-

DApp volumes on Solana have jumped by 87% in the last 24 hours per DappRadar.

The growth comes amid an influx in NFT trading volumes on the platform.

As a seasoned researcher with years of experience in the ever-evolving crypto landscape, I find myself thoroughly intrigued by the recent surge in DApp volumes on Solana. The 87% increase within the past 24 hours is a testament to the growing appeal and adaptability of this blockchain.

It appears that the number of transactions on the Solana blockchain’s decentralized applications (DApps) has grown by more than 87%, which could be attributed to heightened activity on the Tensor NFT marketplace.

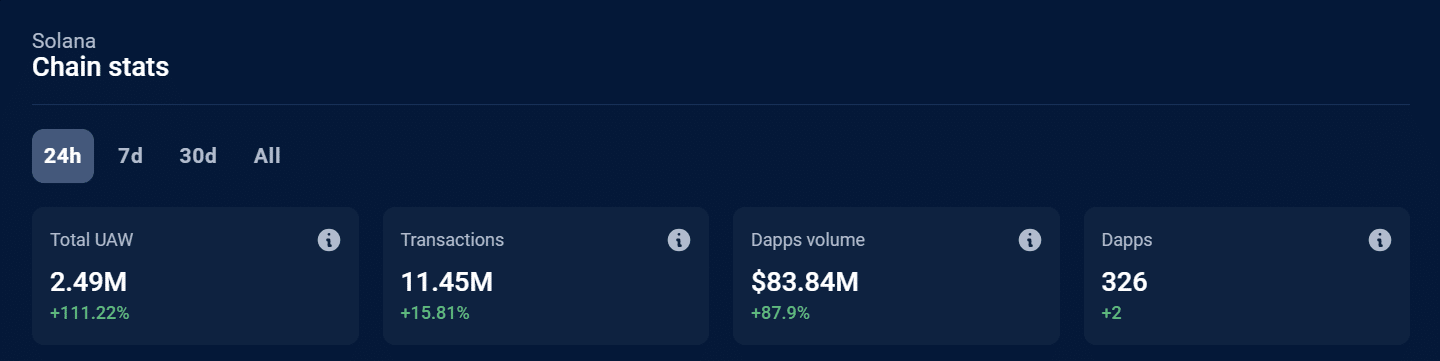

According to recent data from DappRadar, transactions worth approximately $83 million took place on the Solana network over the past day. Notably, Solana led in DApp volume growth among the top five major Layer 1 blockchains.

The gain is significant given that within the same period, Ethereum [ETH], which is the largest blockchain by DApp volumes, saw a 30% decline. Nevertheless, Ethereum continues to dominate the DApp industry, with $4.56 billion in volumes.

The surge in Solana’s network activity also coincides with an increase in user numbers. Solana’s unique active wallets have jumped by 111% to 2.49 million, while transactions are up 15% to more than 11 million.

NFTs drive Solana’s network growth

As a crypto investor, it seems that Non-Fungible Tokens (NFTs) are driving the surge in transactions on the Solana blockchain. Notably, Magic Eden, the leading NFT marketplace on Solana, has recorded a staggering 600% plus increase in trading volumes.

On the Tensor NFT marketplace, there was a significant increase of approximately 95%, with trading volumes soaring. Additionally, the user count on this platform swelled by almost 60%.

As an analyst, I observed a significant surge in my findings, as Solana NFTs recorded a whopping $79 million in NFT sales during the month of August. This places Solana as the second-ranking blockchain in terms of NFT sales volume.

How is SOL performing?

