As someone who has dabbled in the world of cryptocurrencies for quite some time now, I can vouch for the convenience and potential profitability that trading bots like the ones available on Telegram can bring to the table.

In simple terms, as the cryptocurrency market consistently advances, numerous investors seek resources to enhance their trading journey and safeguard their assets from the unpredictable nature of this market. A tool that has garnered attention lately is automated trading bots on Telegram platforms.

These automated crypto trading tools allow users to conduct trades instantly, utilizing the advantages of automation to anticipate fluctuations in crypto prices and adapt swiftly to market shifts.

How do trading bots on Telegram function, what are their advantages and disadvantages, and what are some well-known and commonly utilized examples of these projects?

What Is a Telegram Trading Bot?

A Telegram trading bot is a sophisticated program that works alongside the Telegram app to make cryptocurrency transactions simpler. These bots are crafted to assist traders in automating and simplifying their trades, eliminating the need for continuous manual control and monitoring. By linking to your crypto exchange account through API keys, these bots can carry out trades, manage portfolios, and deliver real-time market updates right within the Telegram platform, which is conveniently accessible on various types of mobile devices.

These bots are particularly attractive due to their adaptability and user-friendly nature. They can be tailored to accommodate various trading approaches, encompassing straightforward buying and selling instructions, as well as intricate algorithms for arbitrage and high-speed trading known as “sniper bot” operations.

As a seasoned trader with years of experience under my belt, I can confidently say that automated trading bots have revolutionized the way I approach the markets. Having used these tools across various platforms and blockchains, I’ve discovered an abundance of opportunities that would have been otherwise unattainable.

In essence, a Telegram trading bot functions as your dedicated trading companion, taking care of routine and time-critical trading duties, enabling you to concentrate on formulating strategies and making informed decisions. The automation of these tasks proves particularly valuable in the fast-paced cryptocurrency market, where swift reactions to market fluctuations can significantly impact outcomes.

How Do Telegram Trading Bots Work?

As a researcher, I find myself customizing my bot after establishing its connection, tailoring it to adhere to a particular trading strategy that’s responsive to specific market signals. This process may encompass basic tasks such as executing limit orders, where the bot buys or sells assets at predefined prices, or more intricate strategies like arbitrage, which capitalizes on price discrepancies between exchanges, and sniper bot tactics.

The bot on Telegram is always watching the market’s real-time fluctuations, examining price trends, trade volumes, and various other signals. Whenever it spots a chance that fits your approach, it swiftly carries out transactions, avoiding the slowdowns typical of manual trading due to delays.

Telegram trading bots serve as tools that provide users with immediate updates and alerts concerning market fluctuations, completed transactions, and other important details. These updates are transmitted via the Telegram application, ensuring users remain informed even when they’re not at their computer. Additionally, certain bots come equipped with comprehensive analytics and performance reports, facilitating improvements in trading strategies over time.

One captivating aspect of Telegram trading bots is their flexibility for customization. Users can adjust the bot’s behaviors according to their unique trading objectives. This might involve copy trading, setting protective stop-loss limits to manage risks, or participating in rapid trades across various blockchains and numerous exchanges.

The fundamental building block of these trading bots is automation, enabling them to function autonomously after setup. Not only does this save time, but it also minimizes the emotional influence a user might have on their trading choices since decisions are based on data and predefined rules rather than momentary impulses or fear.

Telegram Trading Bots – Pros and Cons

Pros

- They work based on automation – Telegram trading bots automate the trading process, eliminating the need for constant monitoring and manual order placement;

- Access to advanced trading strategies – Trading bots can execute complex trading strategies that might be difficult or time-consuming to perform manually. For instance, arbitrage bots can simultaneously monitor and execute trades across several exchanges;

- 24/7 Market Monitoring – The cryptocurrency market operates 24/7, and Telegram bots ensure you never miss an opportunity, even while you’re asleep. The bots can monitor market conditions around the clock and execute trades whenever your preset conditions are met;

- Easily customizable and surprisingly flexible – With Telegram trading bots, you can customize the bot’s actions to fit your specific needs and goals, whether focusing on long-term investments, high-frequency trading, or copy trading strategies. The flexibility of these bots makes them suitable for traders of all experience levels;

Cons

- Security risks – While Telegram trading bots offer a surprising level of automation, they also come with some potential security risks. Granting bot access to your crypto exchange account through API keys means your account could be vulnerable if the bot’s security measures are compromised;

- It implies a steep learning curve – Setting up a Telegram trading bot can be complex, especially for beginners. You may need some technical knowledge to fully understand how to connect the bot to your crypto exchange account properly, configure API keys, and set up trading strategies;

- Pretty high costs and fees – Some Telegram trading bots charge subscription fees, take a percentage of profits, or require payment for advanced features. These costs can increase, so it’s recommended to weigh the potential benefits against the costs before committing to such a tool.

