- Bitcoin rose to reclaim $62,000 on 8 August, but the price has since struggled

- On-chain indicators flashed positive signals, but a moving average crossover on the daily chart pointed to a looming setback

As a seasoned analyst with over two decades of market experience under my belt, I have witnessed numerous bull and bear cycles across various asset classes. The latest developments in Bitcoin are particularly intriguing given the conflicting signals we’re seeing from on-chain indicators and technical analysis.

On Thursday, a recovery took place in the cryptocurrency market, allowing prices to bounce back from their multi-month lows that were set following the crypto and stock market crash over the weekend. Interestingly, Bitcoin (BTC) even reached a high of $62,500 during its upward surge on Thursday.

On Friday, optimistic investors trying to maintain the previous day’s profits for Bitcoin found it challenging, as the leading cryptocurrency slid downwards instead.

Currently as I’m penning this down, the market situation suggests that buyers appear to be taking charge following the intense selling activity we witnessed earlier in the week. Yet, there’s a split opinion among analysts regarding whether the recent heavy losses were a deceitful bear trap or an indication of impending further drops.

On-chain analysis signals trend reversal

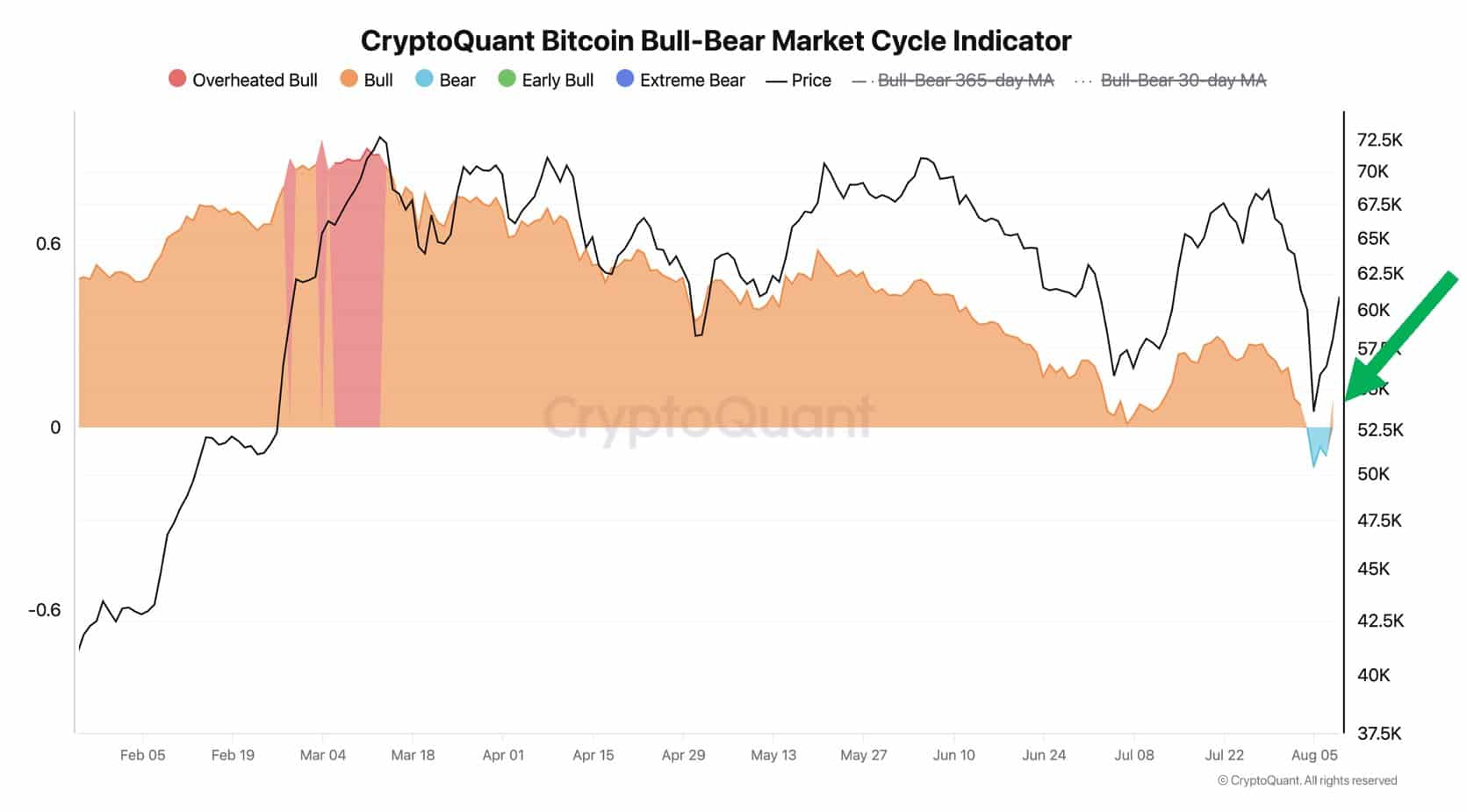

On-chain indicators suggest the market is mainly bullish, despite recent uncertainties.

CryptoQuant founder Ki Young Ju opined in a post on 9 August,

“The majority of Bitcoin’s on-chain cyclical signals, which were previously flirting with bear market territory, are now pointing towards an uptrend or a bullish market condition.”

As an analyst, I’ve noticed that Young Ju has highlighted a shift in Bitcoin’s bull-bear market trend, moving towards a bullish phase once more. This change seems to be triggered by Bitcoin’s swift recovery over the past 36 hours.

As a seasoned investor with over a decade of experience in the volatile world of cryptocurrencies, I have learned to keep a keen eye on market sentiment indicators. This week, when Bitcoin plunged to $49,751 on August 5th, the sentiment tracker I closely follow flashed red. It’s not my first rodeo with such steep declines in the crypto market, but it never gets easier to see the value of my investments drop so dramatically. However, I remain cautiously optimistic and believe that this could be a good opportunity for long-term investors like myself to accumulate more Bitcoin at a lower price.

