- Ethereum has reached an eight-week high as the RSI shows an increase in buying pressure.

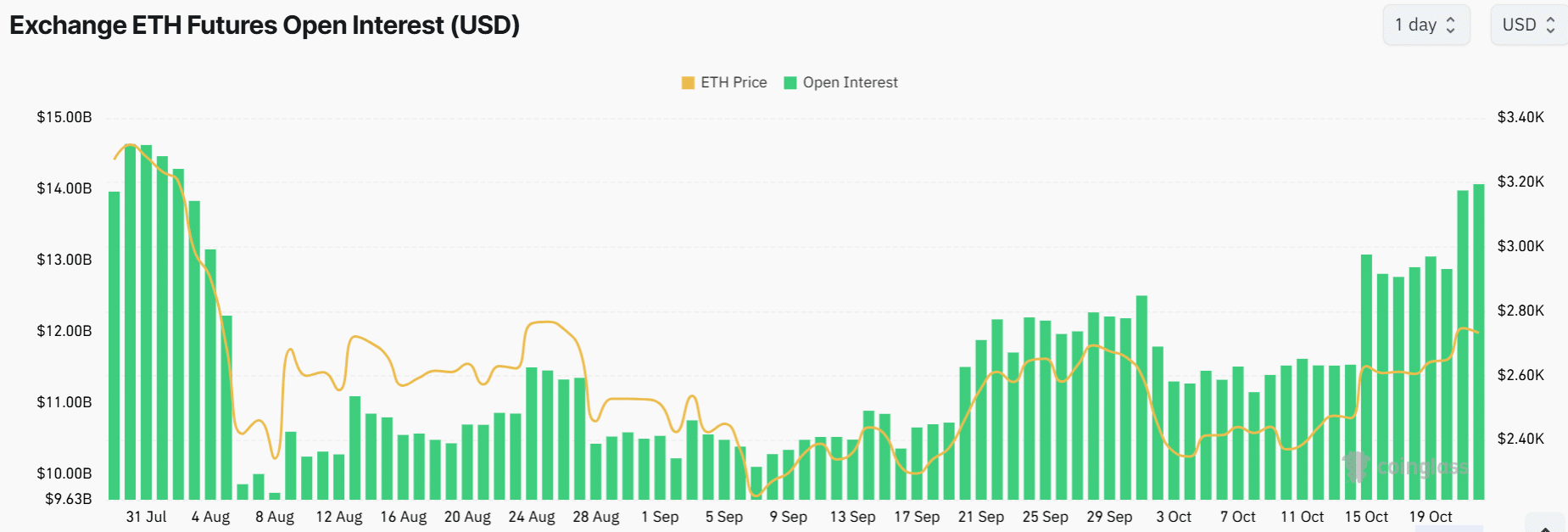

- The open interest at $14 billion shows increased market participation by derivative traders.

As a seasoned crypto investor who’s been through the bull runs and bear markets of this wild ride, I’ve learned to always keep my eyes on the charts and my fingers on the pulse of the market. And right now, Ethereum is looking pretty darn good!

At the moment of reporting, Ethereum (ETH) reached an 8-week peak of $2,735 following a nearly 4% surge over the past 24 hours. This significant rise has led to a more than 100% increase in trading volumes as per CoinMarketCap, indicating growing market enthusiasm.

As a researcher, I’ve observed an interesting trend in the crypto market: Ethereum (ETH) has experienced the most significant number of short liquidations compared to other cryptocurrencies. At the moment of writing, over $23 million worth of ETH short positions have been closed out, according to Coinglass.

Frequent quick closures of short positions, often referred to as liquidations, can be seen as a positive or bullish signal because it means that those who had bet against the market are now buying to close their positions. Examining Ethereum’s one-day chart hints at this optimistic trend potentially persisting.

