- Worldcoin token price and network activity were trending downward.

- The NVT showed the token could be overvalued despite the heavy losses.

As a seasoned analyst with over two decades of experience in the cryptocurrency market, I have seen countless trends and patterns come and go. The recent performance of Worldcoin [WLD] has caught my attention, not for its short-term gains, but for the underlying fundamentals that suggest caution.

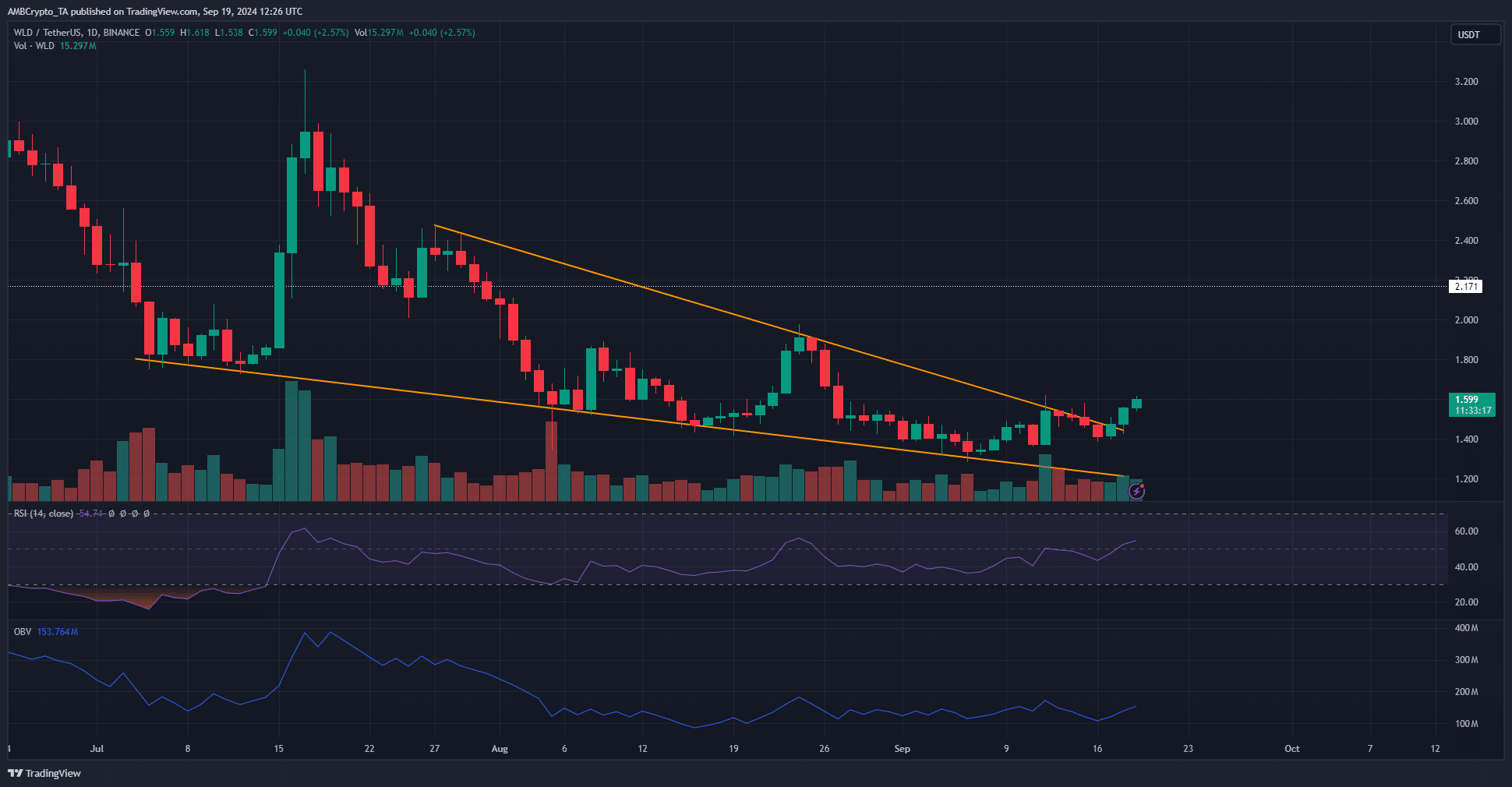

In the last two trading days, Worldcoin (WLD) has seen a 14.32% increase, yet it remains within a prolonged descending trend. On the other hand, Bitcoin (BTC) has experienced a gradual downtrend in recent months, but has only dropped by 13.5% relative to early April.

