- Bitcoin ETFs saw a resurgence, with inflows reaching $365.7 million as of the 26th of September.

- BlackRock’s spot Bitcoin ETF recorded a $184.4 million inflow, the month’s highest single-day surge.

As a seasoned analyst with over two decades of experience in global finance and markets, I’ve witnessed numerous market cycles and trends that have shaped our financial landscape. The recent surge in Bitcoin ETF inflows is indeed a captivating development, one that seems to defy traditional September bearishness in the crypto market.

After facing weeks of uncertainty, Bitcoin [BTC] ETFs are once again gaining momentum.

Contrary to the usual bearish outlook on Bitcoin during September, the digital currency and its exchange-traded funds (ETFs) have astonished many by demonstrating a surprising trend change instead.

Bitcoin ETF, analyzed

According to the latest figures from the 26th of September, a significant sum of $365.7 million has flowed into all Bitcoin Exchange-Traded Funds (ETFs), an amount that’s quite noteworthy.

In this scenario, Ark’s ARKB fund took the front line with an investment of approximately $113.8 million, and Blackrock’s IBT wasn’t far behind, investing around $93.4 million.

Fidelity’s FBTC recorded $74 million, while Bitwise’s BITB sits at $50.4 million.

Additionally, VanEck, Invesco, and Franklin each received investments totaling approximately $22.1 million, $6.5 million, and $5.7 million for their Bitcoin Strategy, Bitcoin Trust, and ETF Focused Bitcoin CryptoIndustries funds, respectively.

Despite two relatively small Bitcoin ETFs attracting inflows under $5 million, the overall increase highlights a revived trust among investors in Bitcoin ETFs.

Remarkably, on September 25th, BlackRock – the globe’s leading asset manager – experienced a significant increase of $184.4 million in investments for its Bitcoin ETF, marking the largest one-day investment of any fund that month.

What’s behind this?

This spike comes amid growing market speculation, potentially influenced by developments in Asia.

For those unaware, Chinese stocks rallied following reports that the Chinese government may inject up to ¥1 trillion($142 billion) into its major state banks, aimed at boosting an economy that has faced challenges recently.

This week, the People’s Bank of China reduced monetary pressure by decreasing the reserve requirement for local banks by 0.5% (50 basis points) and lowering their seven-day borrowing rate to 1.5%, which is a decrease of 0.2% (20 basis points).

It appears that these actions are contributing to a sense of hope, which might be influencing the investments flowing into worldwide markets, such as Bitcoin ETFs.

