- The technical indicators did not show a strong trend in progress for Shiba Inu.

- The short-term sentiment was bearish, aided by the recent Bitcoin drop.

As a seasoned crypto investor with a knack for interpreting market trends and a portfolio that has weathered multiple bull and bear cycles, I must admit that the current state of Shiba Inu [SHIB] leaves me somewhat cautious. The technical indicators are showing a neutral stance at best, with the recent Bitcoin drop casting a bearish shadow over the short-term sentiment towards SHIB.

Shiba Inu’s [SHIB] overall market pattern suggests an upward trend, but it’s been generally downward in the long run. Recently, the short-term trends seem to lean towards the bears. This might mean a return to recent lows before another potential rise occurs.

In other news, the burn rate of Shiba Inu slowed down recently due to reduced activity. This does not impact the short-term price behavior, but if sustained over many weeks, could lead to investors losing confidence.

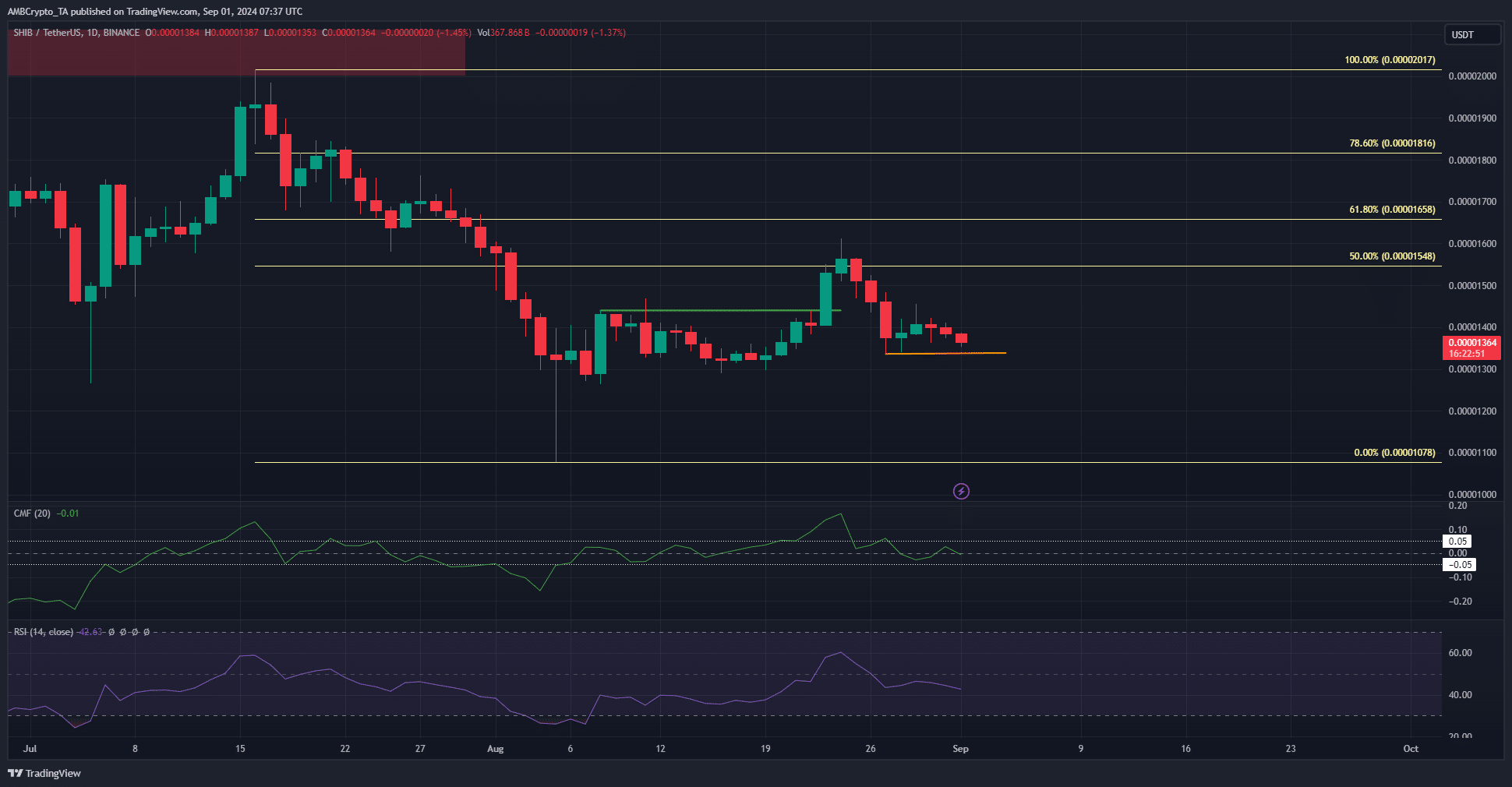

The indicators were neutral on the daily timeframe

Following a drop below the recent support level at $0.0000144 on August 23rd, SHIB displayed a bullish market pattern. However, if the price closes below $0.00001336 during a daily session, this bullish structure will change to a bearish one.

