-

The surge in BTC buying by whales, coupled with the influx of newly minted USDC, appeared to be key driving factors.

Declining exchange reserves and negative Netflow signals indicated that the rally was likely to persist.

As a seasoned analyst with years of experience navigating the volatile world of cryptocurrencies, I have to admit that this BTC rally has caught my attention. The strategic accumulation by whales and the infusion of USDC liquidity into the market have created a perfect storm, driving prices skyward.

Over the past day, the value of Bitcoin (BTC) increased by approximately 4.13%, reaching a price of $57,054.21 at the moment of reporting. It seems likely that this growth could persist in the coming days.

Nonetheless, it remains puzzling why BTC experienced a sudden rise despite $34.79 million being bet on its decline per data from Coinglass.

Whales propel BTC rally with strategic accumulation

Lately, some important data about tracking has shown that large investors (whales) have been amassing more Bitcoins. This suggests that they’re becoming more optimistic about the asset, and their actions are significantly influencing Bitcoin’s market trends.

From early September onward, we’ve noticed large investors (whales) accumulating 2,814 Bitcoin. Notably, one such investor has established a fresh wallet for the purpose of moving 300 Bitcoin, which is equivalent to around $17.19 million.

Additionally, in two transactions 600 BTC was withdrawn from Binance and moved to a new wallet.

The shift of Bitcoins from centralized platforms to personal wallets implies that these key figures are preparing their Bitcoin for a long-term investment strategy, thereby decreasing the likelihood of immediate selling in the market.

At the same time, the U.S. Dollar Coin Treasury produced 50 million USDC, significantly boosting the market’s liquidity. These additions often lead to increased demand for assets like Bitcoin, causing their prices to rise.

BTC upswing likely to continue

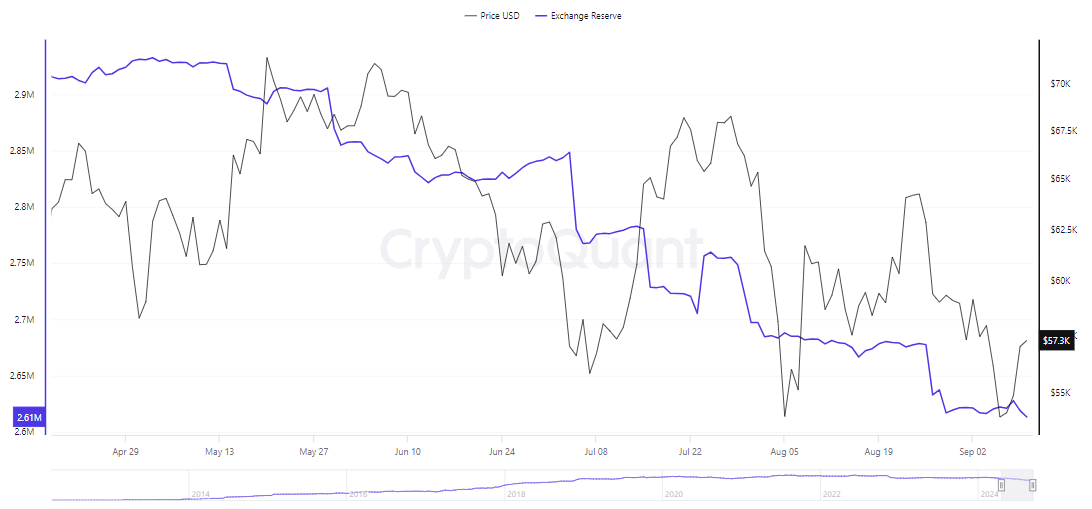

According to CryptoQuant’s analysis of Exchange Reserve and Netflow data, Bitcoin’s ongoing uptrend appears likely to continue, given its recovery following the recent market drop.

The Exchange Reserve for BTC, which measures the amount of the cryptocurrency held in exchange wallets, has sharply decreased to 2,613,649.772.

Generally speaking, an increase in a country’s foreign exchange reserves often indicates a pessimistic perspective on the market, as it suggests that investors are more inclined to sell rather than buy assets in liquid markets.

Instead, when reserves are decreasing, it suggests a tightening in the supply, which boosts investor confidence over the long term. This can be interpreted as a positive outlook or optimism, often referred to as “bullish sentiment.

Additionally reinforcing this optimistic perspective, AMBCrypto’s analysis indicates a predominant negative flow in the Exchange Netflow across all major centralized platforms.

The decrease in positive Netflow signifies that cryptocurrencies, particularly Bitcoin (BTC), are being transferred from public exchanges to personal wallets. This shift may lessen the likelihood of immediate selling, as large-scale investors and whales tend to influence such trends.

With the ongoing whale activities, there’s been a noticeable change among retail investors – their feelings toward the market are increasingly optimistic, or put another way, they’re leaning heavily towards a bullish outlook.

Retail traders capitalize on BTC’s upward trend

It’s clear that retail investors are becoming more optimistic about Bitcoin, as indicated by their rising investments in anticipation of Bitcoin’s price increase.

This change corresponds to a substantial jump in Trading Activity, with Trading Volume rising by 47.98% or $64 billion. Likewise, Options Activity has experienced a remarkable spike of 91.90%.

Furthermore, as reported by Coinglass, the Open Interest (OI) currently stands at $29.98 billion, marking an increase of 3.66%. This figure was recorded at the point of our last update.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

The increase in both trading activity and open interest suggests a significant injection of funds into the Bitcoin Futures market, highlighting the robustness of the ongoing price surge.

Maintaining its current trajectory, it’s probable that Bitcoin will rise further in price over the coming days, suggesting that retail investors remain actively engaged.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Disney’s Snow White Dwarfs Controversy: THR’s Shocking Edit Exposed!

- Shocking Truth Revealed: Is Cassandra Really Dead in Netflix’s Terrifying Mini-Series?

- Kanye West’s Wife Stuns Completely Naked at 2025 Grammys

- Jimmy Carr Reveals Hilarious Truth About Comedians’ Secret Competition on Last One Laughing!

- AUCTION/USD

- See Channing Tatum’s Amazing Weight Loss Transformation

- Patrick Schwarzenegger Strips Down in Shocking White Lotus Scene You Have to See!

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- White Lotus Star Parker Posey Waited 20 Years for Role

2024-09-10 22:16