-

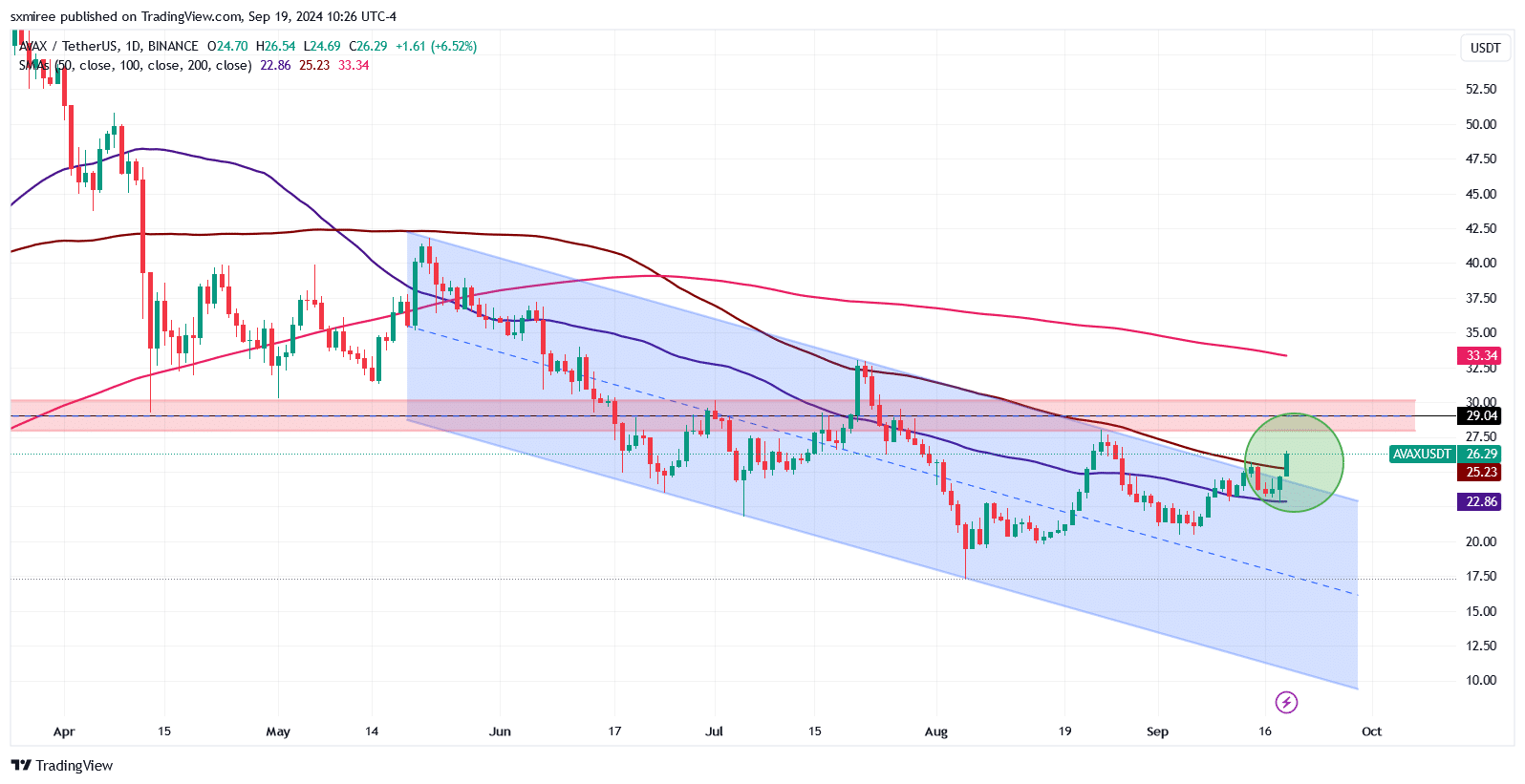

Avalanche has broken out of a multi-month descending parallel channel.

AVAX price faced a crucial test as it approached a key resistance zone of $29.

As a seasoned analyst with over two decades of market experience under my belt, I must say that Avalanche [AVAX] is proving to be quite an intriguing asset in this rapidly evolving crypto landscape. The altcoin’s recent surge to a three-week high of $26.52 and its current 12% gain within the last 24 hours is certainly noteworthy.

