- Japanese firm Metaplanet added $10.4 million in Bitcoin, bringing its holdings to over 1,000 BTC.

- Market indicators, including rising open interest and MVRV ratio, signal potential for Bitcoin’s continued bullish momentum.

As an analyst with over two decades of experience in the financial markets, I find myself increasingly intrigued by the dynamics unfolding within the cryptocurrency space, and Bitcoin [BTC] in particular. The recent moves made by Japanese investment firm Metaplanet Inc serve as a powerful testament to the growing acceptance of digital assets among corporations.

After a fall in Bitcoin’s [BTC] value over the weekend, there are indications that it might be regaining strength, as its price surpassed $68,000 again as the fresh week commenced.

On this past Monday morning, I observed that Bitcoin was being exchanged for roughly $67,953, signifying a 1.3% rise over the preceding 24-hour period. In the wee hours of today, its value peaked at an impressive $68,210.

Metaplanet adds to its Bitcoin holdings

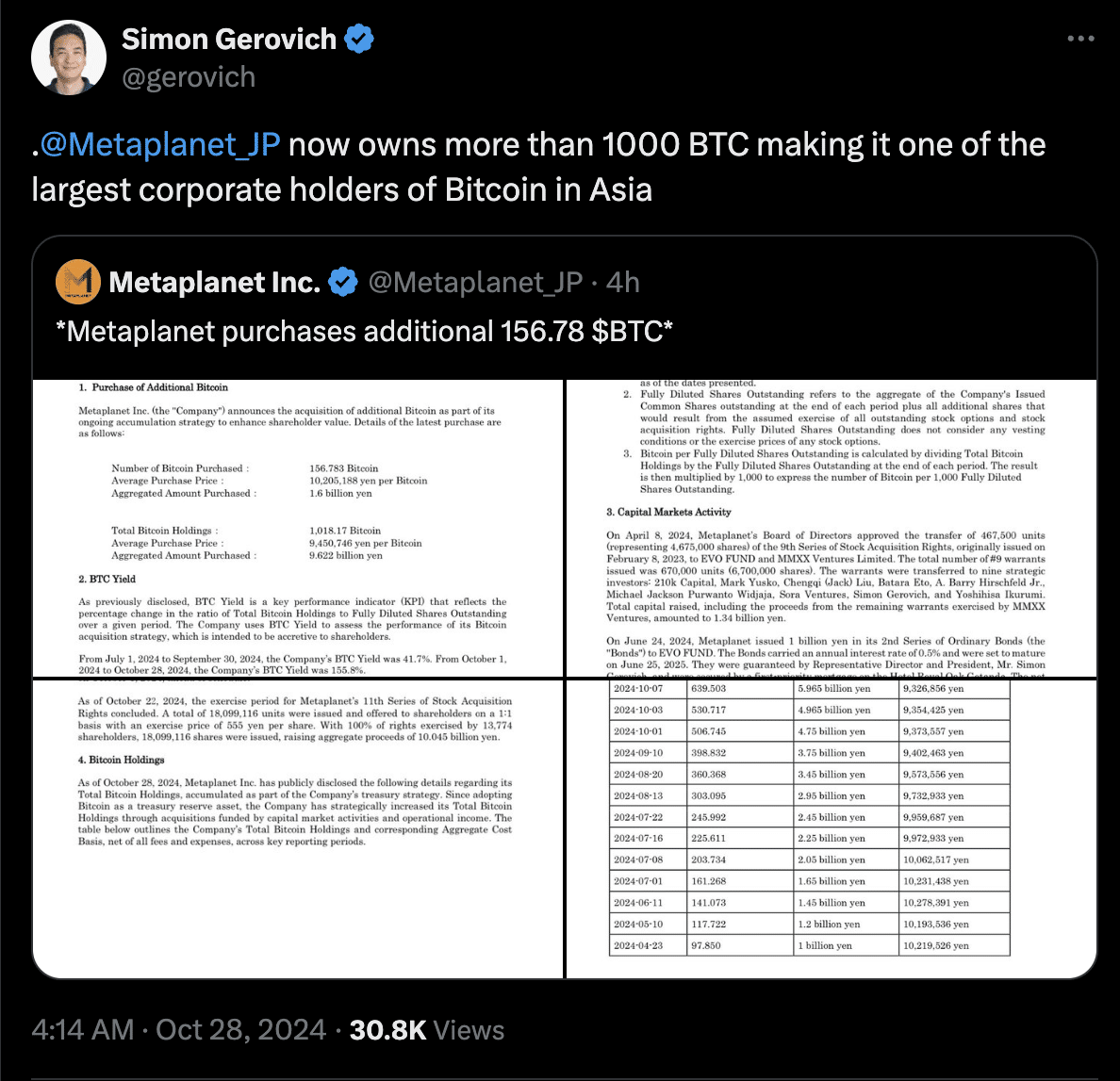

This Bitcoin acquisition by the Japanese firm Metaplanet Inc aligns with a notable event: They have just purchased an additional $10.4 million worth of Bitcoin, expanding their existing holdings.

