- The sharp price dip saw a quick turnaround, although recovery was not complete

- The higher timeframe trend since April was bearish, but this uptrend could be the beginning of a rally

As a seasoned researcher with years of experience navigating the tumultuous crypto markets, I can confidently say that the recent price dip and subsequent recovery in dogwifhat [WIF] has been an interesting turn of events. The retest of former range highs at $1.98 was a stark reminder of the volatility inherent in this space, but the bulls’ swift defense of that level is a positive sign.

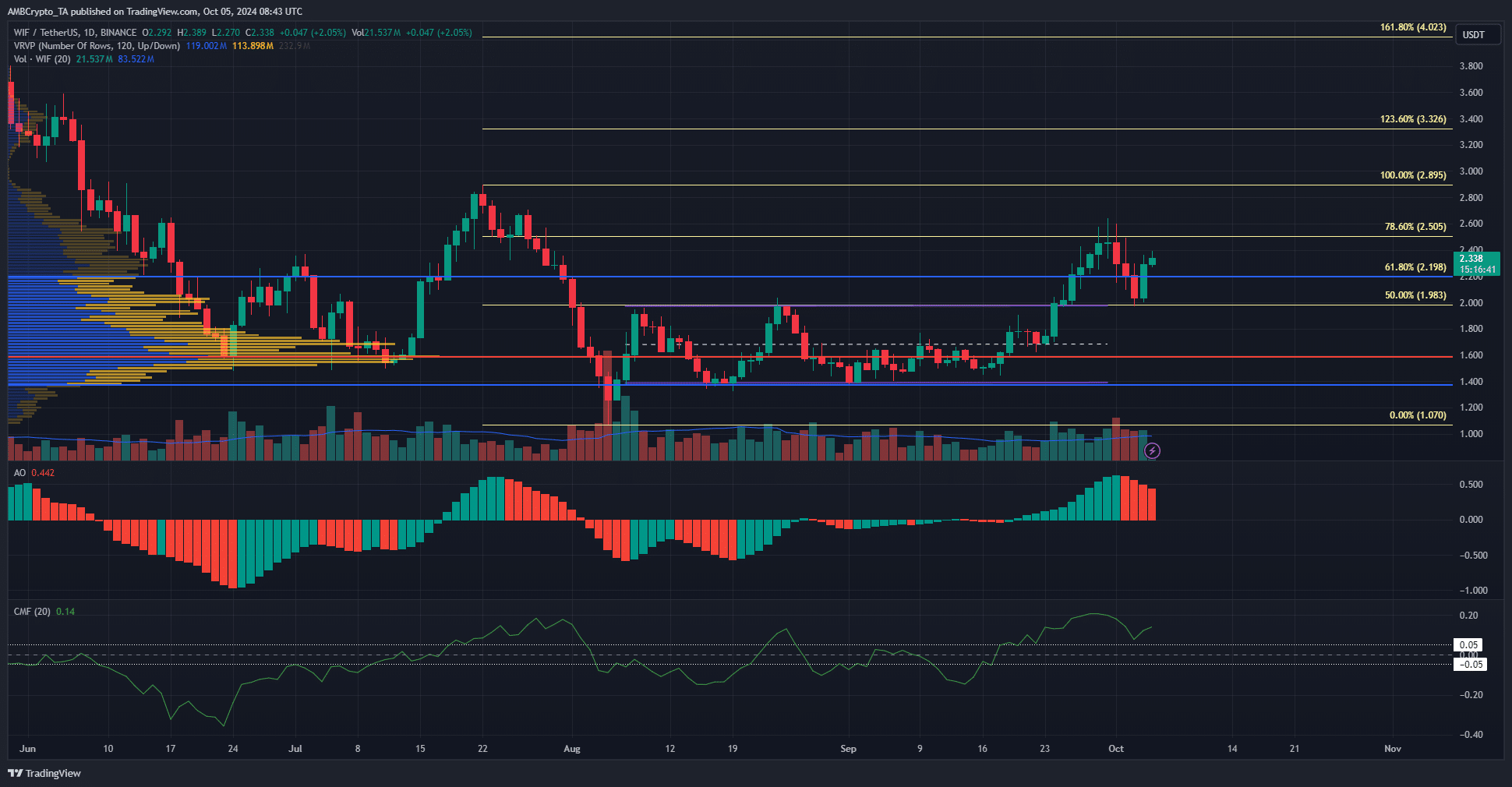

As an analyst, I observed a significant price adjustment of approximately 25.4% from the peak on Monday, 30 September, to the trough on Thursday, 3 October, in the asset I’ve been tracking. Remarkably, this correction also coincided with a retest of the previous high range at $1.98. However, the bullish sentiment held firm as buyers stepped in to prevent further decline, establishing this level as a new support point.

Since then, purchases of the memecoin have caused its price to surge by 18.9%, marking a positive initial move towards recovery. However, the significant barrier at $2.5 remains, leaving uncertainty as to whether buyers will successfully breach this point.

The importance of $2.5

It appears that most trades since June have taken place within the price range of $1.38 to $2.25, as suggested by the Visible Range Volume Profile. Notably, the price surpassing $2.25 once more following the dip suggests a strong bullish sentiment.

As a crypto investor, I’ve noticed that even amidst the recent market turbulence, my Crypto Momentum Factor (CMF) managed to stay above the 0.05 mark, reaching +0.14. This stability suggests a consistent buying pressure from fellow investors. Additionally, the Awesome Oscillator seems to be pointing towards a strong bullish sentiment in the market.

