- Uniswap’s monthly L2 volume has surged to $18.23 billion, signaling strong investor confidence and market activity.

- Technical indicators and whale activity suggest a bullish outlook for UNI, despite rising selling pressure.

As a seasoned researcher with years of experience analyzing cryptocurrency markets, I must say that Uniswap’s [UNI] recent surge in monthly L2 volume to $18.23 billion is truly eye-catching. Having closely monitored this space for some time now, it feels like watching a rocket launch – the excitement never fades!

🔥 EUR/USD Rollercoaster Ahead After Trump Tariff Plans!

The euro faces intense pressure — shocking forecasts now revealed!

View Urgent ForecastThis month’s (October) layer 2 (L2) transaction volume for the Uniswap [UNI] Protocol has soared to an astonishing $18.23 billion, marking a more than double increase compared to last October’s $7.34 billion. This substantial surge suggests strong growth and increased activity within the Uniswap network.

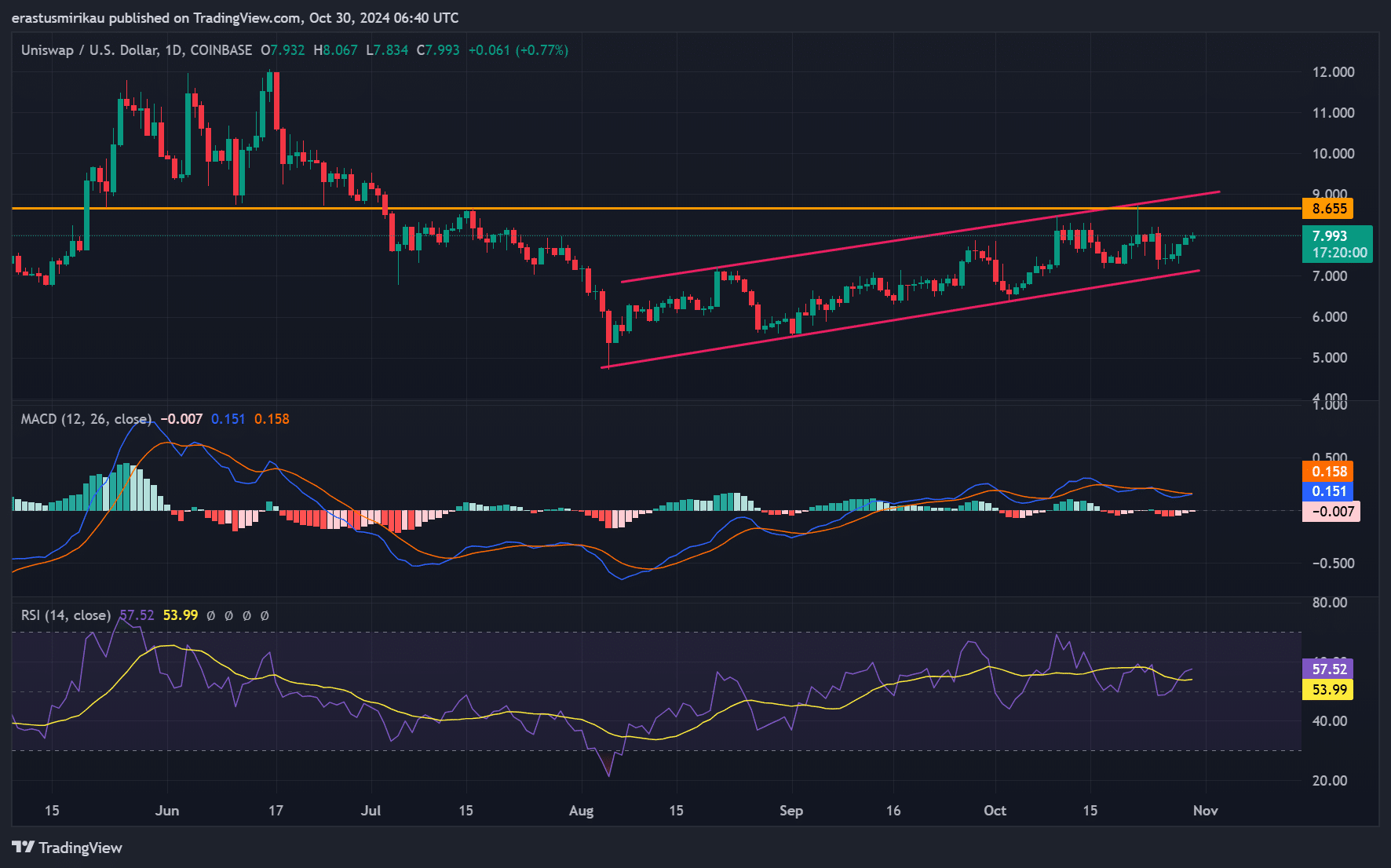

Currently, UNI is being traded at $8.02, representing a 1.82% rise over the past day. Could this boost in trading activity suggest a positive trend for Uniswap’s market standing and user interaction in the remaining days of the month?

What do the technical indicators reveal?

Examining the MACD (Moving Average Convergence Divergence) and RSI (Relative Strength Index) provides additional understanding. The MACD is exhibiting a bullish crossover, where the signal line is on an upward trajectory. This trend usually signifies growing momentum, implying possible price increases.

Moreover, right now, the Relative Strength Index (RSI) stands at 57.52, implying that UNI is in a neutral state, though it leans slightly toward a bullish outlook. This mix of signals implies that the market could potentially see additional upward momentum if conditions continue to be advantageous.