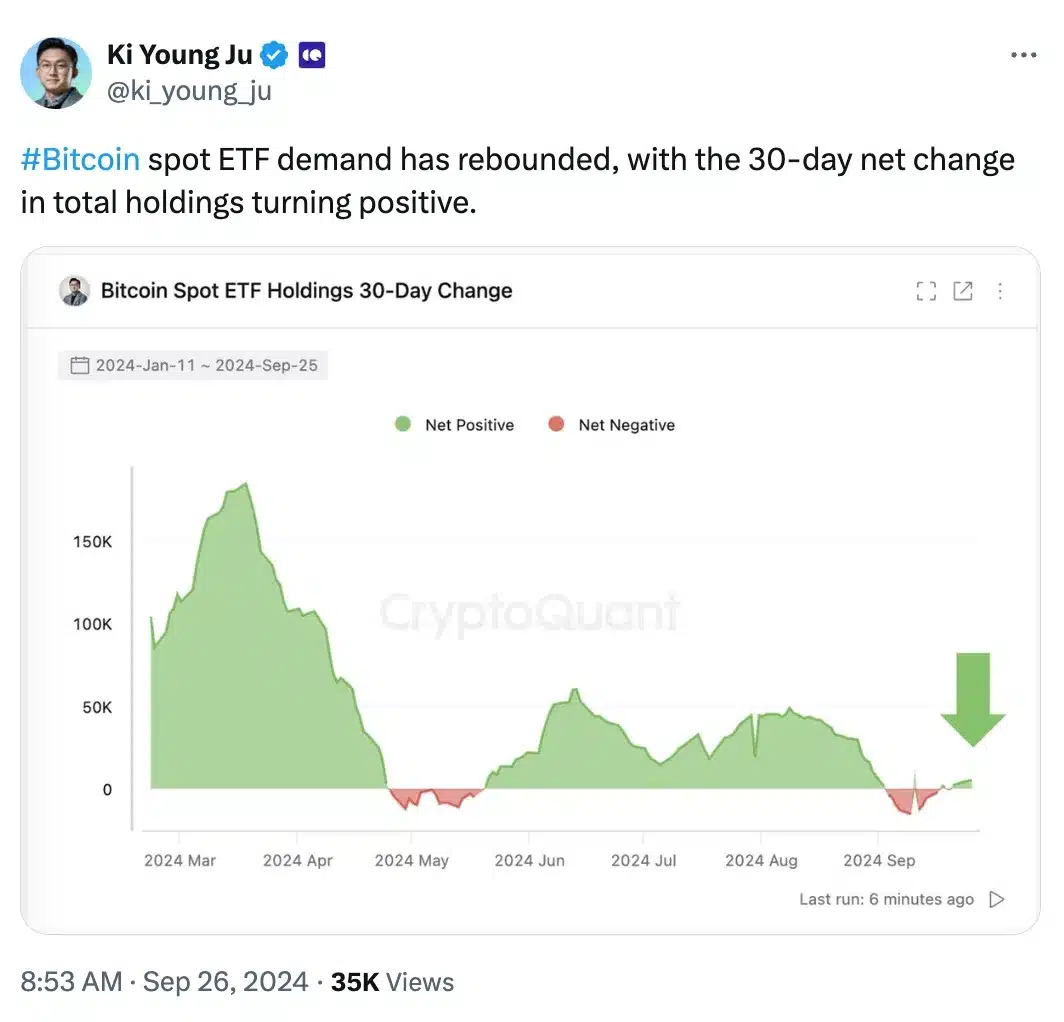

Remarking on the matter, Ki Young Ju, Founder and CEO of CryptoQuant, said,

He further added,

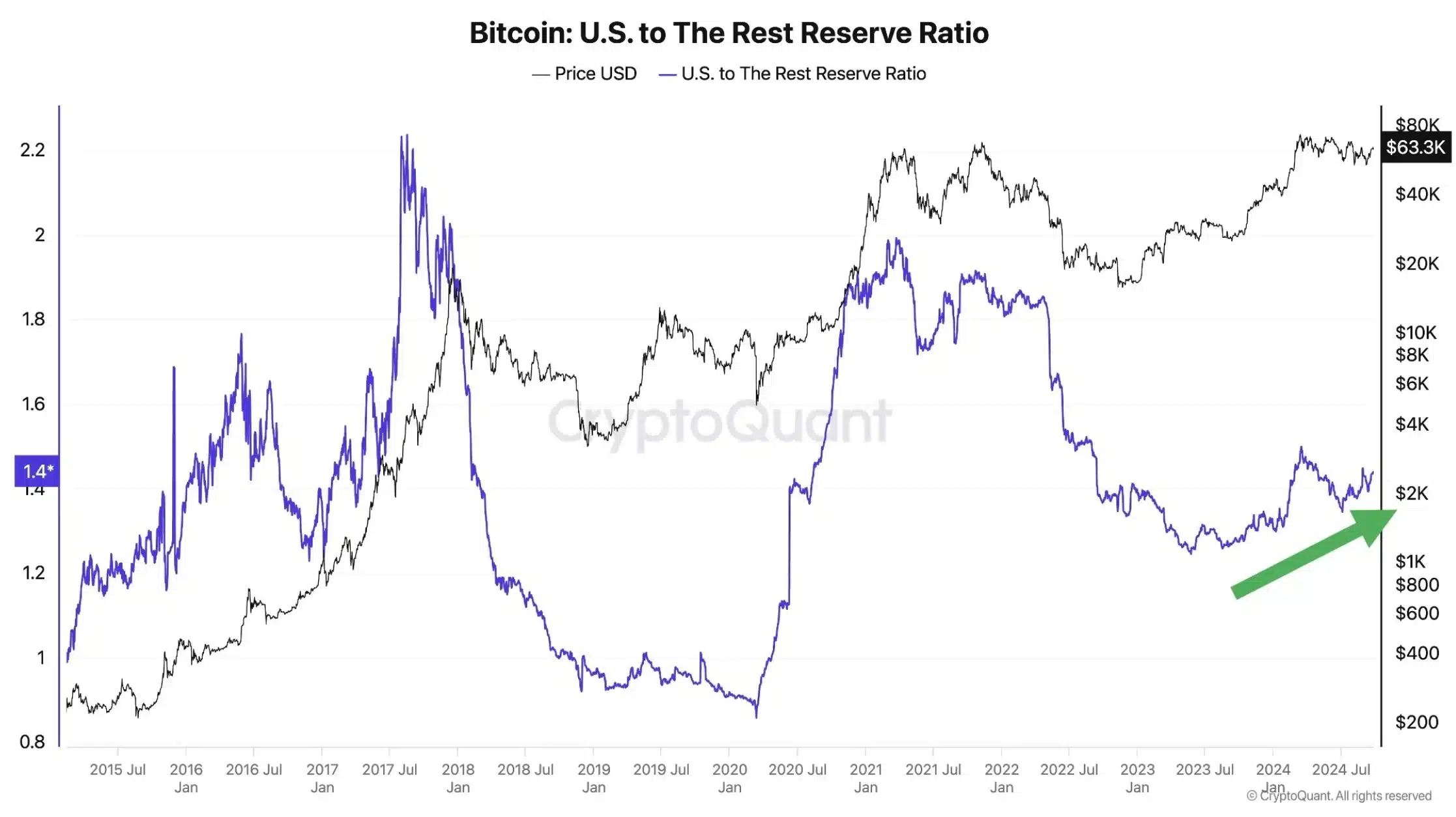

America’s share of Bitcoin ownership is increasing. This trend, fueled by the demand for spot ETFs, is becoming more pronounced when compared to other nations. Only recognized entities are considered in these statistics.

A look at the price front

Meanwhile, on the price front, BTC’s price action has shown remarkable resilience.

Despite battling to exceed $60,000 for several days, the top cryptocurrency experienced an uptick and soared to $65,642, representing a 2.89% increase over the past day.

Towards the end of the month, Bitcoin has shown a robust uptrend, gaining a noteworthy 10.98% over the period, indicating continued strength and optimism in its market growth.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- AUCTION PREDICTION. AUCTION cryptocurrency

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- `Tokyo Revengers Season 4 Release Date Speculation`

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- XRP CAD PREDICTION. XRP cryptocurrency

- Stephen A. Smith Responds to Backlash Over Serena Williams Comments

- Disney’s Snow White Promotion in Chaos as Rachel Zegler Goes ‘Out of Control’

- AEW Fans Are Loving Toni Storm’s Uncanny Mariah May Cosplay From Dynamite

2024-09-27 15:04