Ethereum shows bullish signs

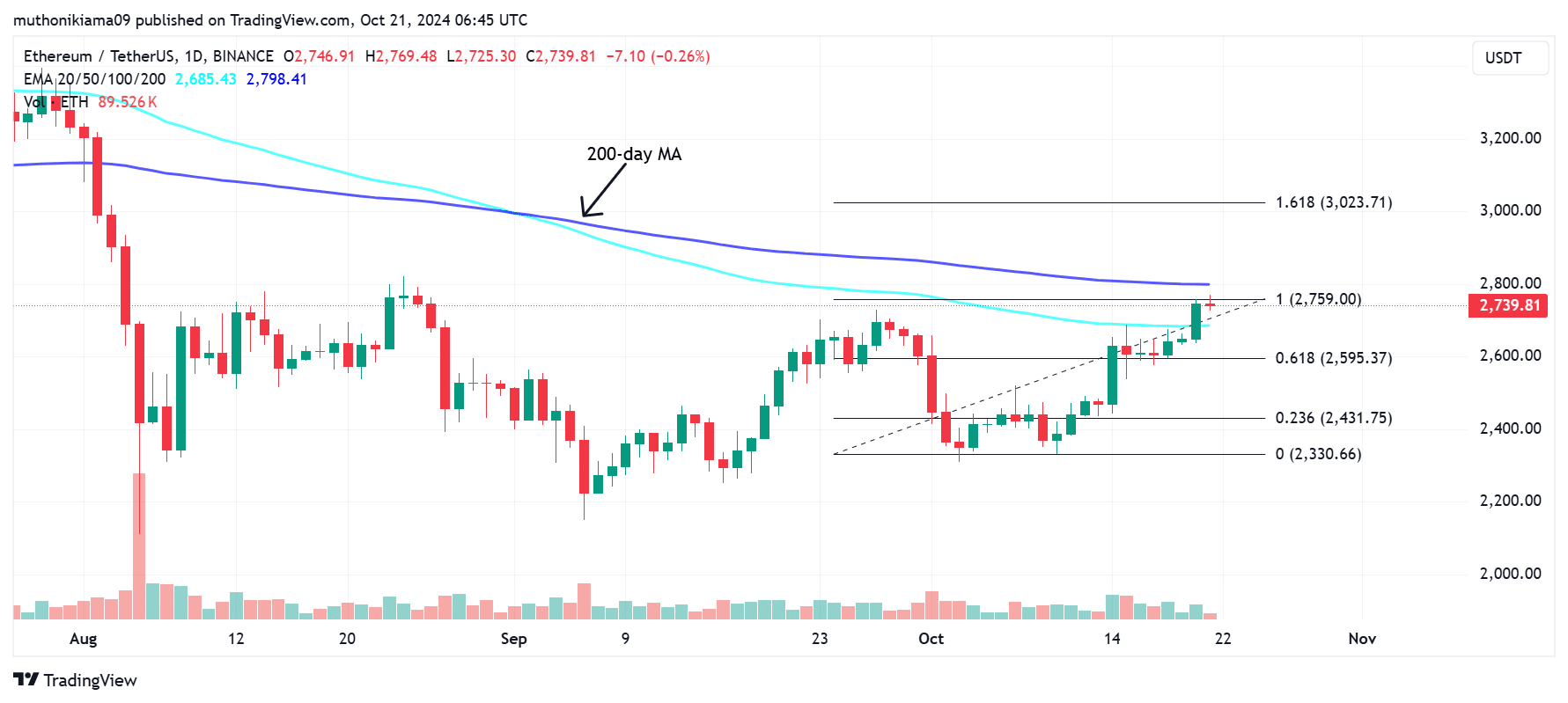

ETH recently surpassed its 100-day Exponential Moving Average (EMA) at around $2,685, indicating a strengthening upward trend. However, this uptrend encountered some obstacles as ETH neared its 200-day EMA.

For traders, the 200-day Exponential Moving Average (EMA), currently hovering around $2,800, acts as a significant psychological barrier. If Ethereum (ETH) manages to surpass this resistance and make a strong move upwards, it would indicate the beginning of a long-term bullish trend. This trend could potentially drive ETH’s price towards the 1.618 Fibonacci extension level, which is located above $3,000.

