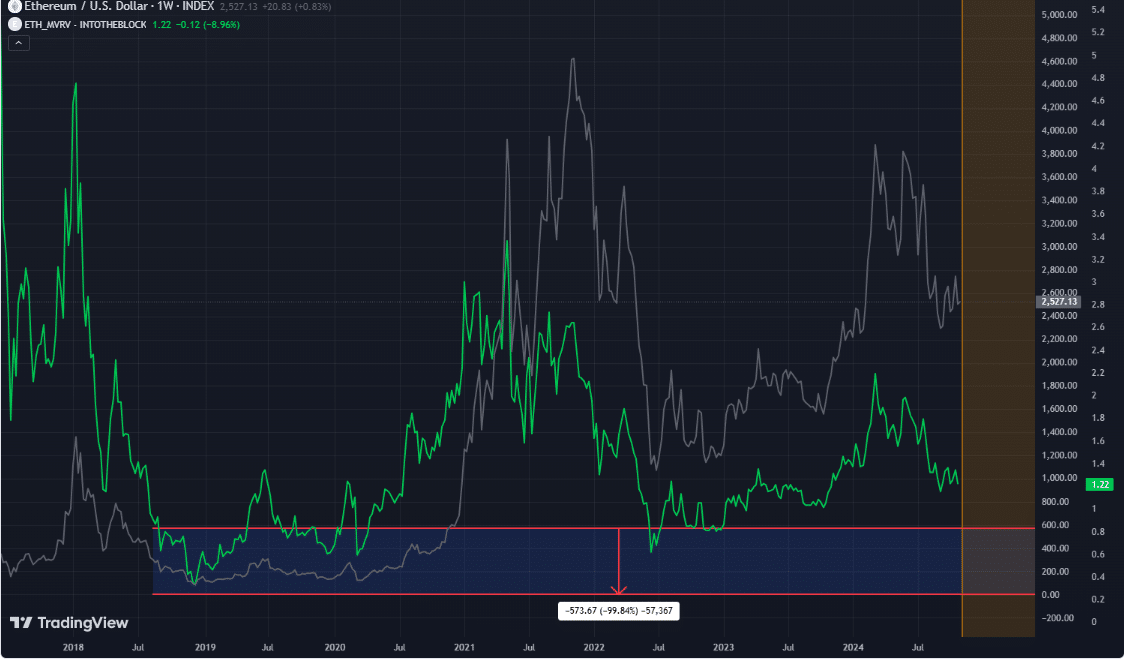

- Ethereum’s MVRV ratio at 1.2, hinting at a subtle overvaluation.

