- ADA was nearing a breakout from a symmetrical triangle, with technical indicators showing indecision.

- On-chain signals show mixed sentiment, but social dominance could play a pivotal role in ADA’s breakout.

As a seasoned crypto investor with battle scars from the 2017 bull run and the subsequent bear market, I’ve learned to never underestimate the power of technical analysis and on-chain data. Cardano [ADA] is at an interesting crossroads right now, teetering on the edge of a potential breakout.

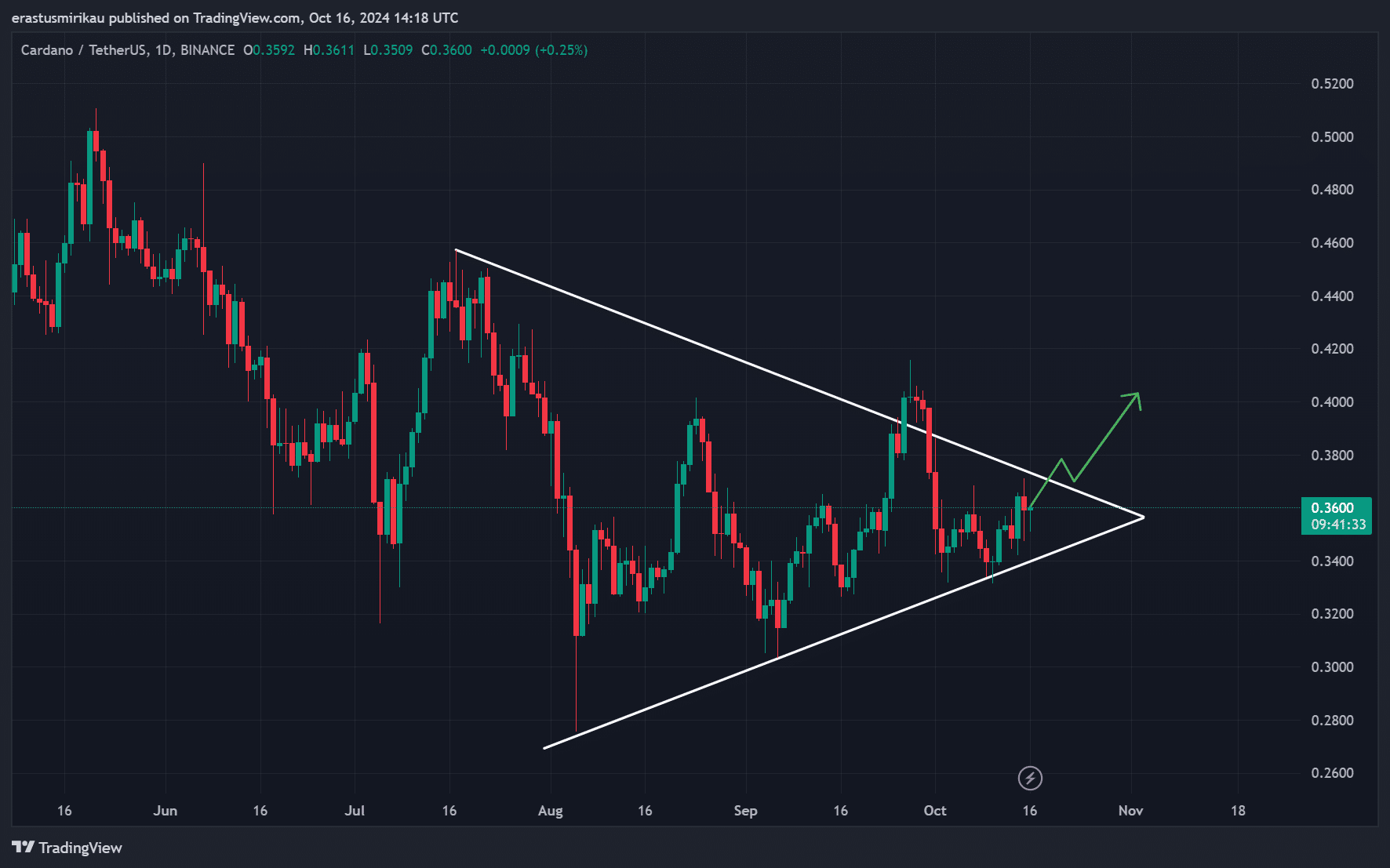

Cardano (ADA) is approaching a significant juncture, as it hangs slightly beneath a symmetrical triangle pattern on its daily chart. This technical configuration suggests that a substantial price change could be impending, with ADA currently trading at $0.3585, representing a 0.80% decline at the moment of reporting.

