-

Should the bullish market sentiment persist, NEAR could achieve an additional gain of 23.15% in the days ahead.

However, a significant hurdle looms at the 5.526 resistance level, where substantial selling pressure has previously been observed.

As a seasoned crypto investor with battle scars from more than a few market cycles, I must say that the current bullish sentiment surrounding NEAR is indeed intriguing. Having witnessed the ebb and flow of numerous altcoins, I’ve learned to read between the lines of technical analysis and market trends.

⚠️ EUR/USD in Danger: Trump’s Next Move Revealed!

Massive forex volatility expected — crucial trading alert issued!

View Urgent ForecastIn just the past week, Near Protocol (NEAR) has experienced significant growth, recording a 34.5% rise according to CoinMarketCap, and even experiencing a 12% jump within the last day.

Although there’s been a temporary decrease in progress, AMBCrypto’s analysis suggests that an upward trend will soon follow.

NEAR’s rally eyes $6.4 as momentum builds

As a crypto investor, I’ve noticed that the surge in NEAR‘s value can be attributed to its bounce back from a significant resistance-turned-support level at approximately $4.366. This rebound has been instrumental in fueling its growth trajectory.

Regardless of hitting a fresh challenge with the resistance line at $5.256, which represents a weak buying zone due to its low demand, NEAR is strategically situated within a broader symmetrical triangle formation.

historically, this trend suggests that the value of NEAR might reach a maximum of around $6.489. Upon reaching this high point, there could be significant selling activity, causing prices to drop or alternatively observing increased trading volume which may further push the price of NEAR up to approximately $7.6.

To determine if the $5.256 resistance is truly insignificant, AMBCrypto scrutinizes the most recent technical graphs.

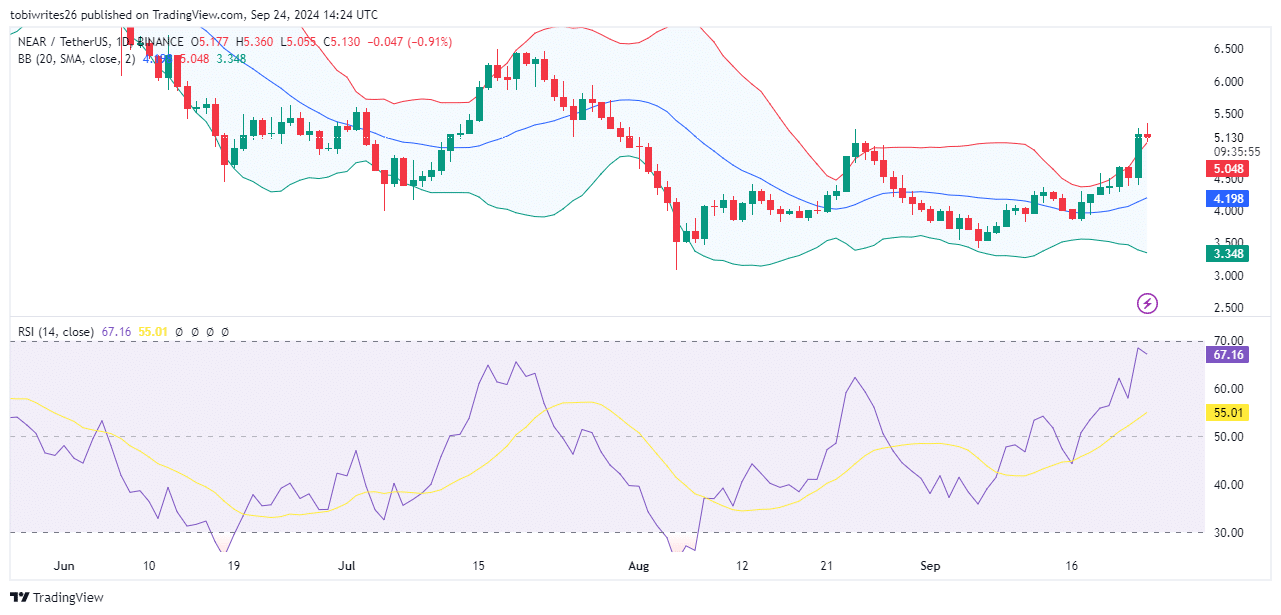

Technical indicators suggest NEAR is set for volatility

In simpler terms, the Relative Strength Index (RSI) – a tool that gauges the pace and size of price changes – suggests a robust positive outlook for NEAR, as its current value stands at 68.5.

As a crypto investor, I’ve noticed that when the Relative Strength Index (RSI) exceeds 70, it usually suggests an overbought market, implying a possible pullback might be imminent. However, with NEAR, its current level seems to indicate persistent accumulation and a likelihood of continued growth in the near future.

Instead, when the Bollinger Bands (BB) are found above their upper limit, it suggests that the current market price has entered an overbought state. This situation coincides with NEAR intersecting its resistance level, a pattern that historically predicts a potential price adjustment or correction may follow.

Though these signs hint at an imminent dip, it’s also plausible that NEAR may continue to rise before any potential correction. The likelihood of this happening remains unclear.

In simpler terms, it appears that the technical analysis indicates that the price of NEAR might break through the resistance point at $5.256, which would support the ongoing bullish pattern.

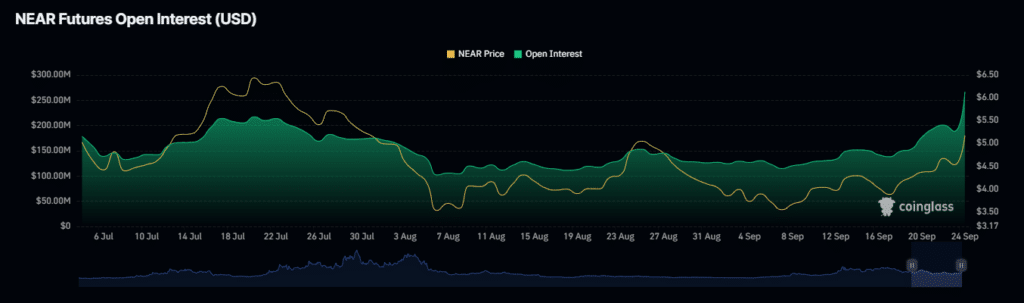

Open interest indicates a continued rally for NEAR

According to AMBCrypto’s analysis based on Open Interest (OI), it appears that NEAR may continue its upward trend, potentially reaching even greater heights.

Realistic or not, here’s NEAR’s market cap in BTC’s terms

According to data from Coinglass, the open interest for NEAR has risen by 18%, reaching a total of $266.84 million from its previous minimum of $188.54 million. This significant increase indicates a strong level of market participation and positive investor sentiment towards NEAR.

If the increasing trend in open interest persists, it’s likely that the price trajectory for NEAR will keep climbing higher as well.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Days Gone Remastered Announced, Launches on April 25th for PS5

- Elder Scrolls Oblivion: Best Pilgrim Build

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Ludicrous

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- Brandon Sklenar’s Shocking Decision: Why He Won’t Watch Harrison Ford’s New Show!

- Elder Scrolls Oblivion: Best Sorcerer Build

2024-09-25 13:12