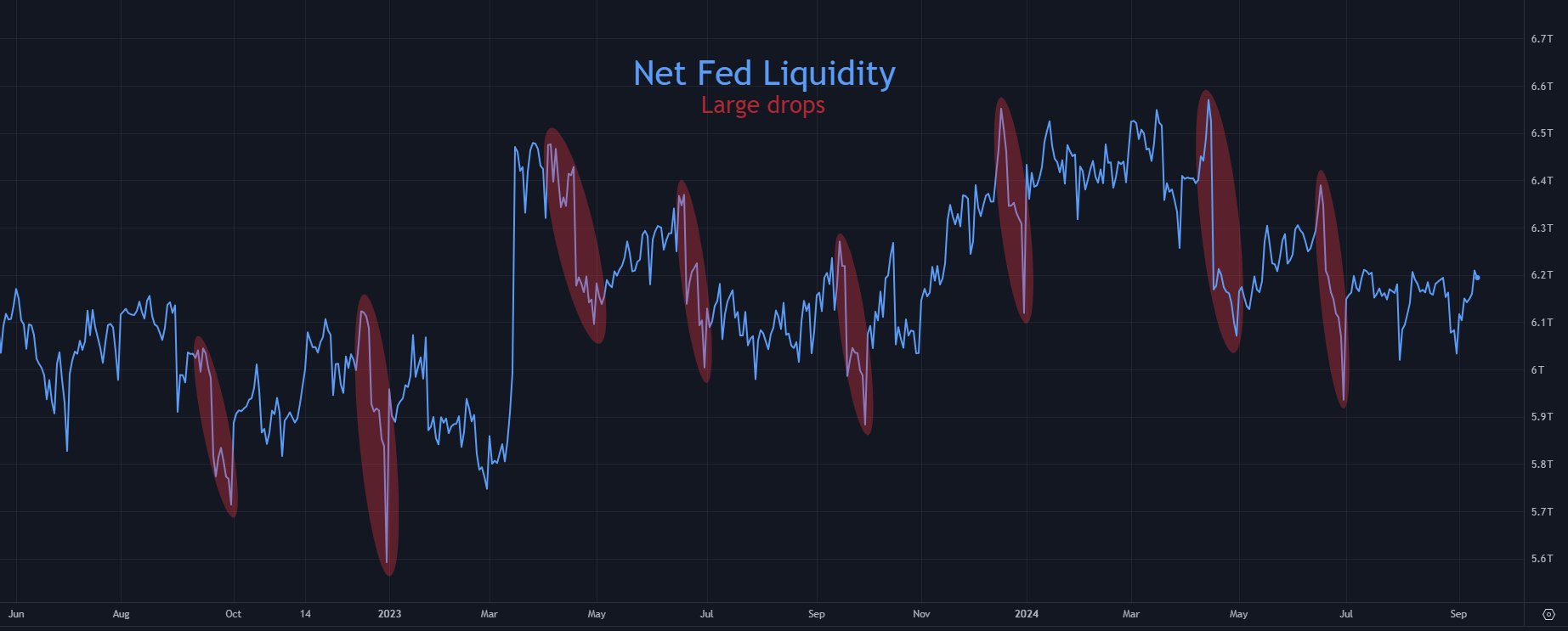

- Net Fed liquidity drop expected in 2nd half of September

- Bitcoin’s price recovery can be expected in October

As a seasoned crypto investor with a decade of experience navigating the volatile Bitcoin market, I find myself cautiously optimistic about the upcoming months. The anticipated Net Fed liquidity drop in September is undeniably concerning, but history has shown us that Bitcoin tends to follow medium-term trends of Net Fed Liquidity.

Bitcoin (BTC) is experiencing major changes in the market, primarily because analysts expect a decrease in liquidity from the Federal Reserve during the latter part of September.

Indeed, renowned analyst Tomas predicts a potential withdrawal of funds in the range of $300 billion to $550 billion. Such an occurrence might impact investment vehicles that are considered high-risk, such as Bitcoin, gold, and the S&P 500.

For the past four years, the link between Federal Reserve liquidity and Bitcoin has stayed robust, but it can shift unexpectedly at any moment.

Historically, significant decreases in liquidity have tended to drive down Bitcoin’s price as shown on graphs. But there’s an indication that a partial turnaround might happen on October 1st, giving us reason to believe that it could potentially bounce back.

From September 2022 to August 2024, Bitcoin’s average daily performance was positive at +0.26%.

In times when there’s a significant drop in Federal liquidity, Bitcoin’s performance has been observed to decline to -0.13%, showing how lessened liquidity can impact Bitcoin’s price.

During periods of liquidity dips, Bitcoin has demonstrated a strong ability to bounce back. Generally speaking, its short-to-medium term price movements seem to align with the trend of Net Federal Liquidity.

Starting from the year 2020, it’s been observed that during periods of decreasing market liquidity, Bitcoin’s value against the US Dollar (BTC/USD) has either stayed stable or dropped. However, it has grown stronger only during increasing market trends.

The continuation of this trend is likely if the Federal Reserve doesn’t halt its ongoing Quantitative Tightening (QT) process. In simpler terms, it means that as long as the Fed keeps reducing its bond-buying program, the current situation is expected to persist.

In simple terms, we could expect a new development regarding QT (Quantitative Tightening) during the Federal Open Market Committee (FOMC) gathering scheduled for September 18. This potential update might provide additional understanding about forthcoming liquidity patterns and how they may influence the value of Bitcoin.