The key question remains: can ADA generate enough bullish momentum to break out to the upside and rally?

The symmetric triangle pattern in Cardano’s chart indicates a significant change in its price might be imminent. As the price fluctuates inside this triangle, it signals uncertainty among traders. Currently, ADA is hovering around the $0.3600 level, which holds great importance.

As a researcher observing the price movement of ADA, I’ve noticed that surpassing the resistance line could potentially drive its value upward. Yet, it’s crucial for the coin to demonstrate substantial trading volume to substantiate this bullish breakout and counteract any potential selling pressure that may arise.

Breaking down the technical indicators

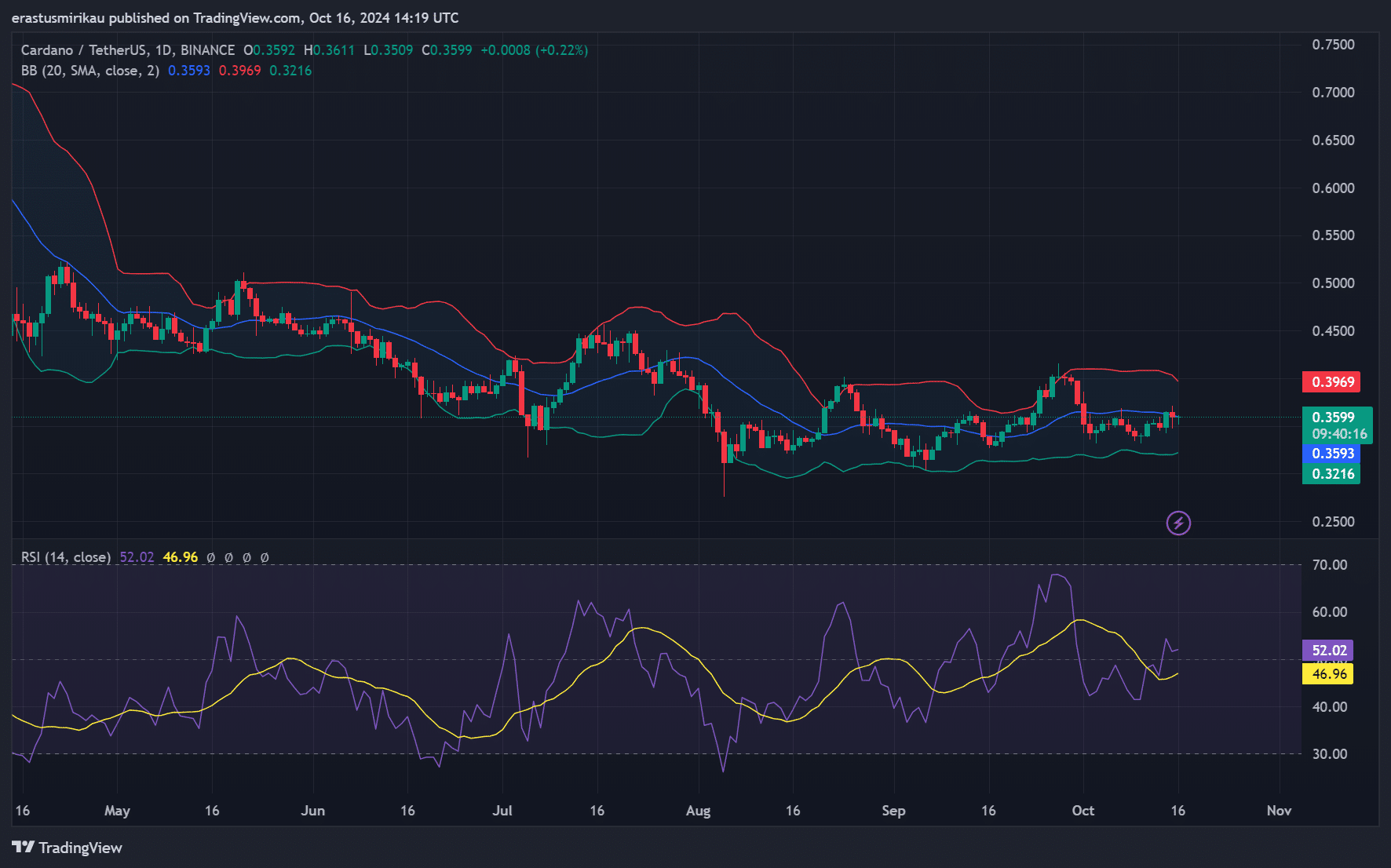

In simpler terms, some important market signals aren’t clearly pointing to a specific direction. For instance, the Relative Strength Index (RSI) for ADA is currently at 46.96, which means it’s in a neutral zone, indicating that there’s no dominant trend in the market right now. This could imply that the market isn’t showing a clear preference for either rising or falling.

