- BTC’s momentum has turned bullish for the first time in H2 2024.

- Will the uptrend continue and follow historical US pre-election trends?

As a seasoned researcher who has navigated through various market cycles and trends, I can confidently say that the recent bullish momentum in Bitcoin (BTC) is indeed intriguing. The 10% surge last week has brought BTC within striking distance of its ATH, a testament to the robustness of this digital asset.

Last week was a great and bullish one for Bitcoin [BTC]. It pumped nearly 10%, rallying from $62.5K to $69.4K due to strong spot market demand.

The recent rally made BTC only 7% away from its ATH of $73.7K, which it hit in March.

As per the analysis from Stockmoney Lizards, the recent rally in Bitcoin has shifted its momentum towards being bullish, potentially gaining even more speed due to past trends associated with U.S. elections.

He noted that BTC’s momentum turned bullish for the first time in H2 2024.

“Momentum is turning bullish”

From my experience as a crypto investor, I’ve come to rely on a tool called the Stochastic Momentum Index (SMI). This handy indicator helps me assess Bitcoin’s current price by comparing it to its recent midpoint. Essentially, it tells me if the price is overbought or oversold.

According to the two-week graph, we saw a bounce back that surpassed the 50 mark, signifying a potential shift towards positive trends, or in simpler terms, it seems like the market is showing signs of recovering.

2020’s pattern preceding Bitcoin breaking out of its accumulation phase seems to be repeating itself, potentially indicating an upcoming bullish surge.

BTC: US pre-elections trend

The analyst noted that the significant increases in Bitcoin’s value, potentially linked to the US elections, could occur once more.

In 2016 and 2020, two weeks before the US elections, BTC pumped 10% and 18%, respectively.

If the pattern continues in 2024, Stockmoney Lizards anticipate that a new all-time high (ATH) might occur prior to the US elections.

By 2024, it’s possible that we might witness a new all-time high (ATH), potentially increasing by around 10% or approximately $74,000. This surge could peak significantly in November and December.

But do on-chain metrics also lean towards this bullish outlook?

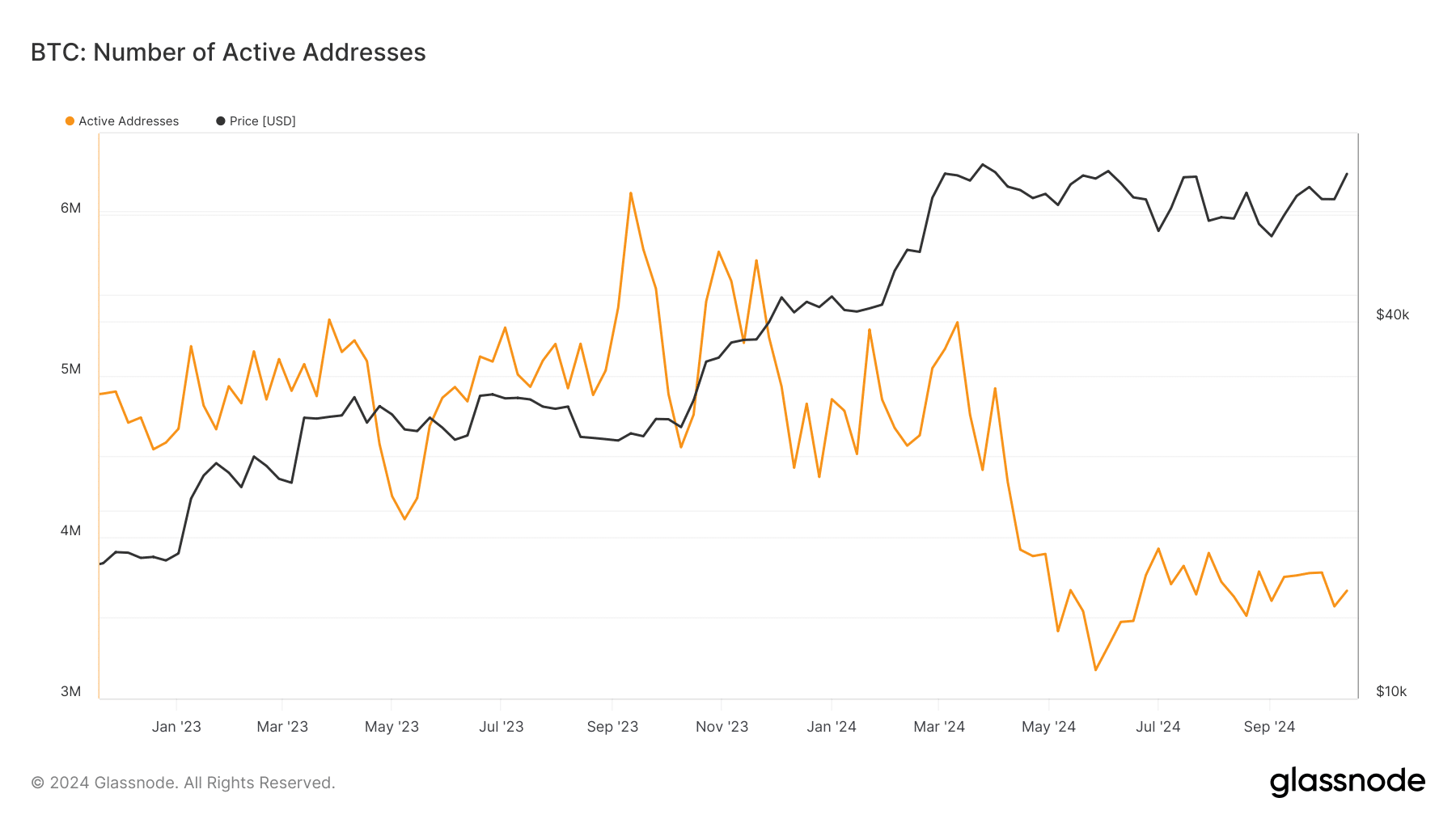

Over the past few months since July, there’s been a slowdown in Bitcoin’s overall interest and network expansion, which is evident from the number of daily active addresses.