How to Use a Telegram Trading Bot

Getting started with a Telegram trading bot is pretty straightforward.

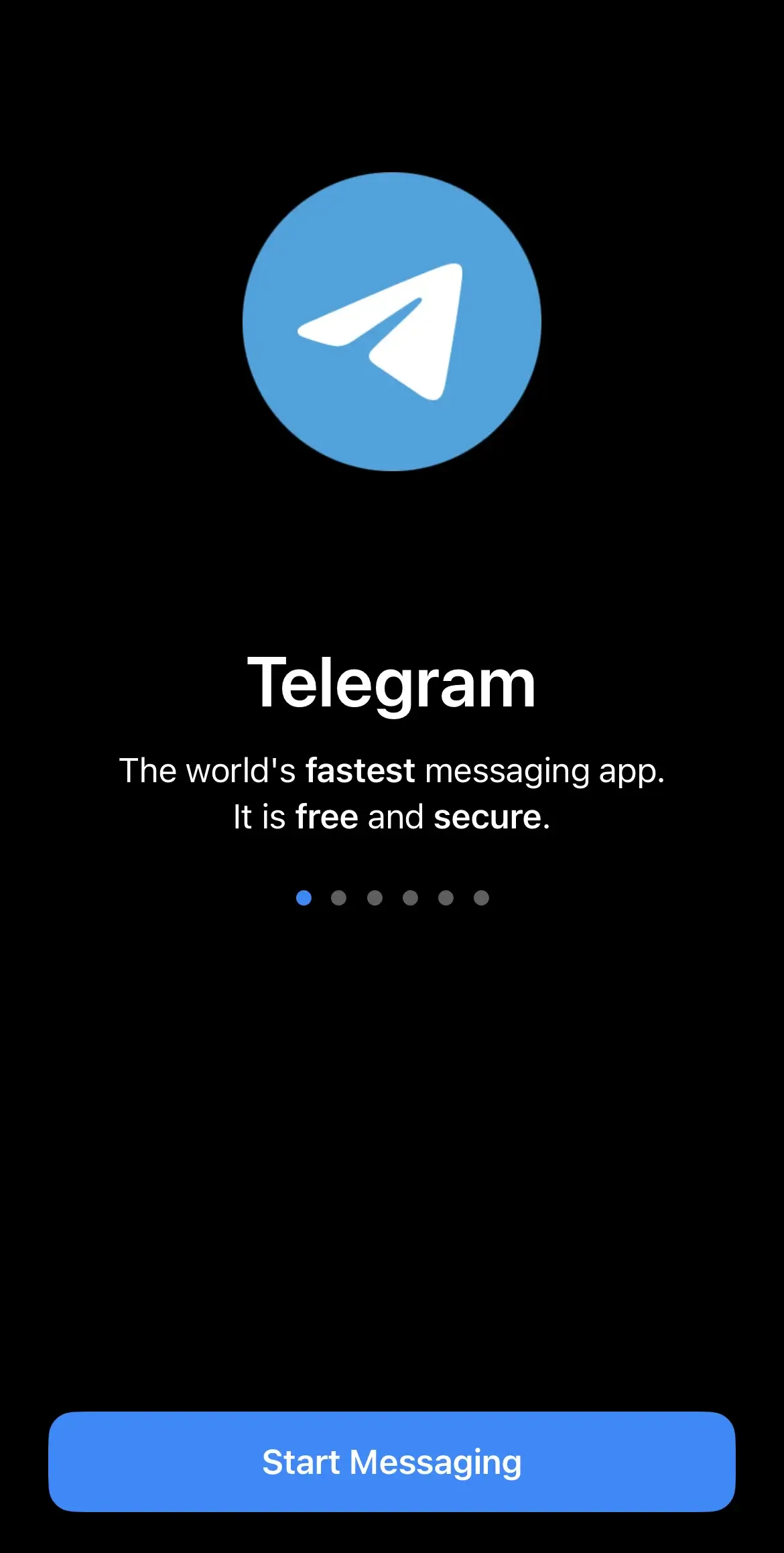

First, if you don’t have a Telegram account, you should download the app and sign up.

To do this, simply open the Telegram app and click on “Start Messaging.”

