- Bitcoin surged to a three-month high as “Trump trades” gained momentum ahead of the U.S. election.

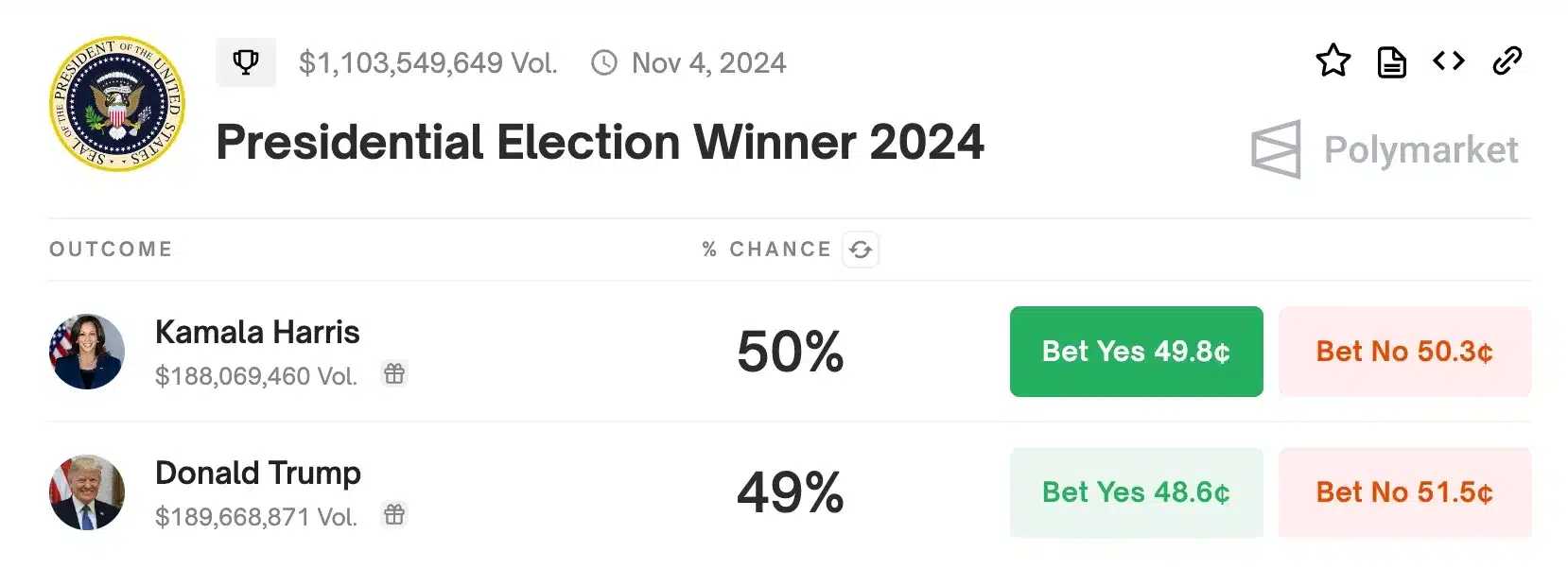

- Donald Trump leads in Polymarket data, viewed as favorable for the cryptocurrency market.

As a seasoned analyst with over two decades of experience navigating global financial markets, I find myself increasingly fascinated by the dance between politics and cryptocurrencies. The recent surge in Bitcoin’s price, pushing it to a three-month high, is a testament to this intricate relationship.

Despite the unpredictable ups and downs in Asian stock exchanges, where stocks consistently gained and lost value, the terrain of cryptocurrencies demonstrated remarkable strength.

Bitcoin (BTC) climbed up to a three-month peak, mirroring an increase in trading hustle and bustle as the ‘Trump trades’ began to pick up steam.

On October 21st, Bitcoin’s early trades reached a high point of $68,496.98, which represented an approximately 6% rise over the previous seven days and a nearly 8% gain during the past month.

This event occurred as investors were preparing for the upcoming U.S. presidential election, which was only two weeks off.

Trump’s rising odds and its impact on the crypto market

According to Polymarket data, Donald Trump is currently ahead with approximately 61.1% of the predicted votes, whereas Kamala Harris lags behind with about 38.8%.

This week, as there were no significant economic occurrences, investors primarily concentrated on company earnings reports and political campaign developments.

It appears that as Trump’s chances increase, so does Bitcoin’s value, due to the perception that his administration will take a more relaxed approach towards cryptocurrency regulations.

His policies regarding tariffs, taxes, and immigration are considered likely to increase prices (inflation), which could strengthen the U.S. dollar and positively impact the cryptocurrency market.

Execs weigh in

Speaking along similar lines, Chris Weston, who leads research at Australian broker Pepperstone, pointed out that investors could potentially face increasing costs as they work to safeguard their portfolios from fluctuations in the U.S. dollar and other related investment risks.

Weston said,

As the United States election draws nearer, happening only 15 days from now, investors must determine whether this is an opportune moment to confidently execute election-related trades.

Joining the discussion, Brad Bechtel, the worldwide head of Foreign Exchange (FX) at Jefferies, noted that a rise in genuine interest rates is bolstering the U.S. dollar, notably versus three significant currencies.

