- Bitcoin HODLing has climbed to impressive levels, with holders now anticipating higher prices.

- Worth assessing the potential risk in case of a major sell-off

As a seasoned crypto investor with battle scars from the 2017 and 2018 market crashes, I can’t help but feel a mix of excitement and apprehension as I watch Bitcoin inch closer to $70,000. The current level of HODLing is impressive, and it’s hard not to get swept up in the optimism. However, I’ve learned the hard way that every bull run comes with its own set of challenges.

Investors holding Bitcoin have been anxiously looking forward to Bitcoin surpassing the $70,000 price mark again, as shown by the substantial accumulation of unrealized gains – A testament that BTC owners are choosing to hang on (HODL), hoping for even higher valuations.

Indeed, as per a recent assessment by CryptoQuant, Bitcoin currently boasts approximately $7 billion in unrealized gains. This finding underscores a significant amount of HODLing and anticipation for increased prices. Yet, it’s crucial to note that such a large accumulation could potentially lead to a substantial correction once profit-taking becomes widespread.

As a researcher observing the Bitcoin market, I’ve noticed that if holders choose to cash out their profits, this could potentially trigger increased selling pressure. This sell-off, reminiscent of what occurred towards the end of July, might result in a steep price drop over a short period. However, so far, the general optimism surrounding Bitcoin has helped it maintain its current position on the charts.

Currently, Bitcoin is being bought for approximately $68,350, which is almost 2.4% from reaching $70,000. It appears that this digital currency is moving towards the next potential resistance levels around $69,400 to $71,500.

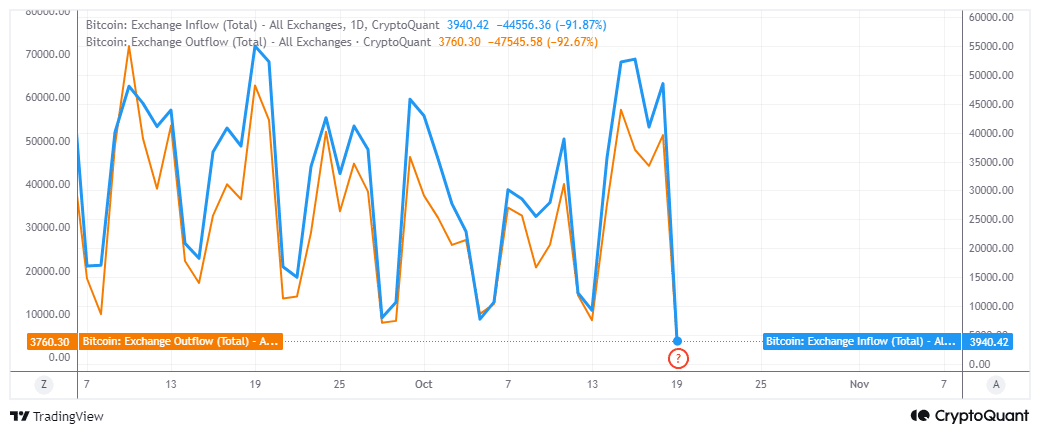

Bitcoin flows fall to the lowest levels in 2024

Bitcoin exchange flows might offer us interesting insights into the crypto’s latest bullish wave.

Over the period spanning from the 13th through the 16th of October, I observed a notable increase in both incoming and outgoing exchange transactions. Yet, since then, these exchanges have significantly diminished to their minimal levels seen this entire year.

Indeed, it appears that approximately 3,760 Bitcoins left exchanges during the past day. Conversely, about 3,940 Bitcoins entered exchanges, resulting in a slight excess of inflows over outflows.

The fluctuations in exchange flow indicate that Bitcoin’s volatility could return. Yet, whether the next shift will carry bullish or bearish momentum is uncertain at this point. However, analysis of address flows might provide us with some clues about the market direction.

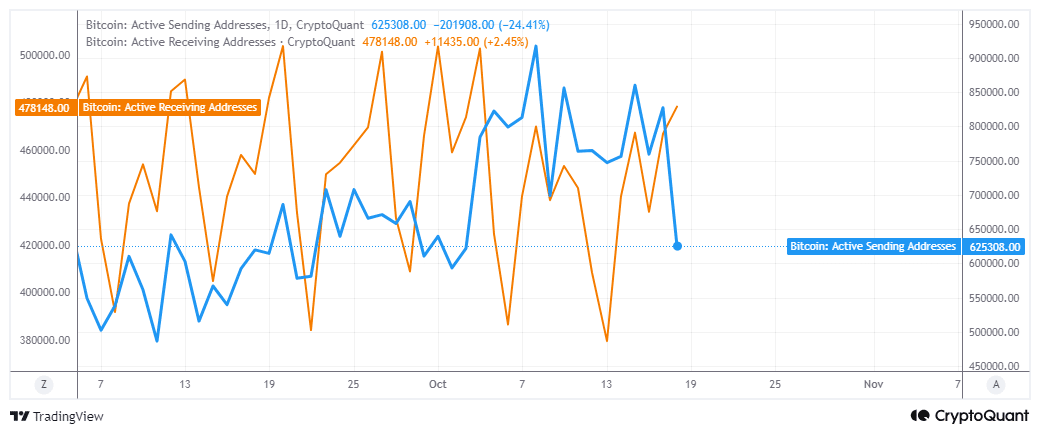

The number of active sending addresses have been declining since mid-October. For instance – They fell from 860,161 addresses on 15 October to 478,148 addresses by 18 October.

Instead, the number of recorded addresses increased significantly, rising from 379,545 on October 13th to 625,308 on October 18th. Furthermore, data showed that more addresses were buying Bitcoin than selling it, and interestingly, the number of receiving addresses was increasing while the number of sending addresses decreased.

Confirmed activity indicates a change, showing diminishing selling intensity even with the recent increase in price. This trend suggests that Bitcoin might continue to rise, but an unexpected surge in selling could still occur.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- ETH/USD

- Solo Leveling Arise Amamiya Mirei Guide

- Kanye West’s Wife Stuns Completely Naked at 2025 Grammys

- Shocking Truth Revealed: Is Cassandra Really Dead in Netflix’s Terrifying Mini-Series?

- Disney’s Snow White Dwarfs Controversy: THR’s Shocking Edit Exposed!

- AUCTION/USD

- See Channing Tatum’s Amazing Weight Loss Transformation

- Kim Kardashian Teases New Romance in Latest Dating Update

- Kim Kardashian’s Hilarious NSFW Confession Gets Silenced by Animal Noises!

2024-10-20 04:07