- Fantom, at press time, had a bearish structure, but the range is expected to hold

- Reset of the short-term MVRV is the first step toward recovery

As a seasoned researcher with over two decades of experience in the cryptospace, I find myself intrigued by Fantom [FTM]’s current bearish structure yet resilient range. The market’s volatility around Bitcoin [BTC] has left no stone unturned, and Fantom is no exception to this rollercoaster ride.

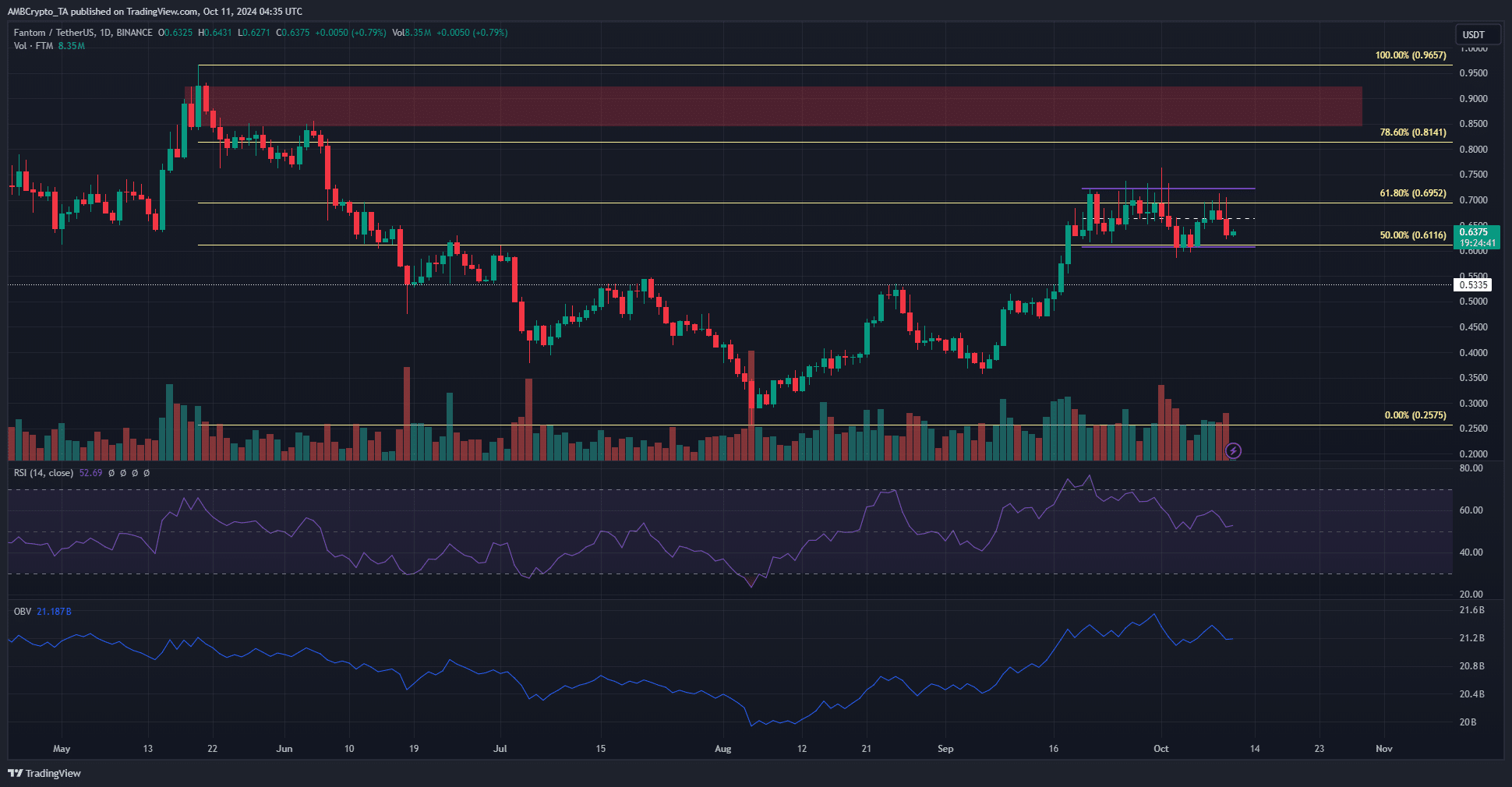

Towards the end of September, Fantom’s [FTM] value was steadily increasing. However, a widespread price drop occurred across the market due to volatility surrounding Bitcoin [BTC]. As a result, Fantom also experienced this decline and hovered around a significant Fibonacci retracement point.

Regardless of the current selling activity, there were indications from the blockchain data and market trends suggesting that buyers were preparing for an upward momentum.

