- Binance faces massive Bitcoin withdrawal amid backlash.

- Liquidations intensify as Bitcoin EFTs face negative net flow.

As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous market fluctuations, both bullish and bearish. The recent events surrounding Binance and Bitcoin are noteworthy, given their potential implications on the broader cryptocurrency landscape.

Yesterday, August 28th, Bitcoin (BTC) showed a more tranquil performance, as it witnessed decreases in multiple market sectors, such as traditional trading platforms and U.S.-preferred Bitcoin ETFs.

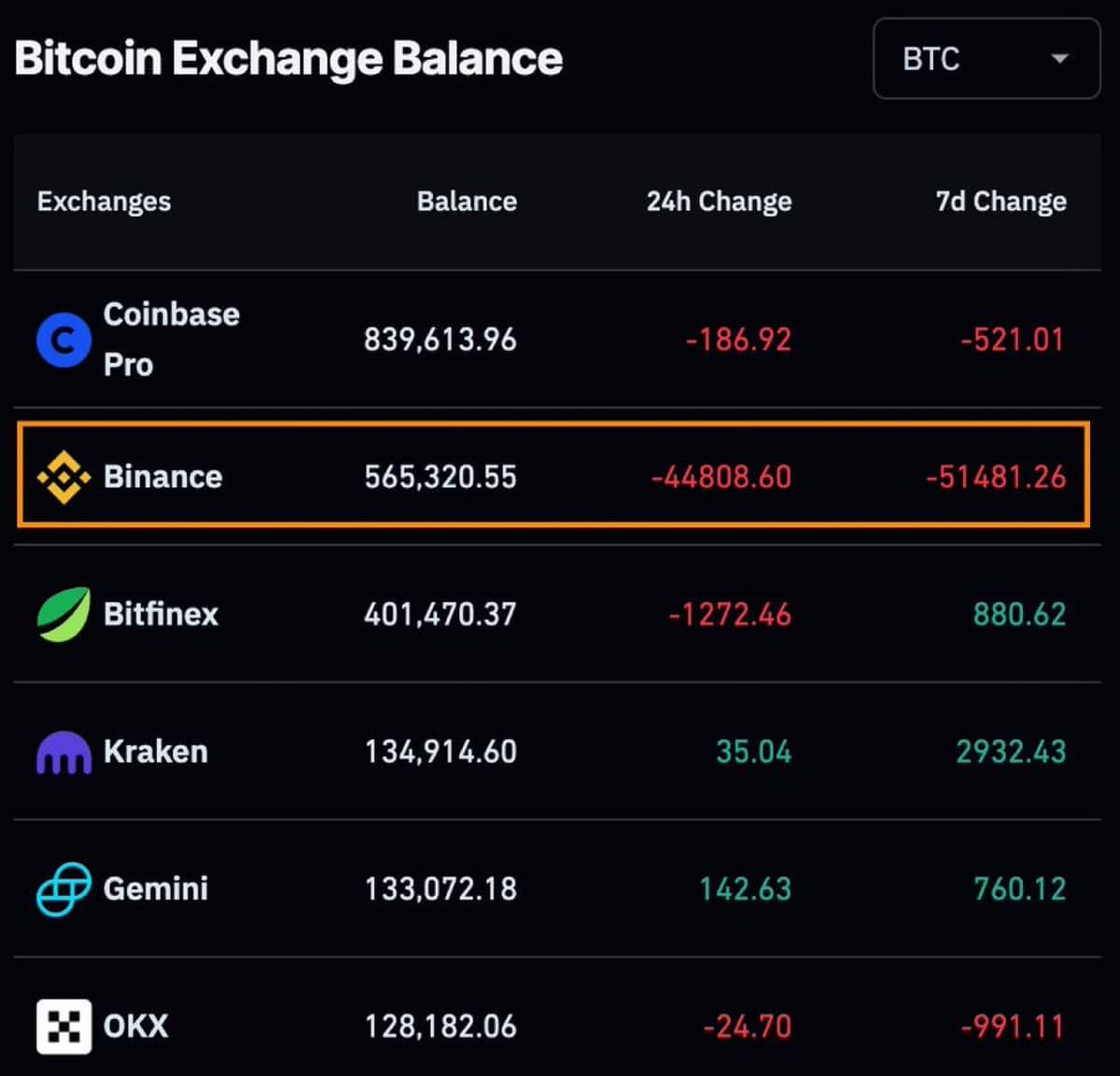

In the past day, a significant withdrawal of about 44,808 Bitcoins, valued at more than $2.6 billion, was taken out from Binance, happening around the same time as the market experienced a decline.

After accusations emerged about Binance confiscating Palestinian funds on behalf of Israeli authorities, a notable Bitcoin withdrawal occurred. Facing criticism, Binance swiftly unlocked the affected accounts.

A large quantity of Bitcoin being released could significantly influence BTC‘s price, possibly causing changes in either an upward or downward direction.

Initially, it’s possible that individuals might hold Bitcoin with the aim of realizing long-term profits, which could potentially push its value up. Conversely, if there’s a massive sell-off, the Bitcoin market, due to the significant volume it handles, could become unstable and cause a drop in prices.

Massive liquidations

66,423 traders were also liquidated over the last 24 hours, totaling approximately $161 million in losses.

Yesterday, I witnessed a significant event in the crypto market – the largest single liquidation happened on Bybit’s BTC/USD pair, amounting to approximately $3.52 million. Interestingly, the day prior, there was another substantial liquidation on Binance’s ETH/BTC pair, totalling around $12.67 million.

For August 2024, these occurrences are projected to result in approximately $4.8 billion in liquidations, which is the highest amount since 2021, with just two days left on the calendar.

