- Bitcoin dominance surges past 57.68%, with indicators pointing to potential bullish volatility.

- On-chain activity strengthens, while the MVRV ratio signals possible buying opportunities for investors.

As a seasoned researcher with years of experience tracking the cryptocurrency market, I find myself intrigued by Bitcoin’s recent surge in dominance and its potential for another bull run. The last time we saw such high levels was back in 2019, a period that marked the beginning of a prolonged uptrend.

For the first time since April 2019, Bitcoin’s [BTC] dominance has surged, reaching 57.68%, indicating a significant milestone. In the past, when Bitcoin’s dominance climbed this high, it often sparked an extended upward trend, pushing its dominance up to 71%.

Given the latest surge and Bitcoin’s current value standing at $59,179, having increased by 0.73% over the past day as reported, there is much debate among investors if we might be witnessing the start of another significant price surge.

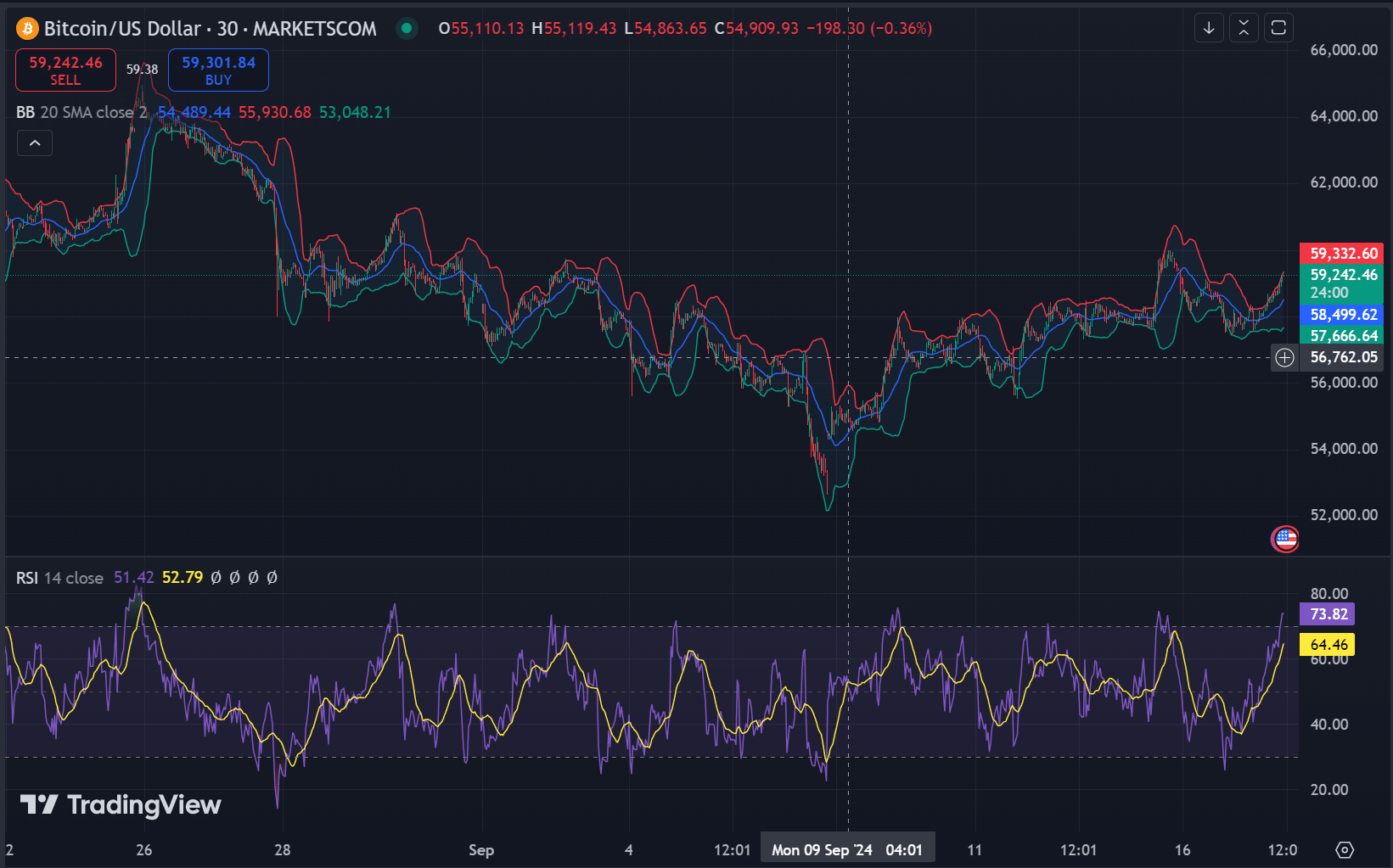

RSI and Bollinger bands suggest a potential upside

right now, Bitcoin’s Relative Strength Index (RSI) stands at 51, indicating a balanced market without any strong indications of intense buying or selling activity. At the same time, Bitcoin’s Bollinger Bands position it close to the upper band, which typically suggests possible high-volatility price increases.

