-

PEPE price was consolidating at the $0.0000077 resistance level after a successive bullish rally.

Steady token supply clashed with unclear short-term price direction.

As a seasoned crypto investor with a knack for spotting trends and interpreting market signals, I find myself at a crossroads with PEPE [PEPE]. The coin has shown promising signs of growth, but the current consolidation at $0.0000077 is causing a bit of uncertainty.

At the current moment, PEPE [PEPE] was assessing a significant resistance point at approximately 0.0000077. This development follows PEPE’s rejection of a promising bullish pennant at 0.0000063, which then led to an impressive jump of around 20% in its recent trading value.

At $0.0000077, a significant hurdle formed, preventing the upward trend from pushing further towards testing the higher resistance at $0.0000091.

Prior to an anticipated series of upward trends, there’s growing interest in the market about whether this bullish surge is set to persist or not, as we enter a phase of consolidation.

The stochastic RSI signal for PEPE shows a potential bullish trend divergence, meaning the current consolidation could result in an uptrend. Yet, it’s important to note that a bearish reversal remains possible as the stochastic RSI is nearing an overbought level.

On the chart, a bullish pennant shape suggests a likely breakout, increasing the odds. Yet, the significant barrier at $0.0000077 could prove difficult for the bulls to surmount.

PEPE whales are watching

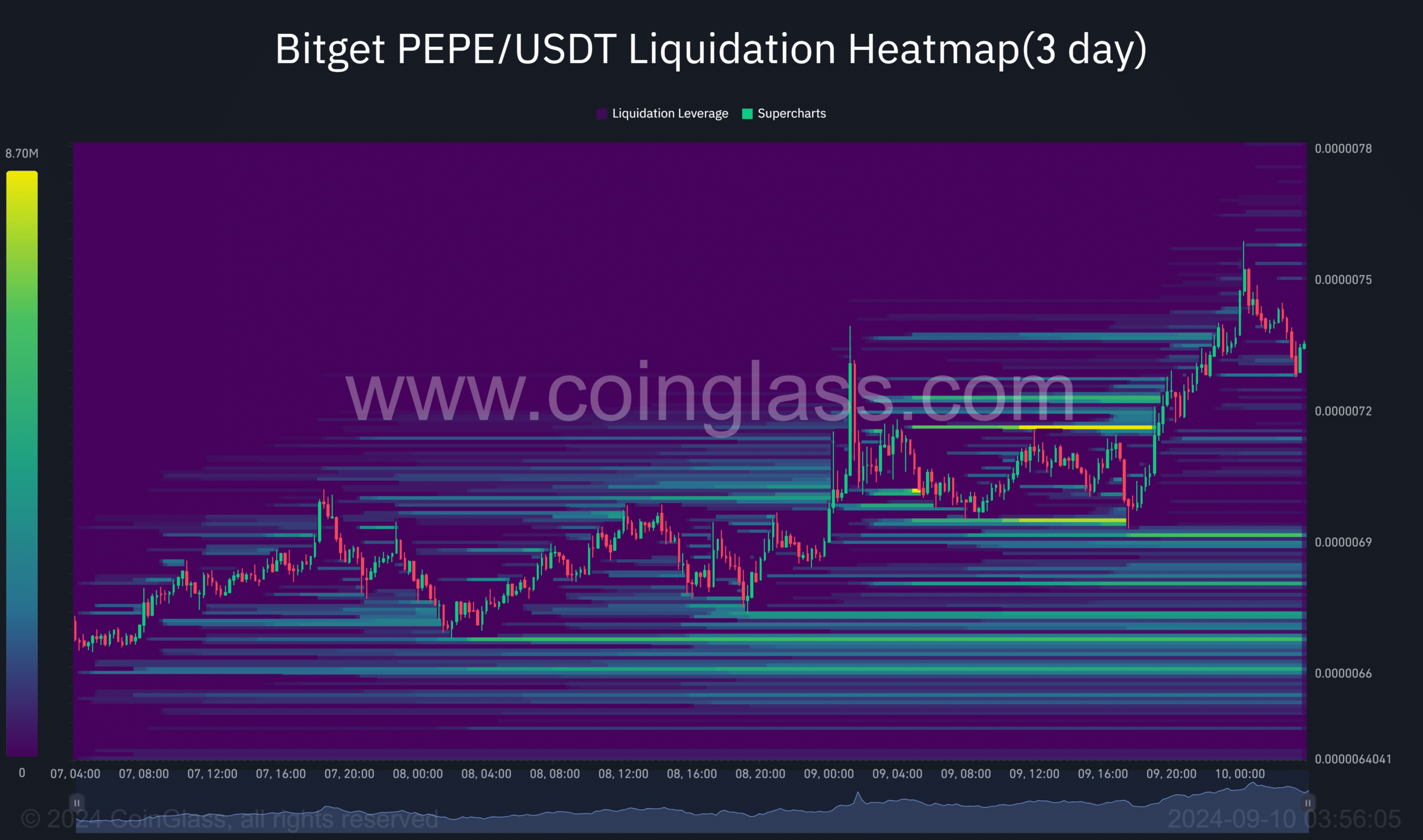

Examining current market movements, the Coinglass liquidation map showcased some intriguing patterns regarding the behavior of large investors, or “whales.

