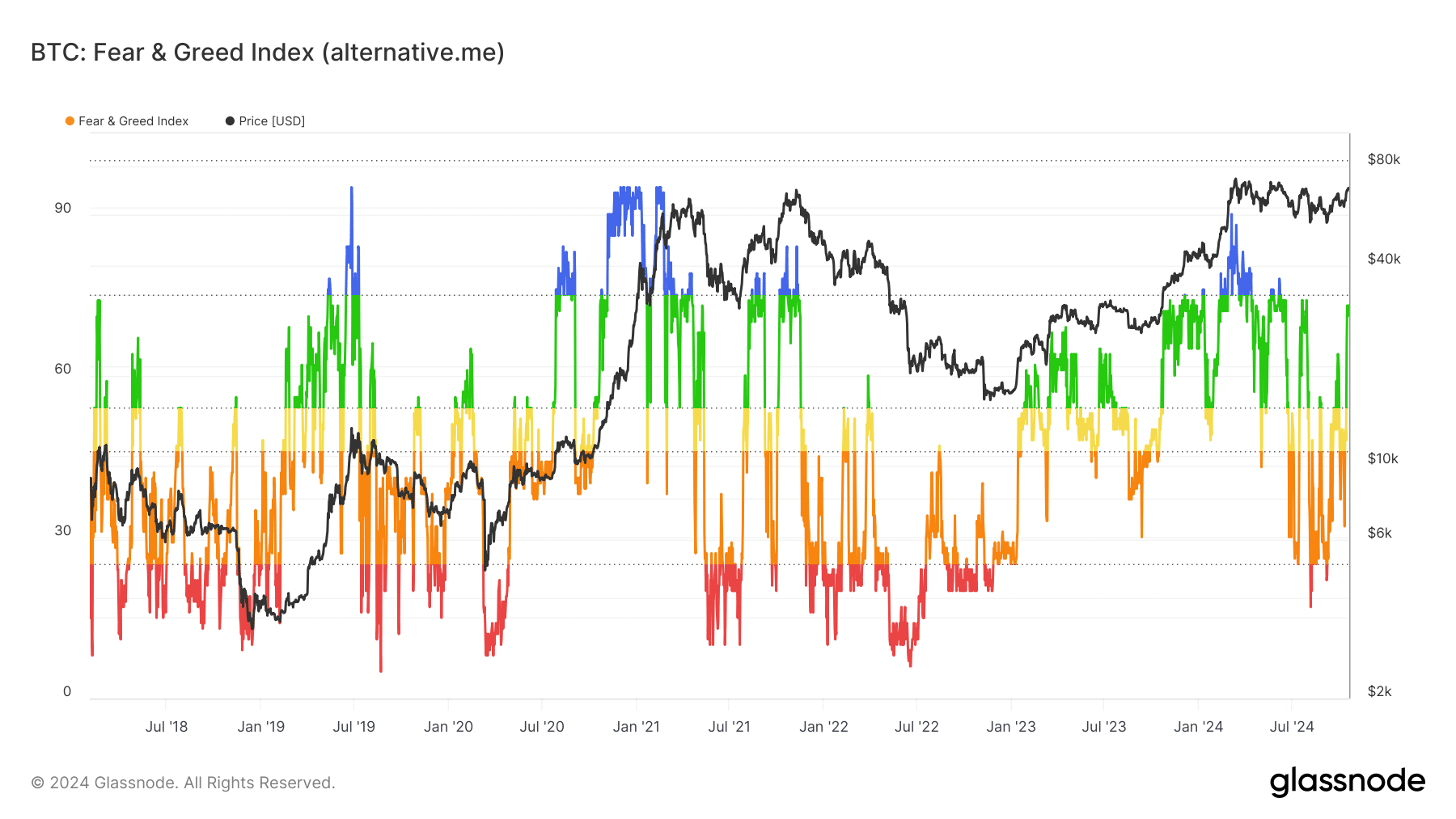

- The Fear and Greed Index was at 73, indicating heightened market optimism.