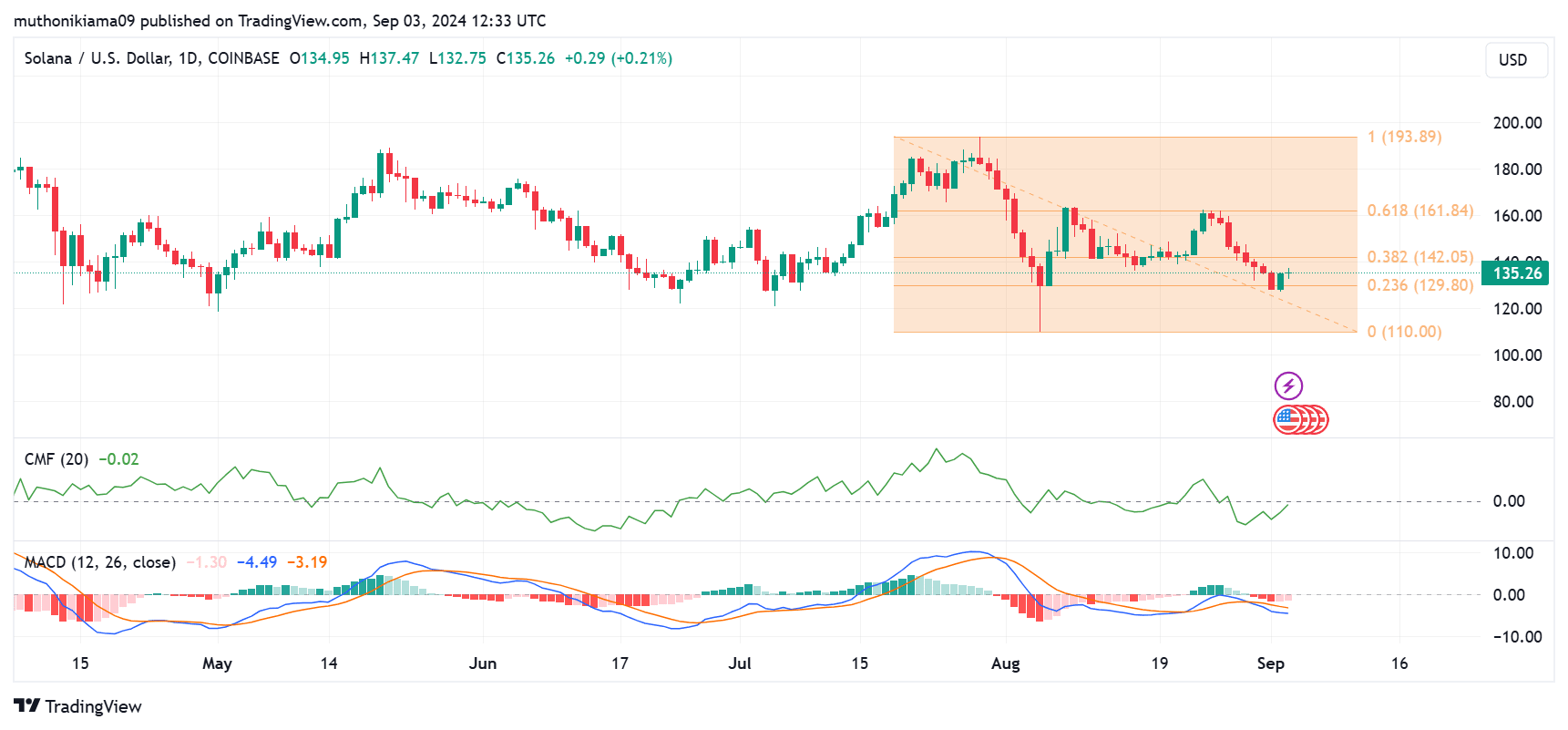

As a researcher examining the Solana ecosystem, I’ve noticed an impressive expansion in the network’s growth. However, I find myself confronted by a challenging situation with the SOL price, as it appears to be underperforming due to dwindling interest from potential buyers. The buying pressure, evident through the Chaikin Money Flow (CMF) indicator, is remarkably low, indicating a negative trend.

Nevertheless, this index has reached a new peak, indicating an increase in buyers returning to the market. To validate the upward trend, it must surpass into positive territory.