Should Bitcoin manage to surpass the $59,000 mark with substantial trading activity, this could be a sign of continued price increases, thereby reinforcing or even increasing its position as the leading cryptocurrency in the market.

Exchange reserves point to long-term holders

Approximately 2.585 million Bitcoins are currently being held by exchanges, which represents a minimal 0.04% rise over the past day. This small increase indicates potential short-term selling pressure, but it’s important to note that the overall trend for this week has seen Bitcoin reserves gradually decreasing.

This suggests that investors could be transferring their Bitcoins from digital exchanges to offline wallets (cold storage), signaling a high level of long-term belief in the cryptocurrency.

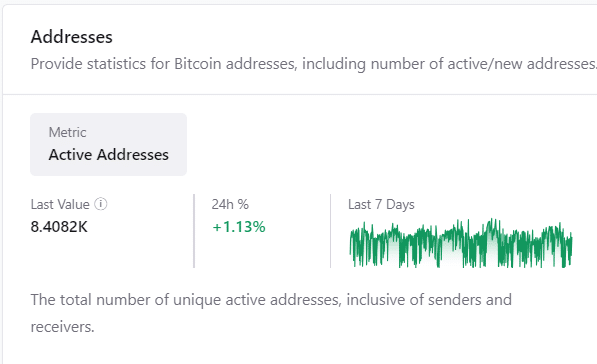

Active addresses and transactions show strong network activity

Bitcoin’s network remains active with approximately 8.4 million active addresses as of today, marking a 1.13% increase over the previous day. Additionally, the number of transactions has grown to 515,260 in the last 24 hours, representing a 0.83% surge, based on data from CryptoQuant.

This steady growth in on-chain activity supports Bitcoin’s dominance surge, highlighting strong network fundamentals.

