-

The CKB token saw massive gains, breaching two-month highs.

Some short-term volatility and profit-taking could see the price and the OI decrease.

As a seasoned researcher with years of market analysis under my belt, I must admit that the meteoric rise of Nervos Network [CKB] has caught my attention. The sheer volume surge and price gains have been nothing short of breathtaking. It’s like watching a rocket launch, where every second brings new highs.

🚀 EUR/USD to Explode? Trump Trade Shocks Incoming!

Don't miss the crucial analysis before the market reacts!

View Urgent ForecastOn September 13th, Nervos Network [CKB] saw a significant surge in its price trend. The trading activity that had been largely inactive suddenly spiked dramatically. In just one day, the trading volume jumped from $5.94 million to an impressive $264 million.

Following a significant 51% price jump that coincided with an increase in trading volume, the token’s trajectory has been upward. Given this trend, what is the forecasted price movement of the Nervos Network over the next few weeks?

Nervos Network breaks July highs

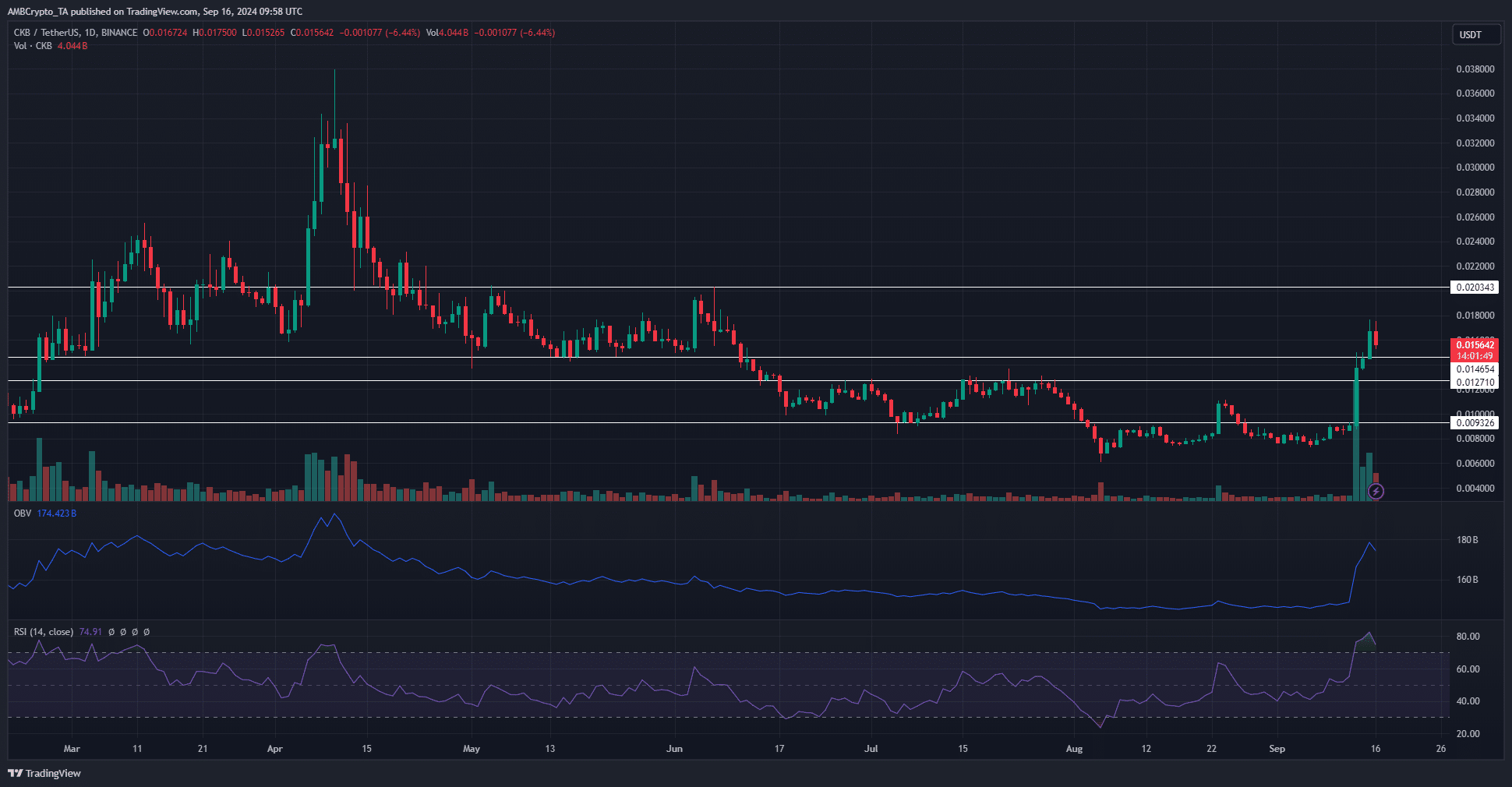