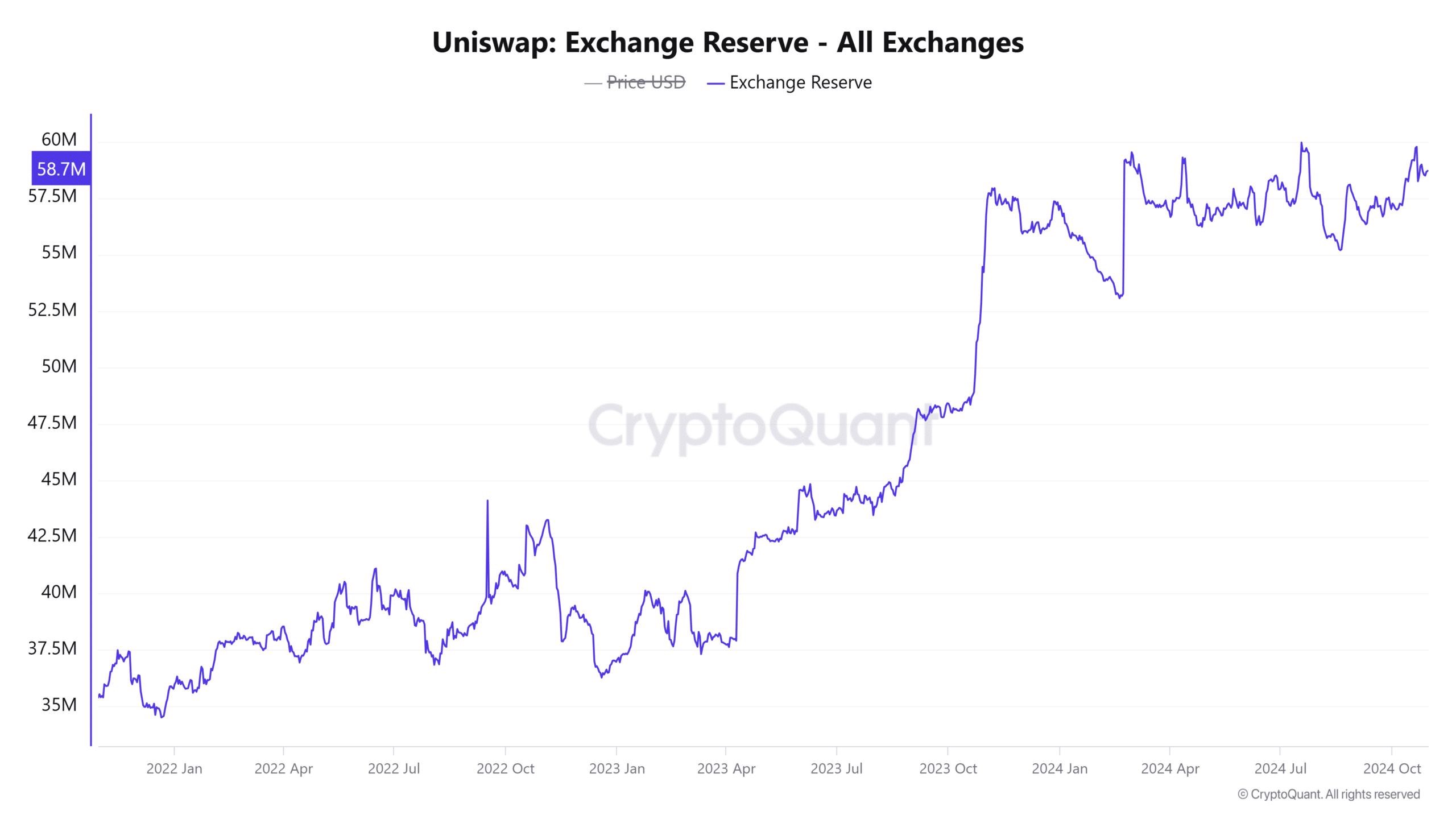

What’s happening with UNI’s exchange reserves?

The exchange reserves for UNI stand at approximately 58.70 million, a modest increase of 0.28% over the past day. This uptick in reserves often signifies increased selling pressure.

