-

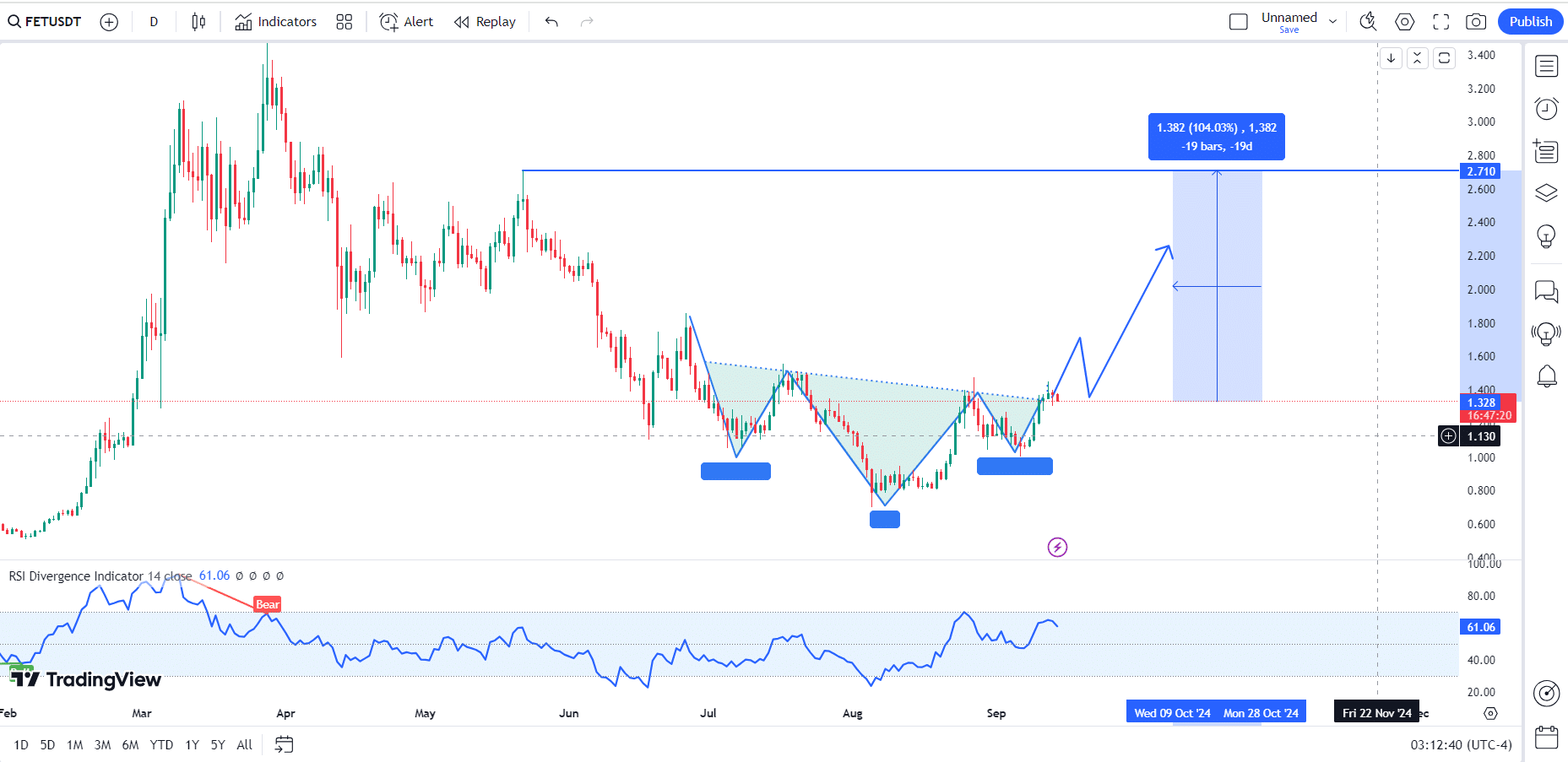

Fetch.AI forms head and shoulders pattern, signal for reversal.

FET on-chain activity and social dominance increase.

As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of market trends and patterns. The current situation with Fetch.AI (FET) is particularly intriguing, given its impressive performance and the formation of an inverse head-and-shoulders pattern.

The Artificial Superintelligence Alliance (FET) has experienced significant expansion recently, with a growth of more than 25% within the last seven days, according to CoinMarketCap.

