- Bitcoin has reclaimed $60,000 amid a surge in OTC desk balances, indicating increased selling by miners.

- Analysts remain cautiously optimistic, despite mixed signals from network activity and large-scale transactions.

As a seasoned crypto investor with over five years of experience navigating the volatile waters of the digital asset market, I must say the recent surge in Bitcoin’s price to $60,798 and the rise in OTC desk balances has sparked mixed feelings within me.

In simpler terms, Bitcoin (BTC) appears to be bouncing back following a few weeks where it stayed below the $60,000 level, indicating some potential growth.

In simpler terms, Bitcoin, the top digital currency, has rebounded above a significant threshold, peaking at $61,830 in the last 24 hours before trading now at $60,798. This represents a 2% rise compared to its value from yesterday.

The rise in Bitcoin’s price has brought a feeling of ease among traders, as they had been worrying about its lack of growth in the past few weeks.

Bitcoin’s price surge aligns with a substantial advancement in one of its crucial indicators, potentially carrying significant ramifications for the market.

Rising OTC desk: What this means for BTC

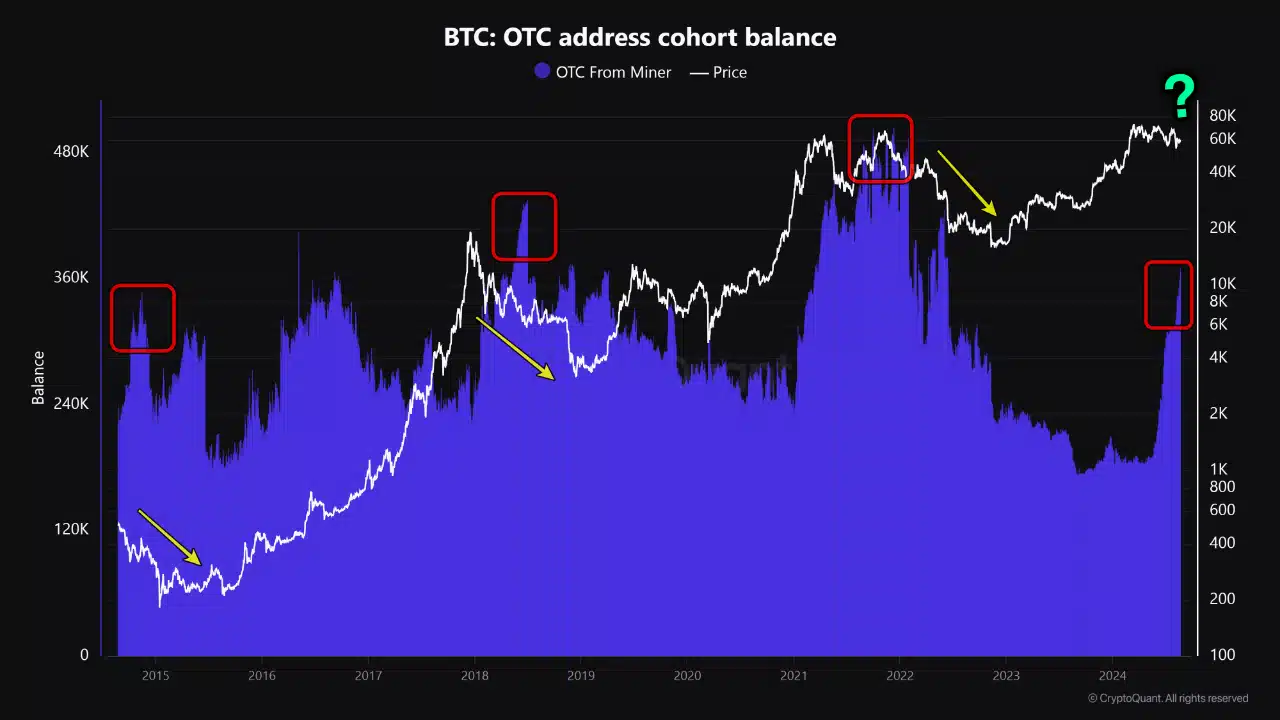

As per the latest findings from CryptoQuant, the amount of Bitcoin stored on Over-the-Counter (OTC) platforms has reached a two-year peak.

