-

NEAR could climb to $5.343 if it breaks through the resistance at $4.476.

Whales and retailers alike are showing bullish sentiment.

As a seasoned researcher with years of hands-on experience in navigating cryptocurrency markets, I find myself intrigued by the current state of Near Protocol [NEAR]. The recent surge in its price, coupled with the notable resistance at $4.476, paints an interesting picture.

As a market analyst, I’ve observed an impressive surge in the performance of Near Protocol [NEAR]. Over the past day, it has grown by a significant 5.52%, and over the last week, its growth has been even more substantial at 10.19%. At this moment, NEAR is trading at $4.46.

The increase we’ve seen is connected to NEAR‘s recent attempts to break through a persistent bearish channel lasting over a month, but it has still faced significant resistance in the form of selling pressure at this level.

Is the momentum of this rally likely to continue, or could there be a sudden surge ahead? Let’s examine NEAR to get some insights on this matter, as reported by AMBCrypto.

Key factor holding NEAR’s potential rise to $5.34

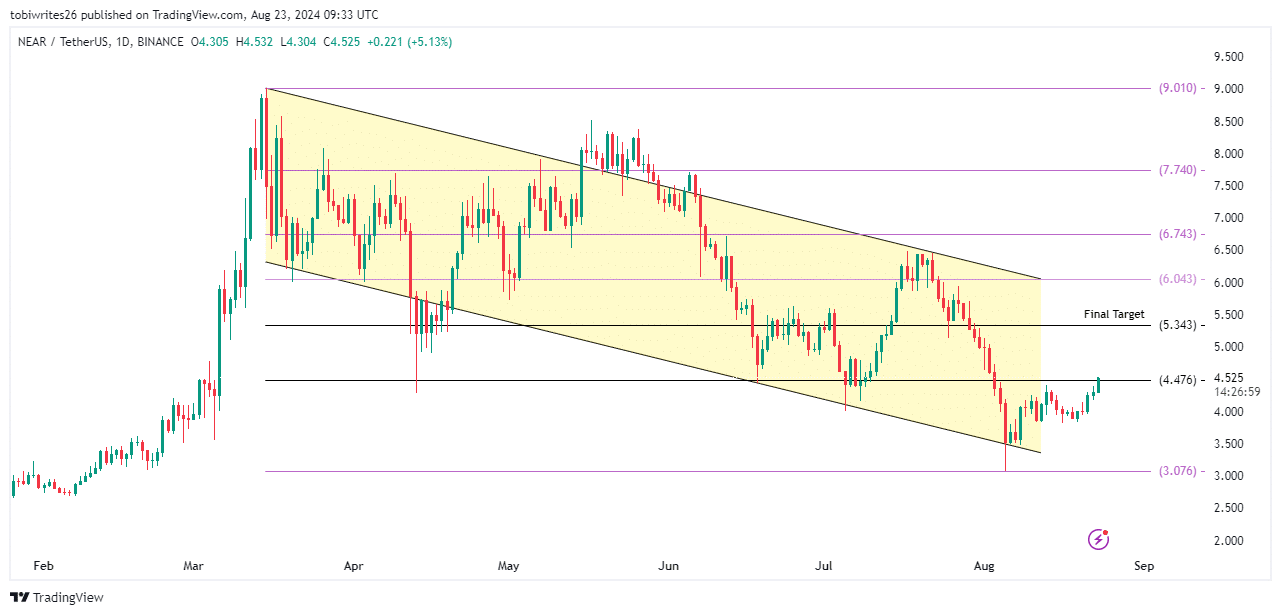

Currently, I find myself observing that NEAR is transacting within a downward trending channel over the past month – a pattern that originated in May.

Based on my years of trading experience, I have noticed that a distinct pattern often appears before a rally occurs – this shape is typically rectangular, with clear upper and lower bounds. I’ve found that when an asset bounces off the lower boundary of this pattern, it usually signals an upcoming surge in its value. This pattern has proven to be quite valuable in my trading strategy, helping me make informed decisions and maximize profits during market fluctuations.

