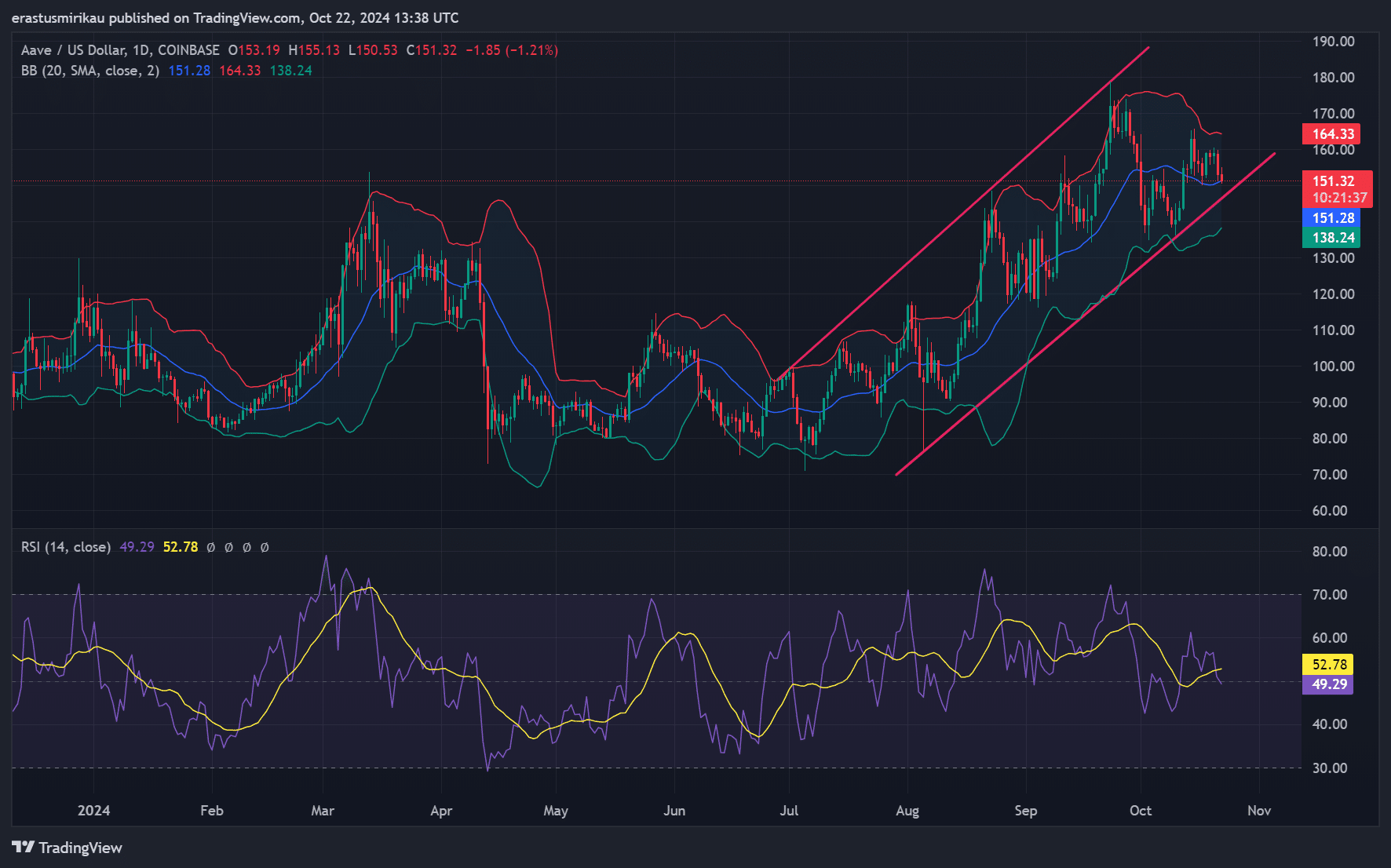

- AAVE price action shows potential, but remains constrained within its ascending channel, with neutral RSI levels.

- Rising exchange reserves and seller dominance could dampen bullish momentum despite the GHO token launch.

As a seasoned analyst with over two decades of experience in financial markets, I have witnessed many bull and bear cycles, and I can say that the Aave [AAVE] situation presents an intriguing challenge. The launch of GHO token has undoubtedly sparked interest across the DeFi space, but the question remains whether it will be enough to trigger a price rally.

