-

Trading at around $60,000, BTC seemed to be on the verge of a death cross

Over $1.7 billion worth of BTC was withdrawn from exchanges despite the price decline

As a seasoned researcher with years of experience navigating the volatile world of cryptocurrencies, I find myself intrigued by these recent developments in the Bitcoin market. The price drop below $60,000 might have sent shivers down the spines of many novice traders, but for those with a keen eye and a long-term perspective, it presents an exciting opportunity.

Lately, Bitcoin experienced substantial drops in value, dipping under the $60,000 threshold – a region once considered secure and steady. This unforeseen plunge caused turmoil throughout the market as dealers and investors responded to this abrupt change.

Contrary to most investors in the market, those with significant holdings, known as ‘whales,’ seemed to be taking a different approach instead.

Bitcoin whales move against market trend

Lately, the fall in Bitcoin’s value has sparked varied reactions from traders and financiers. Some chose to dispose of their assets to cash in on gains or minimize losses, but there was also a conspicuous increase in buying among big-time investors, often referred to as “whales.”

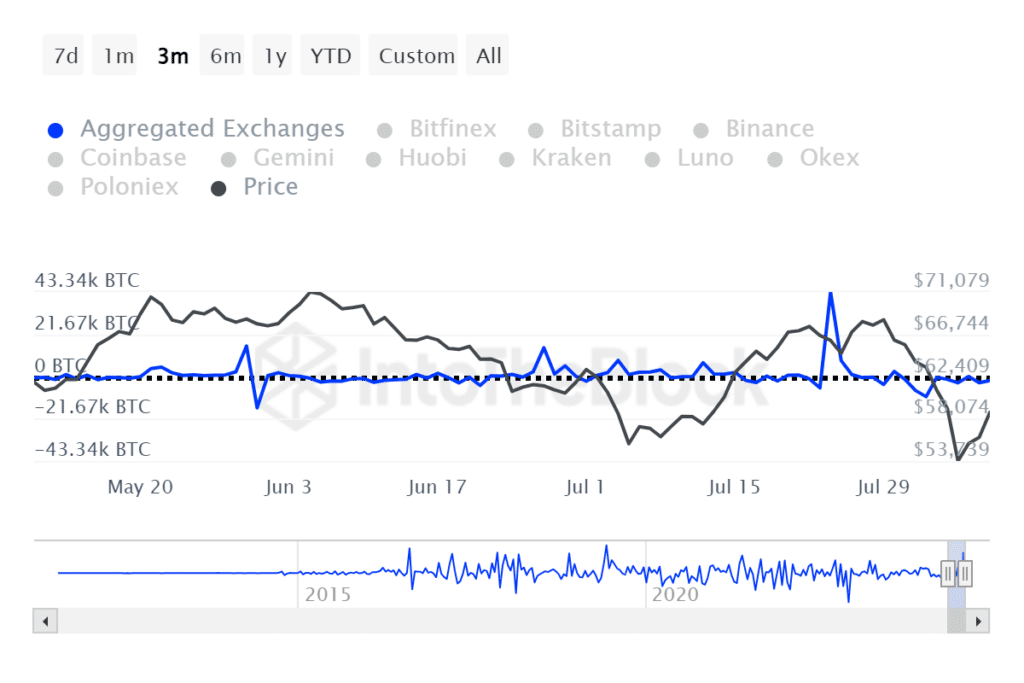

Over the last week, I’ve observed substantial Bitcoin movements away from exchanges, as indicated by Netflow data from IntoTheBlock. This massive outflow amounted to over $1.7 billion, marking the highest volume of such activity in more than a year. This significant shift suggests that a large portion of Bitcoin is being taken off exchanges.

These outflows are usually seen as evidence that investors are amassing assets, as they transfer their investments into personal wallets for long-term storage, not quick resale on exchanges.

What could this mean for the broader market?

As a seasoned investor with over two decades of experience in the stock market, I have seen my fair share of downturns and rebounds. Based on my observations, this current trend suggests that some investors remain confident even amidst the market’s decline. This is evident from the surge in buying activity as prices dip. These experienced investors view these lower prices as strategic opportunities to buy more shares, anticipating a long-term rebound. I too have learned over the years that market fluctuations are temporary and the key to success lies in making informed decisions during such times.

In simpler terms, persistent withdrawals (outflows) by large investors (whales) could maintain or even boost prices due to their accumulation. This pattern suggests optimism among powerful market participants who may counterbalance the current downward pressure, moving us towards a bullish market scenario.