Cryptocurrencies tied to artificial intelligence are picking up speed, notably following the release of Nvidia’s (NVDA) financial results, which surpassed predictions.

As a crypto investor, I’ve noticed that Nvidia significantly impacts the value of AI-focused coins such as Fetch.AI. The recent market trends hint towards an upward trajectory for AI-related cryptos, with the fourth quarter of this year looking promising for a broader market recovery, potentially driving up the price of my investments.

Experts anticipate that Fine Electronic Technology’s latest results might hint at more growth potential, particularly since it has formed an inverse head-and-shoulders pattern, often signaling a shift in market direction.

The FET token’s trajectory indicates it has been on a downward spiral since April; however, the present trend hints at the possibility of a robust support level being established.

Should the FET stock manage to breach its current resistance line (the neckline) and subsequently revisit that same breakout point, it may potentially yield returns exceeding 104% before the year’s end or in the following year.

Moreover, the Relative Strength Index (RSI) exceeded the neutral range, implying that investor confidence might be growing more positive.

Given the bullish trend, these elements suggest a strong possibility for FET‘s price to experience substantial growth over the next few months when considered together.

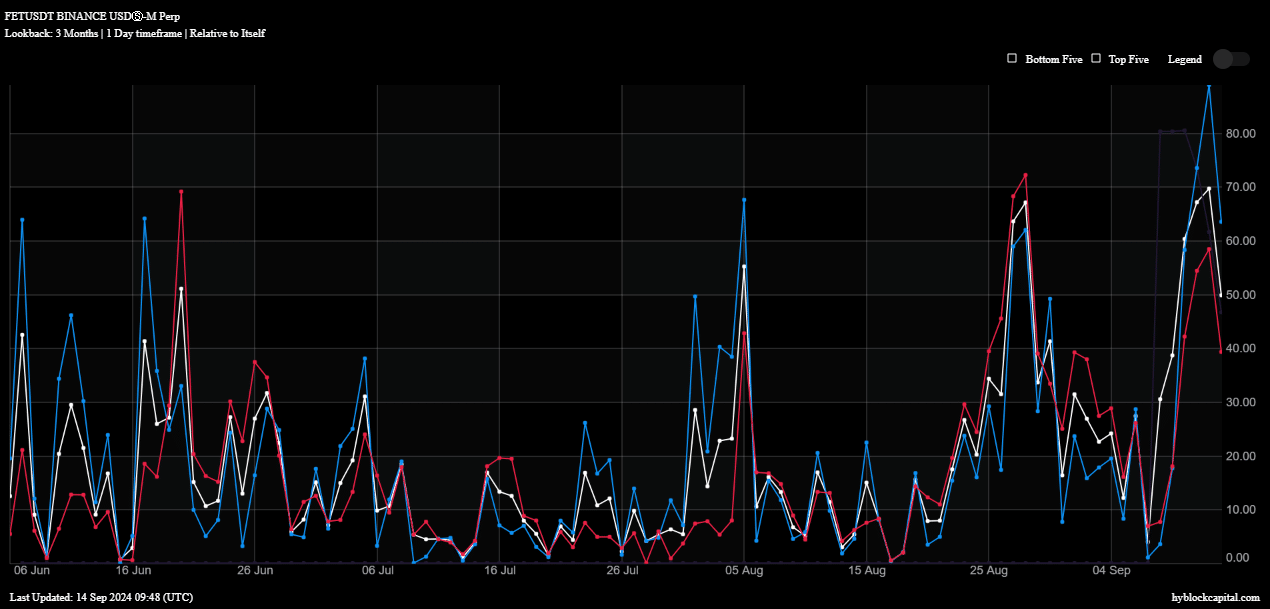

Liquidations, funding rates and volume

Gathering information directly from the blockchain gives a clearer understanding of how the price of FET is fluctuating. Notably, liquidations, funding rates, and trading volumes have been steadily increasing for FET, especially during the month of September, indicating a positive outlook.

As an analyst, I’ve noticed that these specific metrics have been experiencing a correction lately. However, they’ve been consistently climbing since early September, which strengthens the case for potentially increased FET prices in the future.

63% of assets are being liquidated, worldwide funding levels stand at 50%, and trading volume has decreased slightly to 39%.

Over the past three months, these figures have given us robust evidence favoring a positive market view. The steady performance indicates that Asi might continue its upward trajectory.