BTC/USDT technical analysis

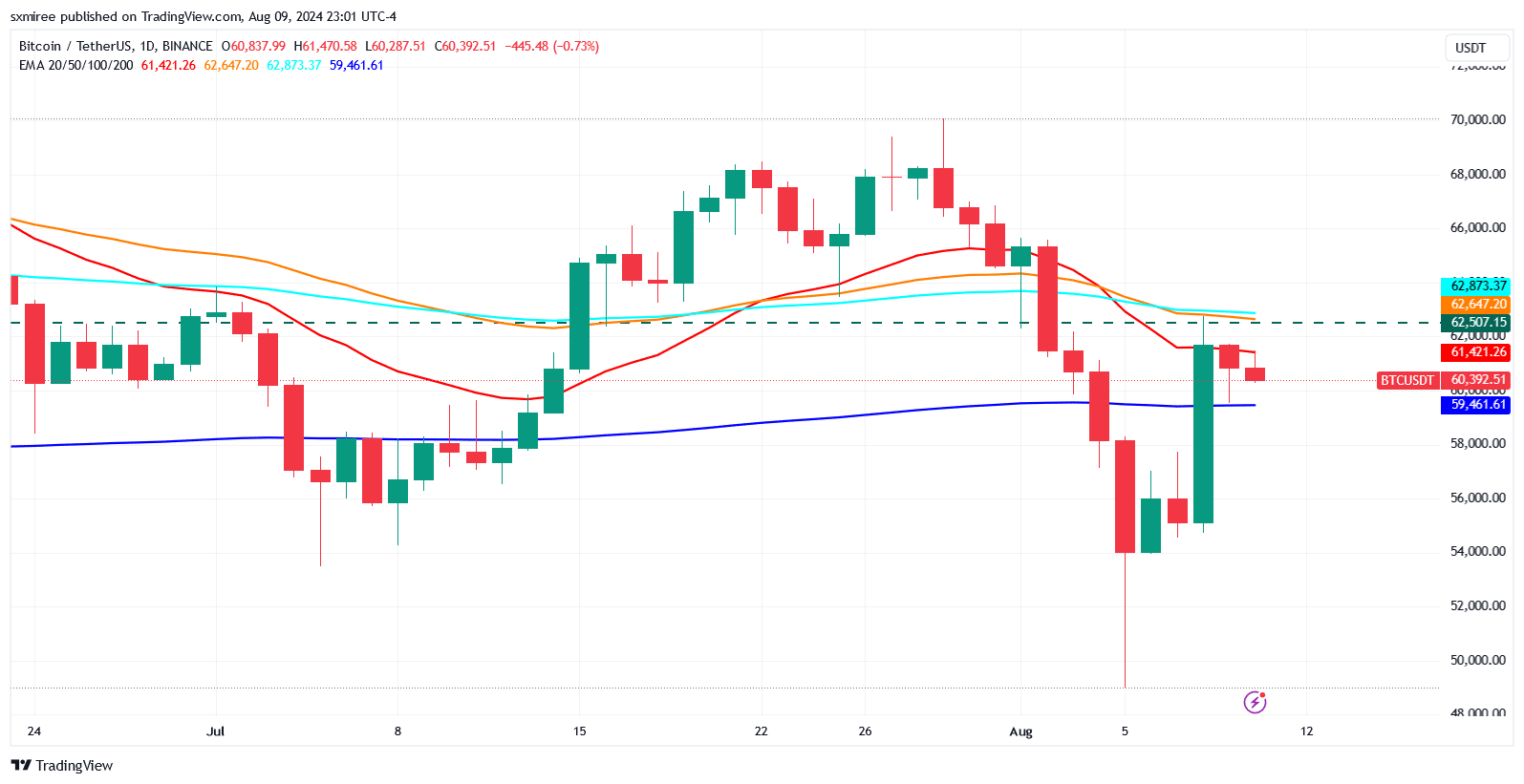

Bitcoin (BTC) enthusiasts are trying to establish a support level at approximately $60,000. If Bitcoin manages to climb out of its current price range, it could encounter selling pressure if it doesn’t surpass the resistance near the 100-day exponential moving average (EMA), which was around $62,873 at the time. This means that even if Bitcoin attempts to rise above its current levels, there might be sellers waiting to take advantage of any potential price increase, as the EMA acts as a significant barrier for further growth.

As a crypto investor, if Bitcoin fails to break through at its current level, it might lead us back to testing significant support at this week’s six-month minimum around $49,900.

It’s noteworthy that throughout the hourly chart, the Bitcoin-to-U.S. Dollar pair consistently stayed above a significant bullish trendline, providing support.