Last week, there were no significant inflows or outflows of capital observed in the market regarding the CMF, which stood at -0.01. This suggests that market participants have remained relatively quiet, which could mean that traders should exercise caution when making trades.

In simpler terms, the indicator suggesting a downward trend (bearishness) was triggered today because its value fell below 50, but the strength of this downward movement wasn’t particularly strong. Given this, it seems probable that the price will drop back down to $0.00001336 before it starts rising again.

Moving towards the 61.8% or 78.6% resistance points above might lead to a quick refusal, offering an opportunity for traders who short meme coins to take advantage of the situation.

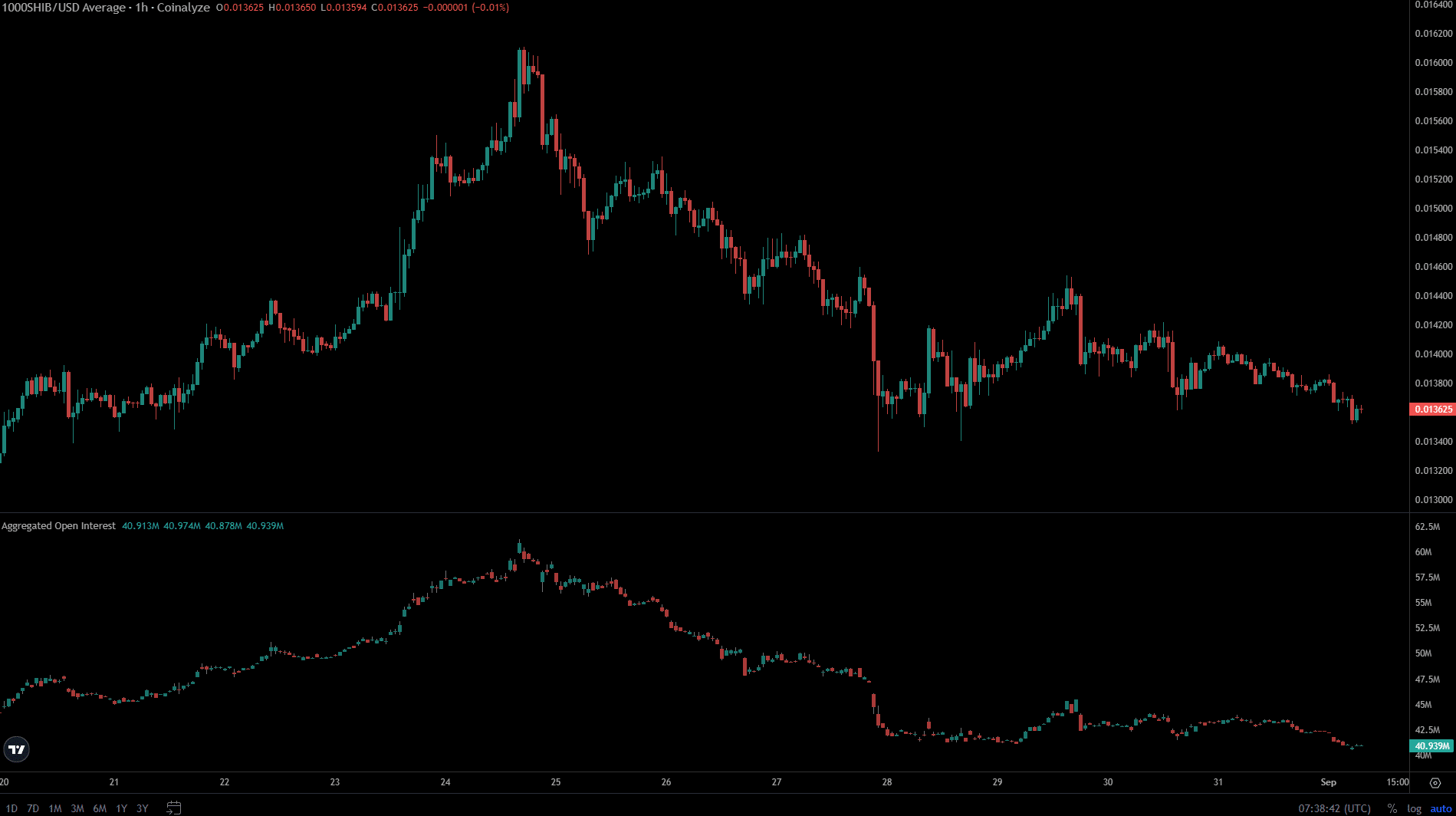

Muted sentiment in the Shiba Inu futures market

Over the last seven days, Shiba Inu (SHIB) has been steadily dropping in value, and this downward trend seems to have influenced the Open Interest as well. This suggests a growing pessimism among traders, who are choosing to stay on the sidelines rather than actively participate in trading activities.