Additionally, the Bollinger Bands are narrowing, signaling decreasing volatility.

At present, ADA is hovering around the midpoint of its trading range, with $0.3969 serving as a potential barrier for further upward movement. For a bullish breakout to materialize, the Relative Strength Index (RSI) needs to surpass 50 and there should be an increase in buying pressure, which would subsequently propel the price over crucial resistance levels.

On-chain signals: Mixed or clear direction?

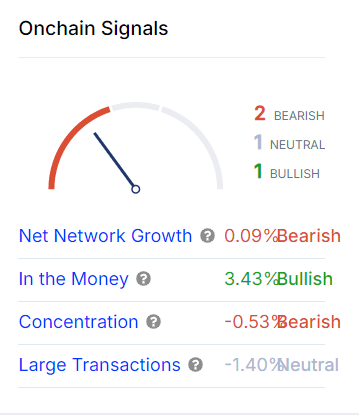

The data stored on the blockchain presents a somewhat ambiguous image. While there’s a slight increase of 0.09% in the network, this gradual growth could be interpreted as a negative sign. Moreover, a decrease of 0.53% in concentration levels suggests that significant investors are reducing their holdings.

Nevertheless, there’s a positive aspect to the “In the Money” indicator, as it reveals that 3.43% of ADA holders are making a profit, suggesting a somewhat optimistic trend. On the other hand, large transactions remain unchanged at -1.40%, implying that big players aren’t showing clear signs of either bullish or bearish behavior.

Will ADA’s social dominance push it higher?