The weak uptrend is also seen in the Moving Average Convergence Divergence (MACD) line, which is below the signal line. The MACD histogram bars are also red, further showing that bears remain in control.

On multiple occasions, SOL has examined its potential support at around $129. For the bullish trend to continue, it is crucial that the token maintains its value above this price point.

Realistic or not, here’s SOL’s market cap in BTC’s terms

If the upward trend persists, Solana (SOL) must surpass the upcoming resistance level at $142 in order for its price to keep rising further.

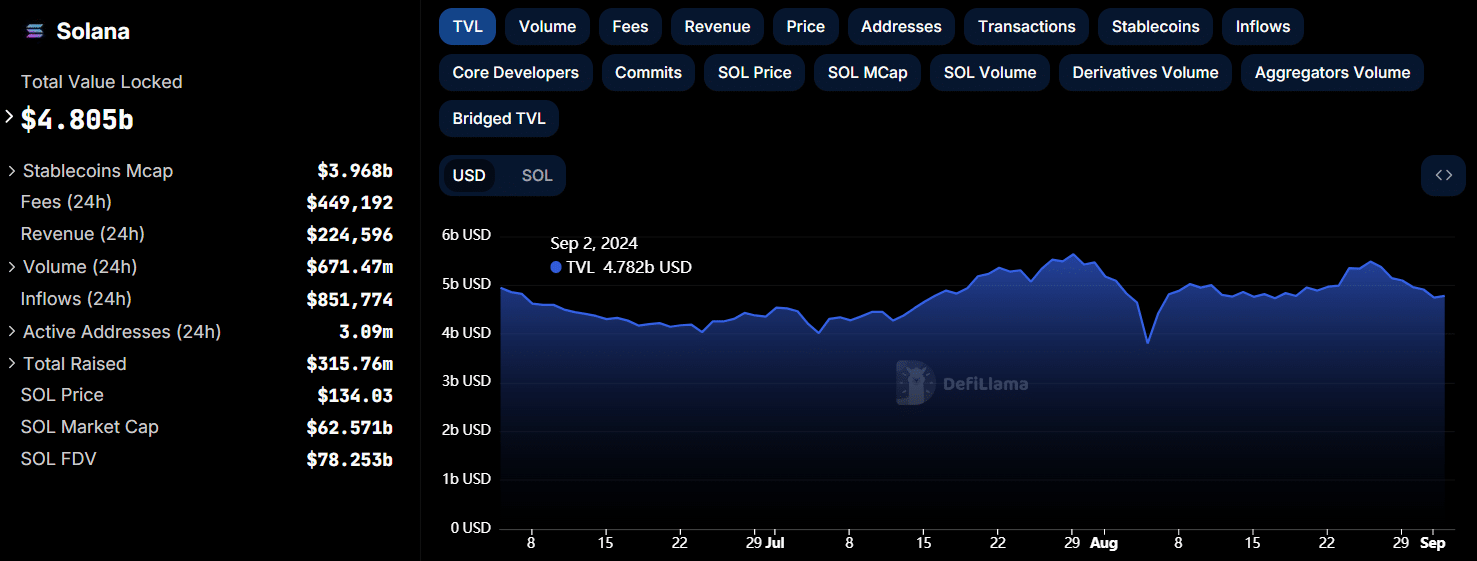

It’s important to note that not every protocol built on Solana is seeing growth. According to DeFiLlama, there’s been a 12% decrease in the Total Value Locked (TVL) over the past week. The TVL of SOL has dropped from $5.48 billion to its current level of $4.8 billion.

Read More

- AUCTION/USD

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- Is Disney Faking Snow White Success with Orchestrated Reviews?

- Stephen A. Smith Responds to Backlash Over Serena Williams Comments

- Solo Leveling Season 3: What You NEED to Know!

- AEW Fans Are Loving Toni Storm’s Uncanny Mariah May Cosplay From Dynamite

- JK Simmons Opens Up About Recording Omni-Man for Mortal Kombat 1

- XRP/CAD

2024-09-04 09:44