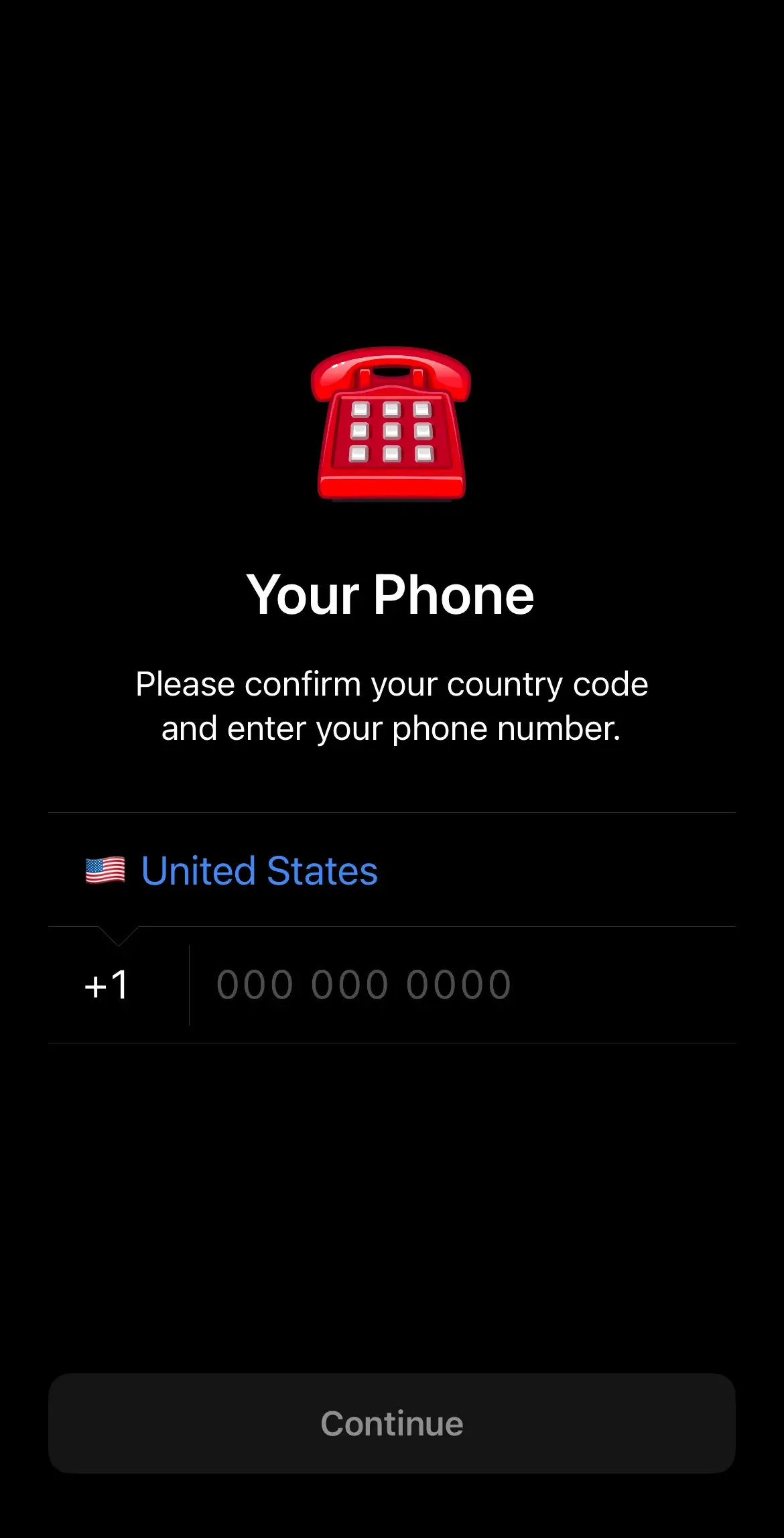

Then, select your country and enter your phone number.

Afterward, all there is left to do is verify your phone number, and you’re all set.

Initially, it’s advisable to select the trading bot that suits your needs best. Typically, these bots come with explicit guidelines for activation. To get started, just review and follow the instructions given to commence using the selected bot.

Top 5 Telegram Trading Bots

As the interest in trading bots grows, so does the quantity of Telegram bots specifically. Yet, not all offer the same advantages. To assist you in initiating automated trading, here are the top five Telegram trading bots worth considering in 2024. Each bot presents unique characteristics and abilities tailored to various types of traders, from novices to seasoned experts.

1. Unibot

Unibot is an exceptional Telegram trading bot known for its robust automation features and intuitive design. It offers various trading methods, such as copy trading, where users can mimic the trades of successful traders. This versatile tool works on multiple networks like Ethereum, Solana, Base, and Arbitrum.

Unibot provides real-time alerts, keeping traders informed about the most recent market updates. Its compatibility with various trading exchanges makes it a flexible instrument for users who trade on multiple platforms. With a strong emphasis on safety, Unibot incorporates robust security features to safeguard users from potential threats, making it a trusted option for global traders.

2. CoinCodeCap

CoinCodeCap is a cryptocurrency trading bot built by experts in the field of finance, trading, and marketing within the crypto market. Essentially, it functions as a comprehensive platform for crypto signals, catering to both newcomers and experienced traders alike.