🚨 RED ALERT: EUR/USD Forecast Shattered by Trump’s Moves!

Markets react violently to tariff news — stay ahead of the shockwaves!

View Urgent ForecastIn recent midweek cryptocurrency activity, Avalanche (AVAX) has been shining brightly. Earlier today, its price reached a peak of $26.52, marking a three-week high and continuing an uptrend that started on the night of September 18th.

The altcoin was, at press time, pictured trading 12% higher in the last 24 hours.

The rise in AVAX‘s price occurred during a larger recovery in the cryptocurrency market, driven by a generally optimistic outlook about the overall economic climate.

After the U.S. Federal Reserve reduced interest rates by 0.5 percentage point to a range of 4.75% – 5% on September 18th, there’s been an optimistic feeling in the air.

The most recent change in the federal funds rate suggests that the monetary policy is being adjusted to control inflation and foster economic expansion.

The Federal Reserve’s recent decision signified the first reduction in interest rates in four years, and it was also the third occasion where policymakers initiated a period of rate reductions by lowering the rate by 0.5%.

Despite widespread expectations, the result triggered fluctuations in both traditional stock and cryptocurrency markets. According to IntoTheBlock’s analysis, nearly half (49%) of Avalanche (AVAX) token owners have benefited from its price surge.

Experts generally anticipate more decreases approaching the final quarter, yet opinions about the impact of the Federal Reserve’s 50 basis points rate cut on risky assets are divided.

Certain experts believe that the recent modification will temporarily invigorate the crypto market, but its long-term impact remains uncertain.

Avalanche’s DeFi outlook

As a crypto investor, I’ve been closely watching the impressive rise in AVAX prices recently. This upward trend seems to be fueled by Avalanche’s growing influence within the decentralized finance sector. It feels like we’re witnessing a promising expansion of this blockchain network.

The amount of assets locked within Avalanche, measured in AVAX, increased by 11% over the course of Q2 compared to Q1, rising from approximately 28.1 million AVAX to 30.8 million. According to DeFiLlama’s data, Avalanche’s TVL (Total Value Locked) has consistently followed this growth pattern.

On the 18th of September, the total value locked (TVL) across all protocols on Avalanche amounted to approximately 38.63 million AVAX. As we move through Q3, the top three protocols with the highest TVL have consistently held the majority of the total value locked on Avalanche.

However, Benqi has overtaken Aave as the largest protocol on the network.

In simple terms, Total Value Locked (TVL) is often seen as a significant measure of the adoption and activity within a Decentralized Finance (DeFi) system. Essentially, a larger TVL indicates robust liquidity and active user participation, which generally boosts optimism regarding price movement in the market.

AVAX approaches key resistance

At the current moment, the AVAX/USDT pair on TradingView’s daily chart is moving upward above both the 100-day Simple Moving Average (SMA) at approximately $25.23 and the 50-day SMA at around $22.82.

In simpler terms, the increase in AVAX‘s price during the middle of the week has allowed it to move beyond a downward trend line that has been shaping its price movement since late May 2024.

AVAX is currently encountering substantial obstacles around the price points of $27.92 and $30.14, an area which has proven to be challenging for the past 3 months.

This stretch stands out as a critical area, since it’s been repeatedly challenged without being overcome so far by the resistance.

Read Avalanche’s [AVAX] Price Prediction 2024–2025

As an analyst, I find that a victorious maneuver within this specific region might pave the way for further northward movements. With optimistic investors keeping a keen focus, $33 appears to be the next potential milestone on our radar.

If we can’t maintain the positive momentum and overcome this resistance, it might lead to a drop in price that dips below our 50-day Simple Moving Average at $22.82. This could further slide us towards the support level around $19.50, which was previously tested earlier in the month.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Days Gone Remastered Announced, Launches on April 25th for PS5

- Elder Scrolls Oblivion: Best Pilgrim Build

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Ludicrous

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- Brandon Sklenar’s Shocking Decision: Why He Won’t Watch Harrison Ford’s New Show!

- Elder Scrolls Oblivion: Best Sorcerer Build

2024-09-20 12:08