- WLD pumps 14% in 24 hours ahead of key update.

Despite overbought conditions, WLD still had a great risk-reward ratio.

As an analyst with over two decades of experience in the financial markets, I have seen my fair share of market movements and events that could make even the most seasoned traders question their decisions. However, when it comes to Worldcoin [WLD], I find myself intrigued by its recent surge ahead of a key update from Sam Altman and Alex Blania.

On October 17th, important insider trading activity was observed in Worldcoin [WLD] before an announcement from Sam Altman, OpenAI co-founder, and Alex Blania, CEO of Tools for Humanity (TFH). This upcoming event is expected to be significant.

Two days before the event, the altcoin jumped 12% in 24 hours, rallying from $2.0 to $2.3.

To this point, significant cryptocurrency events have often led to ‘selling the news’ reactions. Consequently, the recent surge in prices might have been a preemptive move by traders who planned to offload their holdings either during or immediately following the event.

If so, what are the key targets to track?

Key levels to watch

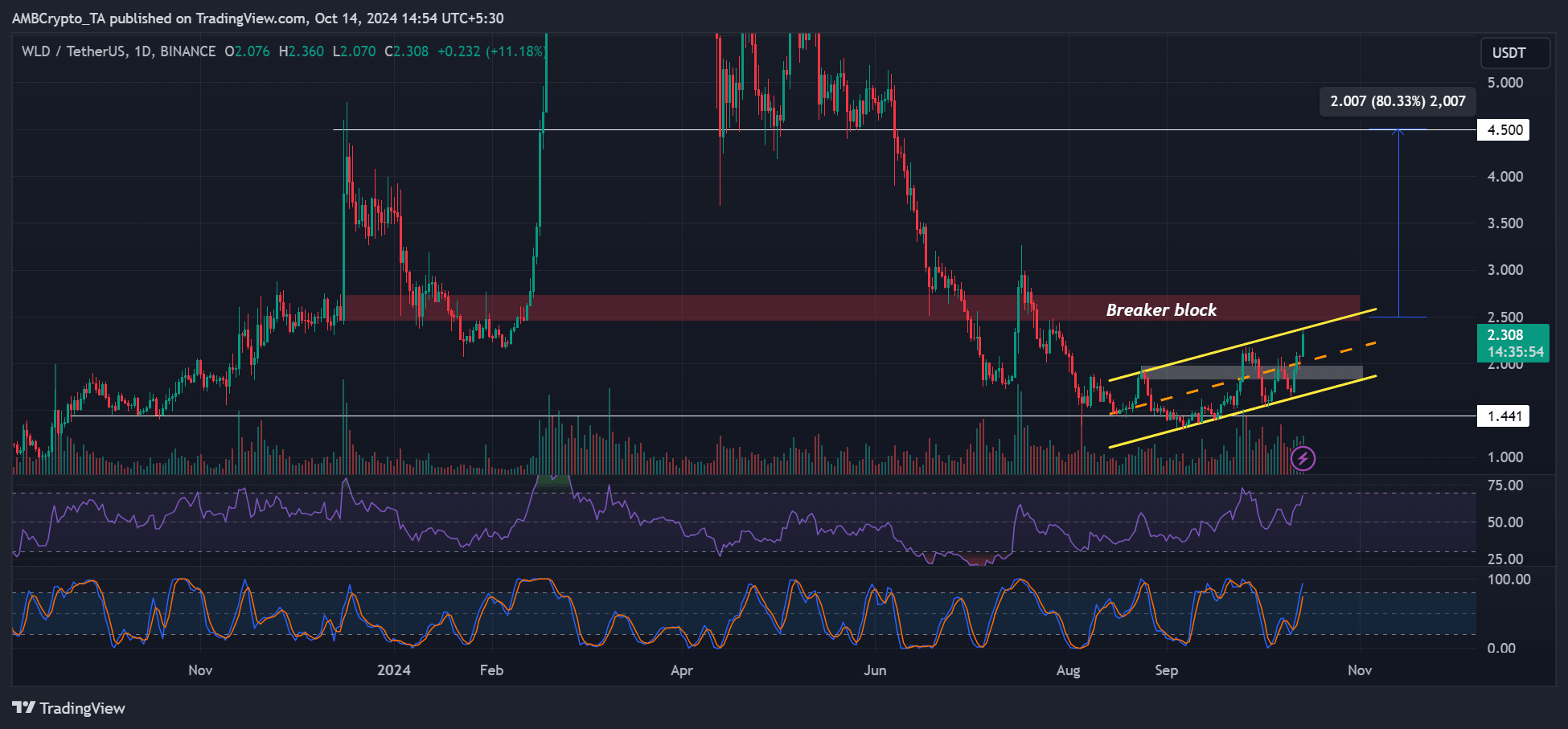

Since August, WLD’s price action formed an ascending channel (yellow).