According to analyst ‘Ego Hash’, the quantities of Bitcoin being sold by miners to buyers via Over-the-Counter (OTC) transactions have experienced a significant surge, exceeding 70% in the last three months.

As an analyst, I’ve noticed a significant growth in the Bitcoin holdings at OTC desks. In June, the balance stood at approximately 215,000 BTC, but by August, this figure had climbed to 368,000 BTC. This represents an increase of around 153,000 BTC over the two months.

Since June 2022, the level of Over-the-Counter (OTC) trading activity has not been matched. An uptick in OTC desk balances is typically linked to heightened selling pressure from miners, a trend that has in the past been followed by falls in Bitcoin’s price.

Although some see a downside from the increase in over-the-counter trading balances, many cryptocurrency analysts and experts continue to express positivity regarding Bitcoin’s future possibilities.

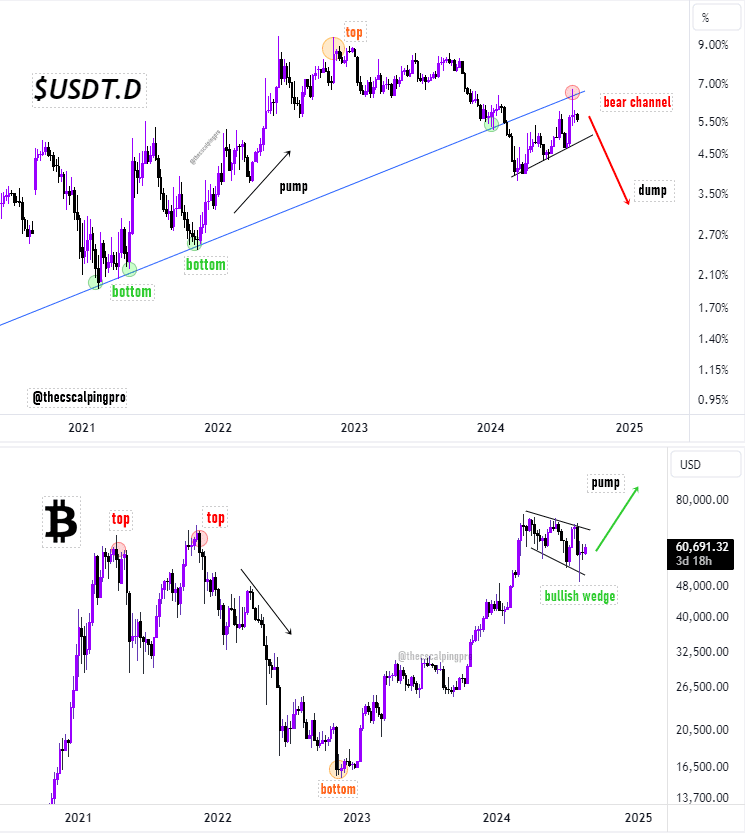

As a crypto investor, I’m excited to share some insights I picked up today from a well-respected analyst in our community, Mags. He’s forecasting a bullish trend for cryptocurrency X, indicating that Bitcoin could be on the brink of a substantial price surge.

Mag observed the reverse relationship between the influence of Tether (USDT.D) and Bitcoin (BTC). Highlighting the potential consequence of a recent break in USDT.D’s trendline support, he suggested that this could initiate a positive momentum or bullish progression for Bitcoin.

As suggested by Mags, under certain circumstances, Bitcoin might dramatically increase to around $72,000 or possibly beyond, in the coming short term.

Ready for the lift off?

Yet, while these optimistic forecasts are significant, they only scratch the surface of Bitcoin’s intricate foundations. A thorough examination of these fundamentals offers a more complete perspective on the present market situation.