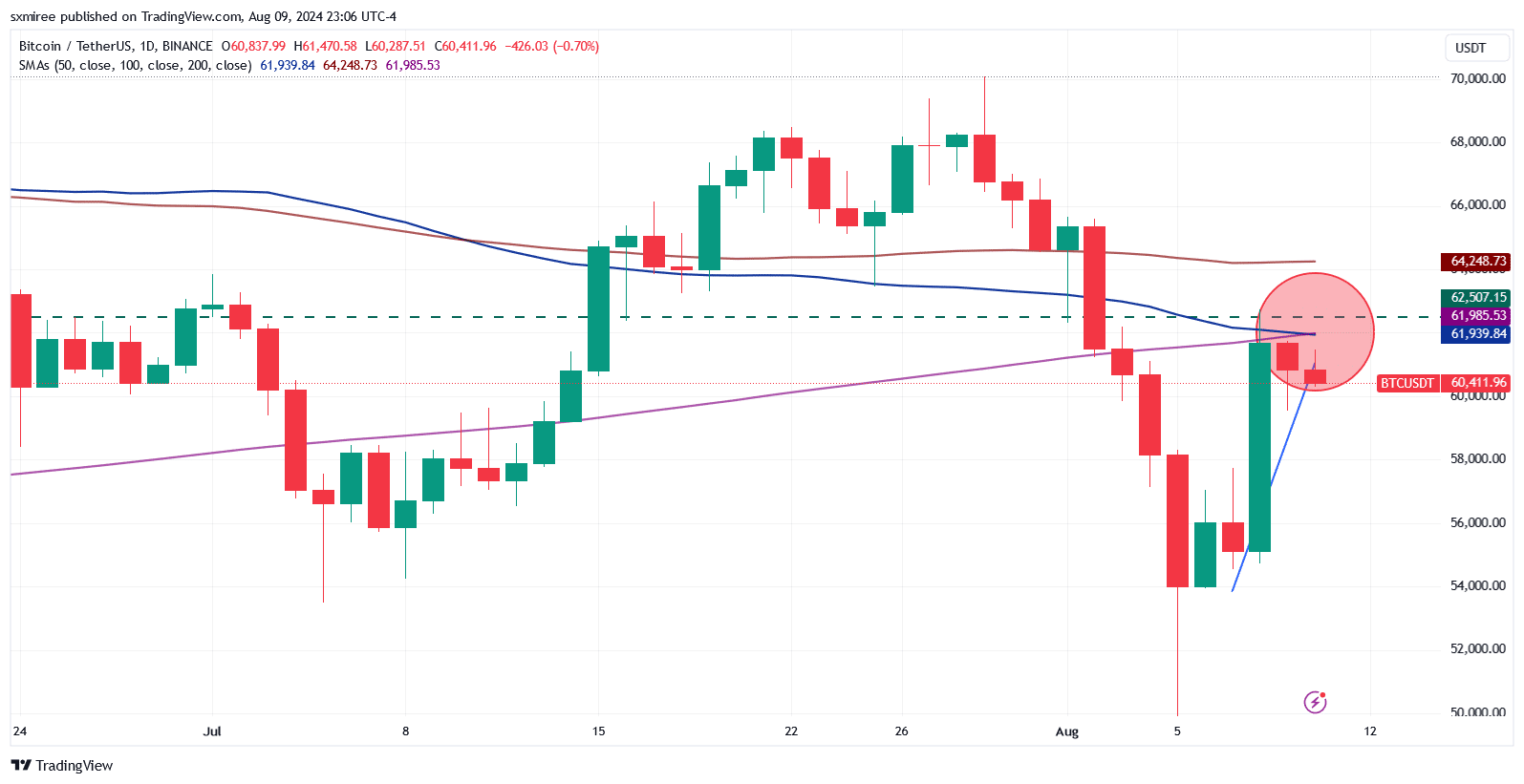

As a researcher studying cryptocurrency trends, I’ve observed an interesting development in the BTC/USD pair’s daily chart. Specifically, the downward-trending 50-day simple moving average (SMA) has dipped below the 200-day SMA, a phenomenon known as a ‘death cross’. This event typically indicates growing bearish sentiment and a potential increase in sell-offs because it occurs when a shorter-term moving average drops beneath a longer-term one.

The 50-day and 200-day SMAs stood at $61,939 and $61,985, respectively, at the time of writing.

While a death cross (when a short-term moving average falls below a long-term one) often signals a potential weakening in an asset’s recent price strength compared to its long-term trend, it doesn’t necessarily predict a continuous market decline.

More recently, when a death cross occurred (for example with Bitcoin), instead of diving into a longer bear market, the price chart showed minimal but positive increases.

Read More

- OM/USD

- Solo Leveling Season 3: What You NEED to Know!

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Kanye West’s Wife Stuns Completely Naked at 2025 Grammys

- ETH/USD

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Benny Blanco and Selena Gomez’s Romantic Music Collaboration: Is New Music on the Horizon?

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- White Lotus: Cast’s Shocking Equal Pay Plan Revealed

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

2024-08-10 09:12