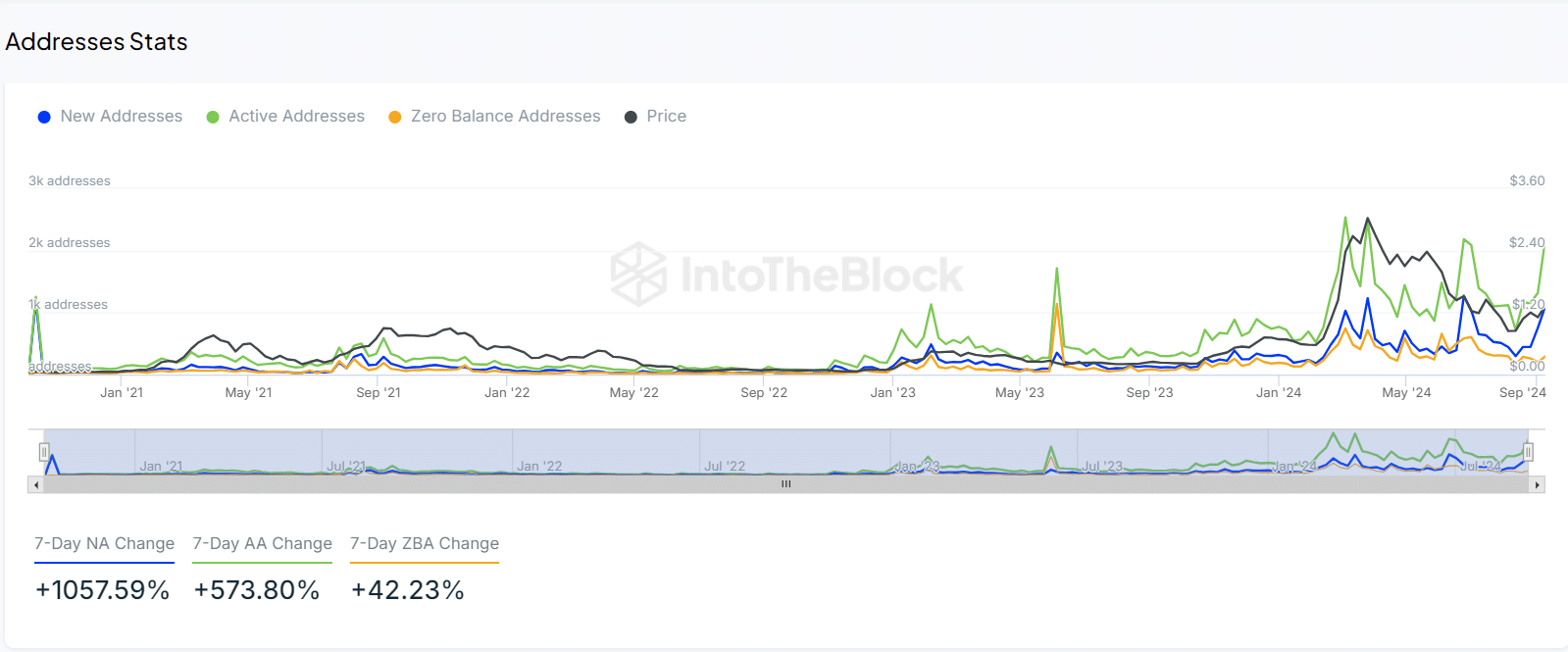

FET active addresses

Observing the transaction data, it shows a continuous rise in the count of unique wallets possessing the token since late August. Simultaneously, there’s been a decline in the number of wallets without any balance, suggesting that more investors appear to be amassing the asset.

Furthermore, the number of active addresses is nearing a brand-new record high, suggesting growing enthusiasm for the token, which could be interpreted as a positive development.

