- Despite trading within a broader bullish structure, PEPE could be forced to seek stronger support zones.

- If PEPE remains unable to clear this resistance, an extended accumulation phase could follow.

As an analyst with over two decades of trading experience under my belt, I’ve seen market cycles come and go, much like the phases of the moon. However, the current situation with PEPE [PEPE] is giving me a sense of déjà vu, as it seems we might be on the cusp of another downturn.

Over the past month, PEPE (PEPE) experienced a significant surge, rising by 23.7%. Yet, the upward trend seems to be slowing down, suggesting that the recent gains may potentially be in jeopardy.

At present, there’s a 2.46% decrease observed in the asset’s value on today’s graphs, suggesting a possible prolongation of this downward movement.

Based on a recent assessment by AMBCrypto, it appears that the downward trend could continue due to the prevailing negative market sentiment towards PEPE, with little demand to propel its price increase significantly.

PEPE faces a major obstacle

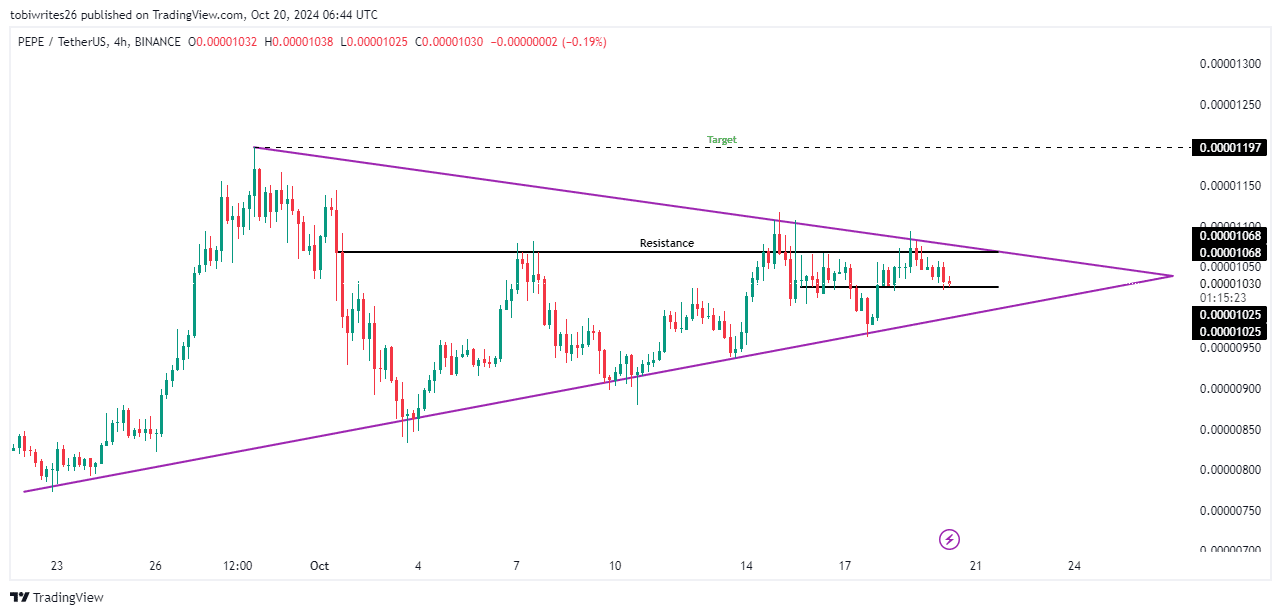

At the moment, PEPE’s trades were occurring inside a symmetrical triangle setup, which is often interpreted as an indicator that a price movement is imminent after a phase of collection.

The token recently reacted to resistance at $0.00001068, a level that has rejected price rallies twice, indicating significant selling pressure at this zone.

Over the given timeframe, PEPE found itself near a potential floor price of 0.00001025 USD. If this support level remains strong and there is significant demand to buy, it could potentially lead to an upward trend.

As a crypto investor, I anticipate the price to bounce back, possibly challenging the resistance level again and breaking the existing pattern, propelling PEPE towards the upper limit of the triangle.

If the support level doesn’t manage to stay strong, it’s possible that PEPE might drop down to the lower support of the ascending triangle. This area is known for its high trading volume, which could potentially trigger a surge in buying activity and push the price upwards again.

Will PEPE’s support level hold?

Based on AMBCrypto’s analysis, it seems that the current support level for PEPE may not be sustainable due to signs of growing selling pressure among traders, as indicated by technical markers.