This recent acquisition brings the firm’s Bitcoin reserves to over 1,000 BTC, positioning Metaplanet among the top corporate Bitcoin holders in Asia.

As an analyst, I’ve observed that Metaplanet’s recent reinforced dedication towards Bitcoin (BTC) aligns with a wider corporate strategy. This strategy involves the adoption of cryptocurrencies as strategic treasury assets, underscoring a growing trend among corporations to embrace digital currencies in their financial portfolios.

As a crypto investor, I’ve been closely watching Metaplanet since their announcement in May. Excited by their strategy, I’ve seen them consistently add to their Bitcoin reserves. From holding 141.07 BTC at the end of June, they’ve now built up an impressive stash of 1,018.17 BTC as we speak.

The strength of this pledge is reinforced by the company’s capital market endeavors, such as the recent issuance of $66 million via its eleventh share purchase program.

CEO Simon Gerovich stated that Metaplanet’s strategy of keeping Bitcoin as a main reserve is consistent with their long-term perspective on digital currencies. It’s important to note, though, that owning shares doesn’t grant shareholders any direct ownership over the Bitcoin held in reserve.

BTC’s growing market indicators signal possible price stability

Besides the encouraging signs from corporate investments, Bitcoin’s technical signals suggest a growing curiosity among investors.

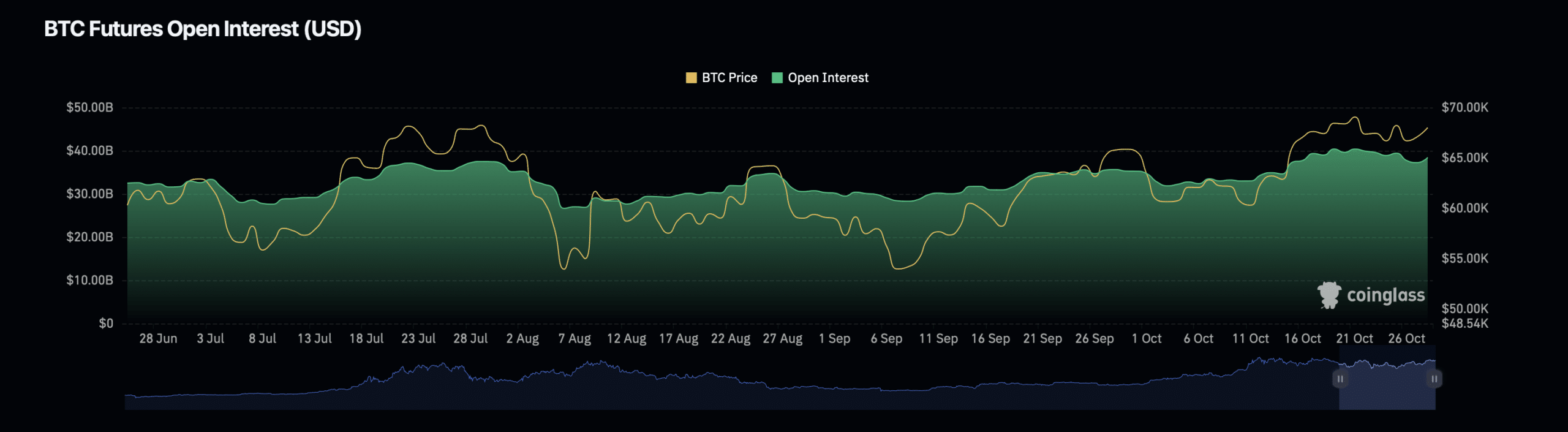

According to information from Coinglass, Bitcoin’s total open interest has risen by approximately 4.26% to reach an impressive $38.89 billion. Moreover, the volume of open interest has experienced a significant jump of around 61.13%, currently standing at about $33.77 billion.

The term “open interest” signifies the overall count of unsettled derivative agreements, like futures and options, that are still active.

A rise in the number of open positions (open interest) might suggest increased market action, implying that investors expect more Bitcoin price fluctuations. When open interest and Bitcoin’s price both go up, it could mean a growing optimism among investors.