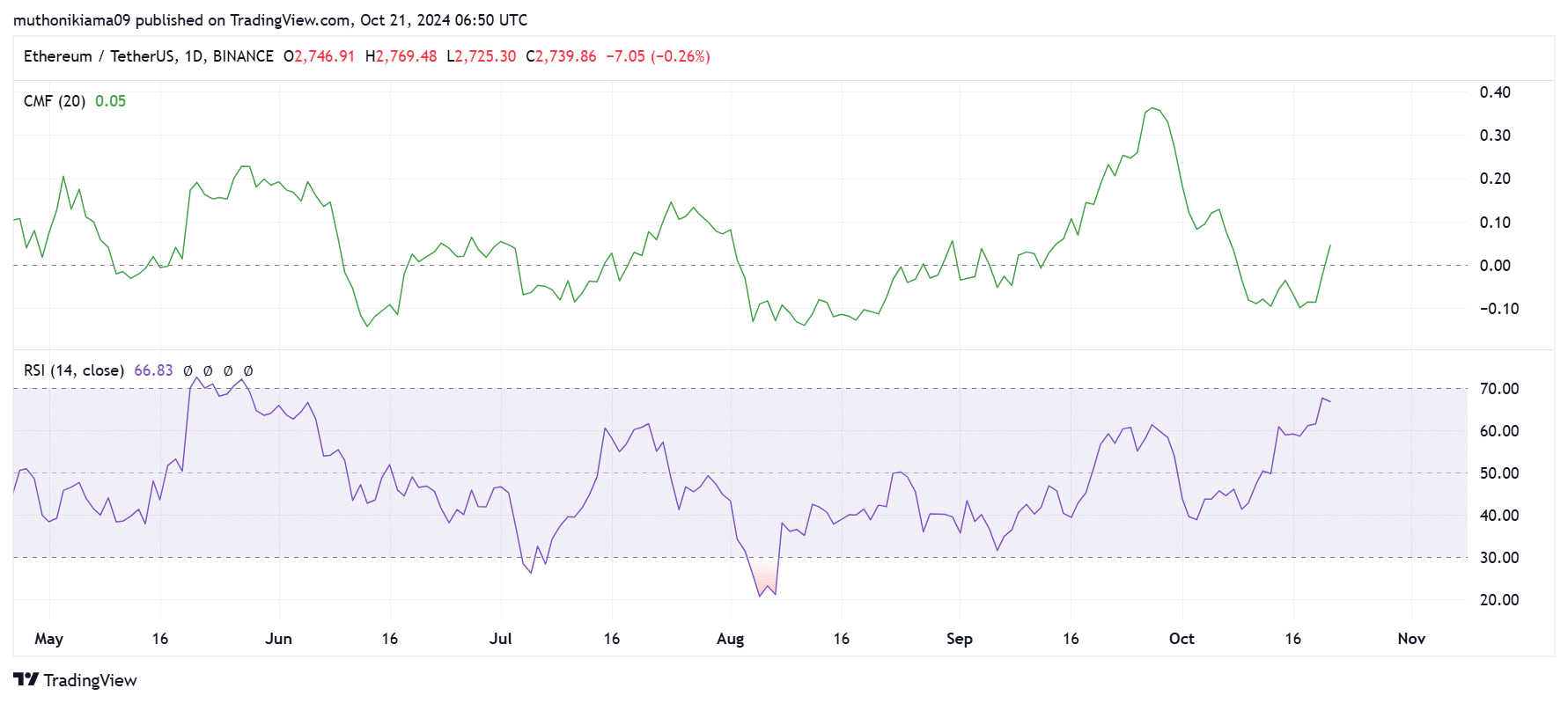

Based on technical analysis, it appears that a rise above the 200-day Exponential Moving Average (EMA) could be imminent for Ethereum (ETH). Additionally, the Chaikin Money Flow (CMF), which measures the flow of money into and out of an asset, has recently turned positive for the first time in about two weeks, indicating that there’s been a net influx of capital into ETH.