Short-term consolidation for FTM

In mid-September, a strong bullish trend in the $1.8 billion market cap asset was replaced by more moderate, fluctuating price behavior. This price range (represented by purple) spanned between $0.608 and $0.724, and for three consecutive weeks, the token has been trading within this band.

In simpler terms, the Relative Strength Index (RSI) was higher than 50 daily, indicating a bullish trend, but it has been decreasing lately. At this moment, its reading is 52.7, suggesting that the momentum is neither strongly bullish nor bearish. Also, the On-Balance Volume (OBV) indicates that both buyers and sellers have equal control during the recent price range.

This suggests that swing traders might employ the extreme points within the range for trading, waiting for the occurrence of a breakout. At present, the low volume could signify that Fantom is in a period of consolidation.

Consolidation allowed profit-taking, but is it bullish?

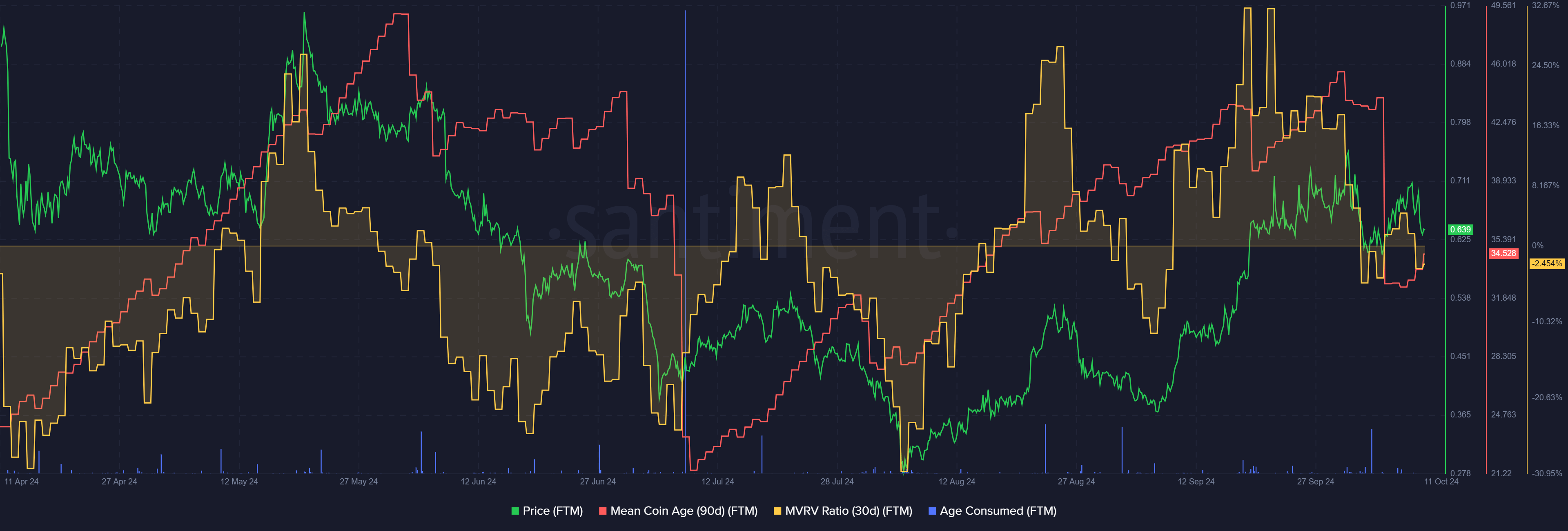

Starting from late September, there was a significant accumulation of coins, leading to a rapid decrease in the average age of coins on October 6th. Simultaneously, the 30-day MVRV (Market Value to Real Value) ratio, previously at 20%, moved closer to zero. This suggests increased distribution and profit-taking by short-term holders of FTM (Fantom), indicating a trend towards selling for profits.

Read Fantom’s [FTM] Price Prediction 2024-25

In spite of the recent dip, the bulls have managed to hold the 50% retracement level steady as a base of support. Lately, the ‘age consumed’ statistic has been rather quiet. This resilience might signal that Fantom is preparing for another price surge moving northward in the near future.

Read More

- AUCTION/USD

- Solo Leveling Season 3: What You NEED to Know!

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- `Tokyo Revengers Season 4 Release Date Speculation`

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- Is Disney Faking Snow White Success with Orchestrated Reviews?

- XRP/CAD

- Stephen A. Smith Responds to Backlash Over Serena Williams Comments

- Disney’s Snow White Promotion in Chaos as Rachel Zegler Goes ‘Out of Control’

2024-10-11 17:11