It’s likely that this pattern will persist right up until the election, and should Trump secure victory, it might carry on beyond the election too.

Is Trump likely to win?

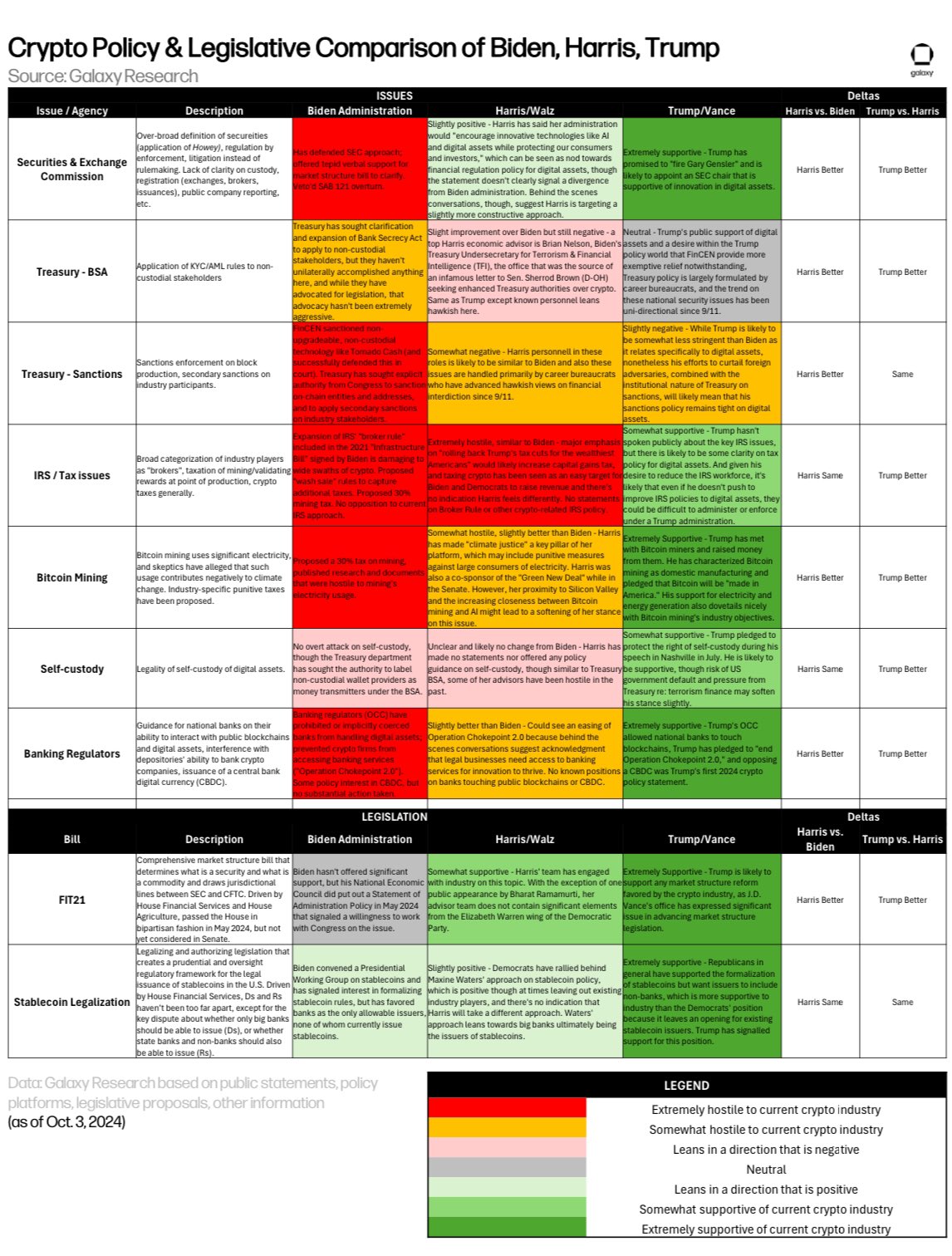

Indeed, in his latest article about X, Alex Thorn, who holds the position of Head of Firmwide Research at Galaxy Digital, presented an evaluation system for gauging the cryptocurrency views of presidential hopefuls Kamala Harris and Donald Trump.

He said,

The negative impact from a Harris win is likely minimal, while a Trump win could lead to significant positive outcomes.

Upon thorough analysis of the scorecard, I found that in seven out of the nine key areas evaluated, my performance surpassed that of Kamala Harris.

Given that the U.S. presidential election is just a few days away, it’s going to be fascinating to see the reactions of the cryptocurrency market throughout and following the event.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- AUCTION PREDICTION. AUCTION cryptocurrency

- `Tokyo Revengers Season 4 Release Date Speculation`

- ETH PREDICTION. ETH cryptocurrency

- How to Install & Use All New Mods in Schedule 1

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Solo Leveling Arise Amamiya Mirei Guide

- Avengers: Doomsday and Secret Wars Directors Break Silence on Concept Art Leaks (and It Changes Everything)

2024-10-21 18:16