Recently, NEAR has bounced back from its support area, showing significant price fluctuations near the lower boundary of $3.076.

In simpler terms, when a market is said to be wicking, it suggests that buyers are rejecting lower prices. This means they’re taking control and driving the price upwards, which could signal an upward trend or momentum in the market.

Yet, NEAR encountered a substantial barrier at a critical resistance point of approximately $4.476 as we speak. For the current upward trend to persist, it’s essential for buying activity to outweigh selling activity.

Should purchasers take control over vendors, it seems likely that the price of NEAR could surge beyond its current trading range and reach a record-breaking peak of around $5.343.

If it persists, there’s a chance it could keep trading inside the falling trendline, possibly extending this pattern for several more weeks.

Short sellers feel the heat as buying pressure mounts

Based on further examination by AMBCrypto, it’s highly probable that the resistance at $4.476 will be surpassed due to increased buying activity in recent times.

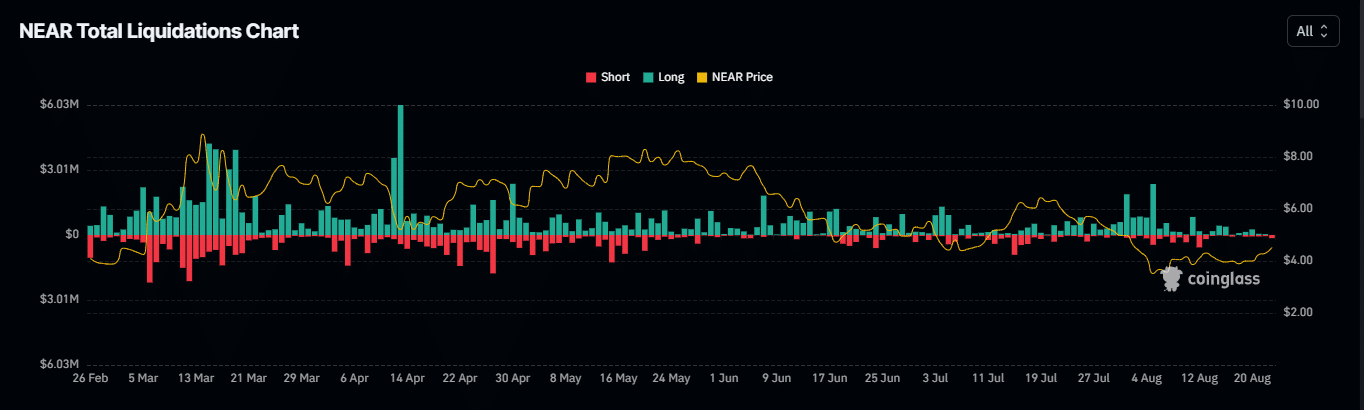

As a researcher, I’ve observed an intriguing trend based on data from Coinglass. Starting from the 21st of August, there was a significant surge in buying activity that resulted in a steep rise in liquidations for traders who had taken a bearish position on NEAR, indicating a strong bullish momentum for this cryptocurrency.

Over the past 24 hours, $182.65k worth of short positions have been eliminated from the market.

These occurrences showed an increasing tendency towards purchasing, along with the appearance of long-term investors, as the selling force started to lessen.

