- Crypto shorts suffered a massive $147M loss as Bitcoin hit $63K.

- However, its resurgence is not off the table.

As a seasoned crypto investor with battle scars from the rollercoaster ride that is Bitcoin, I can confidently say that the recent surge to $63K has brought a glimmer of hope amidst the relentless market volatility. The $147M loss suffered by shorts in this latest move is a testament to the resilience and unpredictability of BTC.

Bitcoin (BTC) enthusiasts have driven a surge, pushing the price up to $63K following several weeks of stability, largely due to Federal Reserve interest rate reductions.

Apart from broader economic influences, the market for Bitcoin derivatives has experienced a “squeeze,” causing short-sellers of cryptocurrency to suffer approximately $147 million in losses.

When Bitcoin nears the $64K peak, it’s crucial for us investors to carefully plan our moves to break through the significant $70K barrier. After all, surpassing this resistance isn’t going to be a walk in the park. Let me delve into why that is with AMBCrypto.

Unfolding the squeeze

Over the last 180 days following Bitcoin’s all-time high (ATH) of $73K in March, bulls have attempted to break through the $71K mark on four separate occasions. However, each attempt has faced substantial resistance, thus far failing to establish a new record high.

As reported by AMBCrypto, for Bitcoin to aim at its next resistance level of approximately $68,000, it needs to maintain a value around $64,000. This resistance has been tested twice since June. If the bullish trend continues, a potential target of $71,000 might become achievable.

