- Bitcoin shows a slight recovery after a significant drop, influencing correlated altcoins like Cardano.

- Analysts suggest monitoring the positive correlation between Bitcoin and altcoins for potential market shifts.

As a seasoned analyst with over two decades of market observation under my belt, I have witnessed various cycles within the financial world, and the crypto market is no exception. The recent fluctuations in Bitcoin and its correlated altcoins, such as Cardano, are reminiscent of patterns we’ve seen before.

Over the last day, Bitcoin (BTC) has displayed a modest recovery following a significant drop of over 10% within two days earlier this week. In this timeframe, its value has risen by about 0.5%, edging closer to the $60,000 threshold.

Even though there’s been a slight improvement, the value of this asset is still 2.3% lower than it was a week ago, suggesting a volatile market. The recent fluctuations in price have ignited debates among analysts, with many focusing on the relationship between Bitcoin and other alternative cryptocurrencies.

Correlation between Bitcoin and altcoins

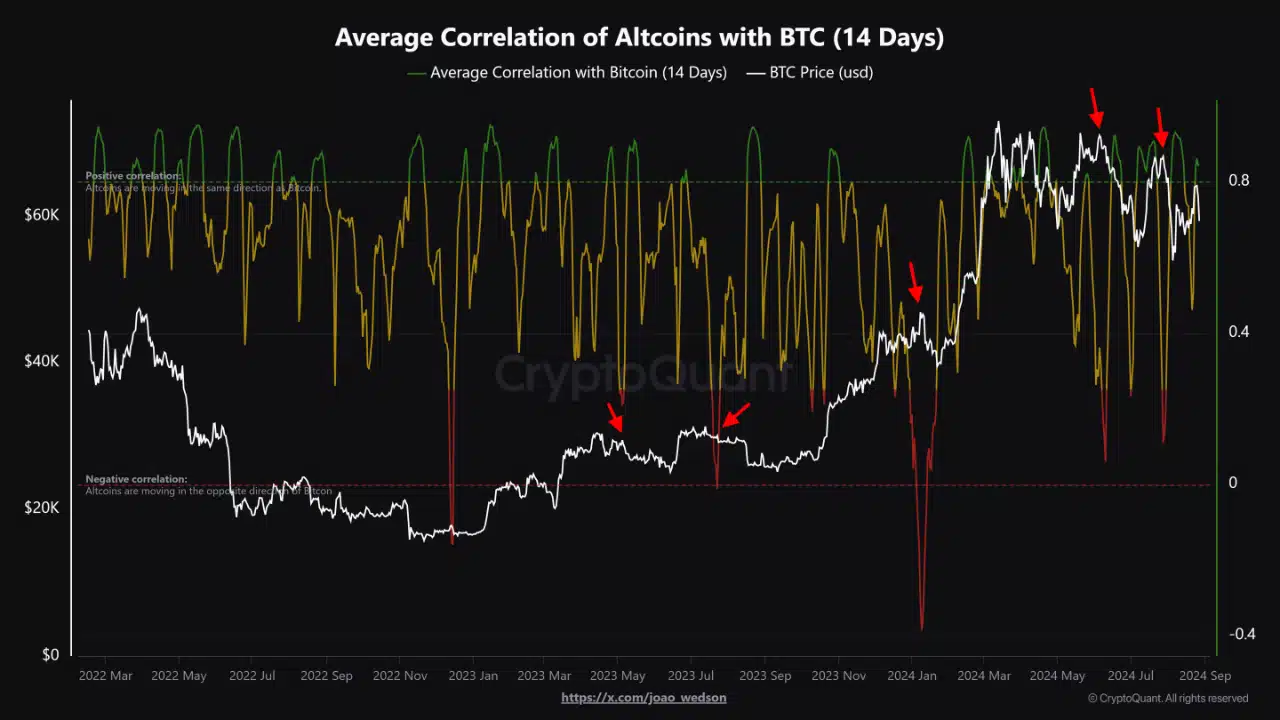

In light of Bitcoin’s ups and downs, a study by CryptoQuant analyst Joao Wedson suggests a strong link between Bitcoin and other cryptocurrencies.