What do the price charts say?

Currently, the value of Bitcoin has surpassed its 4-hour 200 Exponential Moving Average (EMA), and at this moment, it’s being traded at approximately $60,000. After experiencing a dip to the $52,000 support point, Bitcoin has rebounded back.

The shift in the 200EMA suggests that Bitcoin could potentially see a price increase in both the immediate and medium future. This is particularly notable given the market’s current indications of growing momentum and strength.

If Bitcoin’s current level persists, we can expect the upward trend to carry on through October. This prediction holds true despite the upcoming liquidity shift.

Bitcoin’s supply divergence

Furthermore, an interesting disparity emerged in the distribution of Bitcoin’s supply. As we speak, the circulating supply was approximately 19.8 million units, with about 14.6 million Bitcoin (or 73%) being relatively inactive.

Scarcely traded or moved Bitcoin reserves held by entities, which are seldom exchanged or moved, are often referred to as immobile or fixed supply. These Bitcoins are not readily available for market transactions.

The increasing amount of locked-up Bitcoin is decreasing the market’s total fluidity. Conversely, a substantial 5.2 million BTC, which can be easily bought and sold, constitutes both liquid and highly liquid supply within the market.

This imbalance between illiquid and liquid supply adds another layer to Bitcoin’s price movements.

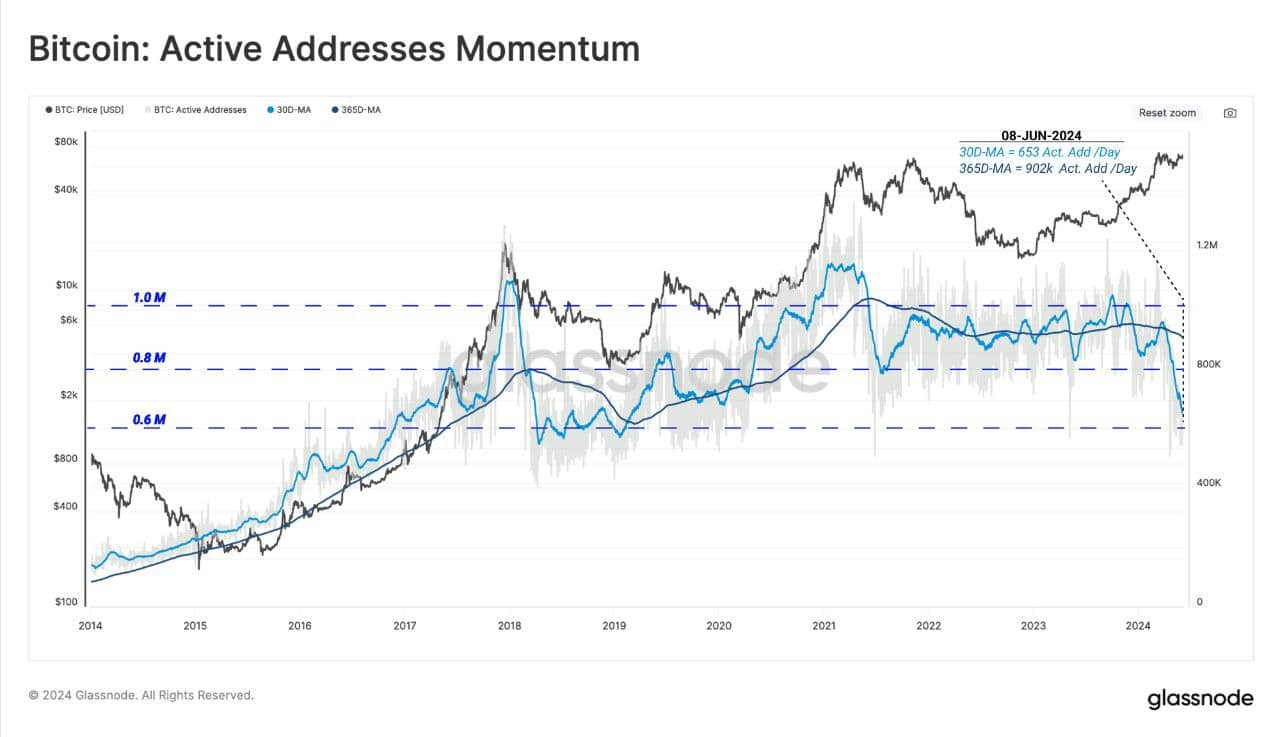

Active addresses momentum

To wrap up, even though the number of Bitcoin transactions has reached a record level, the number of active addresses has dropped significantly. This discrepancy goes against previous bullish trends where both transaction volume and user activity usually increase simultaneously.

To sum up, although Bitcoin’s cost is increasing and it seems to be gaining traction in the market, a decreasing number of people are currently involved in Bitcoin transactions.

Based on Glassnode’s analysis, this discrepancy signals a shift in market trends, potentially influencing Bitcoin’s value over the next few months.

In summary, Bitcoin’s value appears ready to increase further, but the flow of funds (liquidity) and the distribution of supply will remain crucial factors.

Read More

- OM/USD

- Solo Leveling Season 3: What You NEED to Know!

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- ETH/USD

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Aimee Lou Wood: Embracing Her Unique Teeth & Self-Confidence

- Silver Rate Forecast

2024-09-14 18:16