-

Ethereum ETF saw an outflow of over $20 million.

ETH has lost most of its gains from the previous trading session.

As a seasoned crypto investor who has weathered numerous market cycles and witnessed the rise and fall of various digital assets, I can’t help but find myself intrigued by the current state of Ethereum. The recent outflow from the Ethereum ETF, despite ETH showing gains in the previous trading session, is a curious development that seems to defy conventional wisdom.

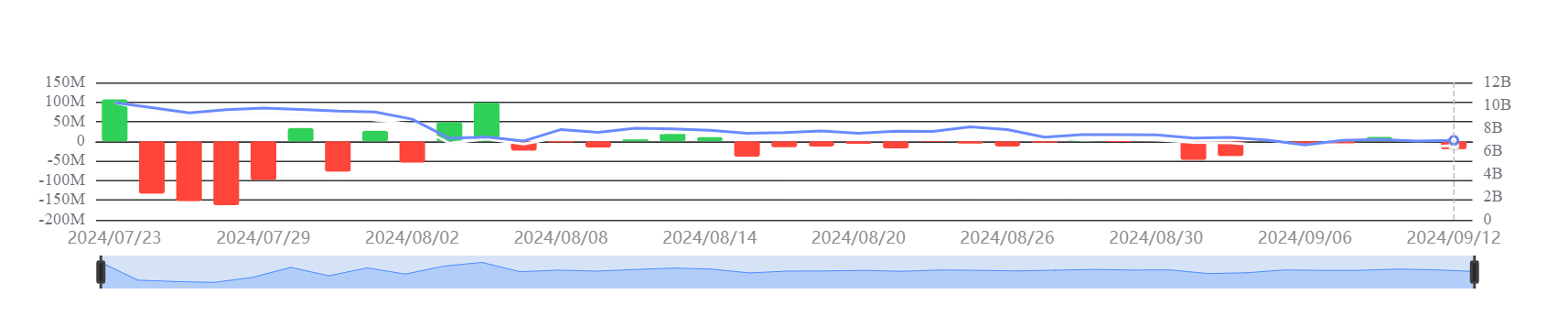

In the most recent data we’ve seen, it appears that an Ethereum-based ETF experienced a decrease in investments during its latest trading day, making this the second straight day with withdrawals.

Despite ending my Ethereum [ETH] trading day with profits, I was still left feeling a bit unsettled due to the overall market trends that seemed to offset those gains.

Ethereum ETF see a consecutive outflow

Based on information from Sosovalue, there were more withdrawals from the Ethereum ETF on September 12th. This trend has persisted even though Ethereum ended the preceding trading day with gains.

Furthermore, it was found that most U.S.-based ETFs experienced no change in their assets (net flow), but there was an exception – Grayscale, which experienced a withdrawal of approximately $20.14 million. At the present time, the total net asset value stands at roughly $6.45 billion.

Investor withdrawals from the ETF could suggest they’re realizing their gains or shifting assets, despite a rising trend in Ethereum’s price.

The pattern implies that although institutional investors might temporarily shift their positions, the demand for Ethereum from retail and direct markets could remain robust. This could maintain or even boost its price level, overriding any potential impact of ETF withdrawal flows.