The introduction of Aave’s [AAVE] GHO token has garnered significant interest within the world of decentralized finance, with the token successfully securing an investment of $31.2 million and establishing itself as the second most valuable asset in Chainlink’s CCIP.

Will the development of GHO promoting effortless liquidity transfers across different blockchains potentially ignite a surge in Aave’s [AAVE] value, or is there a requirement for additional market impetus to maintain a bullish trend?

AAVE price action: Can the rally continue?

At this moment, AAVE is being traded for approximately $151.13, representing a decrease of 1.55%. Its value rests near the center of its Bollinger Bands, suggesting a period of stability or holding pattern.

In simpler terms, the Relative Strength Index (RSI) reading of 49.29 is neither indicating an overbought nor an oversold situation. While AAVE looks promising for a breakout, it might first experience a pullback or retracement before starting a substantial upward trend.

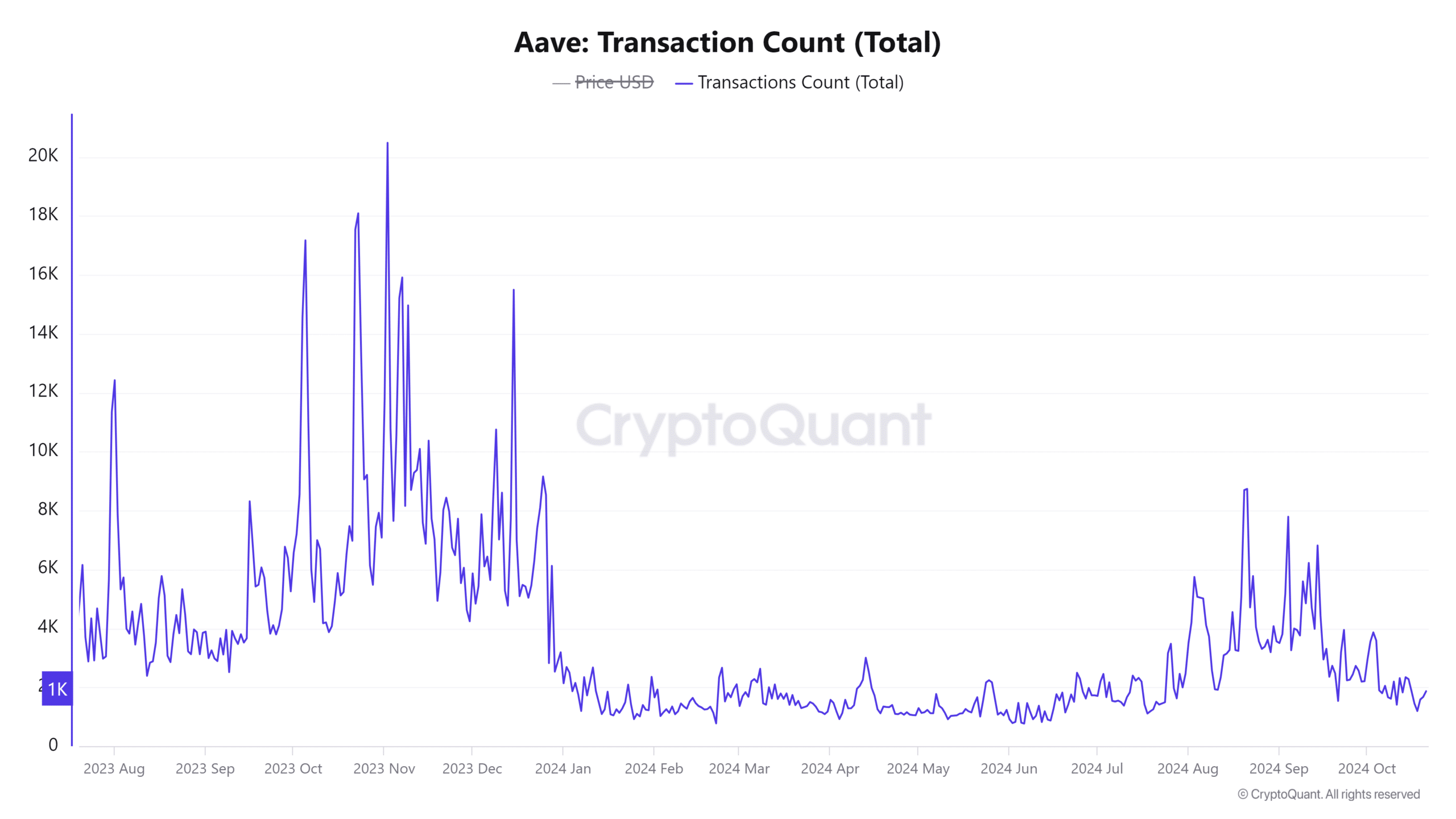

Transaction count hints at growing activity

It’s noteworthy that in the last 24 hours, the number of transactions on AAVE has increased slightly by about 0.84%, reaching approximately 1,662. This growth suggests that while there’s been a small dip in price, activity on the network remains consistent.

Should this trend persist, especially with an increasing number of users utilizing the GHO token, it might serve as a powerful driver for its price increase (bullish catalyst). Maintaining a positive outlook could therefore depend on continuous expansion in transaction volume.