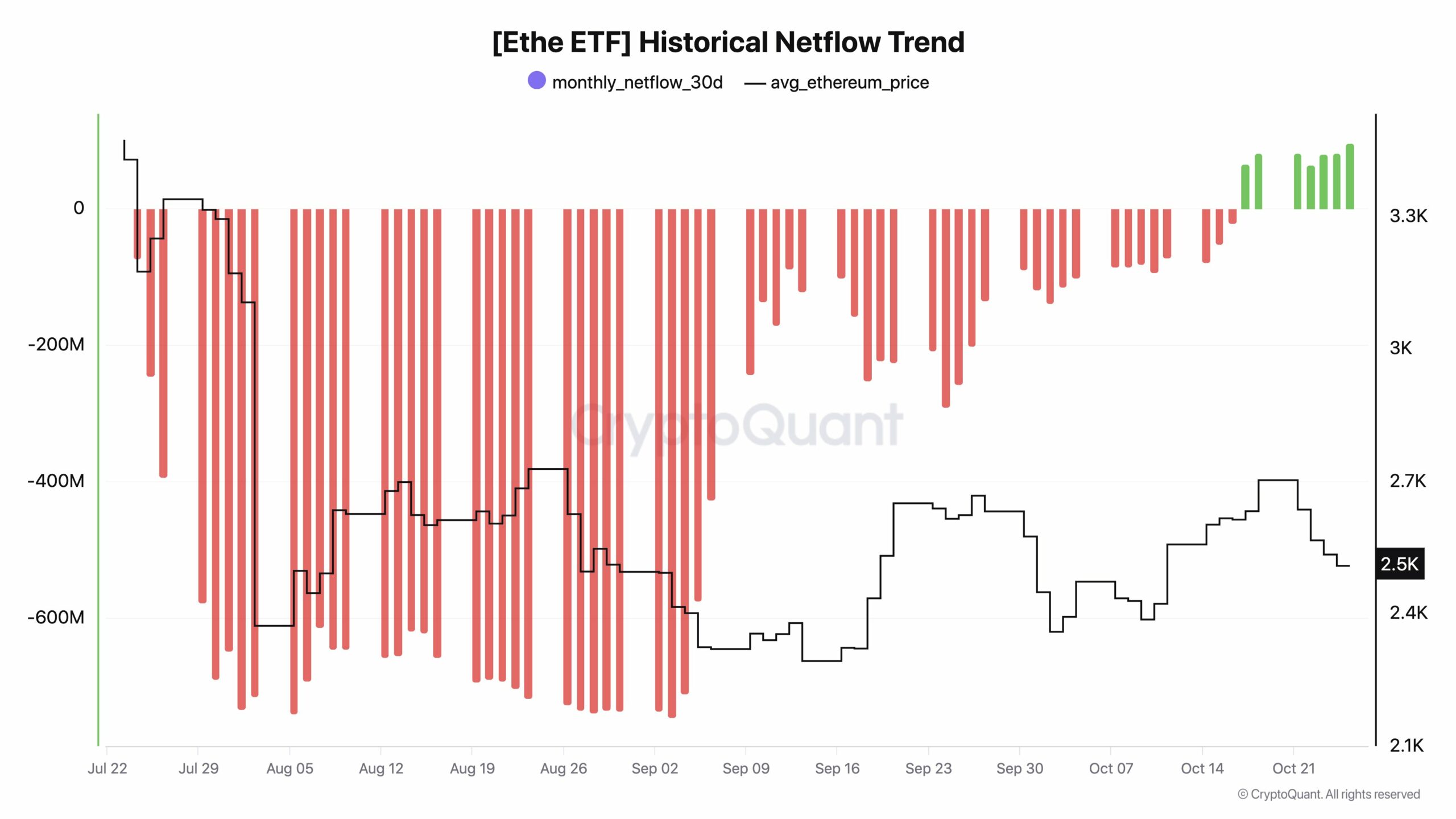

- Ethereum saw positive monthly net flows for the first time since July.

As a seasoned researcher who has navigated multiple market cycles, I find the current state of Ethereum [ETH] intriguing and potentially profitable. The MVRV ratio at 1.2 suggests a subtle overvaluation, but historically, Ethereum has shown support near MVRV levels around 1, marking significant accumulation phases for value-conscious investors like myself.

Currently, the market worth of Ethereum (ETH) surpasses its inherent value, as indicated by its MVRV ratio standing at 1.2, suggesting a slight overpricing trend.

Historically, the price of Ethereum has tended to find support close to Multi-Version Realized Value (MVRV) ratios of approximately 1. This pattern often indicates an accumulation period where investors are looking to purchase at relatively lower prices.

The MVRV (Majority Below Realized Value) indicator on Ethereum frequently signals potential purchase points, especially when the value drops below 1, suggesting a period of widespread selling by investors and increased chances for profitable buying.

Should the cost of Ethereum (ETH) decrease even more, it might provide a favorable situation for traders who prioritize value, as this could offer opportunities for them to purchase ETH at potentially undervalued prices.

As an analyst, I noticed a shift in liquidity patterns regarding Ethereum last October, marking the first positive monthly net flows since July. Contrary to past trends, the influx of capital into Bitcoin reached new heights, with its dominance hovering around the 60% mark.

Some Ethereum owners consider this phase a valuable chance, strategically preparing themselves for possible profits when the movement starts picking up speed.