ETH caught between profit and loss

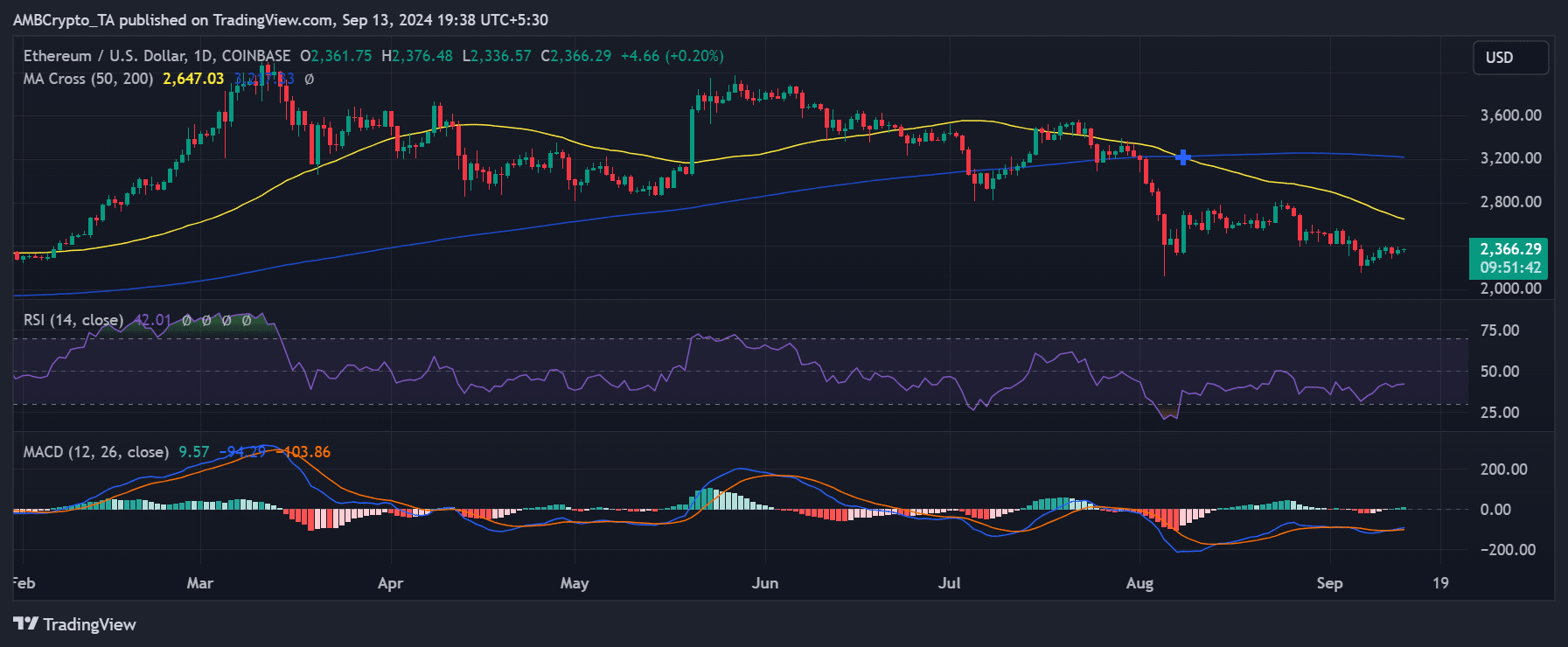

According to AMBCrypto’s examination of Ethereum’s daily price chart, Ethereum ended the previous trading day with approximately a 1% rise, placing its value at roughly $2,361.

Currently, at the moment I’m writing this, the leading altcoin has experienced a significant loss of its previous gains, trading around $2,350, representing a minor decrease of 0.45%.

After closer examination, it was observed that the value of ETH remained relatively stable, similar to the pattern seen in the flow of Ethereum ETFs, as it found difficulty in reaching the $2,500 price mark.

In simpler terms, the yellow line, which represents a brief moving average, has emerged as a significant barrier for the current price range. Each time Ethereum attempts to move beyond it, it fails to do so.

The price of Ethereum has found strong resistance near the $2,500 mark, making it a substantial barrier for its ongoing upward movement.

Holders continue accumulation

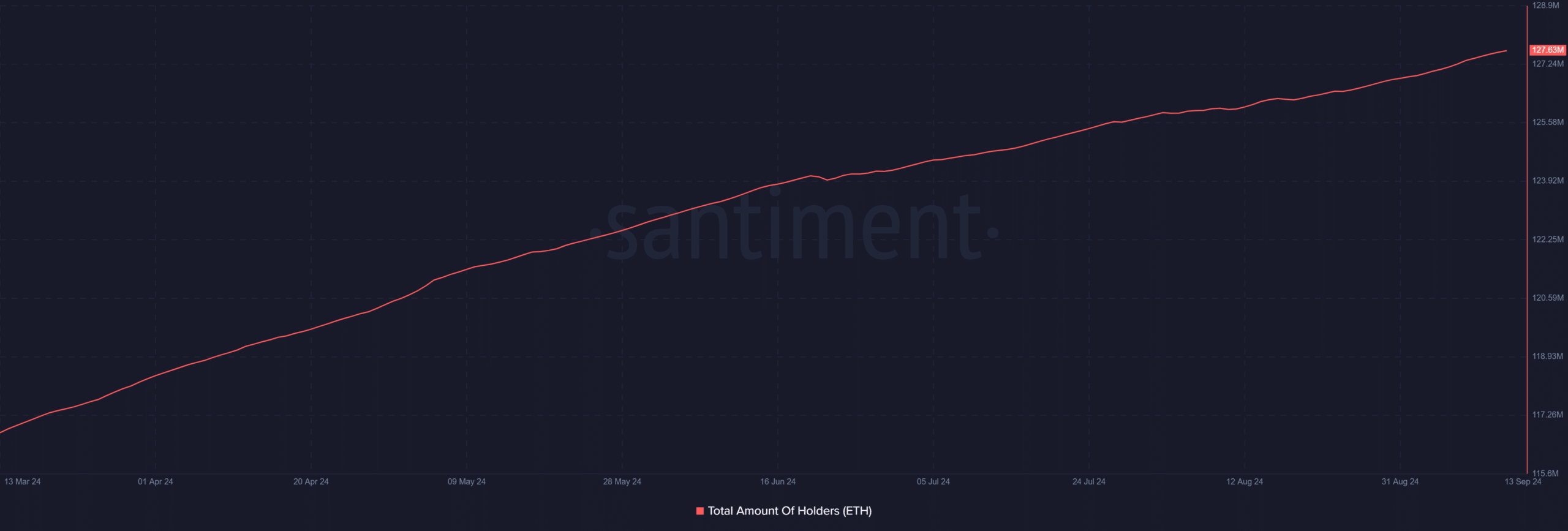

Examining the graph of Ethereum owners, it was found that the total number of Ethereum owners has persistently increased, even as trends show a decrease in Ethereum ETF ownership.

As of this writing, the number of holders surpassed 127 million, showing a consistent upward trend.

Read Ethereum’s [ETH] Price Prediction 2024-25

As I’ve noticed, the count of wallets holding some ETH has been on the rise, hinting at an uptick in new buyers entering the Ethereum market.

The increase in the number of owners is viewed as a promising development, considering the present modest fluctuations in prices and Ethereum’s stubbornness at the $2,500 mark.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- AUCTION PREDICTION. AUCTION cryptocurrency

- How to Install & Use All New Mods in Schedule 1

- ETH PREDICTION. ETH cryptocurrency

- `Tokyo Revengers Season 4 Release Date Speculation`

- Kayla Nicole Raves About Travis Kelce: What She Thinks of the Chiefs Star!

- Why Aesha Scott Didn’t Return for Below Deck Down Under Season 3

- `Kylie Kelce Spills the Tea on Travis Kelce and Taylor Swift’s Relationship`

- Jimmy Carr Reveals Hilarious Truth About Comedians’ Secret Competition on Last One Laughing!

2024-09-14 11:35