On September 13th, a significant increase in trading activity caused the token to end the day 51% above its initial value. Following this, it has also increased by an extra 14.2%.

In simpler terms, when the Relative Strength Index (RSI) for each day exceeded 70, it indicated that the market was experiencing overbuying. This meant that the market trend was strongly upward (bullish), but there was also a possibility that the prices might correct themselves.

Therefore, the Nervos Network price prediction, though bullish, could see short-term pullbacks.

Since April, the OBV had been moving downward, but the latest surge in prices has reignited an upward trend. This surge of buying activity could potentially establish a lasting upward momentum.

To the north, the $0.02 and $0.026 levels were the next key resistances.

CKB confident of a good performance

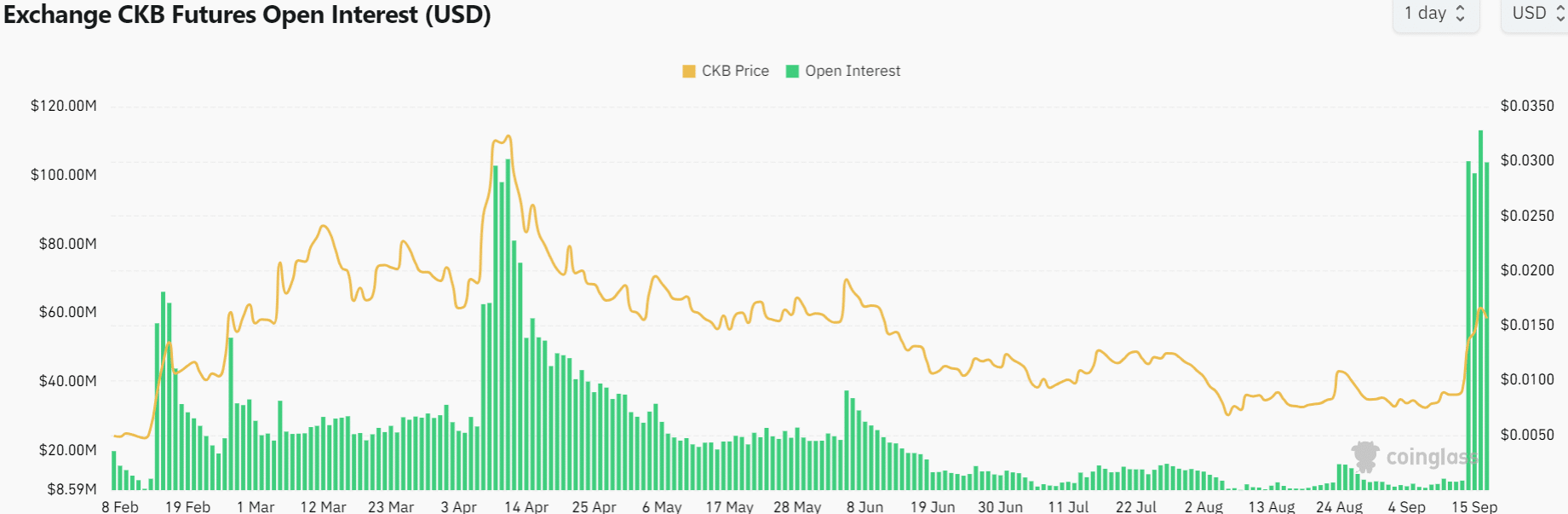

On September 14th, Open Interest surged from $11.3 million to a staggering $104 million, indicating a nearly tenfold increase. This significant jump in Open Interest suggests a massive wave of investors pouring into the market. Moreover, it underscores optimistic forecasts for the market’s future direction.