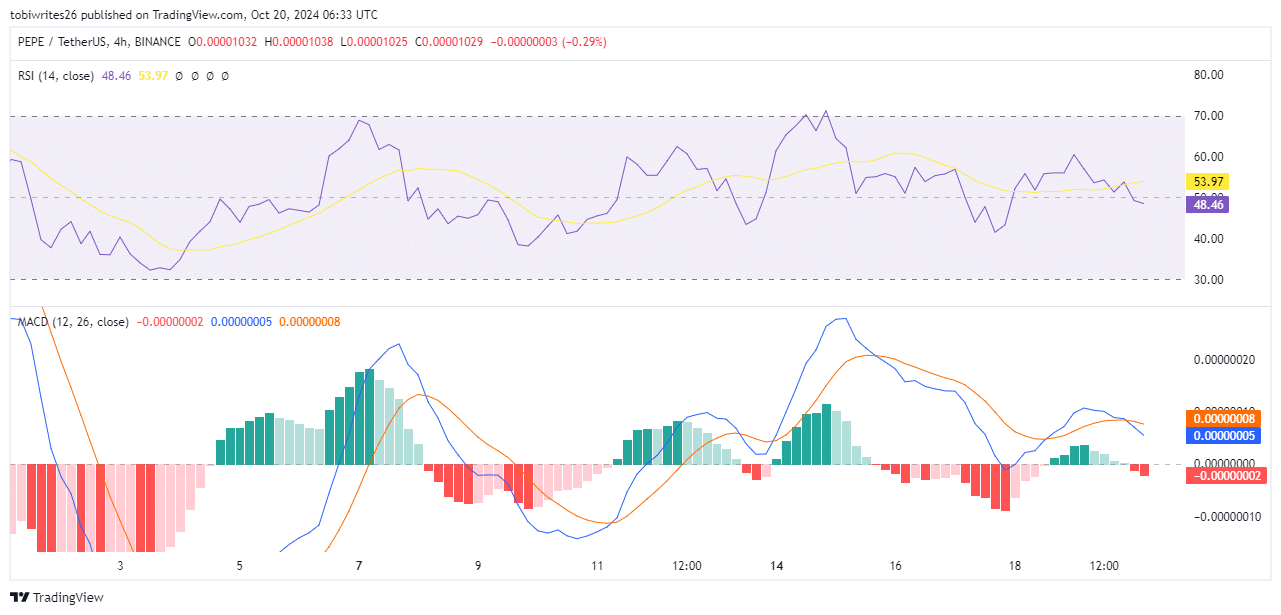

In simpler terms, the Relative Strength Index (RSI) stands at 48.46, which is lower than the neutral level of 50.00. This suggests a predominantly negative market sentiment, possibly causing PEPE’s price to decrease as well.

The RSI measures the speed and change of price movements in an asset.

The Moving Average Convergence Divergence (MACD) has recently displayed a “death cross” pattern, indicating that the negative momentum appears to be growing stronger.

When the MACD line (represented in blue) drops beneath the signal line (shown in red), it suggests that traders are leaning towards selling the asset rather than keeping it.

If this trend continues, PEPE could break below its support level, leading to further declines.

Interest in PEPE continues to fade

At the current moment, the trend suggested by Open Interest – a tool used for measuring market sentiment by observing if traders are more inclined towards buying or selling – pointed towards an escalating level of selling activity.

Read Pepe’s [PEPE] Price Prediction 2024–2025

Based on information from Coinglass, there’s been a 3.61% decrease in the short-term Open Interest for PEPE, currently standing at approximately $165.2 million.

The decrease in Open Interest indicates that it’s probable we may see more price decreases for PEPE, making a drop below its current level appear almost unavoidable.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- ETH/USD

- Shocking Truth Revealed: Is Cassandra Really Dead in Netflix’s Terrifying Mini-Series?

- Solo Leveling Arise Amamiya Mirei Guide

- See Channing Tatum’s Amazing Weight Loss Transformation

- Kim Kardashian’s Hilarious NSFW Confession Gets Silenced by Animal Noises!

- Disney’s Snow White Dwarfs Controversy: THR’s Shocking Edit Exposed!

- How to Install & Use All New Mods in Schedule 1

- Kim Kardashian Teases New Romance in Latest Dating Update

- Paige DeSorbo and Craig Conover’s Massive Fight Pre-Breakup

2024-10-21 03:04