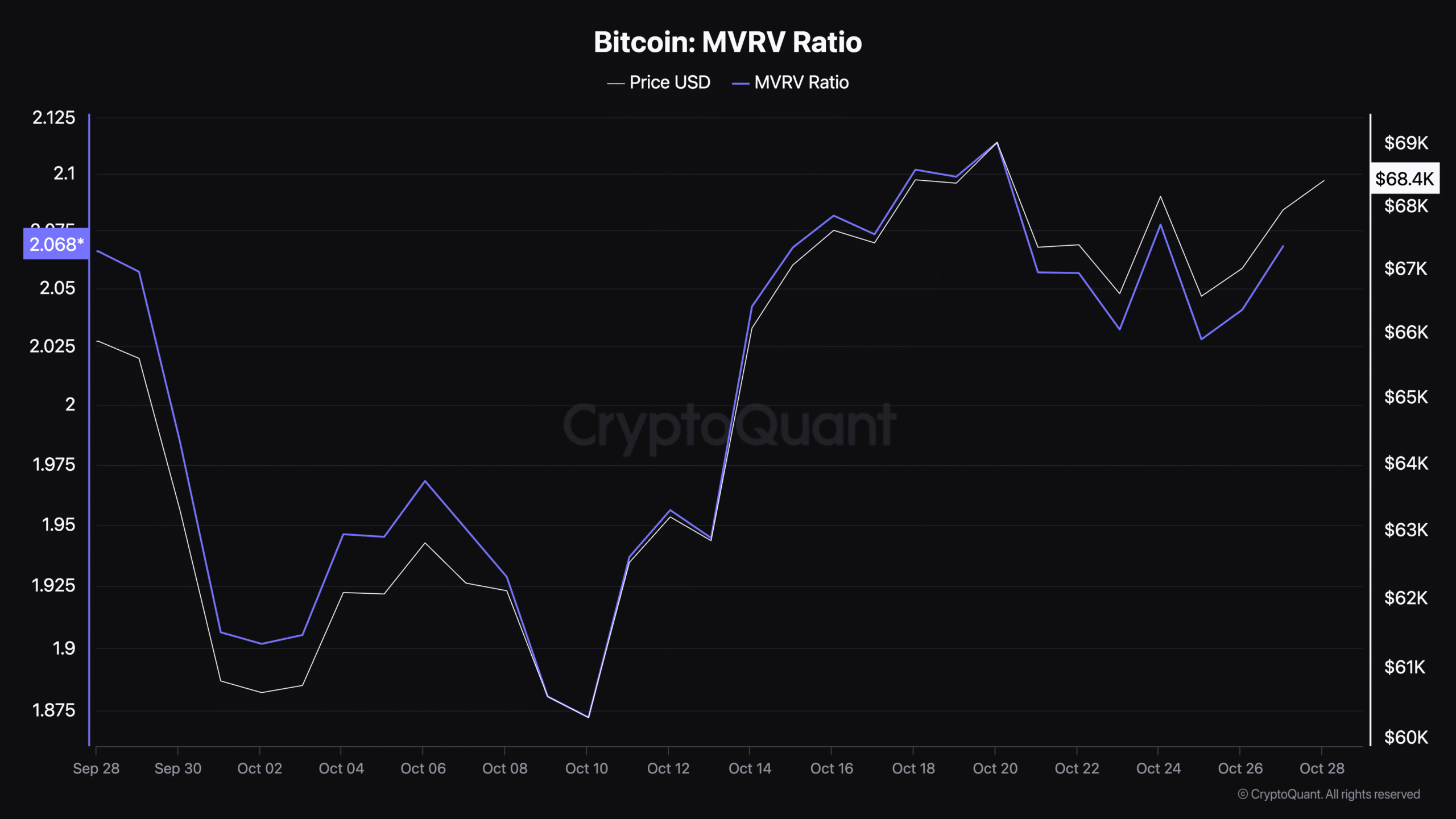

Additionally, the Market Value to Realized Value (MVRV) ratio of Bitcoin has spiked to 2.06 according to CryptoQuant. This measurement examines Bitcoin’s current market value in relation to its average realized value, giving an idea of whether it is currently overvalued or undervalued based on its past performance.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

A Multi-Variable Risk Value (MVRV) ratio greater than 1 often indicates that Bitcoin’s current value surpasses its original purchasing price, potentially hinting at increased chances of investors cashing out to secure profits.

In contrast, an uptick in the MVRV ratio – particularly when prices remain steady or climb higher – often signals optimism within the market, indicating that investors prefer to keep their profits instead of offloading them.

Read More

- AUCTION PREDICTION. AUCTION cryptocurrency

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- Stephen A. Smith Responds to Backlash Over Serena Williams Comments

- JK Simmons Opens Up About Recording Omni-Man for Mortal Kombat 1

- POL PREDICTION. POL cryptocurrency

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- Daredevil: Born Again Spoiler – Is Foggy Nelson Alive? Fan Theory Explodes!

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- AEW Fans Are Loving Toni Storm’s Uncanny Mariah May Cosplay From Dynamite

- Is Disney Faking Snow White Success with Orchestrated Reviews?

2024-10-28 15:04