After observing a decline in mid-July to early August, a series of Fibonacci retracement lines were drawn. These lines indicated that the $2.5 point corresponded to the 78.6% retracement and served as a significant barrier for further price increase.

If the stock closes at or above $2.5 each day, this could indicate that WIF is gearing up for a significant price increase. In June and early July, it served as a resistance zone, meaning it was difficult for the price to move beyond that level. If it continues to rise, the short-term bullish targets are at $2.5 and $2.9.

Bullish sentiment on WIF’s speculative front

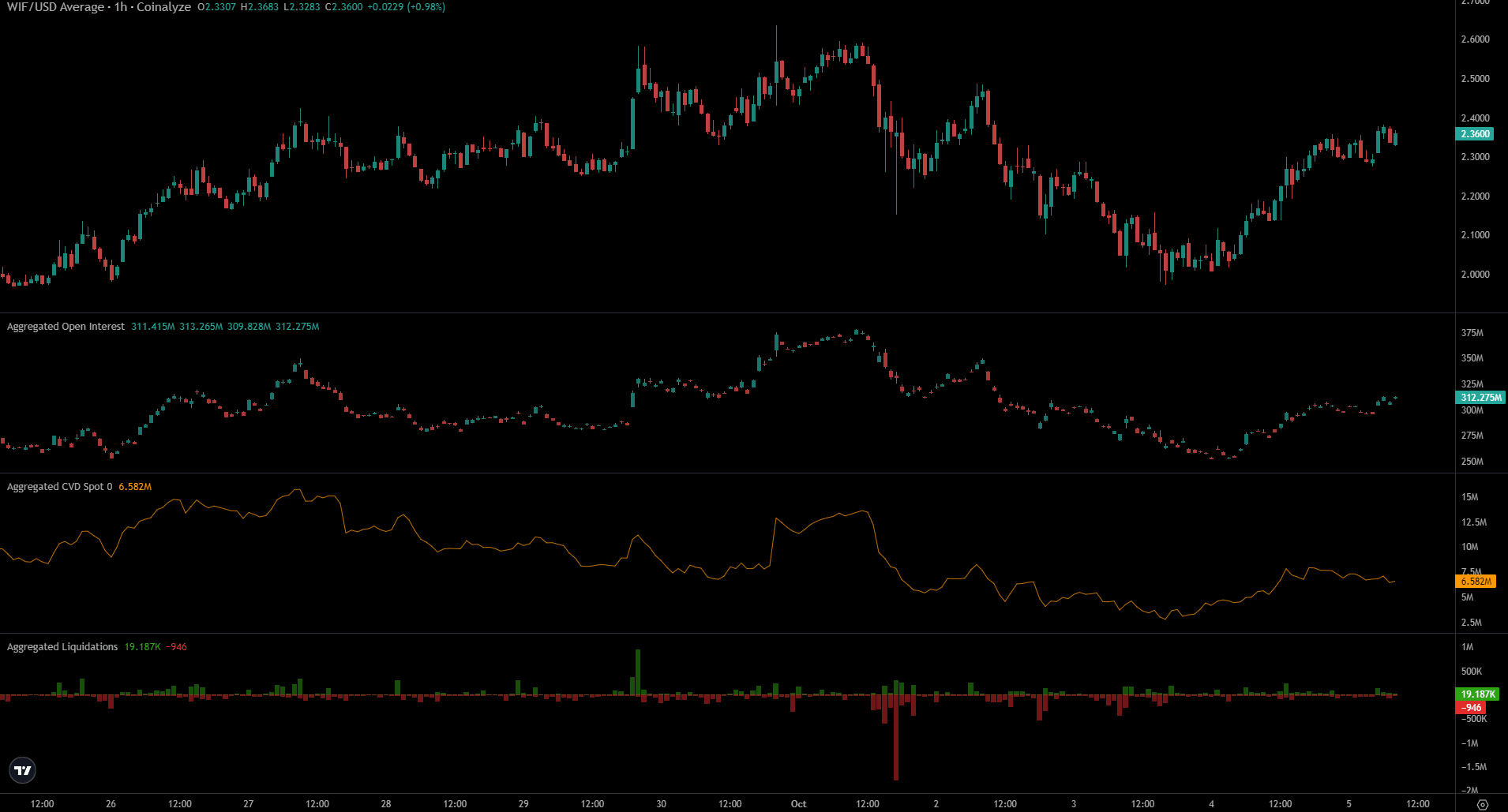

In simpler terms, the Futures market expressed a strong optimistic stance, evident through an increase in Open Interest. Furthermore, the surge in the Cash Deliverable Volume (CVD) reinforced this optimism, suggesting that there’s actual demand driving the upward trend.

Is your portfolio green? Check the dogwifhat Profit Calculator

Over the last two days, I’ve observed that liquidations have been relatively low compared to 1st October. In the recent hours, trader liquidations have been minimal, but it’s intriguing to consider if short liquidations significantly increase as WIF approaches the $2.5 zone. This could suggest a sweep of a liquidity pocket, potentially leading to another price drop afterwards.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Brandon Sklenar’s Shocking Decision: Why He Won’t Watch Harrison Ford’s New Show!

- Top 5 Hilarious Modern Comedies Streaming on Prime Video Now!

- Attack on Titan Stars Bryce Papenbrook & Trina Nishimura Reveal Secrets of the Saga’s End

- EUR PKR PREDICTION

- Solo Leveling Season 3: What You NEED to Know!

2024-10-05 20:07