Trend of Bitcoin balance on exchanges

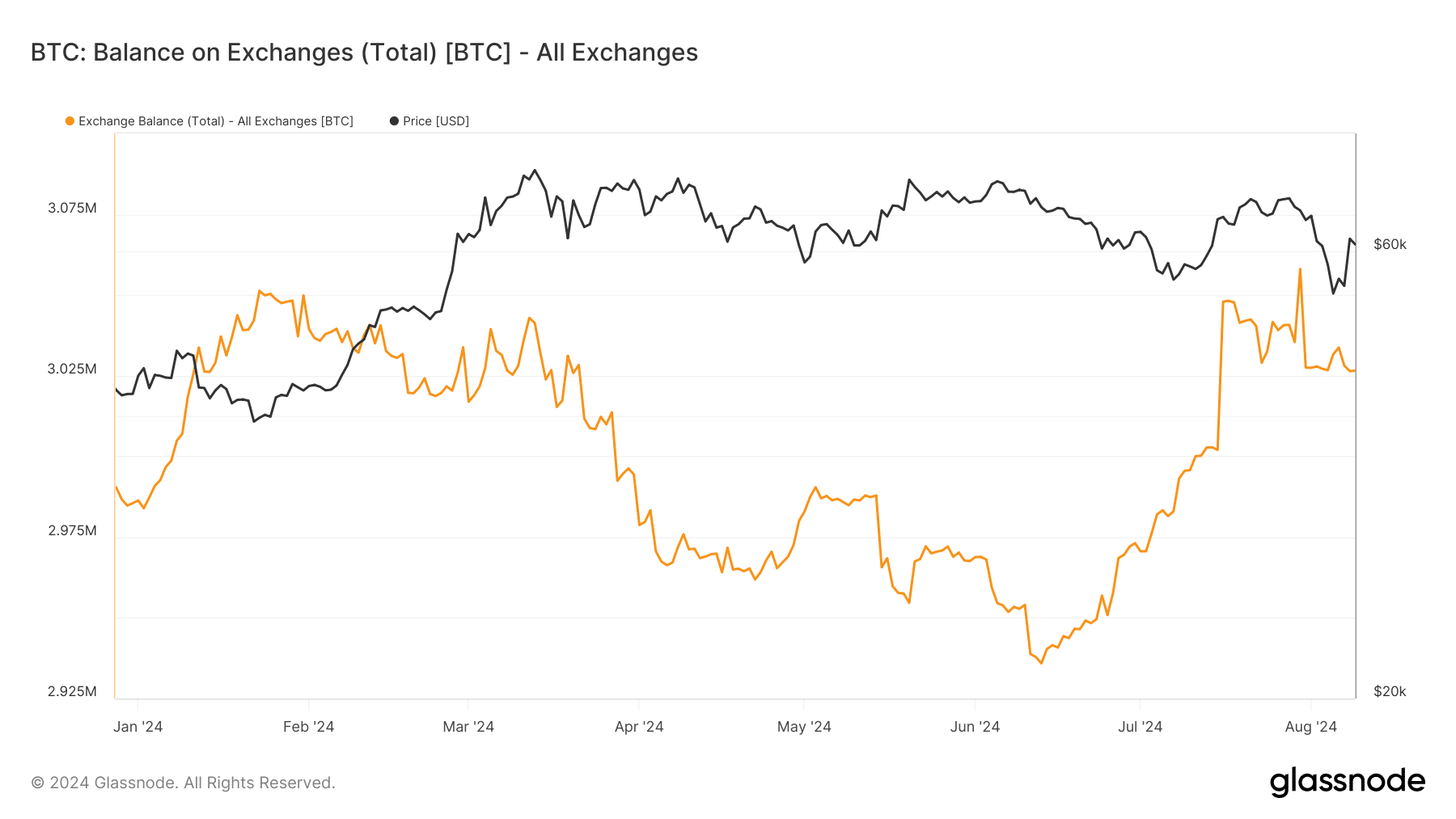

Over the past few weeks, an examination of Bitcoin’s exchange balances, as provided by Glassnode, has shown a substantial drop. For quite some time, the amount had remained close to 3 million, but recently, there’s been a steep decrease in the Bitcoins stored on these exchanges.

On the 30th of July, the Bitcoin balance was approximately 3.057 million. At the moment of reporting, it had dropped to about 3.026 million.

