-

5.1 million addresses remain underwater despite recent Bitcoin’s rally.

BTC has surged by 9.99% over the past week.

As a seasoned analyst with over two decades of experience in the financial markets, I find myself constantly intrigued by the unpredictable nature of Bitcoin and its price movements. The recent surge in BTC‘s price has indeed been impressive, but it’s the underlying fundamentals that truly pique my interest.

⚠️ EUR/USD in Danger: Trump’s Next Move Revealed!

Massive forex volatility expected — crucial trading alert issued!

View Urgent ForecastOver the past week, Bitcoin (BTC) has seen a significant surge in price. Despite starting September with a downward trend, the recent increases have overshadowed the monthly setbacks.

Currently, Bitcoin is being traded at approximately $63,668, which represents an impressive 9.99% increase over the last seven days.

Additionally, on a monthly basis, it experienced significant growth, increasing by approximately 6.99%. After hitting a low of $52,546 on the 6th of September, it has since regained all its earlier losses.

Even though Bitcoin has experienced a rise lately, it’s still substantially lower than its peak of $70,016 on July 29th. This recent fluctuation in price has sparked discussions among financial analysts.

The analysts at IntoTheBlock continue to express caution regarding the current price surge, pointing out that approximately 5.1 million crypto holders are still experiencing losses.

5.1 million BTC addresses remain underwater

As reported by IntoTheBlock, Bitcoin (BTC) is trying hard to surpass the $63k barrier, but a significant number of investors still find themselves in a dilemma. This analysis reveals that approximately 5.1 million wallets currently hold Bitcoin at a loss based on today’s market price.

As an analyst, I’m indicating that approximately 5.1 million Bitcoin wallets currently hold their coins at a price higher than the current market rate. This suggests that these investors initially bought Bitcoin at a cost above its current value, implying their investment has yet to realize a profit.

This situation implies that many investors are holding out, hoping for prices to increase more so they can recoup their initial investment or gain a profit. In such a market, investors face a dilemma: they could sell at a loss to minimize additional losses or choose to hang on and wait for the opportunity to realize a profit.

If they choose to offload their assets, these addresses might induce selling pressure. In other words, if they manage to recoup their initial losses, they could decide to sell, thereby dampening the current bullish trend. However, they may also hold onto their assets in hope of additional profits.

Prevailing market sentiment

Although the metric pointed out by IntoTheBlock raises some concerns about the latest surge, the overall market has demonstrated strength during the last seven days.

