- Cardano NVT ratio surged to June levels, signaling further downside.

- ADA has declined by 8% over the past month.

As a seasoned researcher with over a decade of experience in the cryptocurrency market, I have seen my fair share of bull and bear runs. Currently, the situation with Cardano [ADA] is a bit concerning. Despite a brief recovery following Bitcoin’s surge to $72k, ADA has been on a downward trajectory for the past month, declining by 8%.

As a researcher examining the cryptocurrency market, I’ve noticed that Cardano [ADA] has been on a steady downward trend over the past month. Yet, with Bitcoin‘s recent surge to a new high of $72k and the broader crypto market responding positively, there have been signs of a moderate recovery for ADA on daily charts as well.

In fact, at the time of writing, Cardano was trading at $0.358, a 3.81% increase over the past day.

Previously, I observed a descending trend with ADA, experiencing a drop of 8.0%. Given the persistently bearish market sentiment, there’s apprehension among analysts about potential future declines.

IntoTheBlock analysts have suggested further decline, citing the rising NVT Ratio.

Cardano’s NVT soars to 5-month high

Based on data from IntoTheBlock, the Network Value to Transactions (NVT) ratio for Cardano has reached its peak levels seen in June, suggesting a reduction in network activity compared to its price increase.

If an asset’s NVT (Network Value to Transactions) ratio is structured this way, it indicates that Cardano (ADA) may be overpriced. This assumption is supported by ADA’s less-than-stellar performance in recent times. Consequently, under these circumstances, there could be a potential continued drop in the price of this altcoin.

Based on this examination, historical trends suggest that an increase in the NVT ratio often signals an upcoming drop in prices.

Consequently, if there’s no rise in on-chain activities, it might be challenging for the value of Cardano to sustain its upward trend.

What does it mean for ADA price charts?

According to IntoTheBlock’s analysis, a decrease in on-chain activity often signals a potential continuation of the price drop.

According to AMBCrypto’s assessment, while Cardano (ADA) has seen some growth recently, the broader cryptocurrency market outlook remains generally negative.

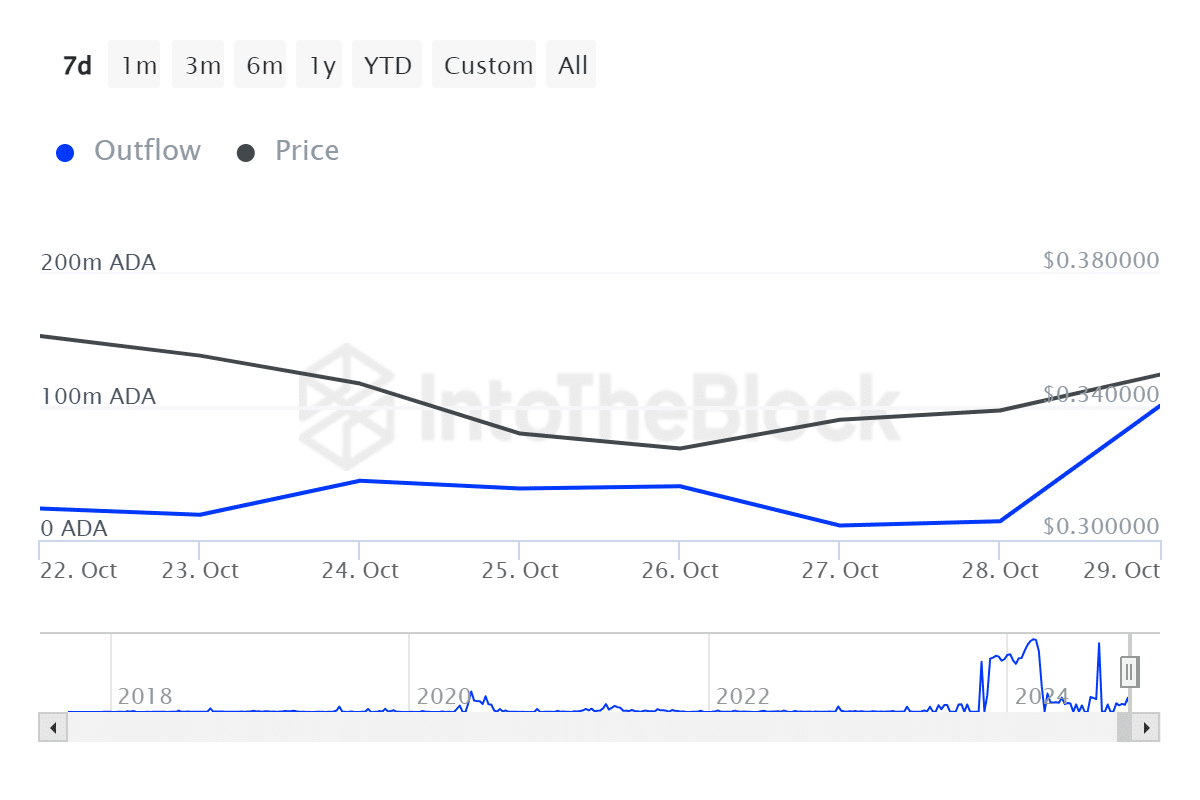

For example, Cardano’s large holder’s outflow has surged over the past week.