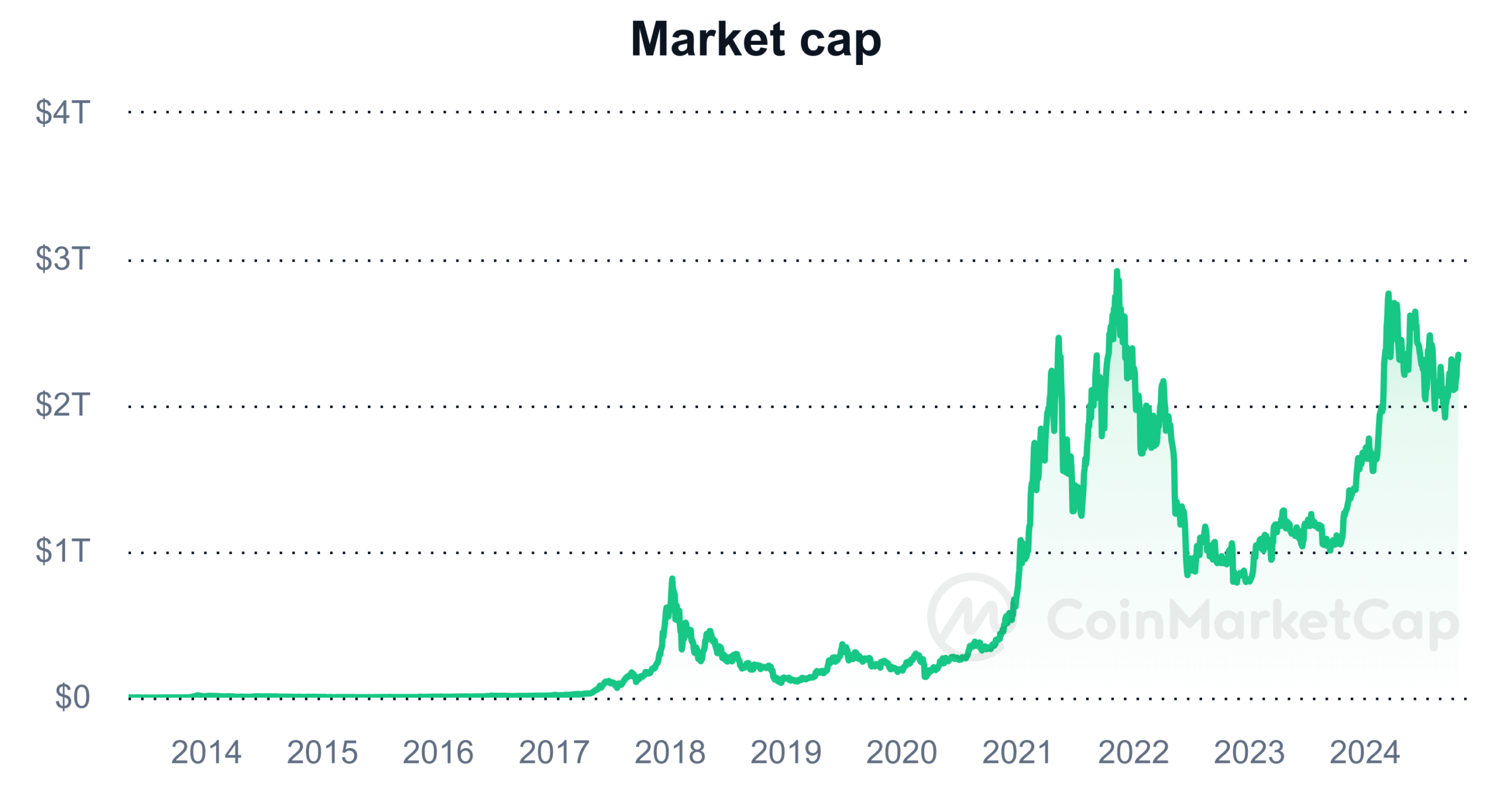

- Despite the rising greed, the total cryptocurrency market cap held strong at $2.23 trillion.

As a seasoned crypto investor with a few battle scars from past market corrections, I find myself in a peculiar position when the Fear and Greed Index hits 73. While the rising optimism can be tempting, my life experience has taught me that extreme greed is often followed by a cold shower of reality.

At the moment, the Fear and Greed Index stood at 73, signifying that the current market sentiment is predominantly one of enthusiasm or greed. Such high levels of optimism imply that numerous investors are feeling assured about potential future price rises.

It also raises concerns about potential market overheating.

Potential for market overheating

According to AMBCrypto’s examination of the Crypto Fear and Greed Index provided by Glassnode, the current reading of 73 indicates that the market is increasingly showing signs of excessive optimism or ‘greed.’

Excessive ambition can sometimes have two faces. On one hand, growing enthusiasm might boost prices; on the other, it may amplify the likelihood of a sudden market downturn.

As an analyst, I find that when the Fear and Greed Index spikes to elevated levels, I might find myself tempted to assume more risk in my trading strategies, aiming for greater rewards. However, it’s crucial to remember that such high levels may obscure potential downsides that should not be overlooked.

As a passionate crypto investor, I’ve noticed that when emotions run high and everyone seems to be jumping on the bandwagon, it could signal a time of excessive enthusiasm, or “extreme greed.” While such moments can lead to price surges in the short term, history has shown us that these periods often precede corrections. It’s crucial to keep this in mind as we navigate the dynamic world of cryptocurrencies.

In early 2021, the index displayed comparable highs of greed, which was then followed by a significant market downturn.

Market holds strong despite Fear and Greed Index

Despite the Fear and Greed Index suggesting a note of caution, the overall value of the cryptocurrency market held firm at approximately $2.23 trillion. This resilience in the market suggests persistent engagement from both institutional and individual investors.

Top digital currencies such as Bitcoin (BTC) and Ethereum (ETH) remained the bedrock of the market’s total worth, helping sustain a favorable trajectory.

Beyond my primary investments, I’ve found that cryptocurrencies like Solana (SOL) and Worldcoin (WLD) have significantly contributed to shaping the overall market dynamics. These altcoins have been instrumental in keeping the momentum going.

Even though there’s increasing avarice, the consistent market capitalization suggests that faith in the long-term prospects of the cryptocurrency market stays robust.

Outlook: Opportunity or risk?

Given that the Fear and Greed Index is indicating a ‘greed’ phase, investors are advised to carefully consider both potential benefits and potential drawbacks. While the robust market optimism and substantial market value might drive near-term profits, it’s equally important to keep an eye on potential risks that could arise in this scenario.

Conversely, prolonged periods of excessive investment greed often lead to market adjustments, where investors cash out their gains and risk-taking decreases.

Similar to many readings, when the Fear and Greed Index is high (indicating fear or greed), it could potentially signal an approaching market adjustment.

With a positive outlook bringing possible profits, it’s wise for traders to stay alert and ready to handle any market fluctuations that may arise.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- AUCTION PREDICTION. AUCTION cryptocurrency

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- `Tokyo Revengers Season 4 Release Date Speculation`

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- ETH PREDICTION. ETH cryptocurrency

- How to Install & Use All New Mods in Schedule 1

- XRP CAD PREDICTION. XRP cryptocurrency

- Is Disney Faking Snow White Success with Orchestrated Reviews?

2024-10-21 04:08