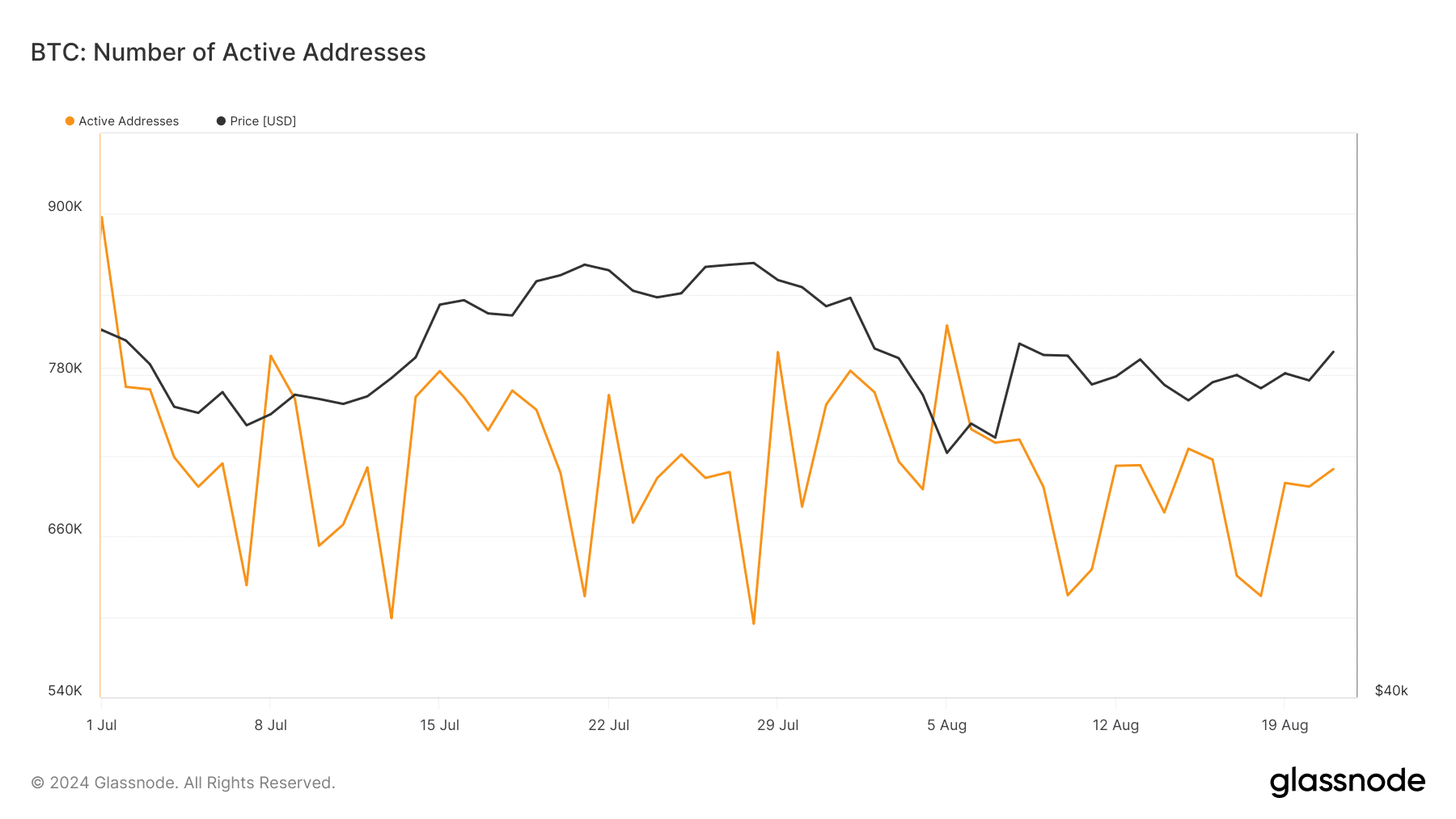

According to data from Glassnode, the number of active Bitcoin addresses – a crucial measure of network activity – has noticeably decreased during the last month.

Active addresses significantly decreased from approximately 900,000 on July 1 to a minimum of 594,000 on July 24. However, there’s been a recent surge, with the number of active addresses now exceeding 700,000 as we speak.

The increase in network activity indicates that users are once more showing interest in Bitcoin, following a time when its usage had decreased.

