- Bernstein analysts envision Bitcoin peaking at $200,000 by 2025.

- Amid inflation concerns, BTC emerges as a safe-haven asset.

As a seasoned crypto investor with a decade-long journey under my belt, I find myself intrigued by this latest bullish forecast for Bitcoin by Bernstein analysts. With my first investment in BTC back when it was worth mere pennies, I can’t help but feel a sense of nostalgia as the market continues to evolve and mature.

Following the ‘Uptober’ surge that swept through the market, Bitcoin’s [BTC] price has seen a minor downturn. Despite this, analysts from Bernstein Research maintain a positive outlook and have issued a favorable prediction for the digital currency.

Matthew Sigel, the Chief of Digital Assets Research at VanEck, recently discussed essential findings from a report called “From Coin to Compute: A Bitcoin Investment Guide” by Bernstein, which he presented on platform X.

The report projects Bitcoin to reach an ambitious target of $200,000 by next year.

Experts Gautam Chhugani, Mahika Sapra, and Sanskar Chindalia outlined essential elements influencing their projected Bitcoin price, explaining:

According to our perspective, the emergence of this new institutional era might drive the price of Bitcoin up to an impressive level of around $200,000 by the year 2025.

It’s important to mention that King Coin has seen a significant increase of approximately 110% within the last year, as reported by CoinMarketCap.

Currently, its market value was approximately $1.3 trillion when I was typing this, representing more than half of the entire cryptocurrency market’s worth, which totals at around $2.32 trillion.

Institutional adoption fuels Bitcoin’s growth

Bernstein’s comprehensive “Black Book,” spanning over 160 pages, underscores the crucial part that institutional investors are playing in driving Bitcoin’s current expansion and future development.

As per the latest findings, ten major financial institutions globally now control more than $60 billion worth of Bitcoin via regulated Exchange-Traded Funds (ETFs). This significant increase represents a leap from the initial $12 billion held back in September 2022.

Additionally, Bitcoin Exchange-Traded Funds (ETFs) have experienced one of the most thriving launches in ETF market history, accumulating approximately $21 billion in investments so far this year.

According to a recent report by AMBCrypto, the leading Bitcoin Exchange-Traded Fund (ETF), known as IBIT, has outperformed Vanguard’s VTI and now ranks third in terms of year-to-date inflows.

In light of this substantial institutional interest, Bernstein’s report highlighted:

“By the end of 2024, we expect Wall Street to replace Satoshi as the top Bitcoin wallet.”

Additionally, Eric Balchunas, a seasoned ETF analyst at Bloomberg, echoed similar views. Notably, it’s speculated that Satoshi Nakamoto, the inventor of Bitcoin, may possess approximately 1.1 million Bitcoins.

With massive accumulation, institutional Bitcoin ETFs are quickly catching up to this number.

The evolving Bitcoin mining industry

The report also emphasizes the anticipated recovery of the mining industry in the limelight, which is due to take place after the halving event scheduled for April 2024.

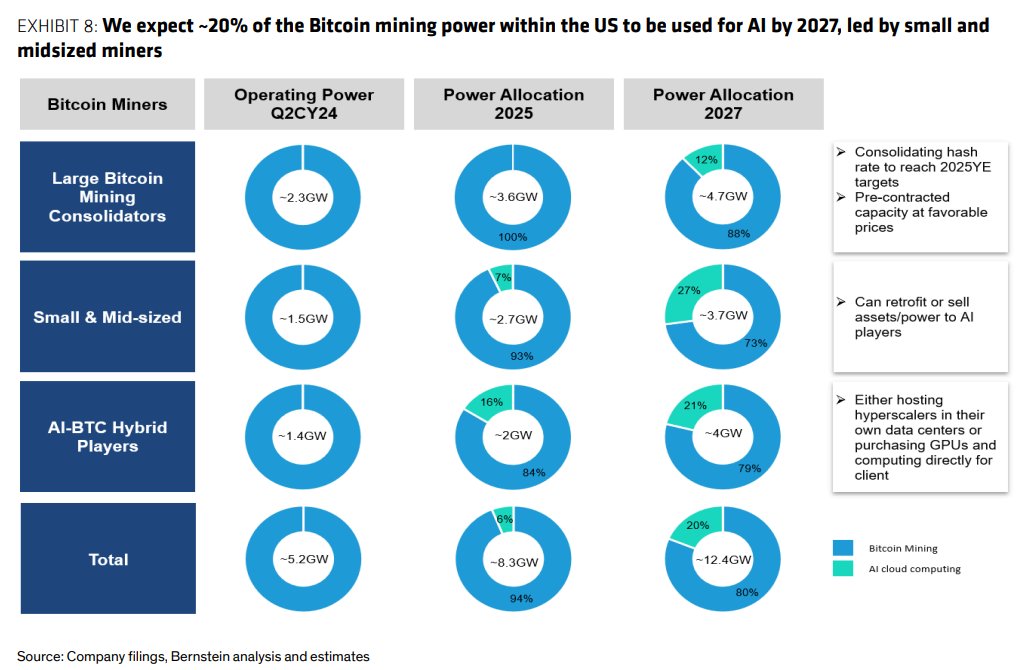

It noted that leading U.S. miners are consolidating their market share and emerging as key energy infrastructure players for AI data centers.

According to Bernstein’s prediction, it is expected that over one fifth (20%) of the United States’ total Bitcoin mining capacity may be allocated towards Artificial Intelligence by the year 2027. Smaller miners are projected to be the primary force behind this transition.

Additionally, it’s forecasted that the Bitcoin mining hardware sector will generate more than $20 billion within the upcoming five-year period.

A ‘conservative’ price estimate?

Simultaneously, Chhugani, a key analyst on the report, considered the prediction of $200,000 for Bitcoin as a more modest forecast, attributing it to increasing levels of U.S. national debt.

As the national debt exceeds $35 trillion, Bitcoin’s fixed supply is becoming more appealing for long-term value storage.

In the past, noteworthy investors such as Paul Tudor Jones have endorsed Bitcoin as a means to guard against inflation.

Amid the backdrop of these factors, Bitcoin reaching $200,000 by 2025 seems increasingly plausible.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- AUCTION PREDICTION. AUCTION cryptocurrency

- How to Install & Use All New Mods in Schedule 1

- ETH PREDICTION. ETH cryptocurrency

- `Tokyo Revengers Season 4 Release Date Speculation`

- Kayla Nicole Raves About Travis Kelce: What She Thinks of the Chiefs Star!

- Why Aesha Scott Didn’t Return for Below Deck Down Under Season 3

- `Kylie Kelce Spills the Tea on Travis Kelce and Taylor Swift’s Relationship`

- Jimmy Carr Reveals Hilarious Truth About Comedians’ Secret Competition on Last One Laughing!

2024-10-24 15:36