- Dogecoin has found its favor with the bulls over the past week.

- On-chain data reveals robust whale or large holder involvement.

As a seasoned crypto investor with a keen eye for market trends and a knack for reading between the lines of on-chain data, I find myself both enthused and cautious about Dogecoin [DOGE] at the moment. The memecoin’s impressive run over the past week has been validated by robust whale involvement, which is a positive sign. However, it’s important to note that every coin needs to catch its breath, and DOGE appears to be approaching zones where sell pressure might start building up.

Could Dogecoin [DOGE] be preparing for a downtrend following its strong upward momentum this week? The meme coin has garnered bullish attention due to its recent performance, however, as it approaches significant areas where selling may become more prominent, a potential reversal could occur.

Exactly a week ago we observed that Dogecoin had struggled to secure momentum after the sell pressure that kicked off at the end of September. However, it found favor with the bulls since Friday last week.

Over the past day, the value of DOGE has risen and currently stands at approximately $0.135. This is the eighth straight day it has increased in value.

Nevertheless, this rapid pace may eventually decelerate, possibly leading some investors who purchased during the low points to sell, seeking profits.

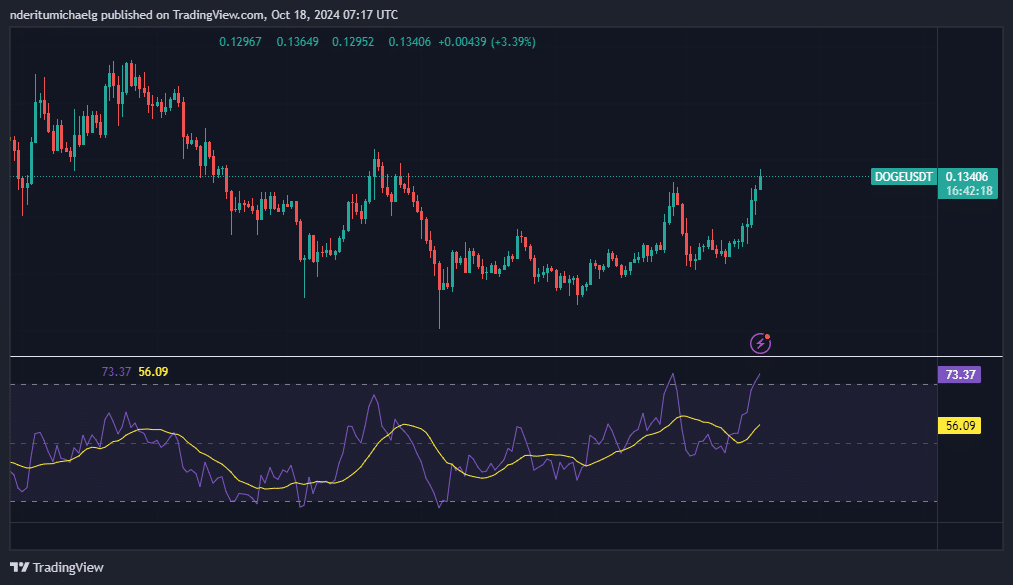

Due to a surge in Dogecoin’s value, it has now moved into an overbought territory based on the RSI indicator. Moreover, it surpassed the initial resistance level around $0.128. The next potential resistance can be found at or close to the $0.140 price point.

Assessing whether Dogecoin sell pressure is building up

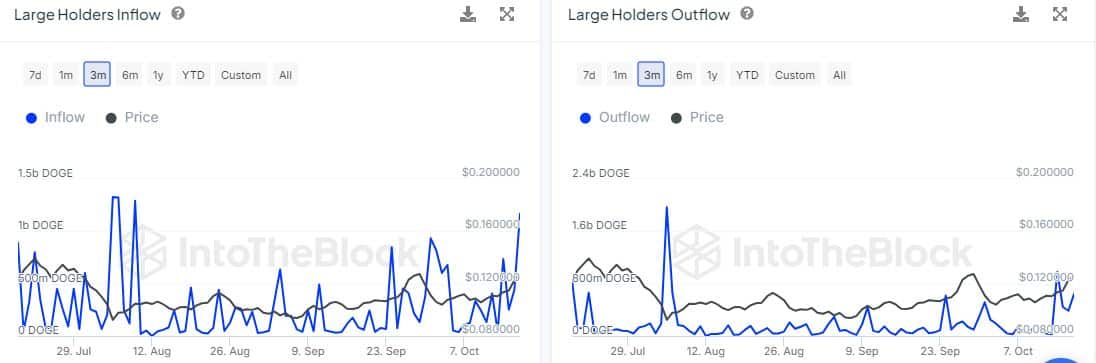

It’s clear that the recent success of Dogecoin isn’t just a coincidence. On-chain analysis shows strong activity from significant investors, or “whales”. For example, there was an enormous increase in large holder transactions for Dogecoin on Thursday, with inflows reaching a staggering 1.17 billion DOGE at their peak.