Significantly, the latest surge has established $2.0 as a temporary floor (white), while $2.5 represents an intersection of the top end of the channel’s range and a resistance area (red).

Even as the chart indicators approached signs of being overbought, there was still a promising risk-reward balance (R:R) for WLD, should it recover in the aftermath.

If company WLD surpasses the milestone of $2.5 and aims for $4.5, there’s an estimated 80% potential profit. Therefore, it’s important to keep an eye on these significant levels, which are $2.0, $2.5, and $4.5, in both the near and mid-term future.

Bullish Futures market

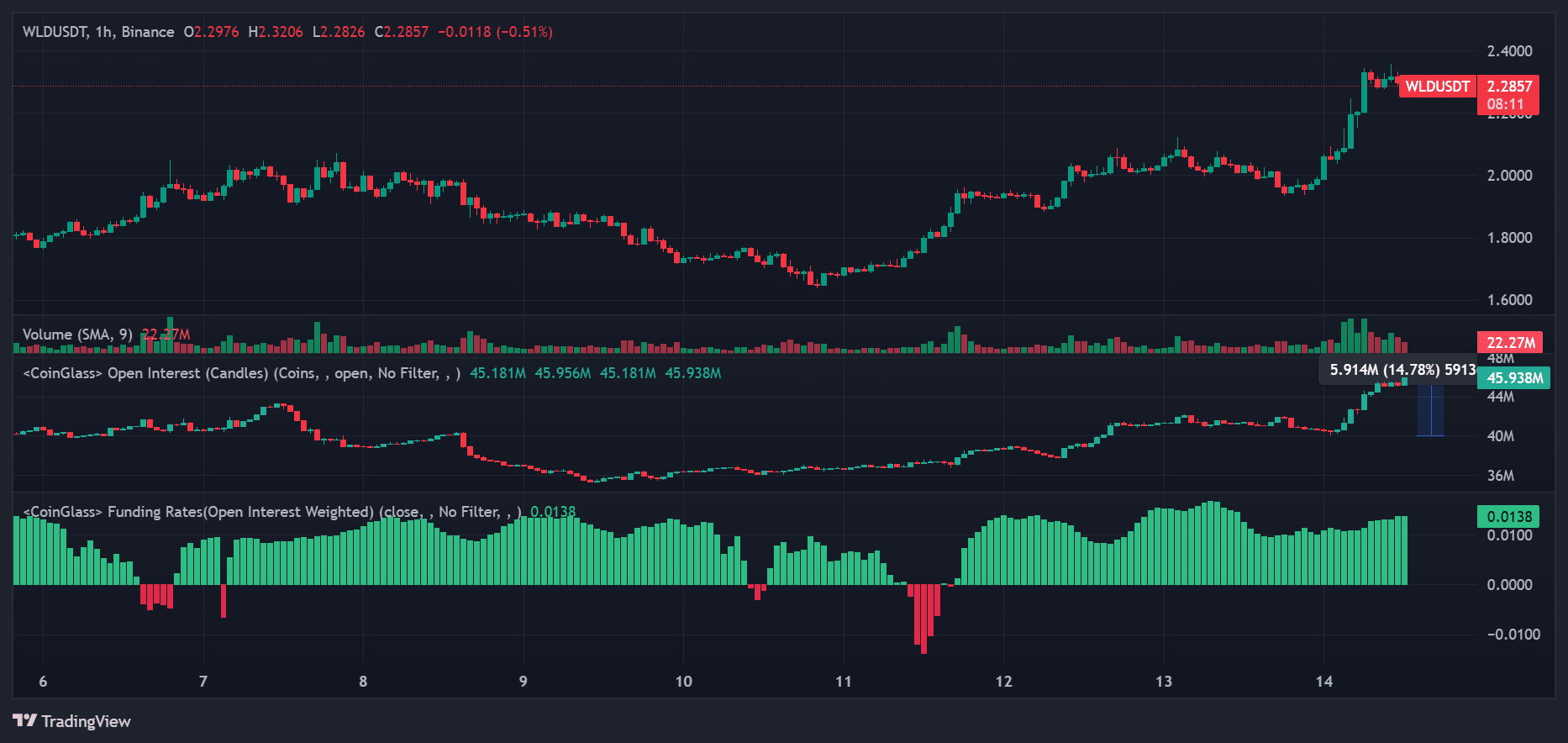

During that period, speculators continued to be optimistic even with the obstacle at $2.5. On October 14th, approximately 5 million WLD contracts were accumulated, which is indicated by a 15% increase in open interest rates (OI).

It meant increased market interest in WLD in the Futures market.

As a crypto investor, I find myself buoyed by the favorable Funding Rates, which seem to be aligning with the upbeat feelings of other speculators in the Futures market. In simpler terms, these rates are providing us with some optimistic momentum!

