-

Litecoin gained 9.5% in the past week, defying the broader crypto market downturn.

Technical analysis indicated a potential breakout to $100, supported by rising Open Interest and SOPR trends.

Among the leading digital currencies, Litecoin (LTC) stands out as it’s been going against the general downward trend that many cryptos have experienced lately

Despite significant declines invaluable investments such as the most important assets taking a hit hard, Litecoin has been,>[orizing, While many out of Lite of Lite Lite, Liteer to Lite if, I’s, Litecoin has maintained its position and even seen increases

For the previous fortnight, Litecoin experienced a 3.5% increase. In just the last seven days, this asset has soared by an impressive 9.5%

Over the last day, there’s been a minor dip, causing LTC to decrease by 0.5%. At the moment of this writing, it is being traded at $65.88

Litecoin poised for further growth?

This bullish price action from LTC has caught the attention of traders and analysts. One such prominent crypto analyst, ZAYK Charts, shared a technical outlook on Litecoin on X (formerly Twitter).

It appears that Zayk (ZAL) has been experiencing a bearish trend in its 1-day charts, with a potentially imminent breakout on the horizon. This could indicate a possible reversal or reverse headwinds

For context, a descending channel formation in trading is a technical pattern that occurs when an asset’s price moves within a downward-sloping parallel trendline.

When the price continues to fall, it might suggest an impending breakout as soon as it touches the bottom of the channel

In simple terms, a breakout occurs when the price surpasses the upper limit of the channel, indicating the conclusion of the declining trend and possibly a shift towards an uptrend

Based on ZAYK analysis, should Litecoin successfully move beyond its current descending trend, the potential price for this cryptocurrency might reach up to $140. In simpler terms, if Litecoin breaks out of its current downward trend, it could potentially reach as high as $100

This projection is based on previous technical patterns observed in the market.

Ultimately, the success ofly, but the outcome of Litecoin’K charting Litecoin manages past its current downtrending trend, it could potentially reaching new cryptocurrency may reach as high as high-1.essence, if Litecoin manages its current downward trend, there is likely reach a pricey as $100, assuming that’d the breakoutlooks, or perhaps wouldn’s detracing for myri time

Fundamental outlook on LTC

There’s been some intriguing development in the underlying factors of Litecoin that could contribute to its potential surge

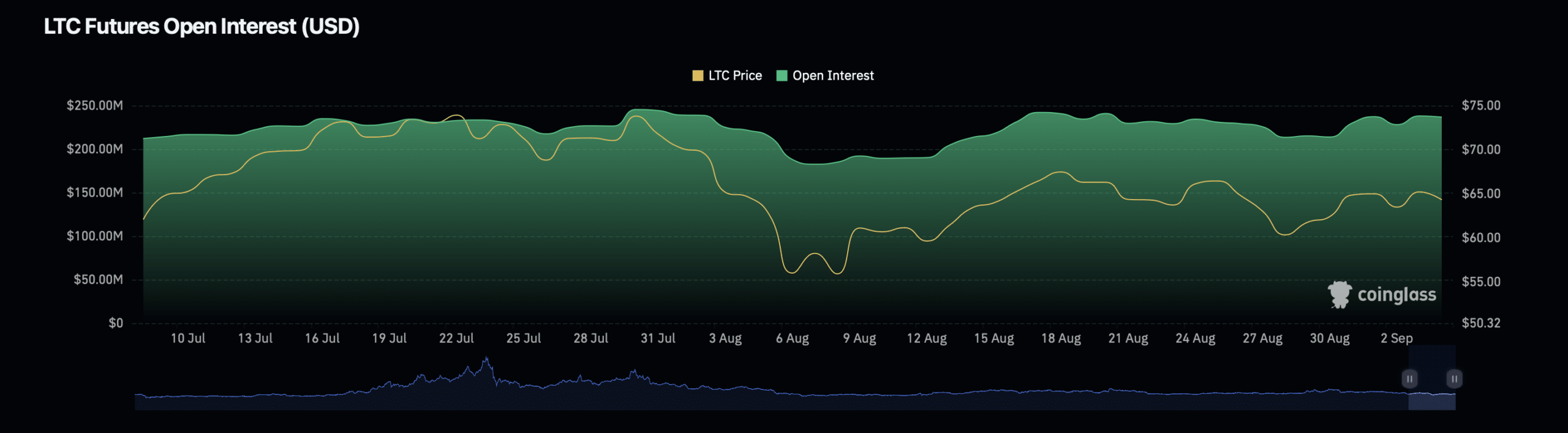

Based on statistics from Coinglass, the value of Litecoin’s Open Interest is climbing steadily and currently stands at approximately $243.96 million, having grown by 1%

Unsettled derivative agreements, such as futures and options, collectively known as open interest, represent the overall count of these agreements that remain unresolved. [Paraphrased]

An uptick in Open Interest implies that more investors are taking up Litecoin trading positions, possibly signaling growing enthusiasm and faith in an upcoming price spike