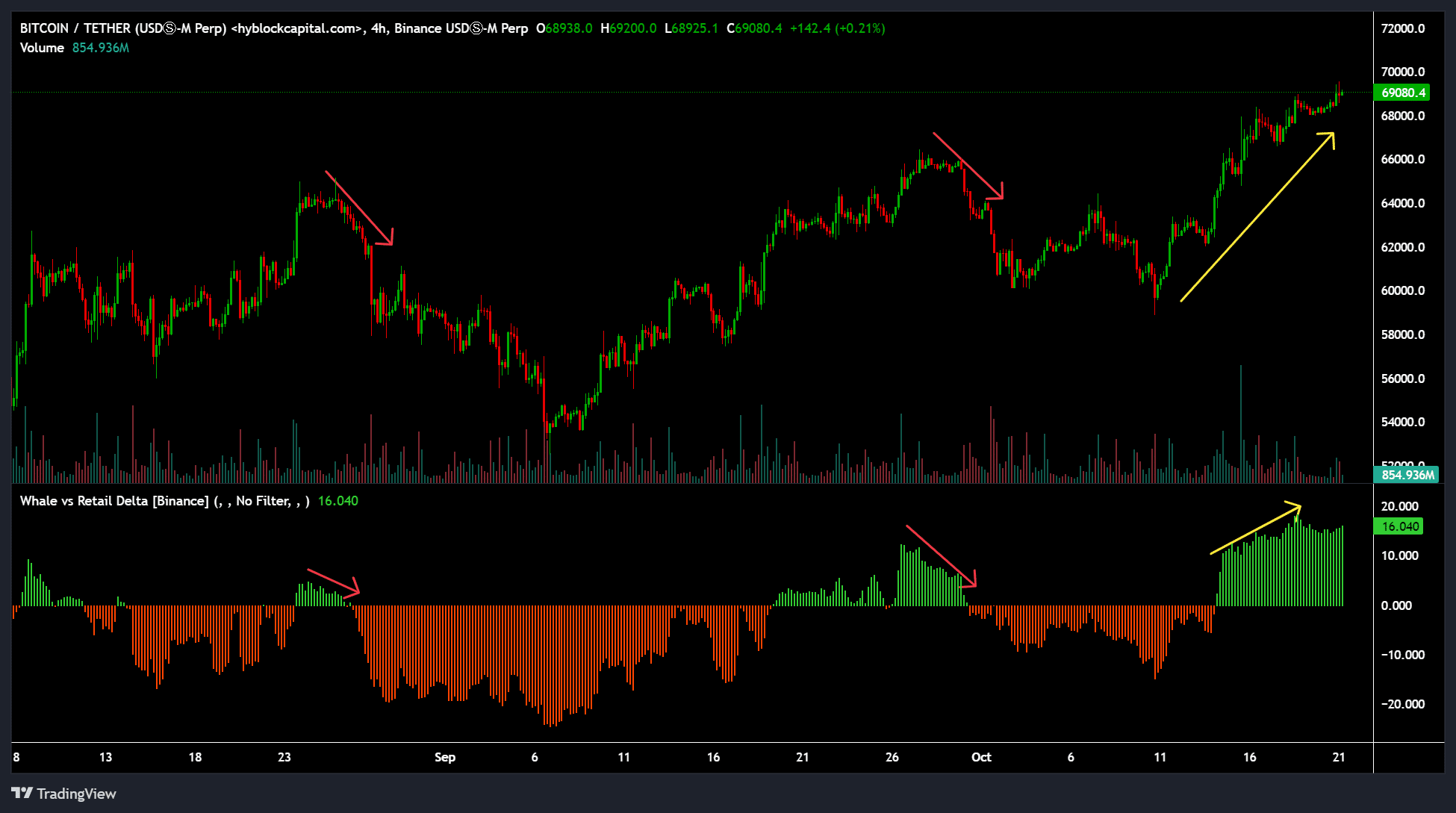

Although this could derail an explosive breakout for BTC, whales were massively adding positions.

Over the past week, large investors (whales) have been holding more Bitcoin positions compared to retailers, as indicated by the Whale vs. Retail Delta metric. This trend implies that these big investors are actively buying up Bitcoins and are optimistic about an increase in prices.

If the given metric shows a decrease, it might be an indication of an upcoming Bitcoin correction. The price level to watch closely would be around $66K if a temporary downturn occurs.

Read More

- GOAT PREDICTION. GOAT cryptocurrency

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- DOP PREDICTION. DOP cryptocurrency

- CYBER PREDICTION. CYBER cryptocurrency

- METIS PREDICTION. METIS cryptocurrency

- DEXE PREDICTION. DEXE cryptocurrency

- WELL PREDICTION. WELL cryptocurrency

- NOT PREDICTION. NOT cryptocurrency

- SCR PREDICTION. SCR cryptocurrency

2024-10-21 15:04