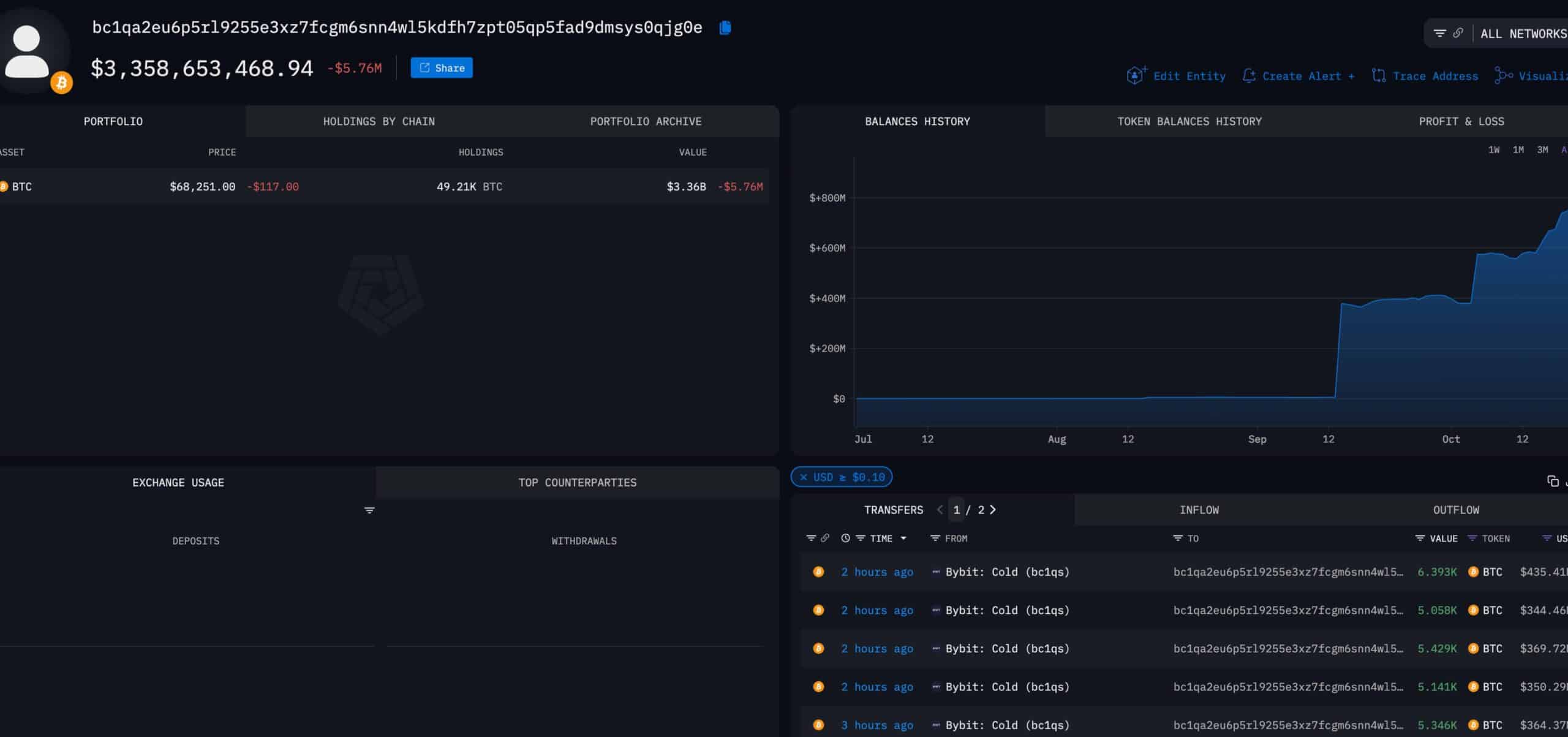

As a seasoned crypto investor with battle-tested nerves and a knack for navigating Bitcoin’s tumultuous waters, I find myself cautiously optimistic about the current state of affairs. The loose order book on Bitcoin Futures creates an intriguing landscape ripe for strategic maneuvers by the big players. With liquidations heating up and nearly $3.3 billion worth of BTC moving from Bybit’s cold storage to a new wallet, it pays to keep a keen eye on these significant shifts.

The price action of Bitcoin [BTC] is creating a dynamic environment as its Futures order book remains loose.

New information from a Bitcoin liquidation visualization indicates increased action, hinting at possible liquidations which may lead to changes in the bitcoin’s price trajectory.