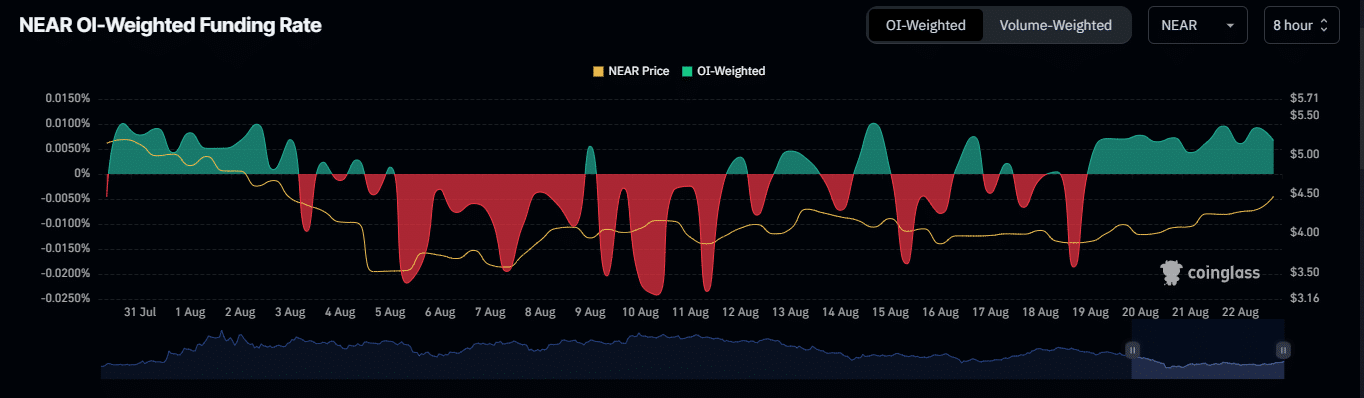

Over the past couple of weeks, starting from the 20th of August, I’ve noticed a consistent upward trend in the OI-Weighted Funding Rate. As we speak, it stands at approximately 0.0066%. This positive rate has been steadily climbing since its initial value.

Based on my years of trading experience, it appears that long positions are dominating the market, as evidenced by long traders offsetting short sellers. This suggests a high level of buyer confidence and the possibility of continued upward momentum. I have seen similar patterns in the past, where such strong buyer sentiment has led to significant price increases. As always, it’s important to keep a close eye on market trends and adjust strategies accordingly.

Should the demand for retail purchases continue strongly, it might outmatch the current supply pressure at the price barrier of $4.476.

Read NEAR Protocol’s [NEAR] Price Prediction 2024–2025

Whales maintain buying pressure

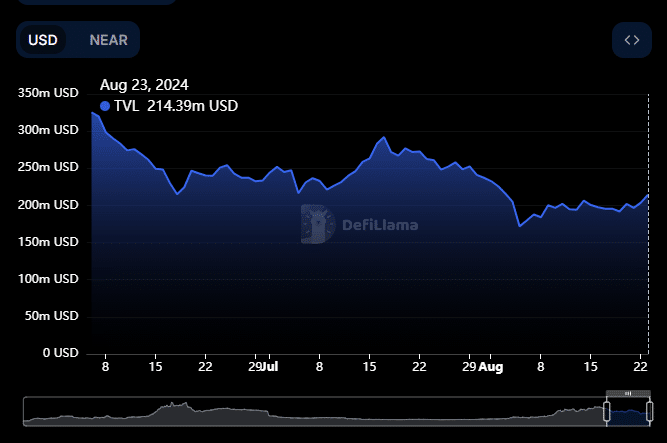

According to DeFiLlama’s data, there appears to be an increase in buyer trust, demonstrated by the growing Total Value Locked (TVL) figure, currently standing at approximately $213 million as we speak.

As I observe an uptick in Total Value Locked (TVL), it’s clear that more Near Protocol tokens are being committed to our ecosystem. This trend usually hints at a prolonged upward price movement, indicating strong investor enthusiasm and a robust market environment.

Read More

- AUCTION PREDICTION. AUCTION cryptocurrency

- Solo Leveling Season 3: What You NEED to Know!

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- `Tokyo Revengers Season 4 Release Date Speculation`

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- XRP CAD PREDICTION. XRP cryptocurrency

- Stephen A. Smith Responds to Backlash Over Serena Williams Comments

- AEW Fans Are Loving Toni Storm’s Uncanny Mariah May Cosplay From Dynamite

- Is Disney Faking Snow White Success with Orchestrated Reviews?

2024-08-23 23:04