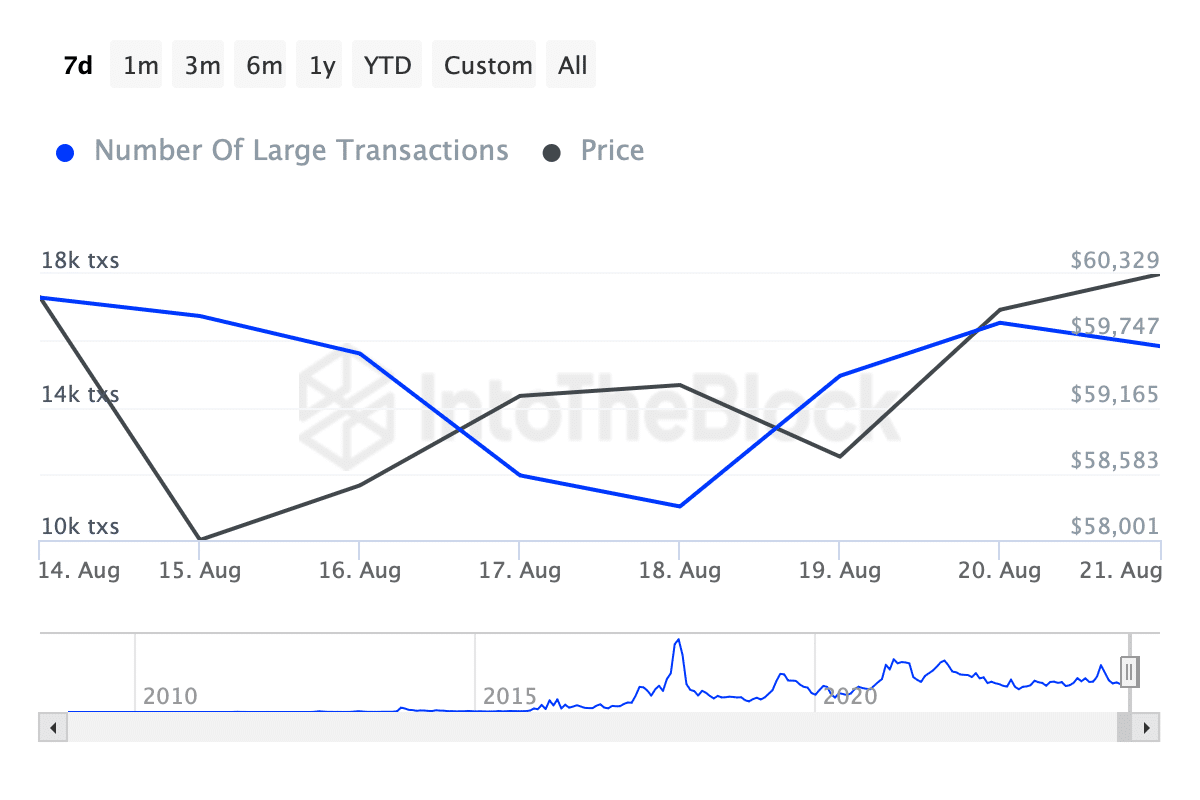

Besides the changes in network activity, significant transactions involving whales (transactions exceeding $100,000) have exhibited some variations as well.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As per data from IntoTheBlock, we’ve seen a minor decrease in the count of significant transactions during the last week. The number dropped from more than 17,000 to slightly less than 16,000.

Even though a drop might suggest some wariness from major investors, it doesn’t automatically mean there’s reason to worry, since the general market mood stays tentatively hopeful.

Read More

- OM/USD

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Solo Leveling Season 3: What You NEED to Know!

- Kanye West’s Wife Stuns Completely Naked at 2025 Grammys

- ETH/USD

- Shocking Truth Revealed: Is Cassandra Really Dead in Netflix’s Terrifying Mini-Series?

- White Lotus: Cast’s Shocking Equal Pay Plan Revealed

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Billy Ray Cyrus’ Family Drama Explodes: Trace’s Heartbreaking Plea Reveals Shocking Family Secrets

2024-08-22 17:44