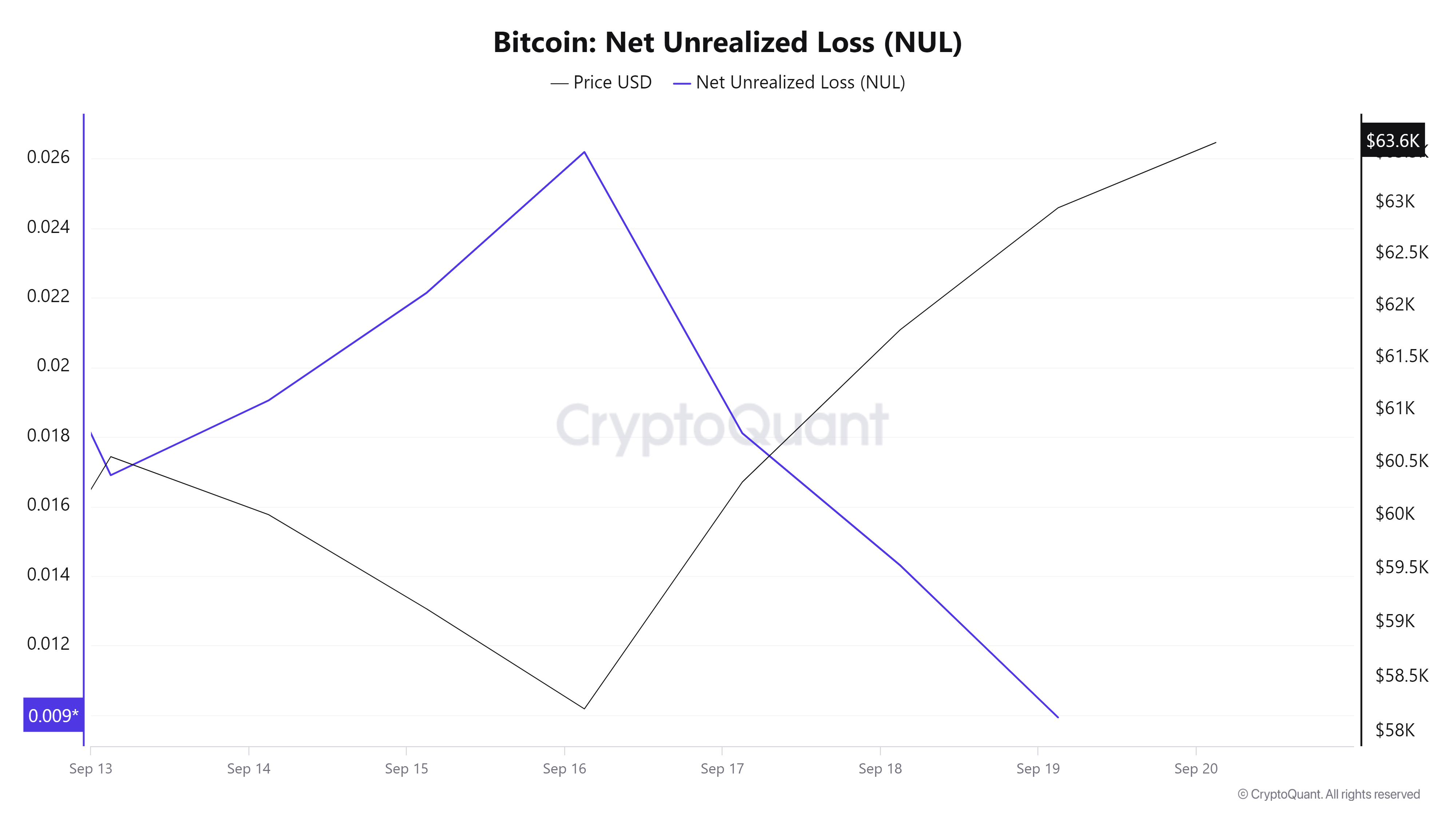

During this timeframe, Bitcoin’s Net Unrealized Loss (NUL) has noticeably decreased. Initially at 0.026, it has now dropped to 0.009. This suggests that the market is rebounding, and numerous investors find their holdings moving closer to a breakeven point or even becoming profitable.

It’s a positive development that the market, which was previously experiencing a downward trend, is now moving towards an uptrend, thereby narrowing the difference between the current prices and the prices at which purchases were made.