In stark contrast, WLD has dropped a significant 80.51% from April 1st onwards. The level of $2.17, which previously represented the lowest points in 2024 prior to the February surge, was decisively surpassed during July.

The chart seemed to be shaping a descending triangle (falling wedge), yet its potential for a bullish outcome wasn’t strong because it hadn’t been fully developed.

WLD is overvalued

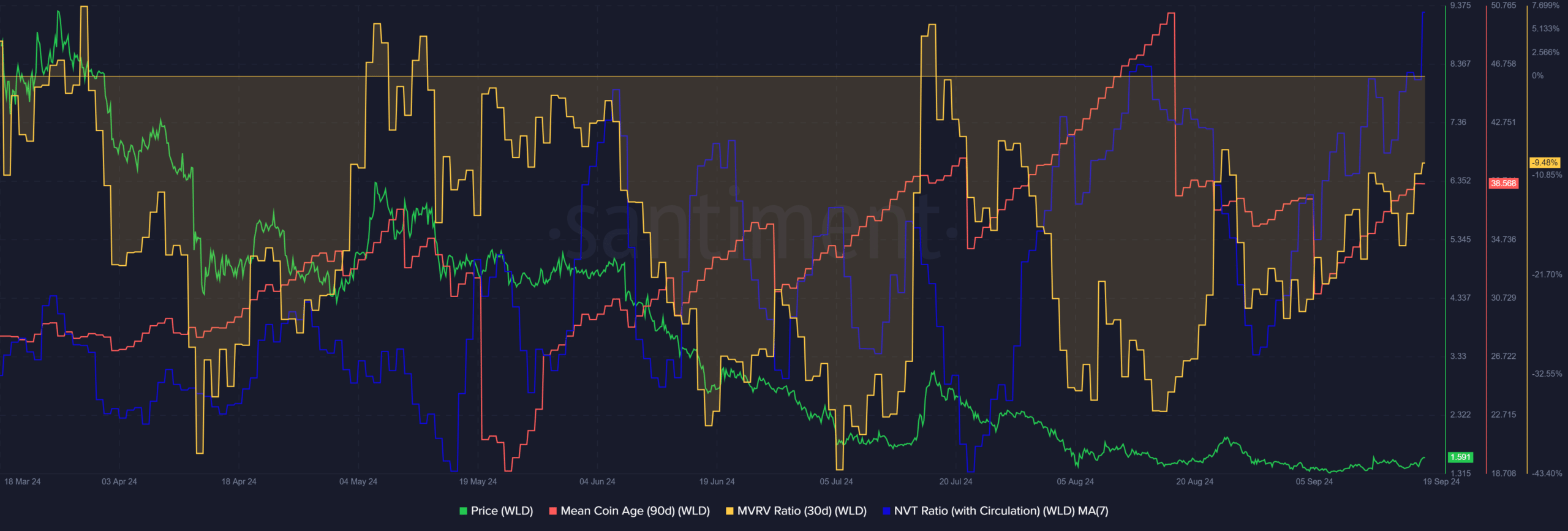

To determine whether Worldcoin investors might see a potential recovery, AMBCrypto analyzed in-depth the key on-chain indicators. By examining both the average coin age and the MVRV (Majority Below Average Realized Value) ratio, a temporary buy signal was detected.

The uptrend of the mean coin age signaled accumulation, while the 30-day MVRV in negative territory showed short-term holders were at a loss. Yet, this signal should be treated with caution.