Based on Wedson’s findings, it seems that altcoins are mirroring Bitcoin’s price changes, which implies a unified trend within the larger cryptocurrency market.

This behavior reflects investor confidence, as the synchronized movement suggests a level of stability in the market. However, the report warns that a shift to a negative correlation could serve as a red flag for Bitcoin and the market at large.

Historically, it’s common to see altcoins performing exceptionally well compared to Bitcoin. This strong performance by altcoins can often trigger a fall in the value of Bitcoin.

In January, June, and July of 2024, it was clear that altcoins were performing better than Bitcoin. However, the market suffered a substantial drop not long after this period.

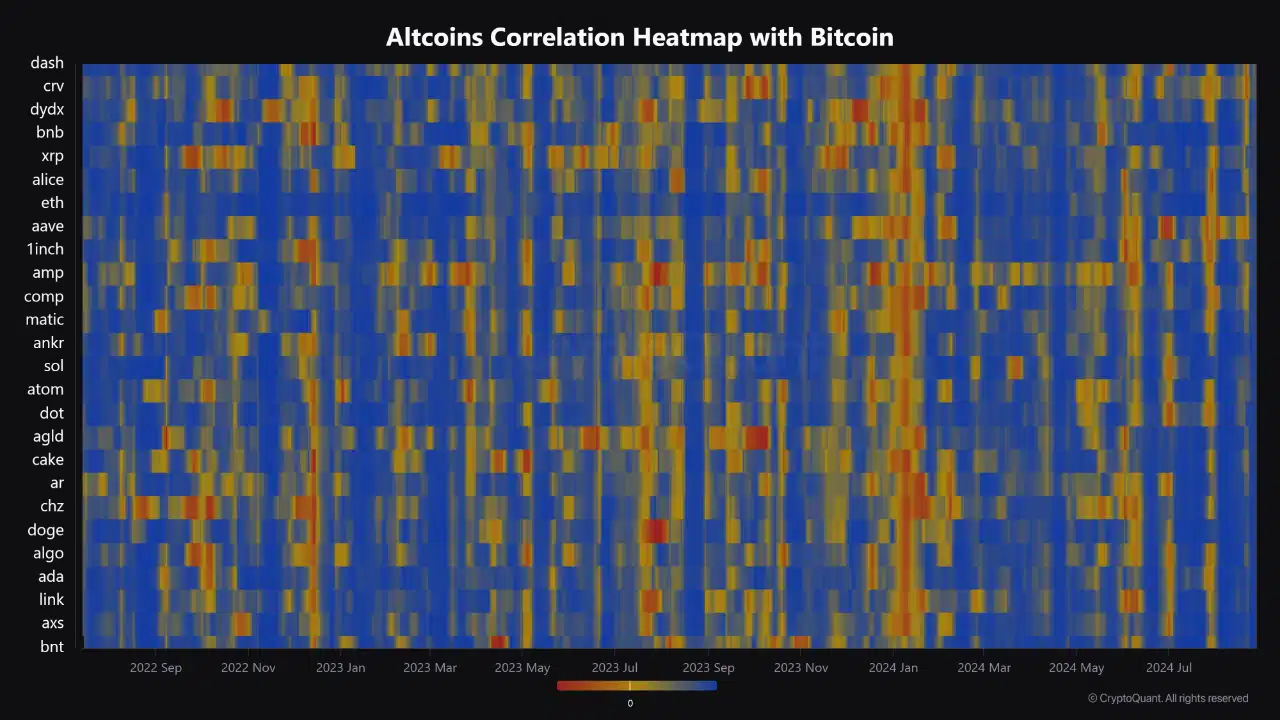

At the moment, various altcoins like Bancor (BNT), Axie Infinity (AXS), Chainlink (LINK), Algorand (ALGO), and Cardano (ADA) tend to follow a similar trend as Bitcoin, suggesting that their prices often mirror or align with that of Bitcoin.