As the trading activity increases and more users join, there’s a chance that this factor could find equilibrium on its own. It would be prudent for traders to keep a close eye on this reserve to detect any changes indicating shifts in market opinion.

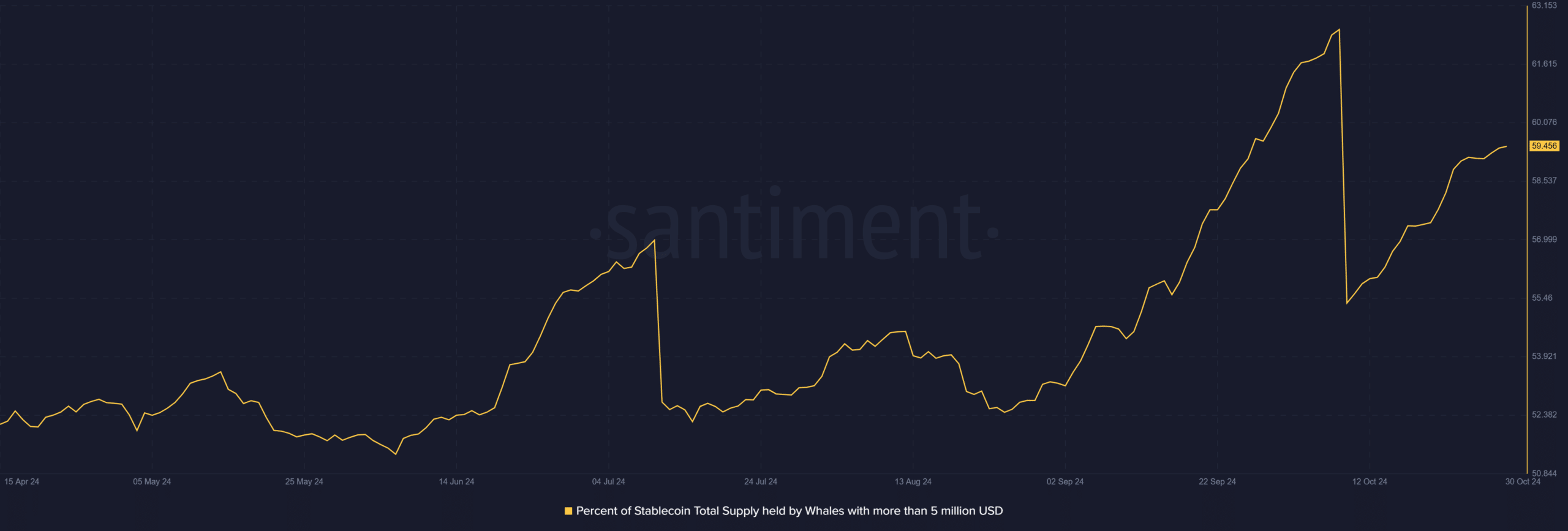

Are whales accumulating UNI?