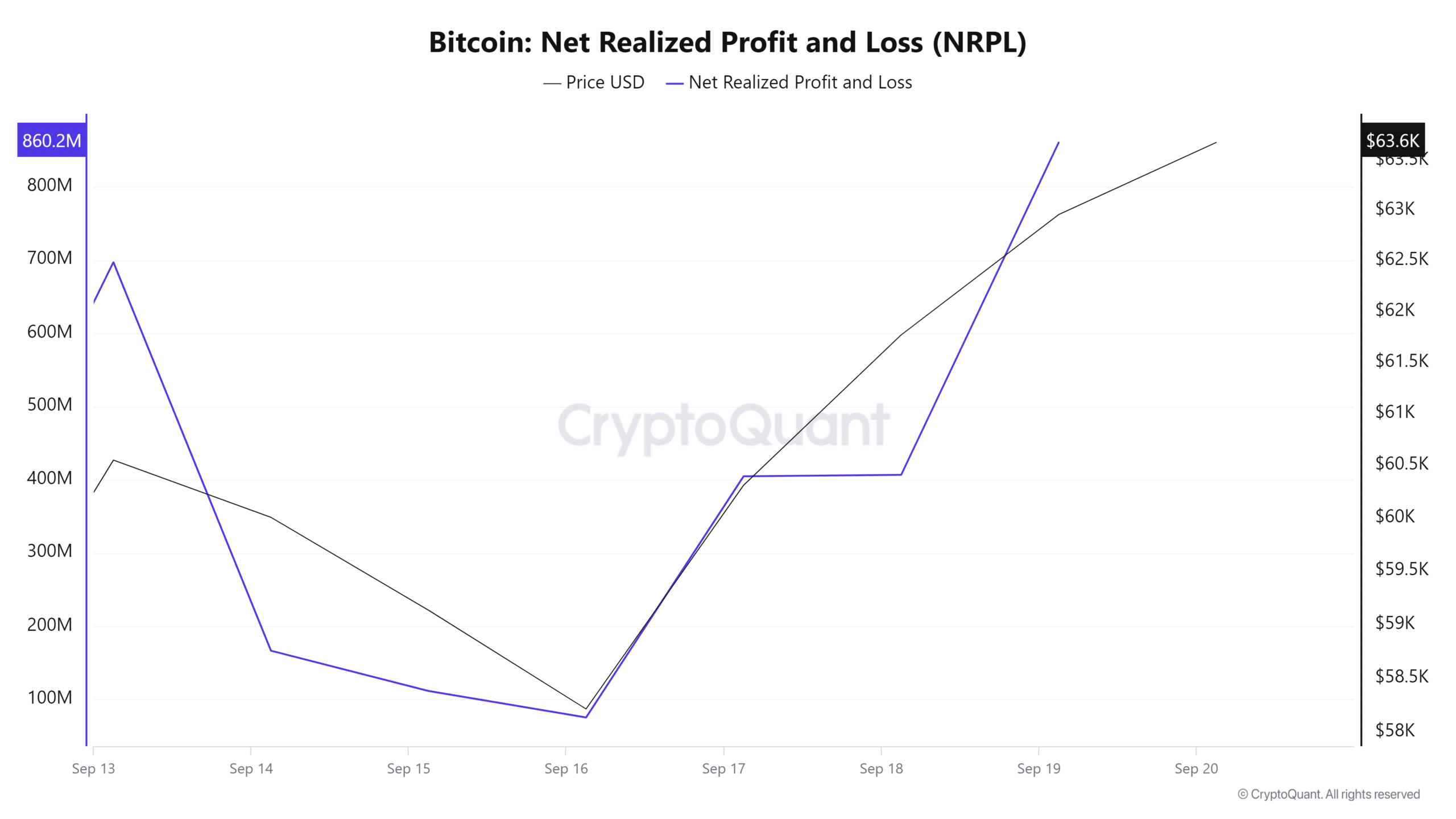

Furthermore, over the last week, the cumulative profit or loss realized from Bitcoin transactions has increased significantly, climbing from approximately $75.5 million to an impressive $860.2 million.

As NRPL (Notional Risk Premium Level) rises, it indicates a strong optimism among market participants who are reaping profits. This optimistic outlook increases the belief that prices will keep climbing, thereby drawing in even more investors.