CoinCodeCap offers a multitude of tools, among them exclusive cryptocurrency alerts for subscribers. Once you sign up to our Telegram bot, you’ll get real-time crypto trading tips aimed at maximizing your profits. The platform delivers different kinds of alerts, such as low-risk future signals, immediate spot signals, high-risk signals, and notifications about NFT opportunities.

3. Maestro Bots

As a dedicated crypto investor, I’ve been following the incredible journey of Maestro Bots (previously known as Catchy). Initially, it started as a simple token-tracking bot on Telegram. Over time, it evolved into a comprehensive platform offering various crypto services like sniper, wallet, whale, and buy bots. Today, Maestro Bots stands among the most trusted and widely utilized Telegram trading bots, boasting an impressive 19 million trades, a staggering $6.2 billion in lifetime volume, and more than 5,000 active users daily.

Maestro Bots is compatible with several networks like Ethereum, Solana, Binance Smart Chain, Base, TON, Avalanche, Arbitrum, Metis, and Linea. It provides a range of tools such as sniper and trading bots, copy trading, call channels, wallet tracking, whale bot, and buy bot. These features enable users to monitor transactions, price fluctuations, and sales for numerous tokens.

4. XCeption

XCeption is a comprehensive toolkit for bots, providing traders with a single destination for all their trading needs. This platform has amassed a total trading volume of approximately $20.9 million, executed over 350,000 trades, and consistently averages around $144,700 in daily trade volume.

Currently, the project provides four primary solutions: Tradeception (a suite of trading tools), Snipeception (a sniper bot for trading), Marketception (market-making tool), and Mevceptoin (MEV bot for maximizing exchange revenues). In addition to these, XCeption is actively working on expanding its offerings. These include Chainception (for cross swap operations), Copyception (copy trading platform), Projectception (P2P white labeling solution), and Gameception (gamification tools).

5. Trojan Bot

As a seasoned crypto investor, I’ve come across numerous projects, but none quite like Trojan Bot. This innovative platform has rapidly amassed a community of over 311,000 users, a testament to its intriguing concept. With an impressive trading volume of $6.13 billion and more than 47 million trades under its belt, it’s clear that Trojan Bot is making waves in the crypto market.

Setting up and using the automated trading system is straightforward, enabling users to customize the bot’s configurations according to their individual tastes and objectives.

Among the offerings from Trojan Bot are functions like limit orders, specialized sniping tools, profit & loss (PNL) analysis, confidential transactions, safety measures for failed sales, as well as the BOLT PRO package, along with additional features.

1. Customization allows for flexible fee arrangements, emphasizing quick transaction processing. Moreover, Trojan Bot’s backup bots offer additional security to every user.

FAQ

What is the best trading bot on Telegram?

As a savvy crypto investor, I’ve come to realize that every trading bot offers unique benefits and distinct features. However, the ideal one for me is the one that aligns with my expectations, preferences, and ultimately contributes to my investment goals. Therefore, it’s crucial to devise a comprehensive plan before embarking on the journey of finding the perfect bot tailored to my needs.

Is Telegram good for trading?

Telegram stands out as a secure choice in the cryptocurrency world due to its robust security mechanisms and end-to-end encryption of all conversations. In the past, such features were not as common, but now they are highly valued for their role in ensuring data safety – a crucial aspect in an industry where security breaches have been prevalent. As a result, users gravitate towards secure platforms like Telegram when handling or exchanging information related to cryptocurrency trading.

How to trade with Telegram bots?

To engage with trading bots using Telegram, it’s necessary to first register an account on Telegram. After that, locate the bot(s) suitable for your needs, initiate them, and they will be at your service. These bots can provide you with a wealth of market data and help you discover profitable trading strategies.

Do Telegram bots make money?

Utilizing Telegram bots effectively can generate income, but the key lies in your chosen strategy and the careful setup of guidelines for your bot’s behavior.

In Conclusion

As a diligent analyst, I find myself captivated by the thrilling world of cryptocurrency trading. It’s an endeavor that, when executed thoughtfully, can yield substantial rewards. The success, however, lies in understanding market fluctuations and crafting a robust trading strategy.

Trading bots on Telegram are equipped with numerous useful functionalities that operate primarily through automation. These bots function according to a predefined set of guidelines you initially set up, which can be adjusted as needed based on the results of your trading activities.

Among the top-tier and frequently utilized Telegram trading bots are Unibot, CoinCodeCap, Maestro Bots, XCeption, and Trojan Bot. Each offers unique benefits, and the ideal choice for you is the one that aligns with your expectations, preferences, and ultimately assists you in achieving your trading objectives.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-08-23 11:58