-

AAVE remained in a bull trend at press time.

The asset will see a golden cross if the token maintains its price trend.

As a seasoned analyst with over a decade of experience in the crypto market, I find myself intrigued by the current state of AAVE. The recent dip is a common occurrence in this volatile market, much like how my morning coffee can sometimes be too hot to handle.

Last week, AAVE [AAVE] closed on a high note, exhibiting robust growth. Lately, though, there’s been a noticeable drop in its value over the past 24 hours.

Even though it has recently experienced a dip, signs point towards a potential increase in its price over the next week.

AAVE shows mixed signals

Based on AMBCrypto’s report, the value of AAVE was roughly around $112.37 yesterday, representing an uptick of more than 1.30% compared to the previous day.

In simpler terms, the shorter and longer average lines (represented in blue and yellow) were acting as strong foundations for the price, holding it up at approximately $99.86 and $97.67 respectively, indicating a robust foundation for its value.

In simpler terms, the Relative Strength Index (RSI) currently stands at 60.76, suggesting that the market is in a bullish phase but not yet showing signs of excessive buying (overbought), which usually occurs when the RSI exceeds 70. This means there could still be potential for the market to rise further before reaching overbought conditions.

In simpler terms, the Moving Average Convergence Divergence (MACD) value currently stands at 1.32, while its signal line is at 1.60. Both these lines are above the zero mark, indicating a positive trend.

However, despite these bullish indicators, data from CoinMarketCap showed that it was among the losers in the last 24 hours, having lost over 1%.

Lately, this asset has experienced a significant drop, placing it among the top losers, indicating either temporary market fluctuations or profit-taking. Surprisingly, AAVE continues to shine as the second-best performer over the last week, showing an impressive rise of 18%.

Nearing a golden cross

At the current moment, the Aave cryptocurrency appeared poised for an upward trend based on its chart analysis. The moving averages indicated a potential ‘golden cross’ formation might occur if the price kept climbing.

When the shorter-duration moving average surpasses the longer-duration moving average (forming what’s known as a “golden cross”), it often indicates a robust positive outlook or bullish trend in the market.

The key hurdle for AAVE‘s price advancement appears to be approximately $120, which has historically served as a psychological resistance point.

Should AAVE manage to surpass its current level, it might aim for approximately $130 – a price point that previously marked a peak. Additionally, this area could function as the upcoming potential barrier for further advancement.

Even though most signs point towards a continued uptrend (bullish indicators), as suggested by the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), it’s essential to remain vigilant for possible pullbacks or corrections in the market.

If AAVE experiences a price decrease, it may encounter potential support levels near the longer-term moving average priced at approximately $99.86 and the shorter-term moving average around $97.67.

If AAVE falls beneath its moving averages, it might indicate a transition towards a more bearish outlook. The value may then approach the $90 region, which previously served as a strong support level.

Holders enjoy profits

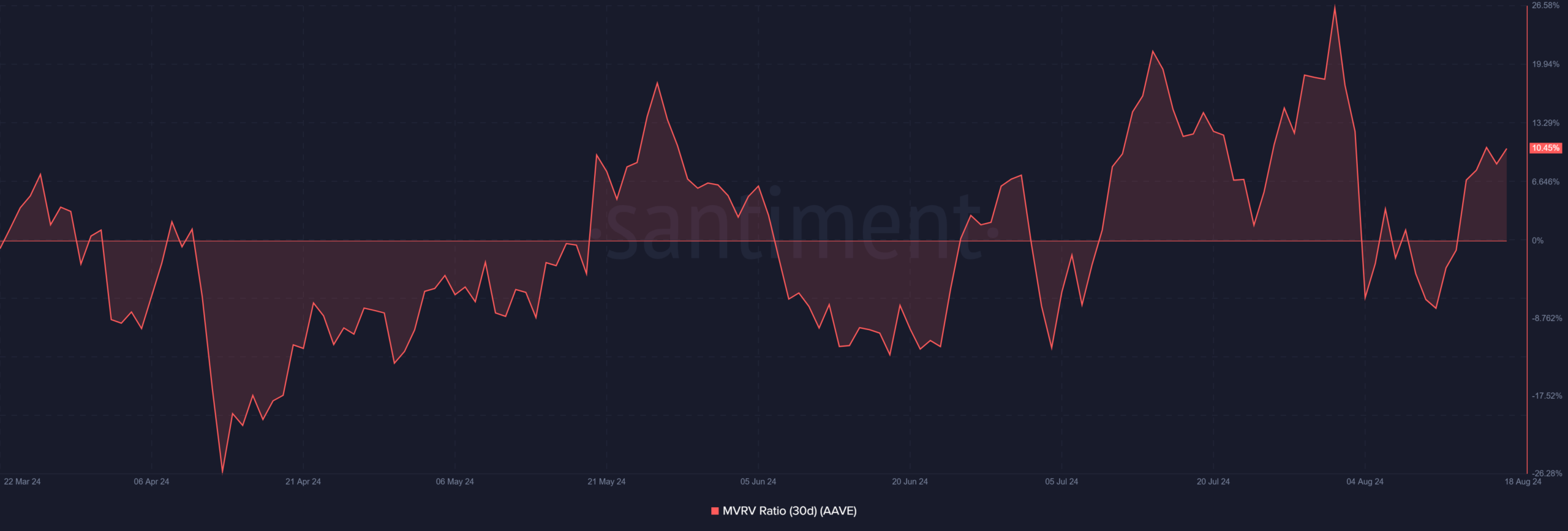

As an analyst, I’ve recently examined the 30-day Market Value to Realized Value (MVRV) ratio of AAVE. At this moment, it appears that holders are currently in a profitable position.

On the 13th of August, the MVRV (Market Value to Realized Value) ratio moved above zero and has been consistently positive since that date. Currently, according to Santiment’s latest data, the MVRV stands around 10.45%.

Realistic or not, here’s AAVE’s market cap in BTC’s terms

In the past 30 days, those who bought AAVE have seen an average return of more than 10% on their investment.

A high MVRM (Market Value to Realized Value) ratio often indicates optimistic market feelings. This implies that the present owners are not just making a profit, but they are also self-assured about the asset’s worth.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-08-19 02:16