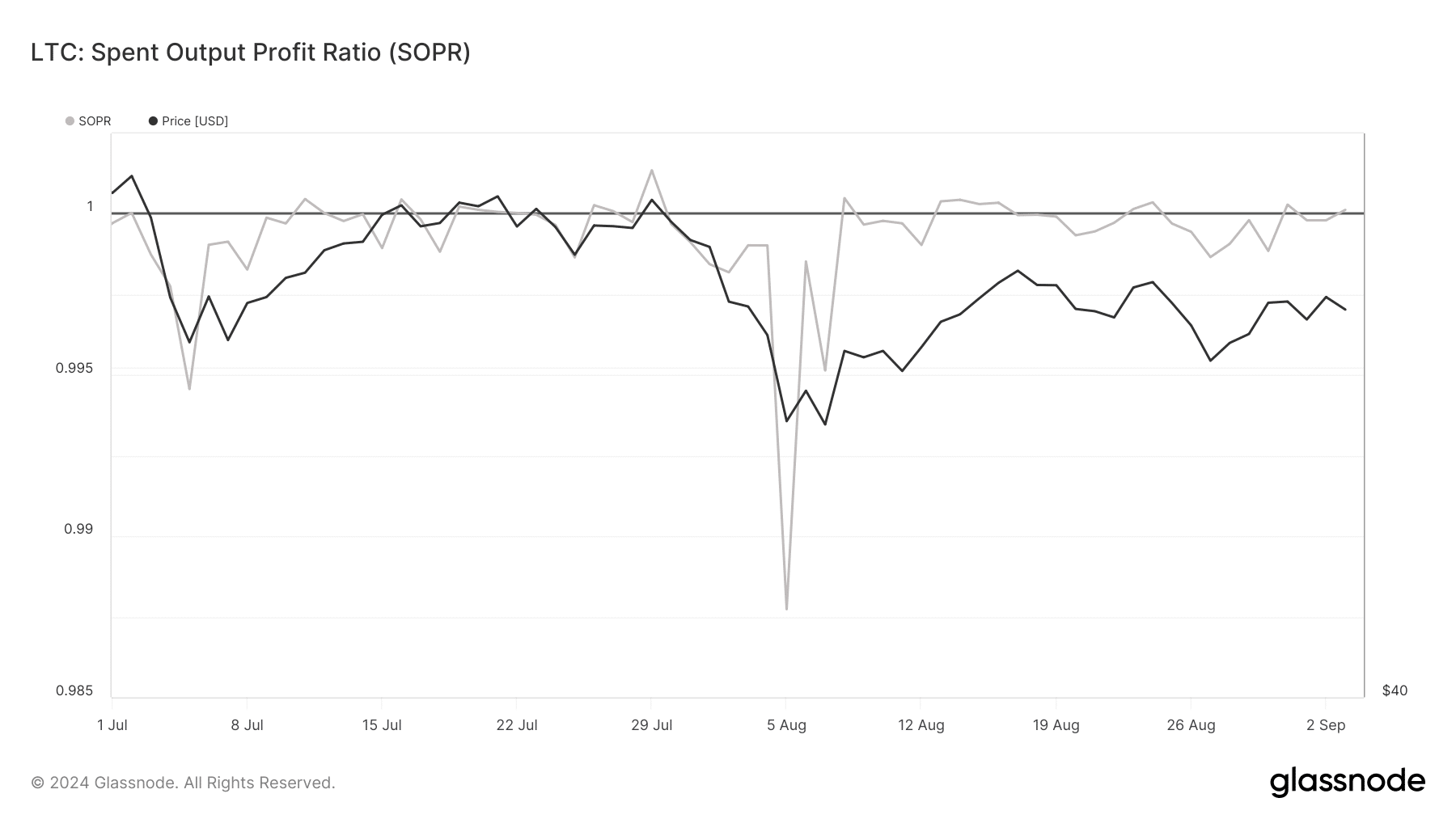

A crucial statistic to track when it comes to Litecoin is the Spent Output Profit Ratio (SOPR), this metric helps determine if Litecoin holders are currently selling their coins at a gain or a loss

A SOPR value of 1.0 signifies that coins are being traded for the same amount as their initial cost. When this value exceeds 1.0, it suggests coin holders are realizing profits from their sales. Conversely, if the SOPR value falls below 1.0, it indicates that holders are incurring losses during their transactions

Based on information from Glassnode, it appears that Litecoin’s Spending Output Profit Ratio (SOPR) has experienced a slight recovery. This ratio had fallen below 1.0 around the beginning of last month, but it has since risen back up to 1.0

Read Litecoin’s [LTC] Price Prediction 2024–2025

This suggests that, on average, Long-Term Contract (LTC) sellers are currently recovering the amount they initially paid, implying a potential trend towards market stability

As a researcher delving into the world of cryptocurrencies, I’ve noticed an intriguing pattern: An upward trend in Spent Output Profit Ratio (SOPR) might be a promising indicator for Litecoin’s price movement. This could suggest that selling pressure is diminishing and investors are growing more confident about their buying decisions

Read More

- Solo Leveling Season 3: What You NEED to Know!

- AUCTION PREDICTION. AUCTION cryptocurrency

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- `Tokyo Revengers Season 4 Release Date Speculation`

- Is Disney Faking Snow White Success with Orchestrated Reviews?

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- XRP CAD PREDICTION. XRP cryptocurrency

- ETH PREDICTION. ETH cryptocurrency

- How to Install & Use All New Mods in Schedule 1

2024-09-05 07:04