As an analyst, I’ve discovered that approximately six out of every ten units of stablecoin are held by entities possessing more than five million dollars worth. This level of concentration suggests a substantial control over market dynamics and potential significant impact on price fluctuations.

These big players significantly influence market trends, implying they can either maintain price consistency or trigger fluctuations. It’s crucial for investors to keep this factor in mind when predicting the movement of UNI within the market.

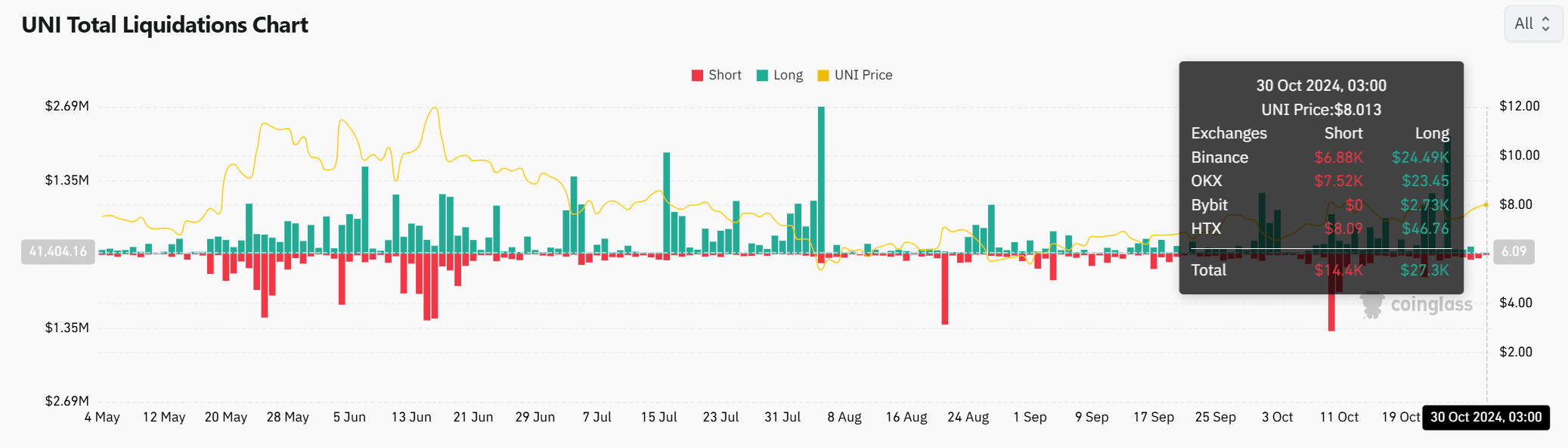

How does liquidation affect the current scenario?

The current figures from UNI’s liquidation data indicate around $144,400 in short positions and only about $27,300 in long positions. This significant imbalance could result in swift price fluctuations, particularly if market circumstances change abruptly. Consequently, traders should stay alert.

In summary, the significant increase in Uniswap’s monthly trading volume, combined with positive technical signs, suggests a rising trend. Yet, it’s important to note that the market can be unpredictable due to factors such as large-scale investor activities (whales) and exchange reserves.

Should Uniswap continue its present trajectory, it’s plausible that it may lead to additional price increases for UNI within the upcoming weeks. It would be wise for investors to remain vigilant, as this could provide chances to seize potential profits.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- OM PREDICTION. OM cryptocurrency

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Gold Rate Forecast

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Solo Leveling Season 3: What You NEED to Know!

- EUR PKR PREDICTION

- Brandon Sklenar’s Shocking Decision: Why He Won’t Watch Harrison Ford’s New Show!

2024-10-30 22:48