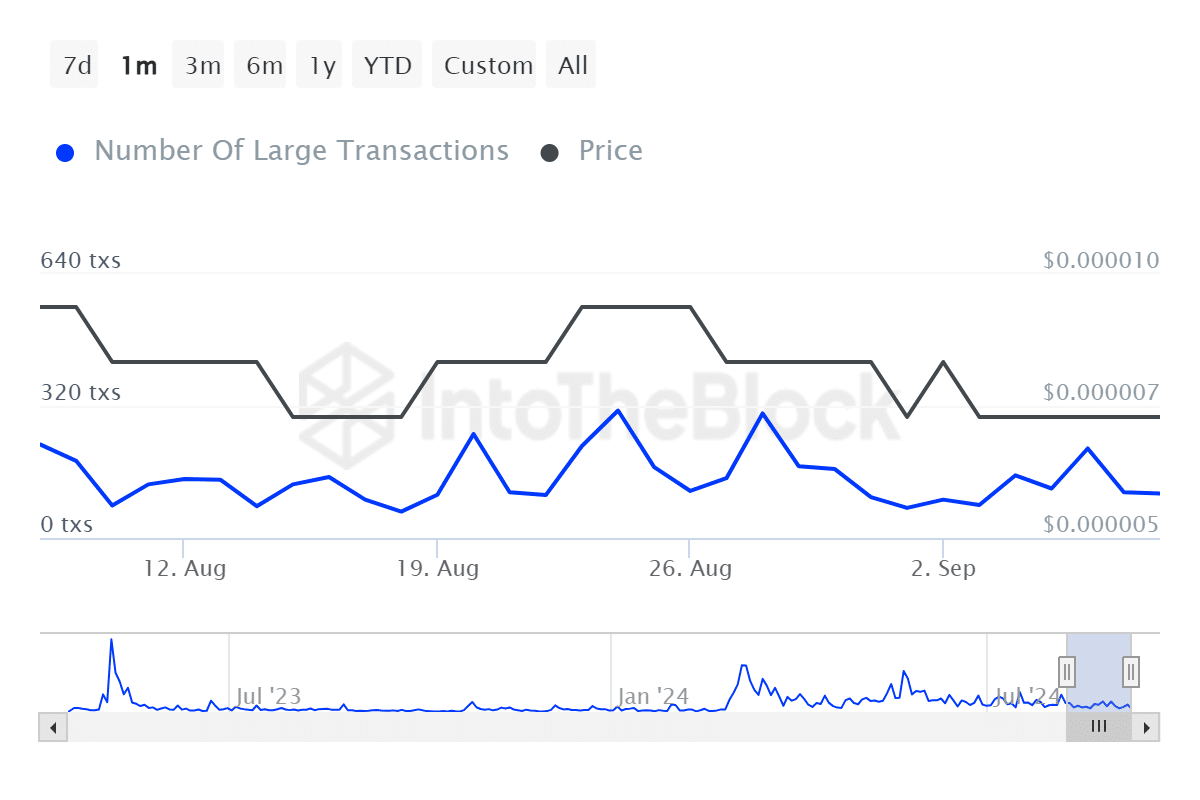

As an analyst, I’ve noticed a trend: PEPE ‘whales’ seem to be re-entering the market. Notably, key players are adjusting their positions near current price points. This strategic positioning could generate anticipation among investors if PEPE experiences a substantial price shift.

Is supply stability becoming a long-term anchor?

Regarding PEPE‘s supply, it has remained stable over the past few months despite temporary fluctuations. If this trend continues, its constancy might serve as a long-term pricing benchmark if demand persists.

43 million worth of PEPE is currently in the liquidation pool, with each unit priced at $0.0000075. This substantial amount could potentially attract the market towards it, causing the prices to surpass the crucial resistance level and potentially boosting bullish trends for PEPE.

Is your portfolio green? Check the Pepe Profit Calculator

In the near future, investors and traders are closely monitoring the $0.0000077 barrier. Breaking through this level might propel PEPE towards its latest peak of $0.0000091.

If it fails to break through, we might see it drop back down to support around $0.0000069.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Disney’s Snow White Dwarfs Controversy: THR’s Shocking Edit Exposed!

- Benny Blanco and Selena Gomez’s Romantic Music Collaboration: Is New Music on the Horizon?

- Jimmy Carr Reveals Hilarious Truth About Comedians’ Secret Competition on Last One Laughing!

- Kanye West’s Wife Stuns Completely Naked at 2025 Grammys

- ETH/USD

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Shocking Truth Revealed: Is Cassandra Really Dead in Netflix’s Terrifying Mini-Series?

- See Channing Tatum’s Amazing Weight Loss Transformation

- Patrick Schwarzenegger Strips Down in Shocking White Lotus Scene You Have to See!

2024-09-10 11:35