Based on information from IntoTheBlock, there’s been a significant increase in the amount of ADA tokens being moved out by large holders. This surge has grown from approximately 10.84 million ADA tokens to around 100.88 million ADA tokens, representing an impressive rise of over 830% in their holdings.

Such a substantial sell-off indicates that whales and significant investors might be exiting their positions, either to cut their losses following recent market declines or to cash out after enjoying gains. This action hints at a lack of confidence among major investors regarding the potential success of the altcoin.

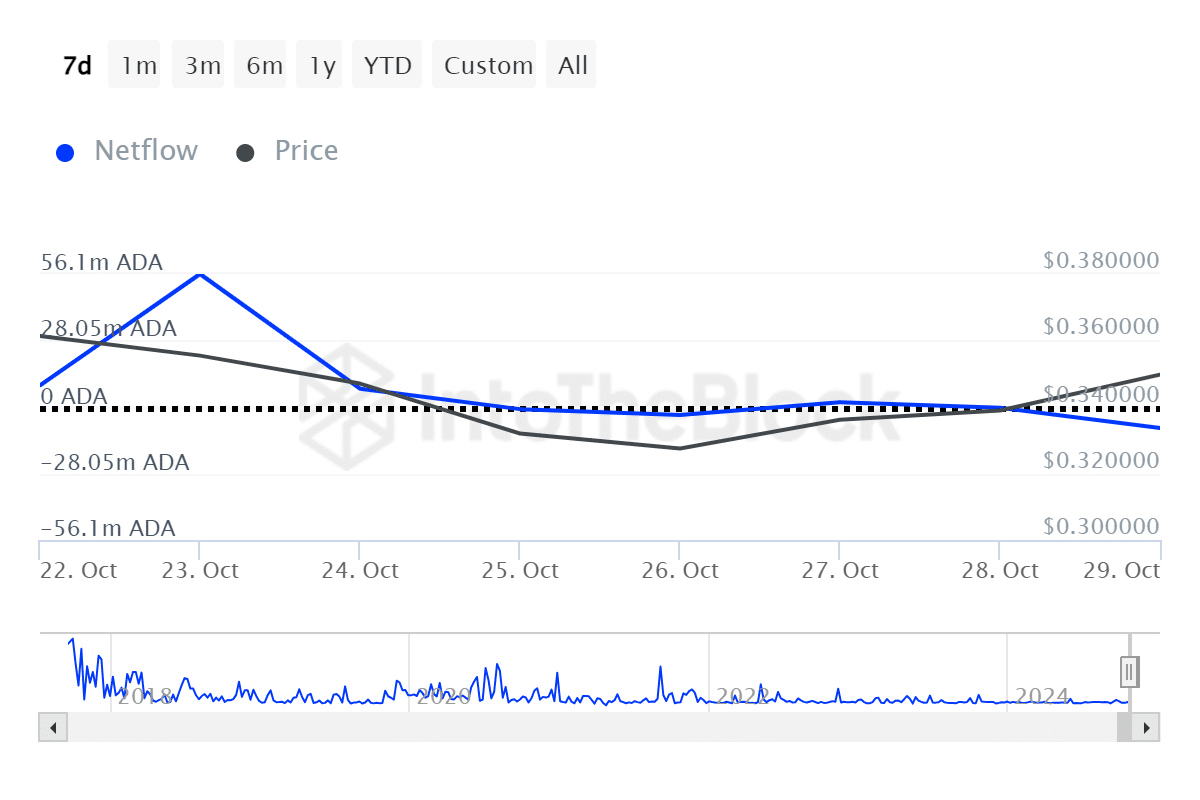

This phenomenon is further strengthened by a decline in large holders’ netflow.

The number has decreased dramatically from 56.1 million to -8.87 million, indicating a higher rate of withdrawals compared to deposits (or inflows).

Essentially, ADA’s price has been having difficulty sustaining a rise, and as a result, it has been moving within a falling trendline for about a month. Given the current pessimistic feelings in the market, ADA lacks the strength to escape from this downward pattern.

Read Cardano’s [ADA] Price Prediction 2023-24

As an observer, I’ve noticed from my research with IntoTheBlock that for the price of ADA to increase, it’s crucial to witness a significant boost in its on-chain activities.

If it doesn’t manage to build momentum, the price of the altcoin might drop down to $0.32. But if it gains strength and challenges the current norms, Cardano (ADA) may aim for a temporary high of $0.38.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- AUCTION PREDICTION. AUCTION cryptocurrency

- `Tokyo Revengers Season 4 Release Date Speculation`

- ETH PREDICTION. ETH cryptocurrency

- How to Install & Use All New Mods in Schedule 1

- Solo Leveling Arise Amamiya Mirei Guide

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- JK Simmons Opens Up About Recording Omni-Man for Mortal Kombat 1

- `Kylie Kelce Spills the Tea on Travis Kelce and Taylor Swift’s Relationship`

2024-10-30 15:04