Furthermore, the Relative Strength Index (RSI) has been hitting successive peak values and recently attained its highest point since June, suggesting intense buying activity.

Even with a surge of buyers, Ethereum’s Relative Strength Index (RSI) at 66 suggests it isn’t excessively bought up yet, implying potential for further increases.

Open interest and leverage ratio spike

The current level of open interest in Ethereum is at its peak since August, according to Coinglass data. At the moment of reporting, this figure was at $14 billion, suggesting a significant influx of both investors and funds into Ethereum.

A rise in open interests often indicates a bullish trend as traders tend to buy rather than sell, but it can also lead to market volatility due to the increased trading activity.

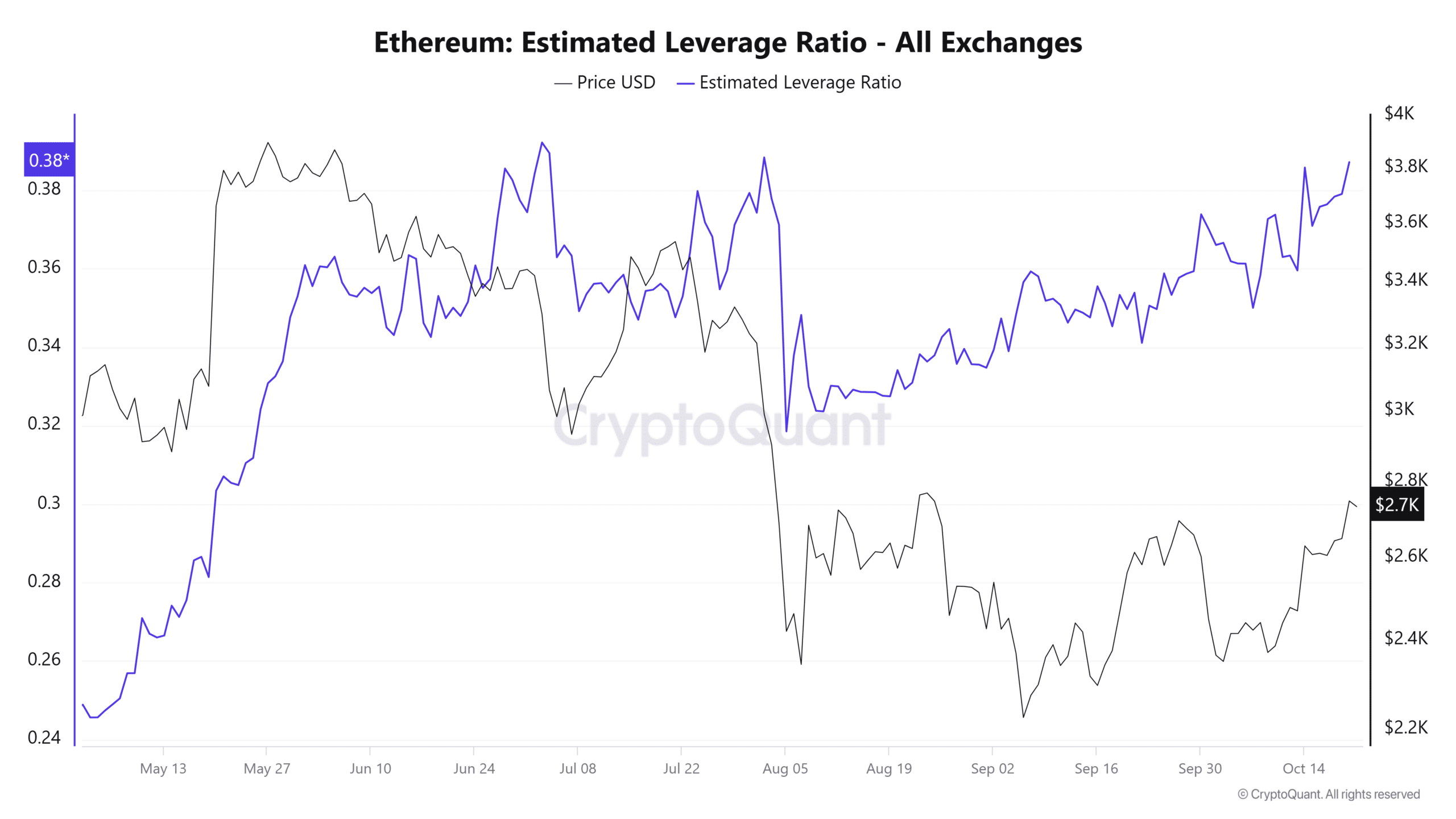

As Ethereum’s projected leverage nears a three-month peak, it indicates a surge in borrowed funds. Should ETH experience abrupt price changes, this influx might lead to numerous compulsory sell-offs, thereby increasing market volatility.

Ethereum wallets in profits