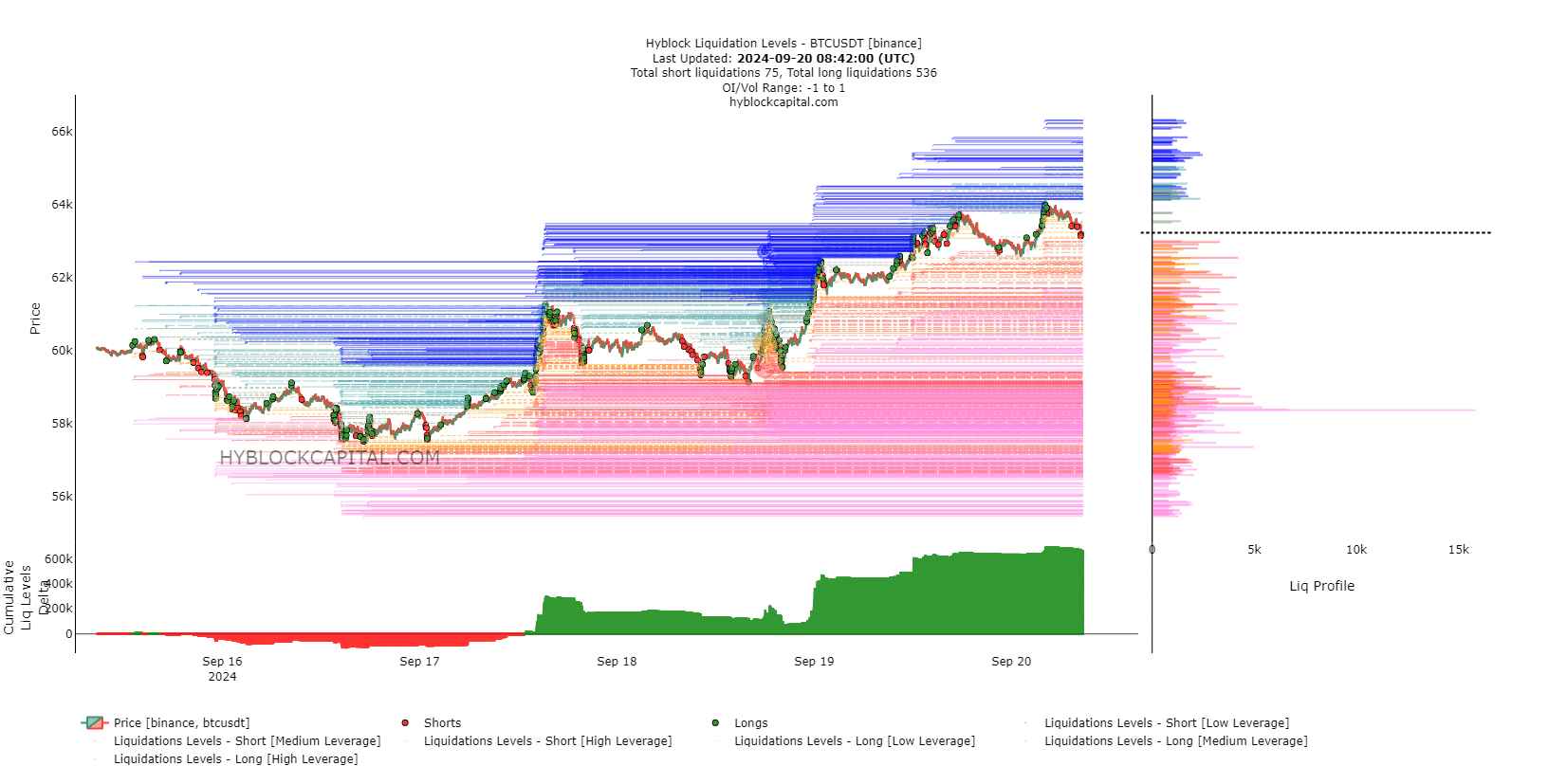

In the meantime, a notable increase in Open Interest (OI) seems to have caused the rise, forcing crypto short-sellers to liquidate their positions, leading to estimated losses of around $147 million.

Interestingly, the ongoing momentum in the OI (Open Interest) movement resembles the late-August phase when Bitcoin hit $64K. This could indicate that Bitcoin might reach or even surpass that price level once more.

In my analysis, should a comparable pattern emerge, the chances of a Bitcoin breakout might decrease. This is because, having exited the market earlier, Bitcoin sellers (or ‘BTC bears’) may re-enter, potentially preventing another attempt to surpass the current resistance levels.

Even though the rate decrease has occurred, reaching $64K for Bitcoin remains difficult given its current state, and a broader surge might not happen soon. As for the losses in the cryptocurrency short positions, it seems plausible that they were caused by a “forced buying” or “short covering,” where traders are compelled to buy to limit their losses.