During early July and early August, a potential buy signal emerged, yet the overall downward trend prevailed on the larger timeframes. Despite their efforts, the bulls lacked the strength to trigger a substantial upward momentum.

The NVT ratio, calculated using the total circulation, reached its highest point in the past six months.

A significantly large ratio between the network’s market value and the volume of transactions suggests that the WLD token may be overpriced or inflated in value.

Network activity is also in decline

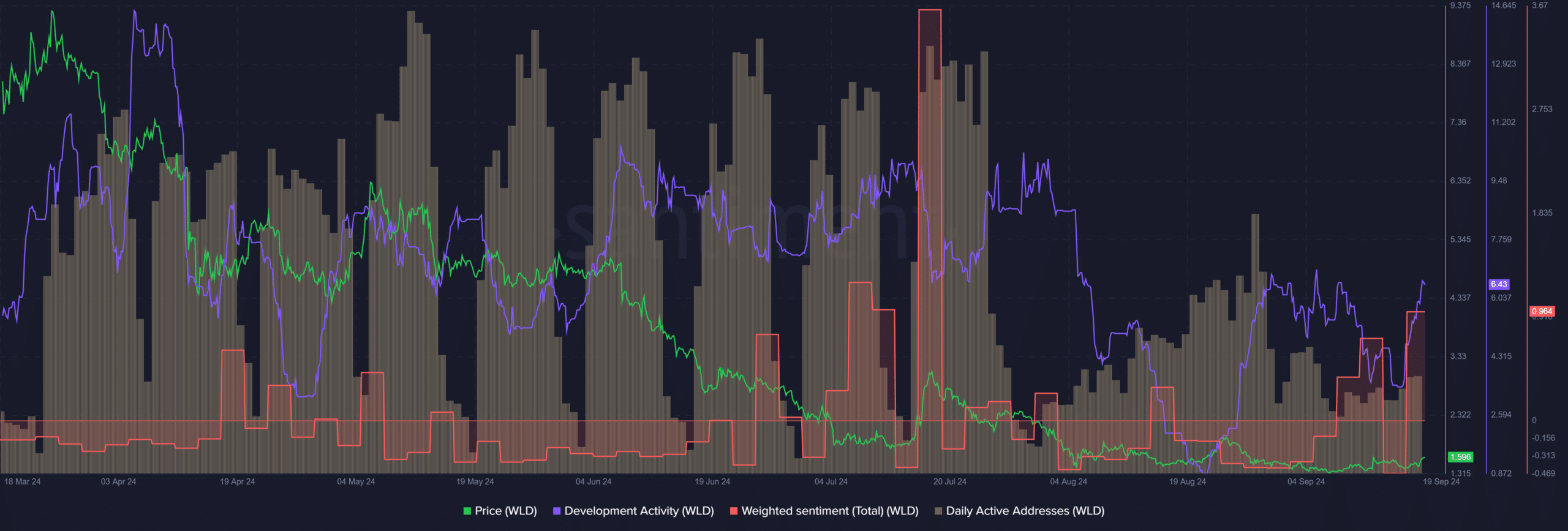

For about four months from April to July, the number of daily actively used addresses peaked on weekdays and consistently dropped on weekends.

Read Worldcoin’s [WLD] Price Prediction 2024-25

The steady activity seen back then fell dramatically in early August and struggled to recover.

At that point, progress slowed down as well, yet it soon recovered approaching the peak levels seen in July. Nevertheless, the decrease in activity might warrant caution among long-term investors.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- Kayla Nicole Raves About Travis Kelce: What She Thinks of the Chiefs Star!

- `Tokyo Revengers Season 4 Release Date Speculation`

- AUCTION/USD

- Shocking Truth Revealed: Is Cassandra Really Dead in Netflix’s Terrifying Mini-Series?

- ETH/USD

- How to Install & Use All New Mods in Schedule 1

- Solo Leveling Arise Amamiya Mirei Guide

- Why Aesha Scott Didn’t Return for Below Deck Down Under Season 3

2024-09-20 07:03