total of 25,757 ETH ($63.1M). Some of these ETH were not moved to Binance in 2021; others were withdrawn from Binance but not transferred to Huobi.

Nevertheless, Arkham Intelligence challenged the findings, emphasizing that over $450 million worth of Ethereum was transferred within the last 24 hours, as indicated by their data point X.

In the last 12 hours, over $450 million worth of funds, primarily Ethereum, has been transferred between more than 40 wallets linked to Plustoken.

The unsettling news along with contrasting accounts has caused unease among ETH investors, dealers, and experts, as they are concerned about possible increased selling activity.

The cryptocurrency Ethereum (ETH) has seen significant volatility after the stock market plunge on July 5th, hitting a bottom at approximately $2116. Although ETH hasn’t completely bounced back from the crash yet, rumors of a potential $2 billion ETH transaction have heightened market anxiety and sparked concerns about selling pressure.

Due to this recent news, there’s been a 4.56% drop in trading volume, now amounting to approximately $23.6 billion, and a decrease in market capitalization by 3.59%, currently standing at around $291.1 billion.

What Ethereum price charts suggest

Currently, Ethereum (ETH) is being exchanged at approximately $2,421 following a 3.35% drop in its daily value. Simultaneously, the market capitalization of ETH has decreased by 3.79%, now standing at $290.8 billion over the past 24 hours. Additionally, the trading volume has experienced a decrease of 4.05% during this same period.

Consequently, according to AMBCrypto’s analysis, it appears that the recent drop in prices isn’t just a result of the PlusToken incident, but rather a broader market correction.

At RVGI level of -3961, it indicates that the closing prices are significantly lower compared to the trading range, implying a robust downward trend or strong bearish pressure in the market.

The Relative Strength Index (RSI) stood at 26 as well, indicating a heavily sold-off area for Ethereum, suggesting it faced intense selling pressure.

At present, the Relative Strength Index indicates that the current selling might be excessive, hinting at an approaching price reversal. This situation could offer a good chance for traders to seize the falling prices, often referred to as “buying the dip.”