Stakeholders in net profit

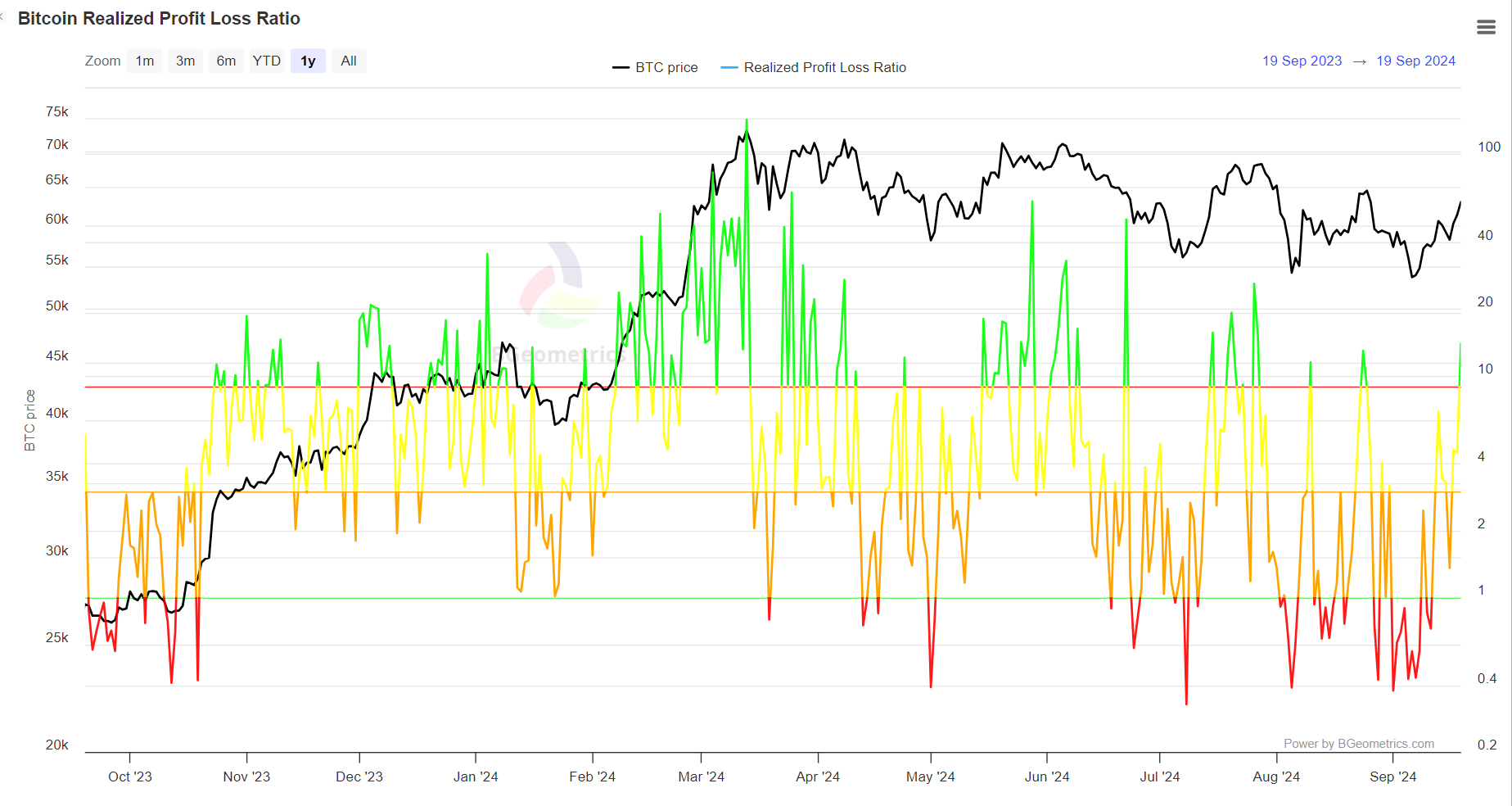

The following graph illustrates how various stakeholders react to fluctuations in prices. At present, a substantial number of purchasers find themselves within the profitable range, denoted by the green shaded area.

Previously, increases in this ratio have been observed around market peaks. Contrastingly, the recent surge at approximately $64K did not sustain for long, as traders who had shorted cryptocurrency swiftly reaped their profits.

If this pattern continues, there’s a chance a breakout might slow down due to traders selling off before the upward momentum weakens, thereby strengthening the idea of a “short squeeze.” In simpler terms, if the current trend persists, there’s a possibility that the breakout could decelerate because traders are taking profits and triggering a situation where more short sellers are forced to buy, amplifying the price rise.

Additionally, should there be a resurgence in short positions on cryptocurrencies, buyers might find it necessary to capitalize on another chance to propel Bitcoin upwards towards the $70,000 mark.

BTC might retrace if crypto shorts regain control

For the last three days, with Bitcoin (BTC) climbing above $60K, there’s been a noticeable withdrawal from short positions in crypto, creating room for a substantial increase in long positions.

Read Bitcoin’s [BTC] Price Prediction 2024-25

If the price of Bitcoin experiences even a small decrease, it might lead to significant sell-offs if buyers are unable to keep the price stable. If traders choose to sell and the bullish momentum weakens, there could be an increase in short positions, potentially pushing Bitcoin’s price below $60K again.

Traditionally, $64,000 has functioned as a pivotal point for both resistance and support in Bitcoin’s price movement. Whether it will lead to a breakout depends significantly on the strategies employed by investors. If opportunities arising from the $147 million short squeeze in the crypto market are not seized, there is a potential for Bitcoin to dip back down to around $55,000.

Read More

- AUCTION/USD

- Solo Leveling Season 3: What You NEED to Know!

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- `Tokyo Revengers Season 4 Release Date Speculation`

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- XRP/CAD

- Stephen A. Smith Responds to Backlash Over Serena Williams Comments

- Is Disney Faking Snow White Success with Orchestrated Reviews?

- Disney’s Snow White Promotion in Chaos as Rachel Zegler Goes ‘Out of Control’

2024-09-20 19:04