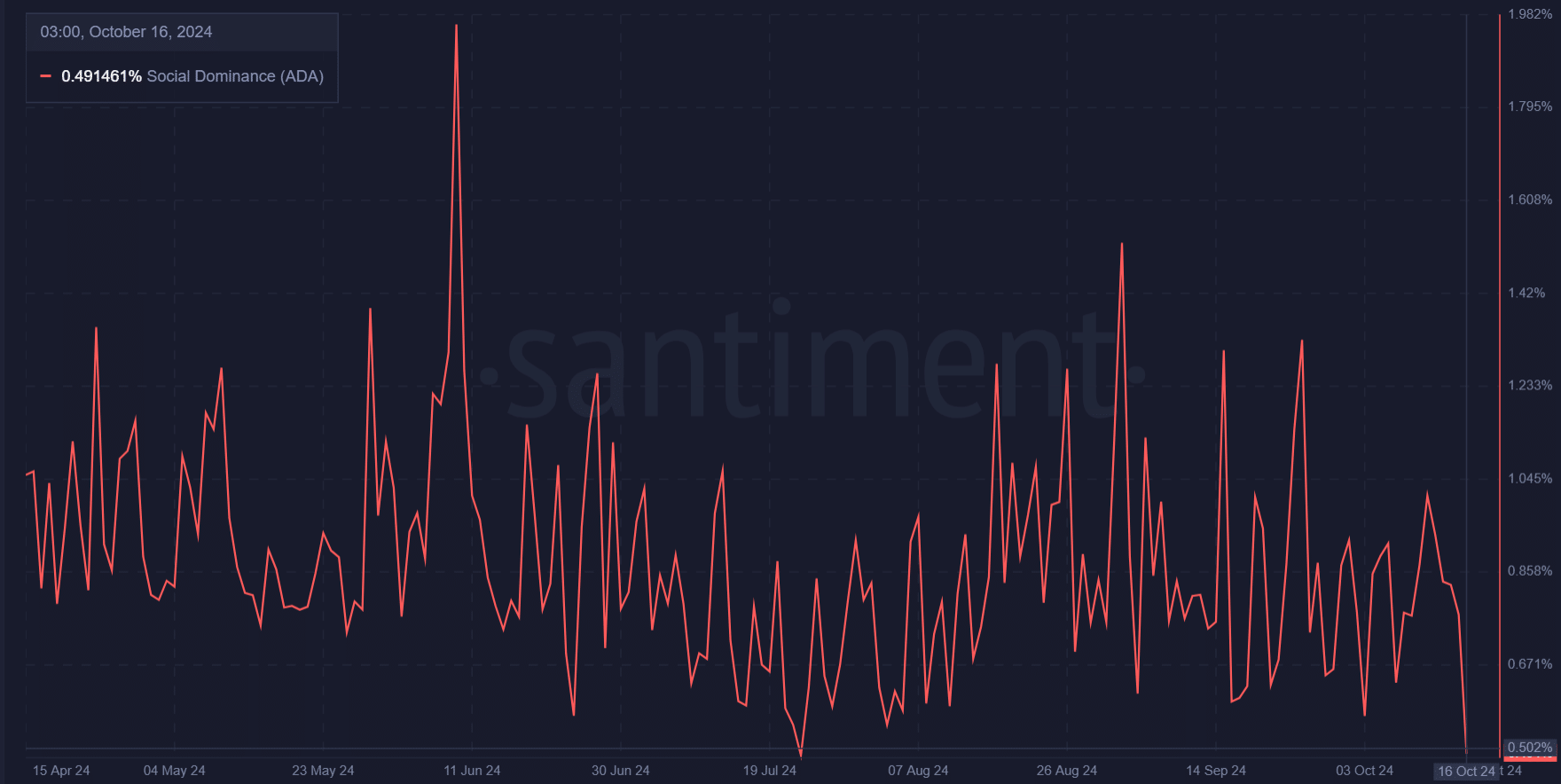

The relatively small but present 0.491% control that Cardano has in the social sphere indicates a reasonable level of community engagement. This degree of public focus is important since substantial price fluctuations are frequently linked to heightened conversations within the community.

Consequently, an increase in Cardano’s social influence might stimulate increased market attention, potentially triggering a surge. Nevertheless, for ADA to maximally benefit from this technical configuration, it requires continuous social engagement and substantial purchasing on a broader scale.

Read Cardano’s [ADA] Price Prediction 2023-24

At a crucial point, Cardano stands on the brink of a possible breakthrough. The technical arrangement hints that such a breakout might be imminent, but for Cardano to surmount its major resistance points, it requires a strong wave of purchasing energy.

Blending various data points from the blockchain introduces some ambiguity. Yet, should Cardano gain traction in both public interest and market trends, a surge might propel its price upward over the next few days.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Disney’s Snow White Dwarfs Controversy: THR’s Shocking Edit Exposed!

- Jimmy Carr Reveals Hilarious Truth About Comedians’ Secret Competition on Last One Laughing!

- Kanye West’s Wife Stuns Completely Naked at 2025 Grammys

- Shocking Truth Revealed: Is Cassandra Really Dead in Netflix’s Terrifying Mini-Series?

- Patrick Schwarzenegger Strips Down in Shocking White Lotus Scene You Have to See!

- AUCTION/USD

- See Channing Tatum’s Amazing Weight Loss Transformation

- Benny Blanco and Selena Gomez’s Romantic Music Collaboration: Is New Music on the Horizon?

- How to Install & Use All New Mods in Schedule 1

2024-10-17 11:36