In a maturing and expanding market, players tend to assume greater financial risk (leverage) which can result in substantial losses when significant market fluctuations occur.

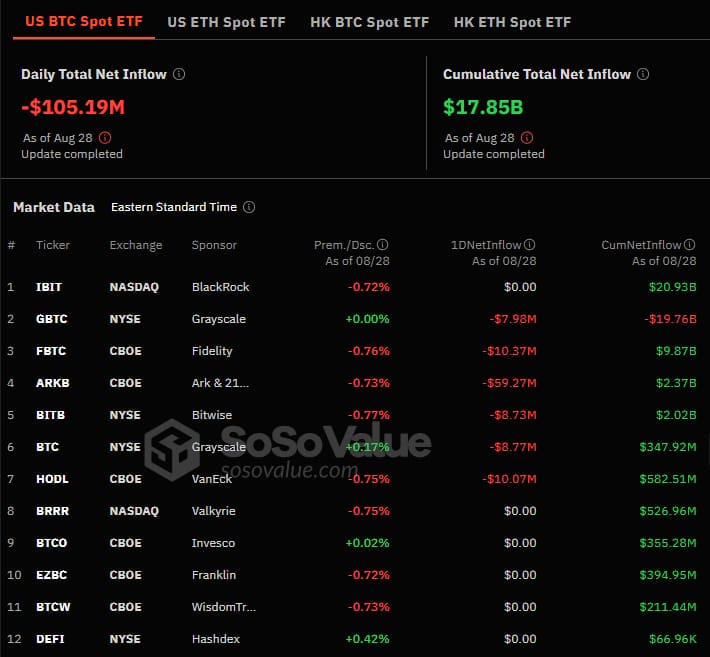

Bitcoin ETFs face negative NetFlow

On August 28th, the significant Bitcoin withdrawal from Binance coincided with a total withdrawal of $105.19 million from ETFs, suggesting a possible interconnection between the two events.

21Shares’ ARKB ETF had the largest outflow of funds at $59.27 million, with Fidelity’s FBTC coming in second at $10.37 million, followed by VanEck’s HODL with $10.07 million and Grayscale’s GBTC with $7.98 million in outflows.

The persistent unfavorable situations are causing worry that Bitcoin might struggle to bounce back, given that its value remains close to the $60,000 level.

Will stablecoin supply help Bitcoin recover?

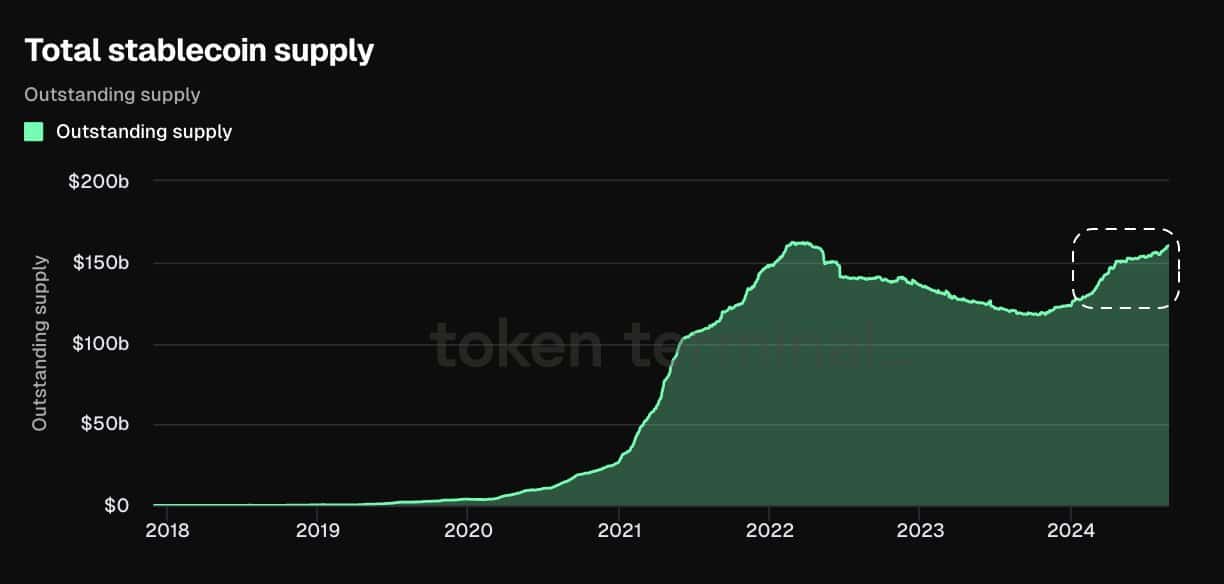

Regardless of the significant Bitcoin withdrawals on Binance, numerous margin calls (liquidations), and unfavorable ETF investments, there’s optimism that Bitcoin’s inverse relationship with stablecoins might trigger a change in its trajectory.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Over the past day, approximately $67 million worth of USDC has been minted, about $70 million in USDC has moved to unidentified wallets, and an additional $100 million USDT has been shifted to Bitfinex.

The surge of stablecoins in the market might lead to price increases and possibly boost Bitcoin’s value. Given that stablecoin charts are close to record highs, it seems a shift for Bitcoin and other digital currencies towards growth may be imminent.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- AUCTION PREDICTION. AUCTION cryptocurrency

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- `Tokyo Revengers Season 4 Release Date Speculation`

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- Stephen A. Smith Responds to Backlash Over Serena Williams Comments

- XRP CAD PREDICTION. XRP cryptocurrency

- AEW Fans Are Loving Toni Storm’s Uncanny Mariah May Cosplay From Dynamite

- Is Disney Faking Snow White Success with Orchestrated Reviews?

2024-08-30 03:04