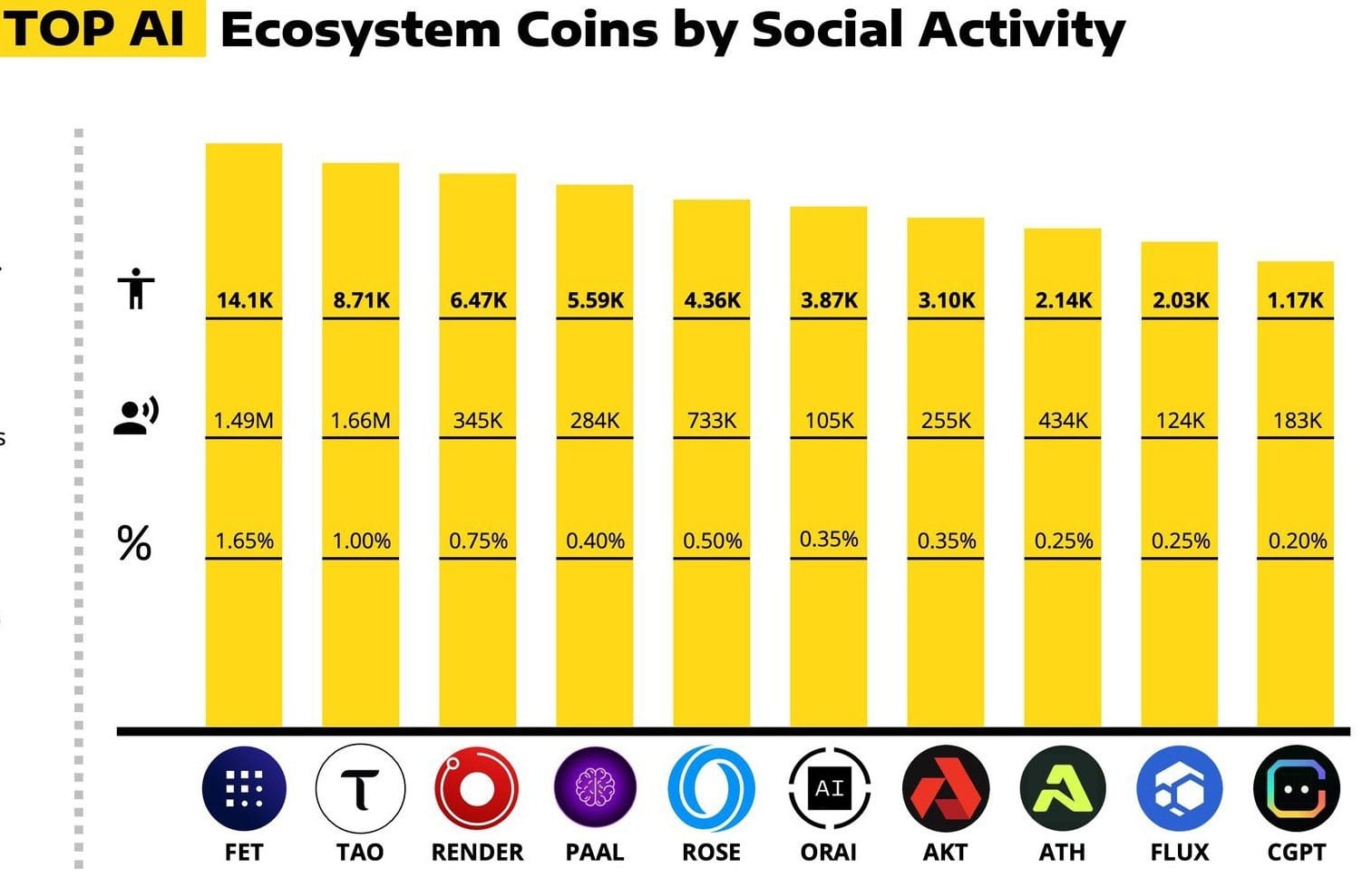

FET leads by social dominance

As a researcher delving into the realm of Future and Emerging Technologies (FET), I’ve noticed that social media presence is proving to be an advantageous factor for FET. This boosts my optimism about its future prospects even more. In the AI ecosystem, FET stands out as a dominant force, maintaining a 1.65% lead over its closest competitor, TAO, in terms of social influence.

On social media platforms such as Twitter, there’s a noticeable surge of conversations about FET, with approximately 1.5 million user engagements and over 14,000 individual posts dedicated to the token.

Read Artificial Superintelligence Alliance’s [FET] Price Prediction 2024–2025

This increase in social engagement supports the growing adoption of FET, adding yet another layer of optimism for this AI-powered crypto.

Based on its robust technological trends, positive blockchain statistics, and increasing community attention,Fetch (FET) seems poised for increased price fluctuations, particularly as the market shows signs of improvement during the last three months of the year.

Read More

- AUCTION/USD

- Solo Leveling Season 3: What You NEED to Know!

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- `Tokyo Revengers Season 4 Release Date Speculation`

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- Stephen A. Smith Responds to Backlash Over Serena Williams Comments

- XRP/CAD

- Is Disney Faking Snow White Success with Orchestrated Reviews?

- Disney’s Snow White Promotion in Chaos as Rachel Zegler Goes ‘Out of Control’

2024-09-15 12:08