Instead, digital currencies such as Dash (DASH), Curve (CRV), dYdX (DYDX), Binance Coin (BNB), and MyNeighborAlice (ALICE) exhibit reduced correlation, suggesting they have separate trends in their pricing patterns.

Although there are differences among various altcoins, their general tendency to move together with Bitcoin indicates a potentially stable short-term market. Yet, it’s crucial to keep a close watch for any departures from this pattern as they could indicate heightened risks.

Cardano: A case study in correlation and market trends

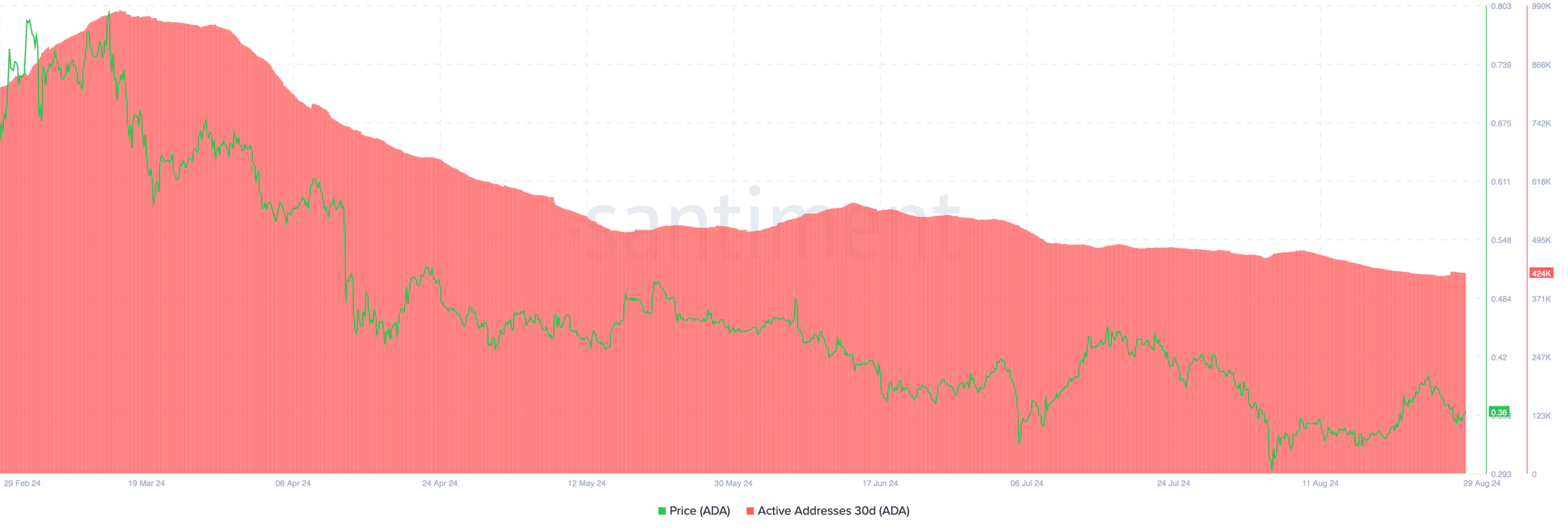

Examining Cardano (ADA) specifically, we notice its price trend closely follows Bitcoin’s, with a substantial dip to around $0.34 observed in the recent past.

Over the last day, it appears that ADA is on an upward trajectory, having increased by 2.8% in value. This growth mirrors a small rebound pattern observed across the market, where prices have risen slightly after an initial drop.