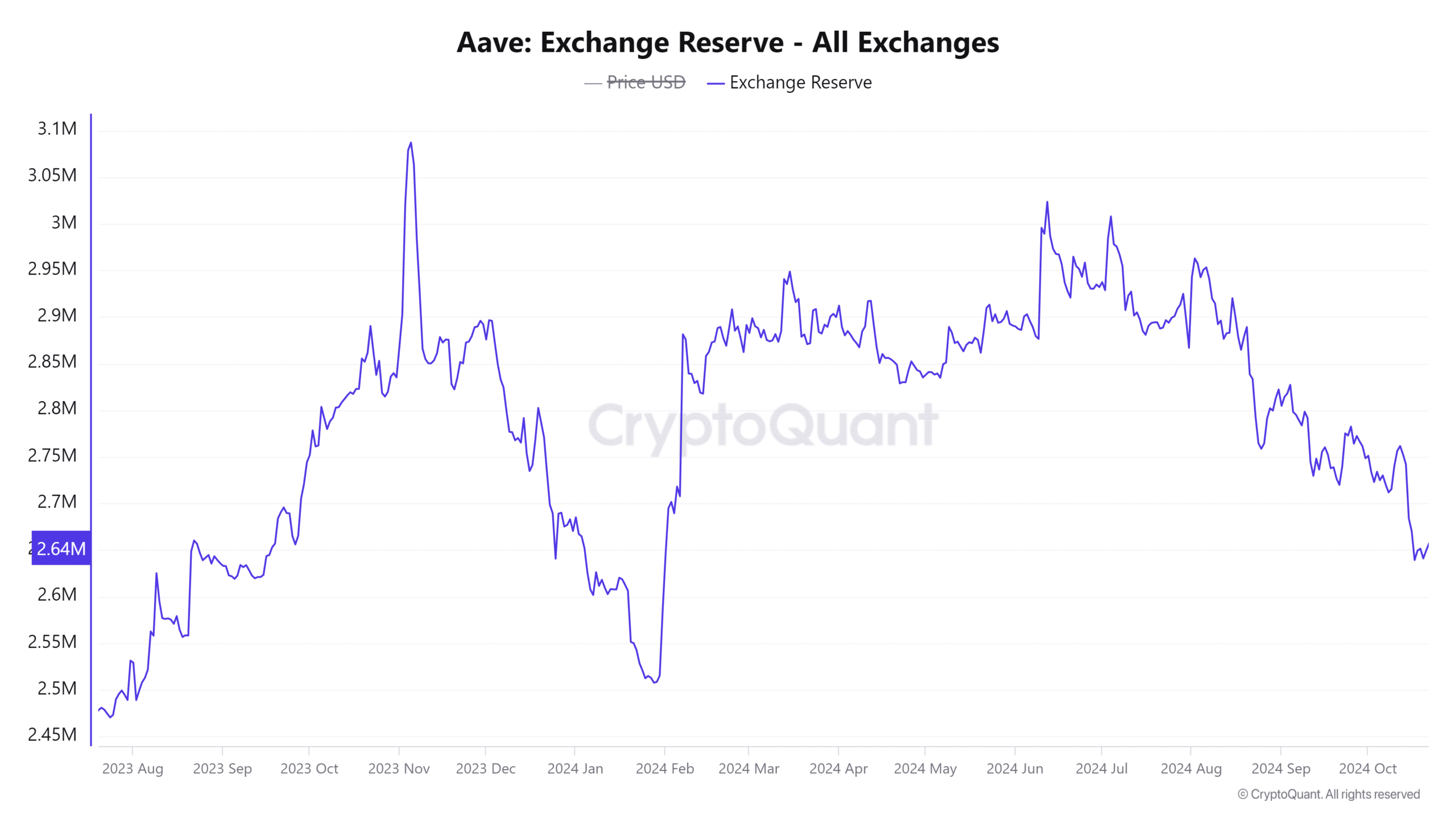

Exchange reserves: Higher selling pressure looming?

Furthermore, the reserves of AAVE’s exchange have grown by 0.55% to reach 2,657,800 tokens. A larger reserve often indicates a rise in selling pressure because more tokens are stored on exchanges, presumably to be sold later during liquidation.

Consequently, this pattern might hinder any forthcoming price surge. Should stocks keep accumulating, there’s a possibility that heightened selling pressure could suppress any quick upward trend.

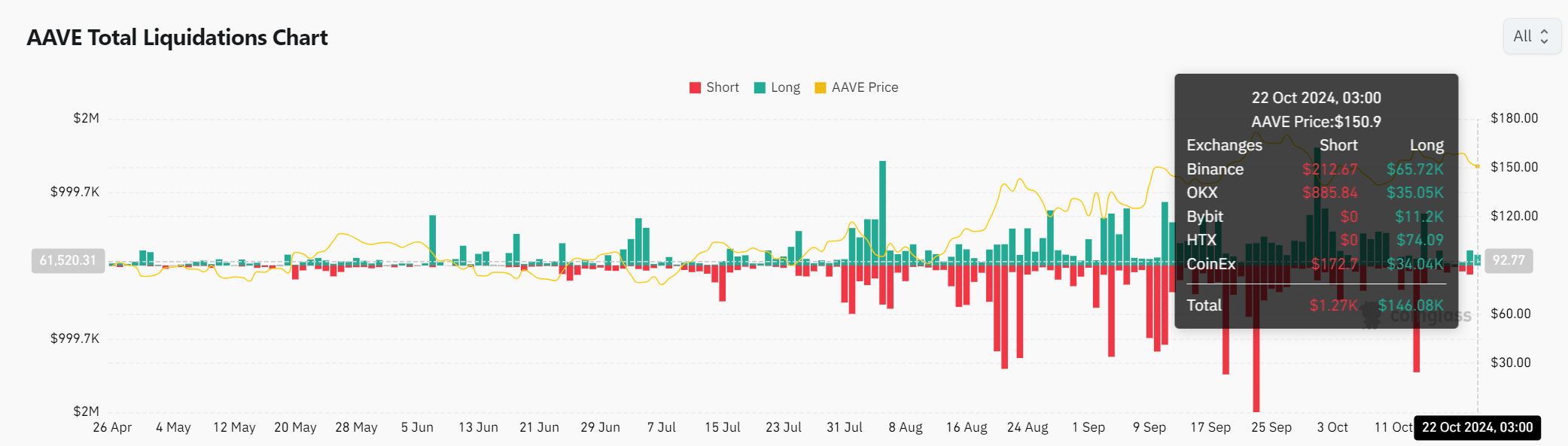

Liquidation data: Bears taking the lead?

Examining the data on liquidations, it’s clear that sellers are dominating the market right now, as they’ve liquidated positions worth about $1.27 million, while buyers have only liquidated positions totaling approximately $146,080. This significant discrepancy indicates a stronger influence by sellers in the current market dynamics.

If purchasers start to narrow the difference, especially on major platforms such as Binance, this might tip the scales towards an upward trend in pricing.

Read Aave’s [AAVE] Price Prediction 2024–2025

The debut of Aave’s GHO offers a potential boost for optimistic trends, yet there are some elements such as increasing exchange reserves and temporary selling pressure that might temporarily halt an immediate surge.

Consequently, although African American Vernacular English (AAVE) holds promise, a significant improvement in market conditions is necessary for a consistent surge to take place.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-10-23 10:15