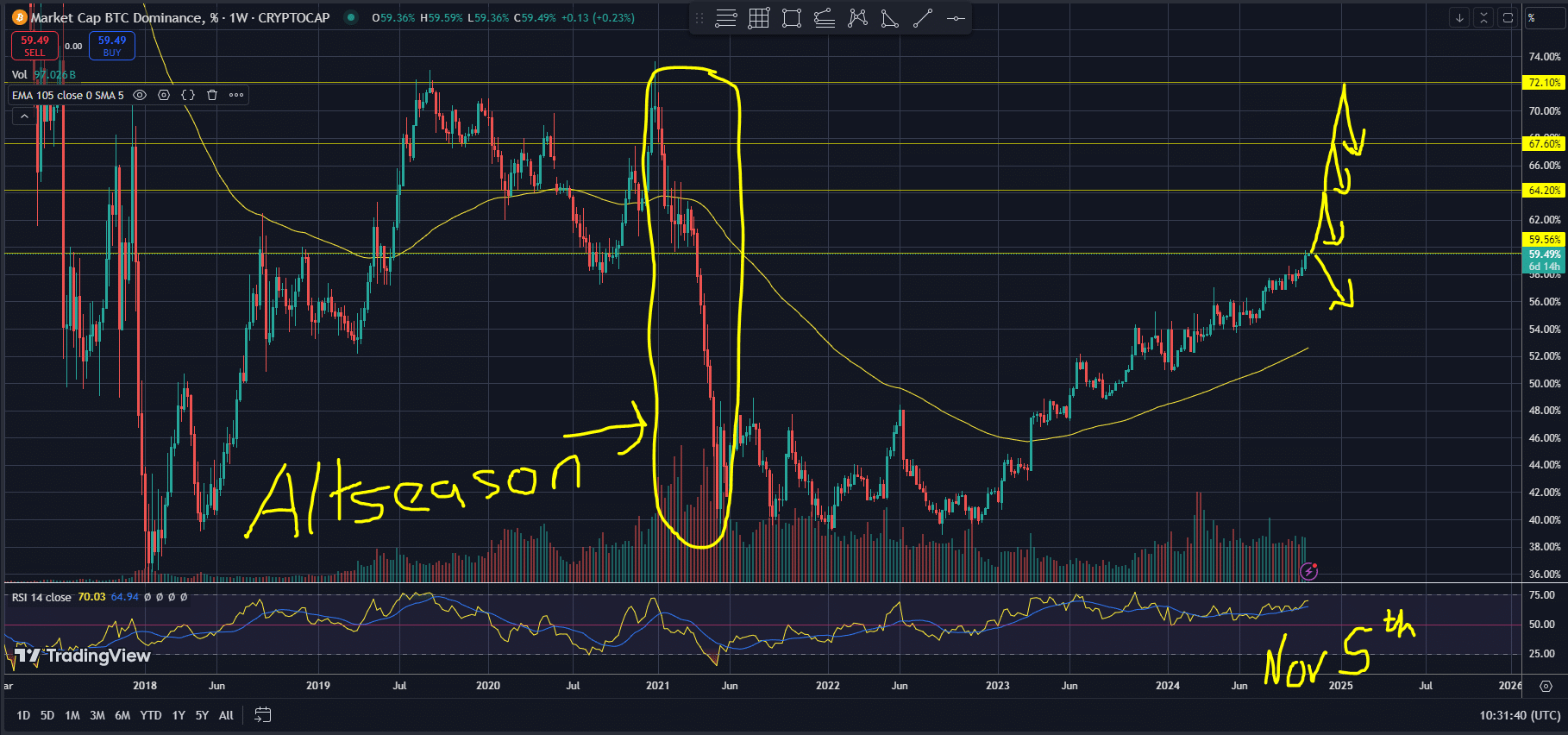

On the other hand, some are advocating for caution, pointing out that a substantial increase in price might not happen until Bitcoin’s dominance noticeably decreases substantially.

ETH Supertrend indicator is bullish

Even as more money poured into Bitcoin, Ethereum held its ground with strength, thanks in part to its Supertrend indicator, which consistently showed a positive outlook.

Despite dropping as low as $2,640, Ethereum’s repeated formation of higher lows has instilled optimism in long-term investors, suggesting a prolonged bullish trend could be on the horizon.

According to Ethereum’s Supertrend analysis, if ETH manages to break past the $2,570 barrier, it might lead the bulls to drive the price upwards further.

To numerous market observers, the current position of Ethereum serves as not just an opportunity to invest, but also a moment of strategic foresight.

Despite the volatile market changes, there have been strong signs of recovery akin to past market cycles, as seen with assets such as Solana that bounced back following prolonged low points.

An “altseason” might be approaching – this is a term frequently used by traders to refer to a timeframe during which Ethereum and other alternative cryptocurrencies tend to surpass Bitcoin in performance.

Currently, Bitcoin’s stronghold of more than 60% continues to serve as a notable sign of the market’s present preference for security-oriented investments.

Approaching November, events such as the U.S. elections might lead to market turbulence, potentially causing a rise followed by a decline in Bitcoin’s influence over the cryptocurrency market.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Experts believe that this transition could potentially set up circumstances favorable for an ‘altcoin season’ if funds flow towards Ethereum and other alternative cryptocurrencies, igniting a widespread price surge.

In the near future, the behavior of Ethereum’s price will continue to be a key area of interest among traders. It is anticipated that if Bitcoin’s influence decreases, Ethereum might experience a significant increase in value, particularly if there’s a shift in momentum and investment away from Bitcoin.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Gold Rate Forecast

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Elder Scrolls Oblivion: Best Thief Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Silver Rate Forecast

- Elder Scrolls Oblivion: Best Sorcerer Build

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

2024-10-29 10:18