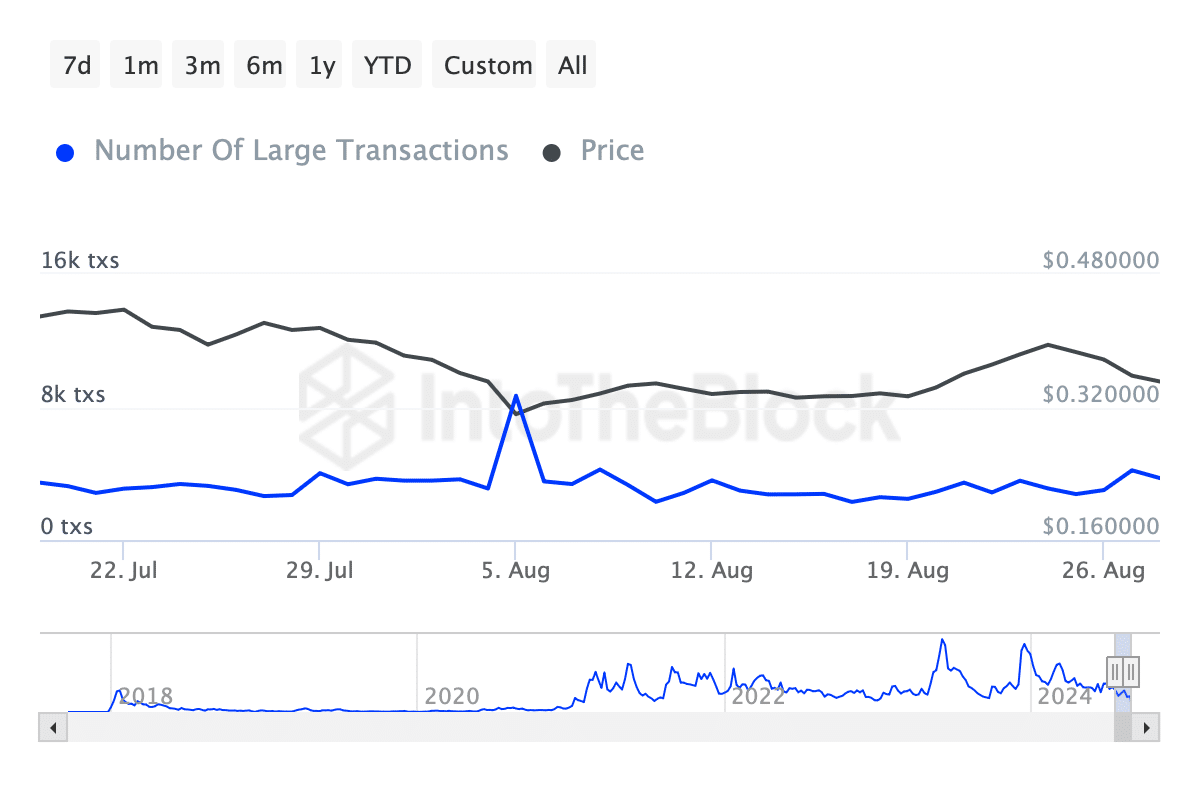

Interestingly, despite ADA’s price drop, its fundamentals indicate growing whale interest.

According to data from IntoTheBlock, there has been a significant rise in large transactions (transactions over $100,000) with approximately 4,000 such transactions taking place today, marking a substantial spike compared to the around 3,000 transactions of this size that were recorded just last week.

This suggests that larger investors are taking advantage of the lower prices to accumulate ADA.

Read Cardano’s [ADA] Price Prediction 2024-25

Conversely, data from Santiment indicates a drop in the number of active Cardano (ADA) addresses during the last month, dipping below half a million – a substantial decrease from approximately one million active addresses in March.

This decline in active addresses could reflect reduced retail investor activity, even as whales continue to engage with the asset.

Read More

- OM/USD

- Solo Leveling Season 3: What You NEED to Know!

- Kanye West’s Wife Stuns Completely Naked at 2025 Grammys

- Solo Leveling Season 3: What Fans Are Really Speculating!

- ETH/USD

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- White Lotus: Cast’s Shocking Equal Pay Plan Revealed

- Shocking Truth Revealed: Is Cassandra Really Dead in Netflix’s Terrifying Mini-Series?

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Jimmy Carr Reveals Hilarious Truth About Comedians’ Secret Competition on Last One Laughing!

2024-08-29 23:36