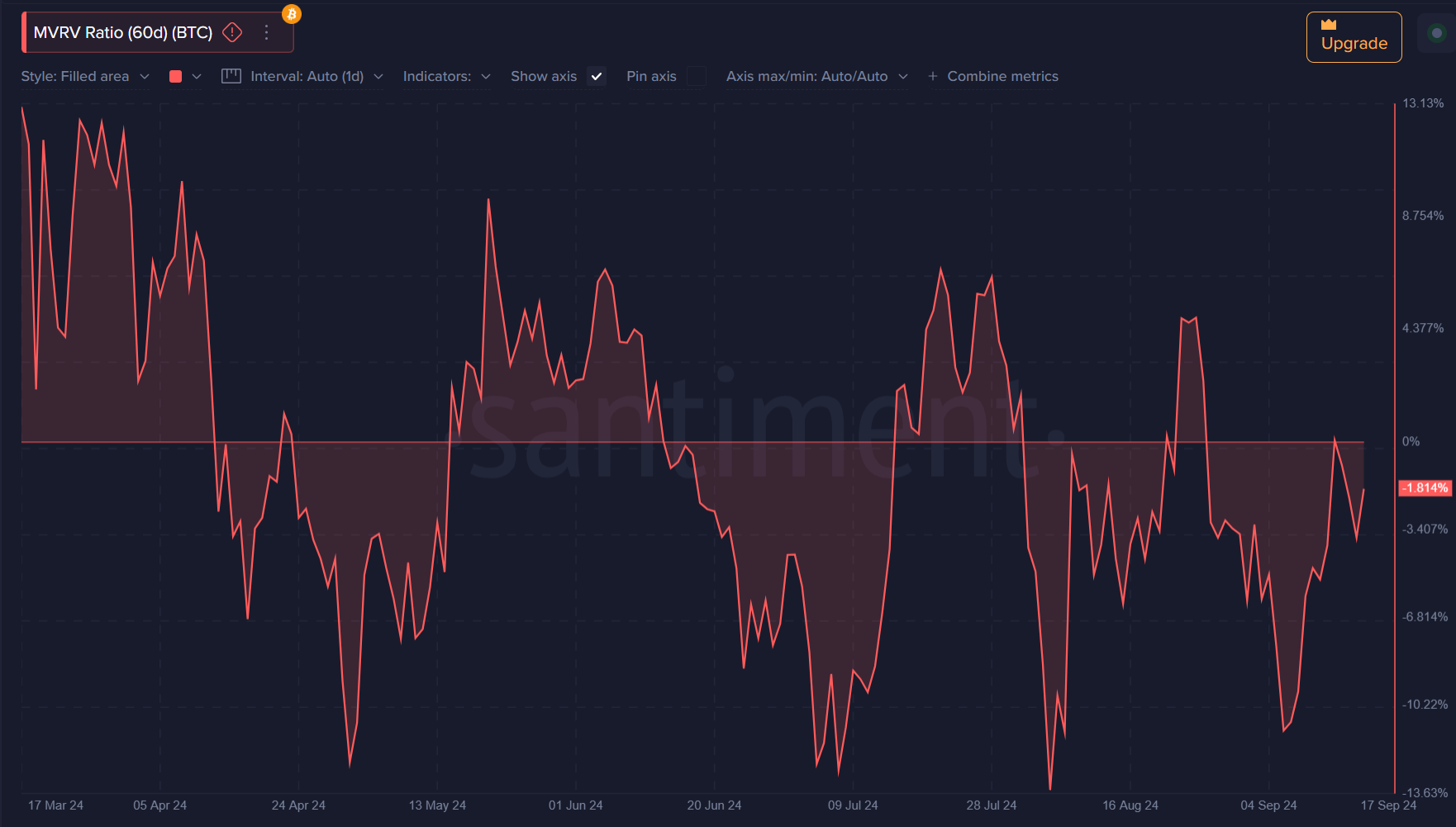

MVRV ratio hints at a buying opportunity

Currently, the average Bitcoin investor is experiencing a slight loss, as the 60-day MVRM ratio (Market Value to Realized Value Ratio) stands at approximately -1.81%.

Previously, when the Miner’s Verification of Value (MVRV) indicated a negative value, it has often meant that Bitcoin was being sold at a lower price than its production cost. This situation can potentially indicate an upcoming price increase, offering a good chance for investment, or in simpler terms, it could be a good time to consider buying Bitcoins.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Can Bitcoin Lead the Market Into Another Bull Run?

With a dominance level exceeding 57.68% and robust blockchain foundations, as well as technical factors falling into place, there are signs that Bitcoin could be preparing for another significant price surge.

On the other hand, significant milestones such as $59,000 and continuous network activity are essential indicators for determining if Bitcoin can further strengthen its leadership role and spark another widespread bullish trend.

Read More

- CAKE PREDICTION. CAKE cryptocurrency

- FLOKI PREDICTION. FLOKI cryptocurrency

- OKB PREDICTION. OKB cryptocurrency

- TRB PREDICTION. TRB cryptocurrency

- DMTR PREDICTION. DMTR cryptocurrency

- TRAC PREDICTION. TRAC cryptocurrency

- OM PREDICTION. OM cryptocurrency

- API3 PREDICTION. API3 cryptocurrency

- CTK PREDICTION. CTK cryptocurrency

- XDC PREDICTION. XDC cryptocurrency

2024-09-18 05:11