An increase in Open Interest (OI) accompanied by a significant decrease in price could suggest extensive short selling, an activity that’s been relatively scarce as of late.

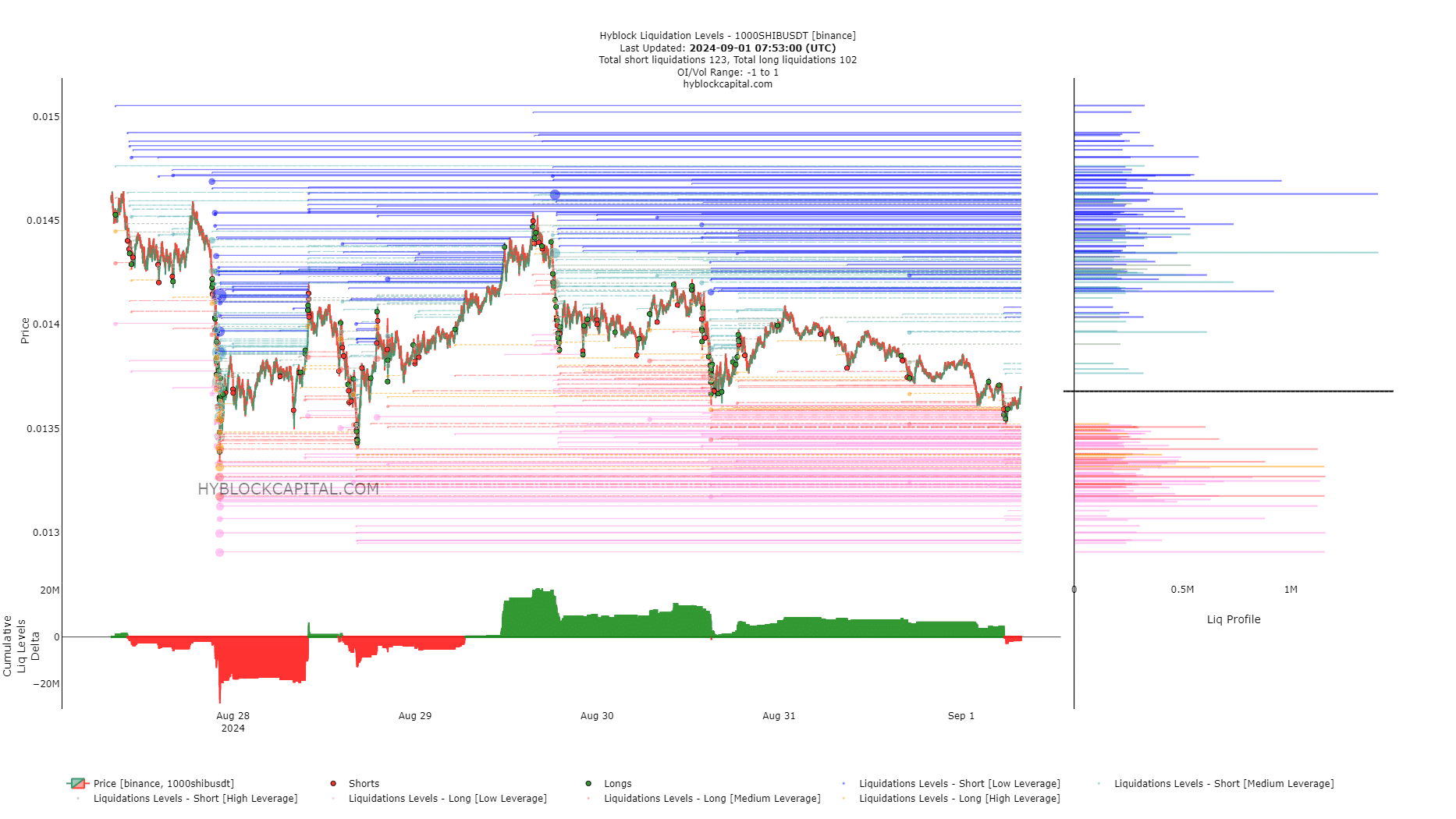

The cumulative liquidation levels were also muted. The futures market was fairly balanced in the near term and neither side was overextended. Therefore, a choppy and indeterminate trend is anticipated over the next few days.

Read Shiba Inu’s [SHIB] Price Prediction 2024-25

When a significant number of investors collectively grow restless, as indicated by a substantial accumulation of funds, the price of Shiba Inu might trend towards this accumulated fund pool.

Until then traders needed to bide their time as a short-term trading opportunity was not apparent.

Read More

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- OM PREDICTION. OM cryptocurrency

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Elevation – PRIME VIDEO

- Christina Haack and Ant Anstead Team Up Again—Awkward or Heartwarming?

- WWE’s Braun Strowman Suffers Bloody Beatdown on Saturday Night’s Main Event

2024-09-01 20:08