The decrease in Bitcoin held on exchanges matches up with recent Netflow analysis observations, suggesting that Bitcoin is being transferred off exchanges and away from them.

Such movements are generally interpreted as a sign of accumulation among investors.

MVRV shows negative trend

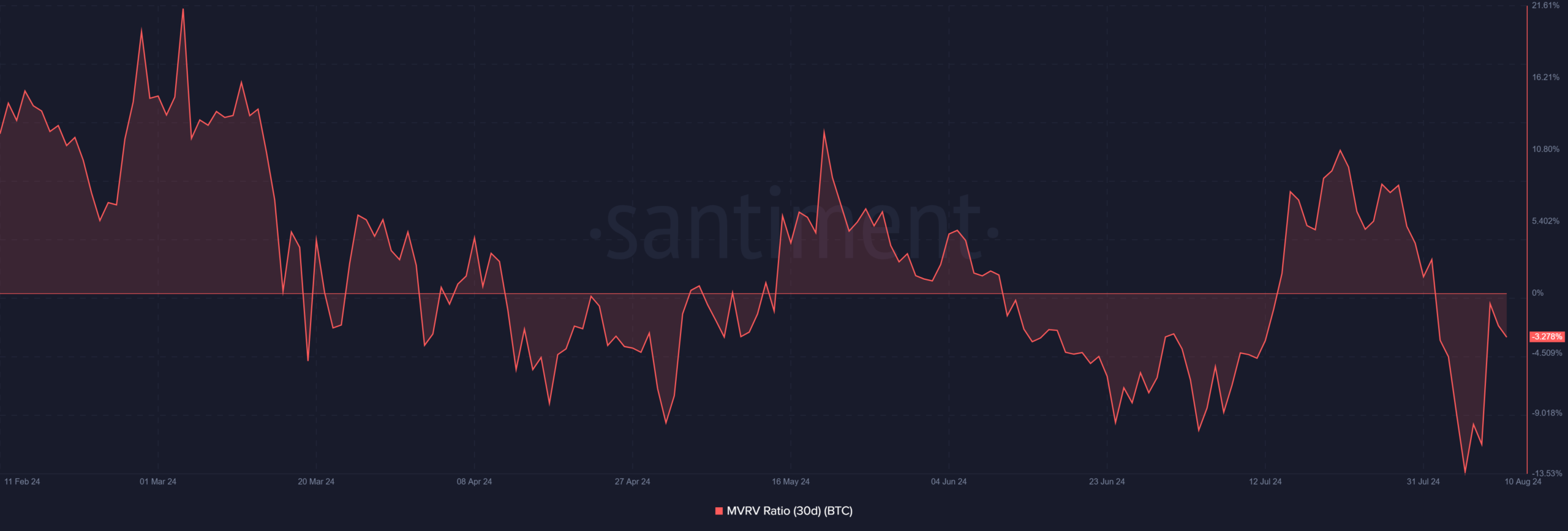

Ultimately, examining the MVRV ratio graph found that as of now, Bitcoin’s 30-day MVRV stood at a negative 3.278%, indicating a slight loss compared to the investor’s initial investment over the past month.

As a seasoned investor with over a decade of experience in the cryptocurrency market, I can confidently say that the negative value in the average holder’s balance over the past month suggests an opportunity for potential gains. This undervaluation could mean that Bitcoin (BTC) is currently underpriced compared to its true worth, which aligns with my personal observations of market trends and cycles. However, it is crucial to remember that investing always comes with risks, and it’s essential to conduct thorough research before making any investment decisions.

– Read Bitcoin (BTC) Price Prediction 2024-25

Historically, when MVRV levels are this low, it’s frequently considered a good time to buy. The graph mirrors the current pattern of big investors amassing Bitcoin in periods when the market is down.

In simpler terms, this suggests that there’s a growing trend among investors to buy more, as they expect the prices to rise again in the near future.

Read More

- AUCTION/USD

- Solo Leveling Season 3: What You NEED to Know!

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- `Tokyo Revengers Season 4 Release Date Speculation`

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- Is Disney Faking Snow White Success with Orchestrated Reviews?

- Stephen A. Smith Responds to Backlash Over Serena Williams Comments

- XRP/CAD

- AEW Fans Are Loving Toni Storm’s Uncanny Mariah May Cosplay From Dynamite

2024-08-10 22:16