Meanwhile, large holder flows peaked at $640.1 million DOGE during the same session.

More than $71 million flowed into the large holders’ accounts, suggesting strong demand even with increasing prices. If selling pressure remains low, this situation could lead to further price increases.

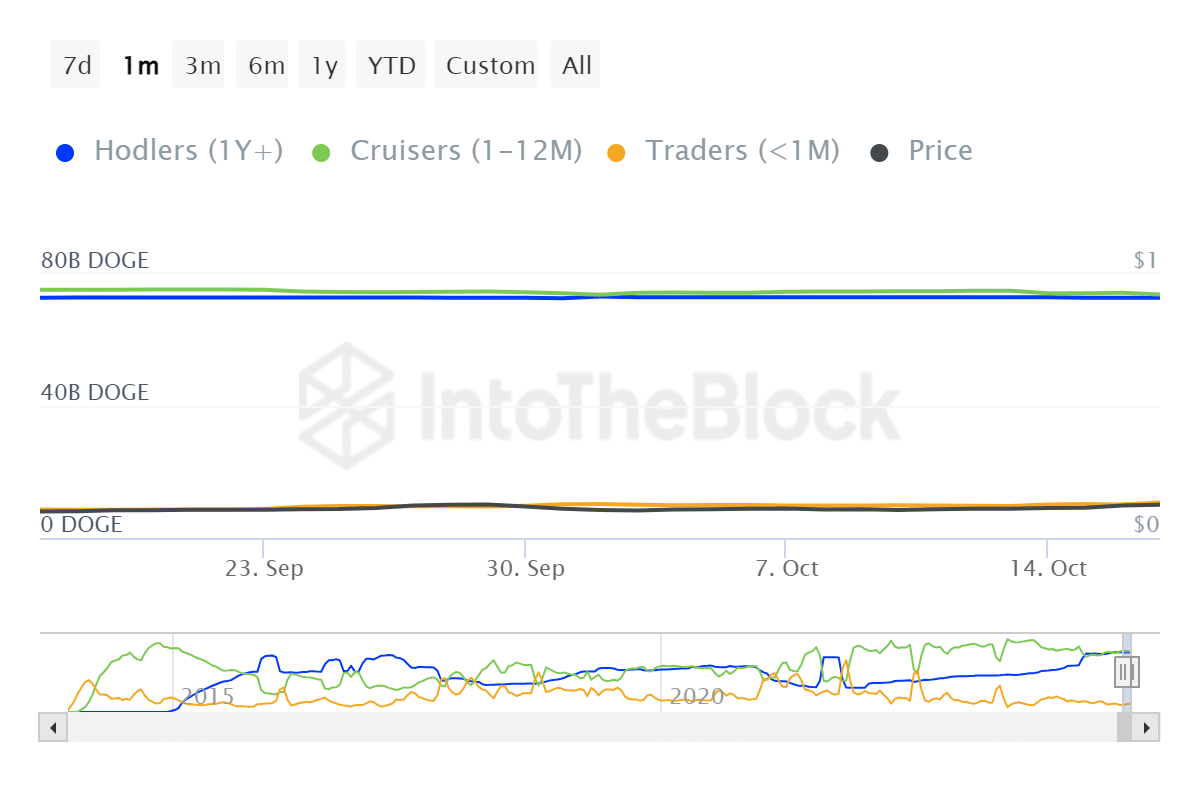

The duration a person holds Dogecoin can provide valuable information about potential selling or profiting activities. For instance, the amount of Dogecoins held by HODLers decreased from approximately 72.97 billion coins on October 12th to around 72.17 billion DOGE on October 18th.

The quantity of coins on the cruiser decreased from 74.89 billion to 73.77 billion over that timeframe.

Despite these outflows, retail trader balances absorbed any potential downfall. Their balances grew from 8.75 billion DOGE to 10.74 billion DOGE from 12th to 18th October.

Realistic or not, here’s DOGE market cap in BTC’s terms

The data indicates that certain whales and swing traders might be cashing out during the rise, but robust interest from the retail sector is driving Dogecoin’s continued growth.

The bullish momentum may thus not have much upside left without strong accumulation by whales. Nevertheless, these observations confirm the growing confidence among Dogecoin holders in Q4 2024.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- ETH/USD

- Solo Leveling Arise Amamiya Mirei Guide

- Shocking Truth Revealed: Is Cassandra Really Dead in Netflix’s Terrifying Mini-Series?

- Kanye West’s Wife Stuns Completely Naked at 2025 Grammys

- Disney’s Snow White Dwarfs Controversy: THR’s Shocking Edit Exposed!

- See Channing Tatum’s Amazing Weight Loss Transformation

- AUCTION/USD

- Fire Force Season 3: Release Date and Plot Revealed!

- How to Install & Use All New Mods in Schedule 1

2024-10-19 00:07