In this range ($67.5K – $69.5K), there’s room for major actors to manipulate price fluctuations, which suggests a high level of market turbulence or instability.

In these designated areas, the prices of Bitcoins might experience swift fluctuations, whether rising or falling, due to even minimal investment funds being involved in Futures contracts.

If Bitcoin can’t sustain being above its significant Fibonacci retracement level, a crucial resistance point at around $63K might be challenged. Yet, long-term investors could find solace as the 180 and 120-day moving averages appear to provide robust support.

Approximately 49,000 Bitcoins have been transferred from Bybit’s offline wallet to a newly created one, which has sparked interest among investors due to the substantial nature of these transactions.

As a crypto investor, I’m always on the lookout for potential market changes, and the large-scale asset movements within the Bybit team certainly catch my attention. Particularly when liquidations are involved, it’s crucial to keep a close eye on these transactions, as they could indicate shifts in the market dynamics.

BTC local top and sentiment

Regarding projected costs, Bitcoin is nearing a resistance level at around $70,000, while the CME Futures are slightly higher than its current market value.

Market observers are closely monitoring if Bitcoin (BTC) will be able to surmount this resistance level or encounter a rebuff instead.

In simpler terms, bulls must hold strong at the $68K mark to avoid a larger price decrease.

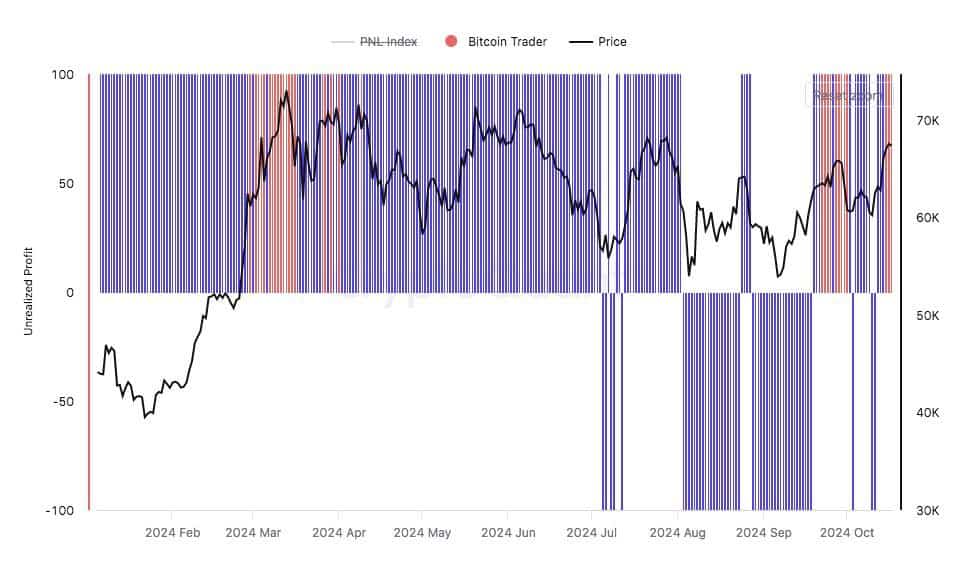

In the past, when profits that haven’t been realized increase significantly, such as the current $7 billion surplus, traders often decide to sell these gains. This increased selling could lead to heightened selling pressure, potentially causing a temporary peak in the market before a decline occurs.

Furthermore, there’s been an observable change in the attitude towards Bitcoin from skepticism to optimism. A surge in bullish sentiments can be noticed across various social media platforms.

Investing when there’s widespread panic (fear) and offloading investments when there’s excessive optimism (euphoria) has, in the past, proven beneficial for traders. This approach can increase the faith of those looking to leverage present market conditions.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As Bitcoin navigates its fluctuation zone and crucial barrier points, it’s essential for traders to remain vigilant, as market fluctuations could occur in the upcoming period. The possibility of significant price swings is high, with major investors potentially manipulating the market by executing calculated transactions.

Will Bitcoin surge beyond its current levels or experience a temporary dip prior to another upward trend? Swings in price are likely within the significant selling areas, offering chances for both futures and current market traders.

Read More

- DYM PREDICTION. DYM cryptocurrency

- ZK PREDICTION. ZK cryptocurrency

- CYBER PREDICTION. CYBER cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- POPCAT PREDICTION. POPCAT cryptocurrency

- SKEY PREDICTION. SKEY cryptocurrency

- TURBO PREDICTION. TURBO cryptocurrency

- Top gainers and losers

- EUR CAD PREDICTION

- FLUX PREDICTION. FLUX cryptocurrency

2024-10-21 05:12