Yet, with greater leverage came a significant risk of liquidation and market turbulence, potentially manifesting during Altman and Blania’s anticipated speech on Thursday.

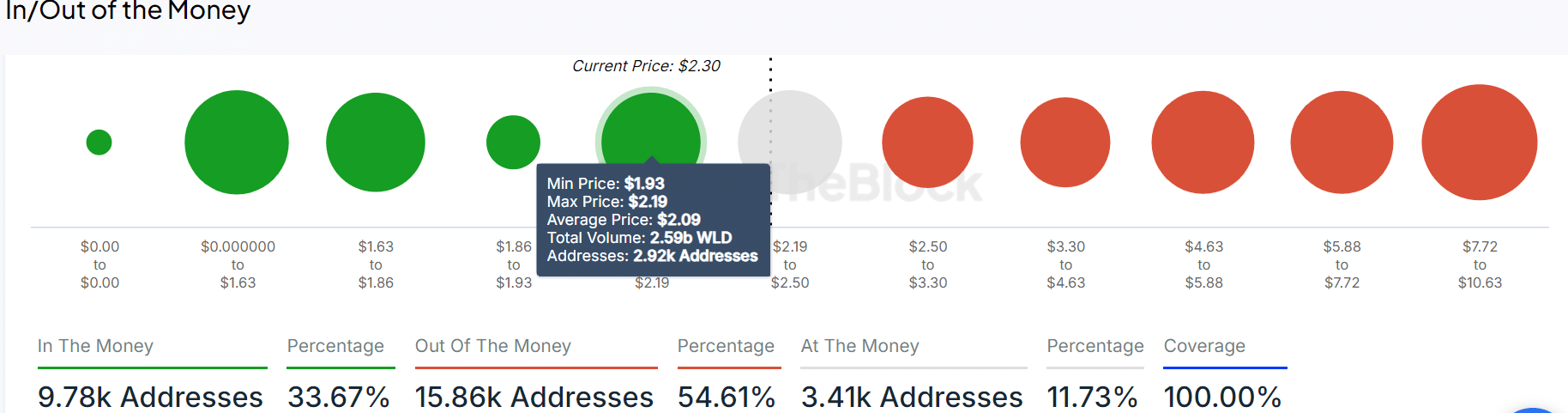

Based on the analysis, the range of $1.9 to $2.1 was a significant support level, as indicated by the white marks on charts. According to IntoTheBlock data, approximately 2.59 billion WLD coins, equating to around $6 billion, were bought at this specific level.

Read Worldcoin [WLD] price prediction 2024 -2025

As a researcher, I’ve observed that the $2 mark played a pivotal role in supporting WLD traders and investors. However, it’s essential to note the potential reversal of the resistance at $2.5 into support for WLD. If our analysis is correct and the WLD hits its predicted target at $4.5, this could potentially yield an 80% profit.

However, a drop below $2 would invalidate the above bullish thesis.

Read More

- DYM PREDICTION. DYM cryptocurrency

- ZK PREDICTION. ZK cryptocurrency

- CYBER PREDICTION. CYBER cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- POPCAT PREDICTION. POPCAT cryptocurrency

- Top gainers and losers

- SKEY PREDICTION. SKEY cryptocurrency

- TURBO PREDICTION. TURBO cryptocurrency

- RUNE PREDICTION. RUNE cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

2024-10-15 00:07