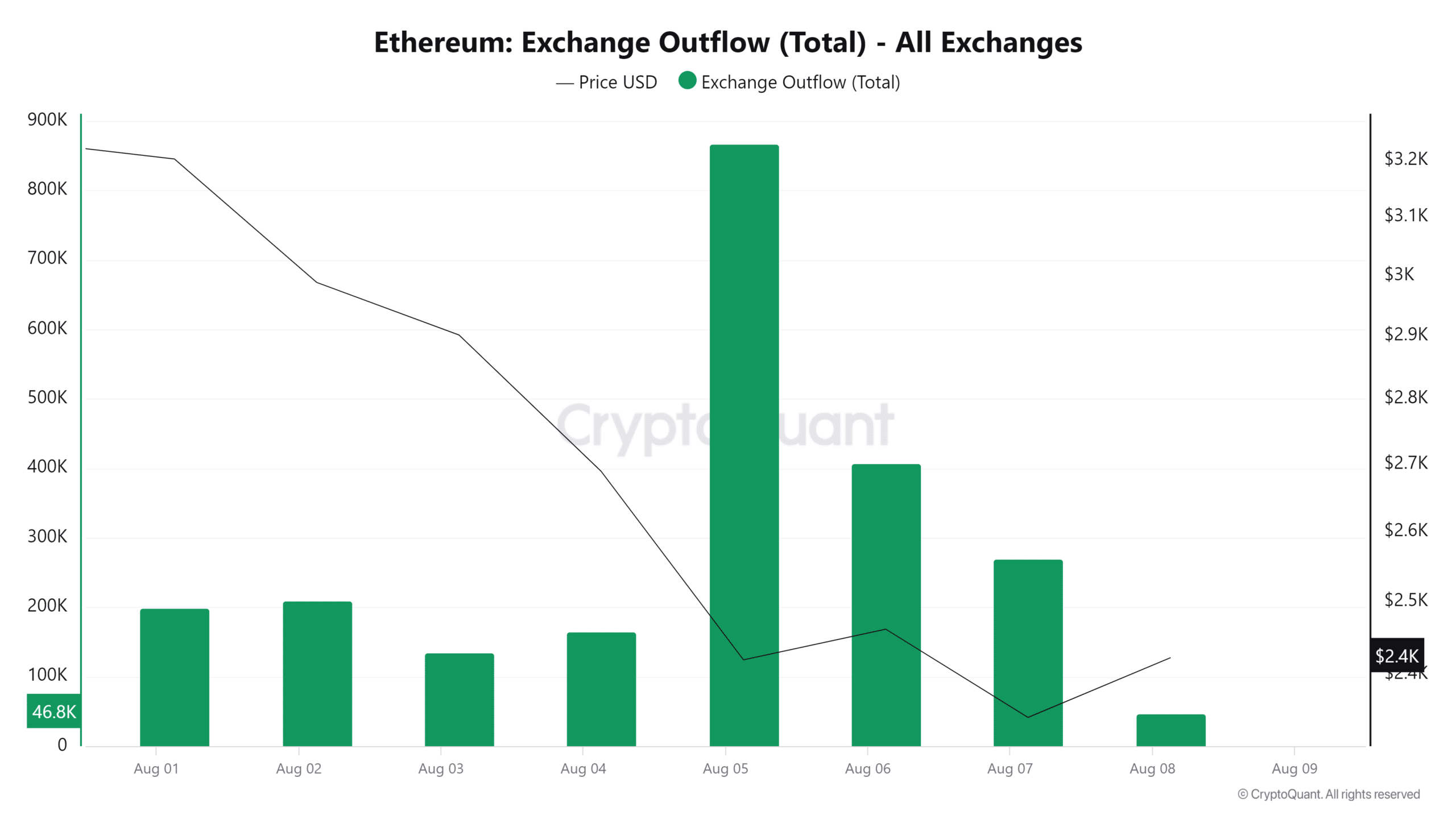

Upon closer examination, it appears that the outflow from cryptocurrency exchanges, as observed by Cryptoquant, has decreased in the last seven days. This could imply that traders are choosing to keep their holdings readily available for possible future sales.

Investor sentiments indicate a low level of trust in Ethereum’s future growth, leading them to hold onto the cryptocurrency in liquid form for quick sales.

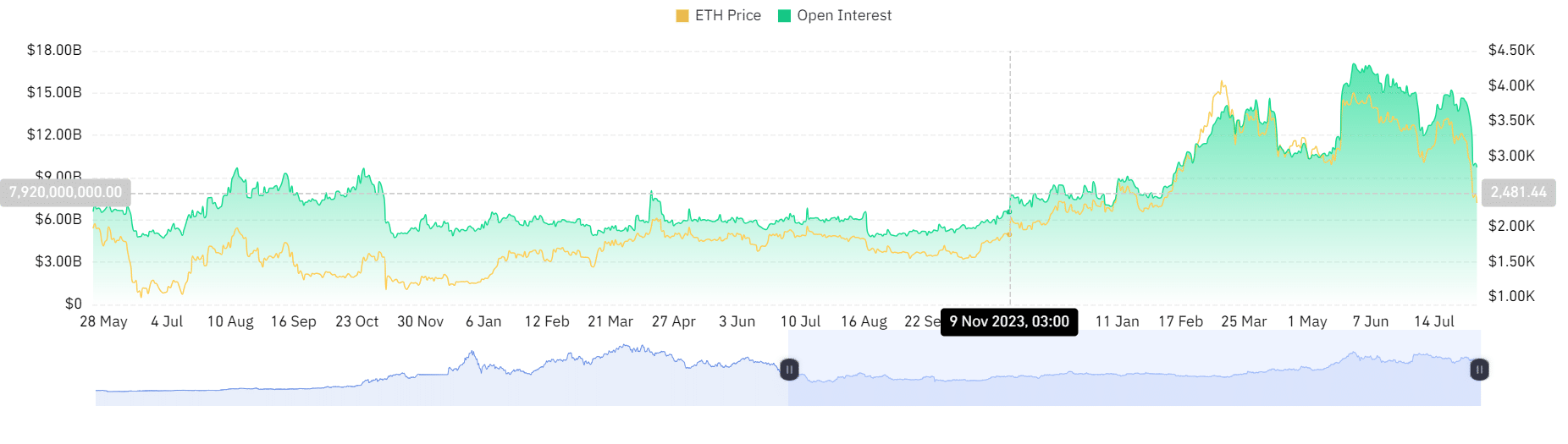

Furthermore, according to Coinglass data, the open interest for Ethereum has decreased during the last seven days. This figure has dropped significantly from its peak of $14.6 billion to now stand at $9.7 billion.

Read Ethereum’s [ETH] Price Prediction 2024-25

As a researcher, I’ve observed a decrease in open positions among investors, indicating they’ve been proactively wrapping up their existing commitments rather than entering into new ones based on recent news.

Consequently, even though the PlusToken Ponzi scheme has been transferring ETH, it’s important to note that Ethereum (ETH) has been trending downwards before these transfers took place. This suggests that the recent price action isn’t solely attributable to the movements of the PlusToken Ponzi scheme.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Disney’s Snow White Dwarfs Controversy: THR’s Shocking Edit Exposed!

- Jimmy Carr Reveals Hilarious Truth About Comedians’ Secret Competition on Last One Laughing!

- Kanye West’s Wife Stuns Completely Naked at 2025 Grammys

- Shocking Truth Revealed: Is Cassandra Really Dead in Netflix’s Terrifying Mini-Series?

- See Channing Tatum’s Amazing Weight Loss Transformation

- AUCTION/USD

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Benny Blanco and Selena Gomez’s Romantic Music Collaboration: Is New Music on the Horizon?

- Kim Kardashian’s Hilarious NSFW Confession Gets Silenced by Animal Noises!

2024-08-08 23:04