- Ethereum long-term accumulation addresses now hold over 19 million ETH, nearly doubling since January 2024.

- With nearly 29% of ETH’s total supply staked, reduced market liquidity could support future price stability.

As a seasoned analyst with over two decades of market experience under my belt, the surge in long-term accumulation of Ethereum [ETH] has piqued my interest. The fact that these addresses now hold over 19 million ETH – nearly doubling since January 2024 – speaks volumes about investors’ confidence in Ethereum’s future potential.

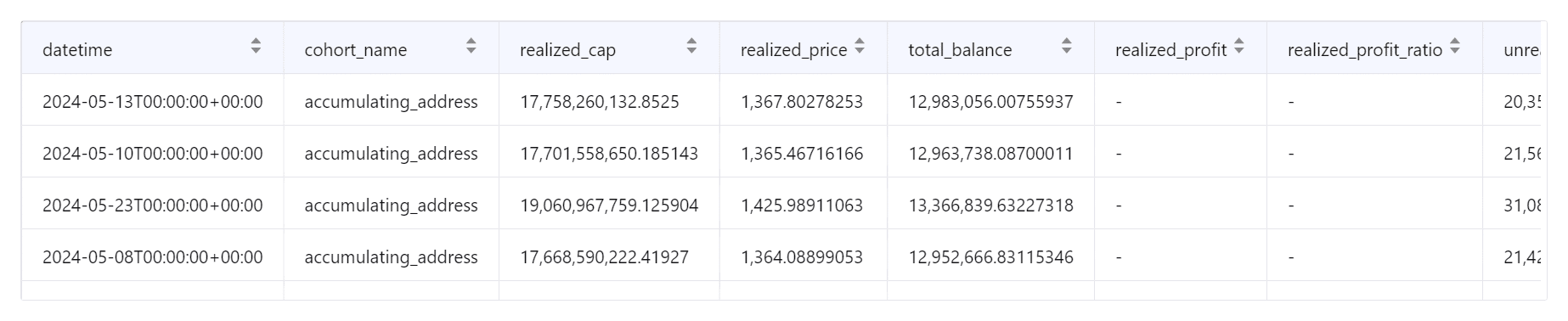

On the 18th of October, there was a significant increase in long-term holding of Ethereum (ETH), with over 19 million ETH stored in various wallets.

This substantial increase represents a jump from 11.5 million ETH as of the beginning of the year, indicating an uptick in investor faith regarding Ethereum’s future potential.

Ethereum accumulation rises

According to data from CryptoQuant, the amount of Ethereum stored in accumulation wallets significantly increased. Initially, these wallets held approximately 11.5 million ETH in January 2024, but by October, that number had almost doubled.

It’s predicted that by year-end, the total Ethereum stored in these accounts might exceed 20 million units, maintaining this upward trajectory.

The rise in long-term investments suggests that major investors and Ethereum enthusiasts are accumulating assets, anticipating potential future expansion.

1) The endorsement of Spot ETFs for Ethereum (ETH) in early 2024 has added to the amassing by piquing greater interest from the mainstream in ETH. Meanwhile, the surge in ETH staking serves as another significant factor fueling this accumulation process.

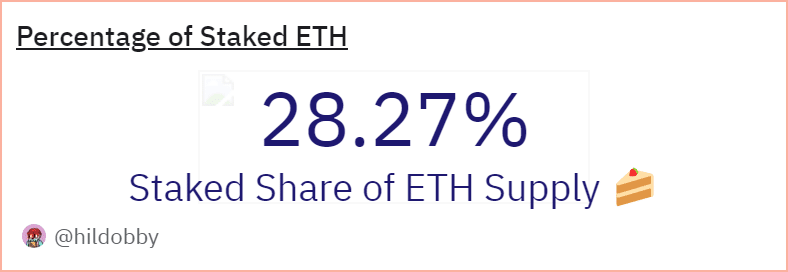

Staked Ethereum near 30% of supply

Over time, staking has emerged as a crucial element in the market movements of Ethereum. At present, data from Dune Analytics indicates that about 29% of Ethereum’s total supply, equivalent to approximately 34,600,896 ETH, is currently being staked.

A significant amount of Ethereum is now tied up in staking agreements, potentially leading to less urgency for selling in the broader market.

In the coming days, a possible factor boosting Ethereum’s value might be its reduced supply for trading. This scarcity could lead to increased price stability and potentially even higher values due to enhanced demand.

Ethereum maintains a positive trend

AT press time, Ethereum was trading at $2,649, slightly above key support levels.

In simpler terms, the line that represents an average price over the past 50 days at approximately $2,476 is serving as a solid base for the asset’s price, preventing it from falling lower. Meanwhile, the line representing the average price over the past 200 days at around $3,022 has been acting as a significant barrier that the asset’s price hasn’t been able to surpass.

To keep rising over the long term, Ethereum needs to surpass this current resistance level first.

In simpler terms, the Relative Strength Index (RSI) currently stands at 61.61, suggesting a strong upward trend that’s not yet excessive or overextended.

Read Ethereum’s [ETH] Price Prediction 2024-25

Currently, the Chaikin Money Flow (CMF) shows a slight decline at -0.07, indicating a lack of significant buying pressure. However, this decrease doesn’t yet suggest a turnaround to a bearish trend.

Even though Ethereum appears optimistic, breaking through the $3,022 barrier is essential for a more robust upward trend. In case of market turbulence, the 50-day moving average at $2,476 might serve as significant reinforcement.

Read More

- AUCTION/USD

- Solo Leveling Season 3: What You NEED to Know!

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- `Tokyo Revengers Season 4 Release Date Speculation`

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- Stephen A. Smith Responds to Backlash Over Serena Williams Comments

- Is Disney Faking Snow White Success with Orchestrated Reviews?

- XRP/CAD

- AEW Fans Are Loving Toni Storm’s Uncanny Mariah May Cosplay From Dynamite

2024-10-21 07:04