As a crypto investor, I find myself bracing for potential turbulence in the near future. The massive surge in speculative trading during this rally could lead to the market correcting itself, rather than moving upward as some might expect. In essence, the price may be more focused on targeting late long positions instead of extending the current bullish trend.

It remains to be seen if the market is overextended like mid-April earlier this year.

Realistic or not, here’s CKB’s market cap in BTC’s terms

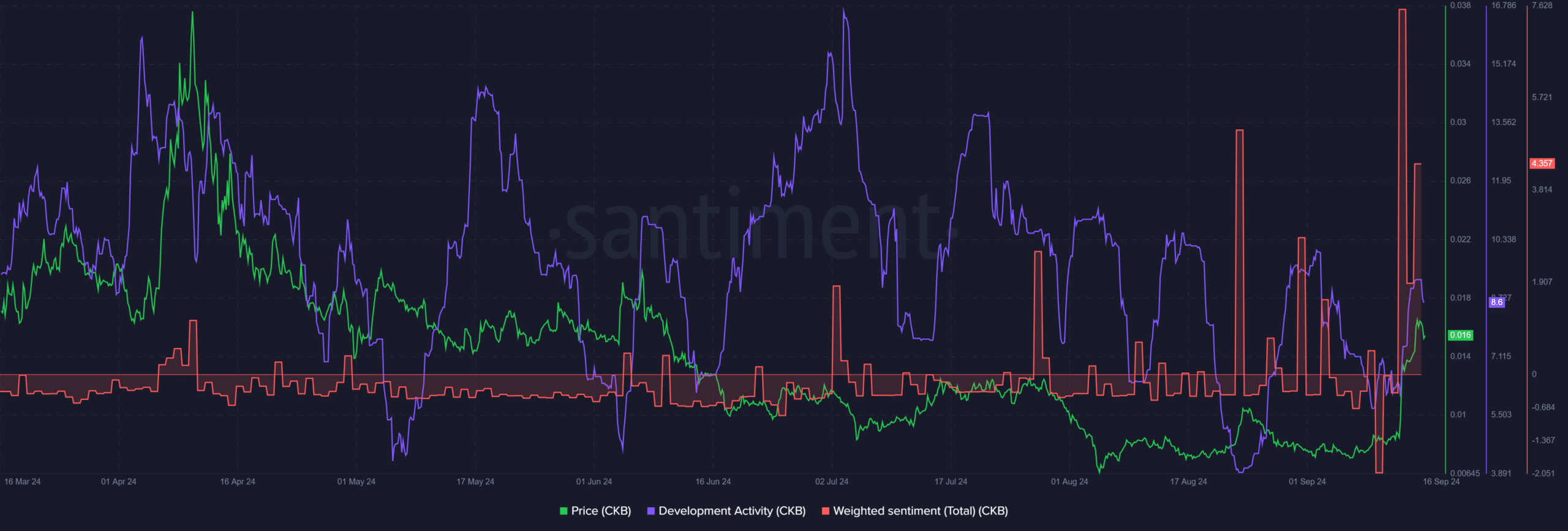

In the past six months, we haven’t observed such high sentiment scores. However, despite a downward trend recently, the level of activity remains notably high compared to other periods.

In essence, those who have invested long-term in the Nervos Network might anticipate further growth, yet it’s important to note that there could be fluctuations in the short term.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Days Gone Remastered Announced, Launches on April 25th for PS5

- Elder Scrolls Oblivion: Best Pilgrim Build

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Ludicrous

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- Brandon Sklenar’s Shocking Decision: Why He Won’t Watch Harrison Ford’s New Show!

- Elder Scrolls Oblivion: Best Sorcerer Build

2024-09-17 04:07