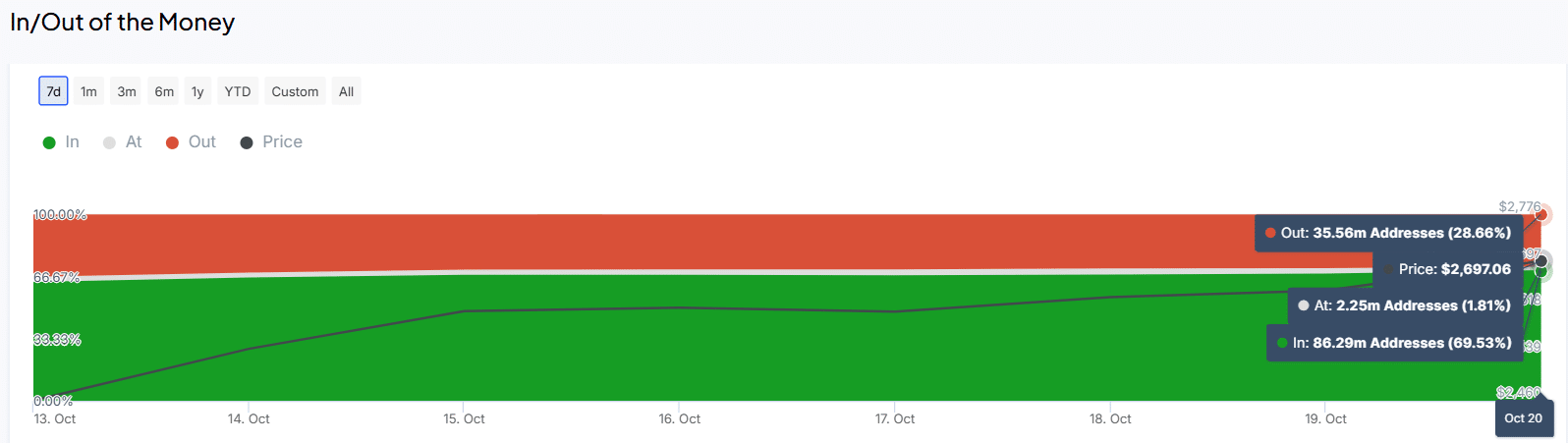

Recently, Ethereum’s price rise has led to a surge in the number of wallets that are currently profitable. Currently, about 69% of all Ethereum addresses are showing profits, marking a 6% jump over the past week.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Meanwhile, at the current moment, there were approximately 35 million cryptocurrency wallets experiencing losses, marking a significant decrease from the 42 million wallets in loss only a week prior.

As more Ethereum wallets become profitable, it could result in positive sentiment around ETH.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- AUCTION PREDICTION. AUCTION cryptocurrency

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- `Tokyo Revengers Season 4 Release Date Speculation`

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- Stephen A. Smith Responds to Backlash Over Serena Williams Comments

- XRP CAD PREDICTION. XRP cryptocurrency

- AEW Fans Are Loving Toni Storm’s Uncanny Mariah May Cosplay From Dynamite

- Is Disney Faking Snow White Success with Orchestrated Reviews?

2024-10-21 17:44