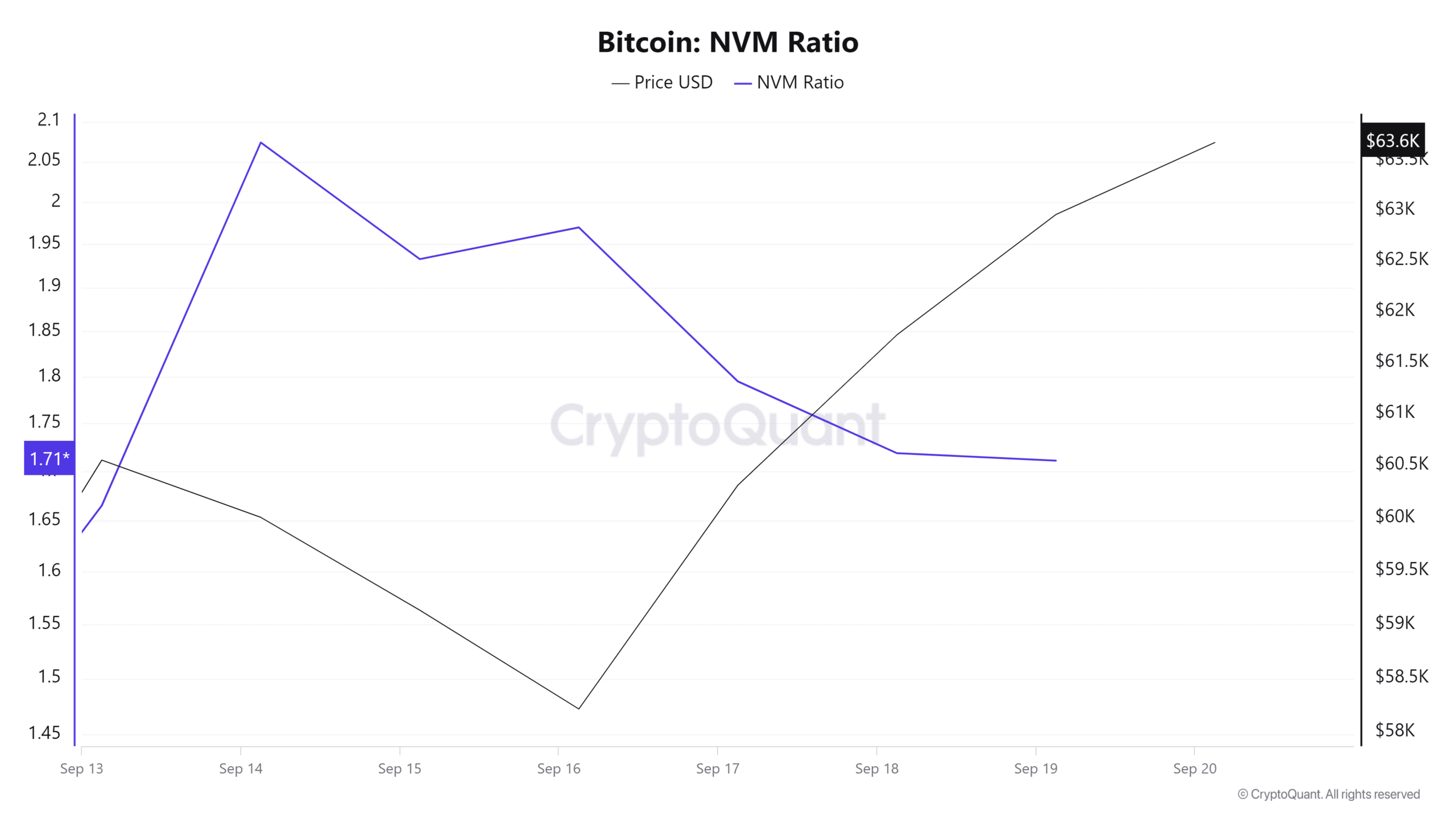

In summary, the Network Value to Transaction Ratio (NVT) of Bitcoin has been decreasing recently, indicating increased network activity or engagement. However, the market seems not to be fully acknowledging this trend yet. This could mean that there is potential for price increase in the future.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Essentially, despite about 5.1 million addresses indicating uncertainty as per IntoTheBlock’s observations, the overall sentiment in the Bitcoin market has moved from negative to optimistic. Consequently, this bullish outlook suggests that Bitcoin could potentially see more growth ahead.

If the current market mood persists, I anticipate that Bitcoin will strive to break through the near-term resistance at approximately $64,727 in my analysis.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Days Gone Remastered Announced, Launches on April 25th for PS5

- Elder Scrolls Oblivion: Best Pilgrim Build

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Ludicrous

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- Brandon Sklenar’s Shocking Decision: Why He Won’t Watch Harrison Ford’s New Show!

- Elder Scrolls Oblivion: Best Sorcerer Build

2024-09-21 10:48