- Dogecoin rallied by 22% amid the Musk-Trump buzz, with 86% of holders in profit and active large transactions

- On-chain metrics flashed generally bullish signals too

As a seasoned analyst with years of experience navigating the cryptocurrency market, I find the current state of Dogecoin (DOGE) intriguing. The recent 22% rally, pushing DOGE to its highest point since May 2024, is undeniably captivating, especially in light of the Musk-Trump buzz.

Over the recent span of days, I’ve noticed a significant surge in Dogecoin’s (DOGE) price, propelling it by more than 22% within just a week to reach $0.1704. Remarkably, this current level represents DOGE’s highest point since May 2024, underscoring its impressive recovery trajectory.

Recently, the relationship between Elon Musk and former President Donald Trump has piqued curiosity among Dogecoin investors and spectators. The news of Musk’s collaboration with Trump’s administration on efficiency projects has fueled speculation, particularly due to the similar “D.O.G.E.” acronym they both use.

Musk’s longtime connection with Dogecoin, such as referring to himself as the “Dogecoin Dad” and tweets that fueled previous price increases, have heightened expectations in this context.

Given that the likelihood of Donald Trump securing the 2024 Presidential election, as perced by Polymarket, is currently estimated at 65.1%

Positive on-chain data for Dogecoin

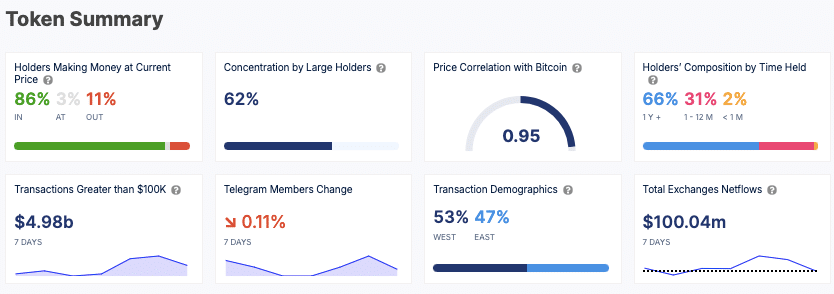

According to data from IntoTheBlock, Dogecoin’s transaction history has been consistent with its current price rise, indicating strong faith among holders. Approximately 86% of these holders are in profit right now, suggesting that a significant number of investors bought in at lower prices.

To add, approximately two out of three investors have maintained their investments for more than a year, indicating a strong foundation of long-term investors.

Over the last seven days, there’s been about $4.98 billion worth of large transactions (over $100,000) taking place. This high volume suggests continued involvement by significant investors or financial institutions.

With a large portion (62%) of the supply controlled by significant players, there’s a possibility that price fluctuations could occur if these entities decide to shift their assets.

As I delve into the analysis of cryptocurrencies, it’s evident that Dogecoin’s value remains significantly tied to Bitcoin‘s price movements. This is underscored by a strong correlation coefficient of 0.95, suggesting that when Bitcoin’s price rises or falls, so does Dogecoin’s, to a large extent. In essence, Bitcoin seems to be the key driver behind Dogecoin’s price fluctuations in this context.

Global interest and market signals

An analysis of transaction data shows a steady worldwide enthusiasm for Dogecoin, as 53% of transactions originate from Western territories while 47% stem from Eastern countries. This distribution hints at a relatively even global interest in Dogecoin.

Over the last seven days, there has been a shift in trading patterns indicated by a net flow of approximately $100.04 million. This trend could suggest heightened liquidity or possible selling activity.

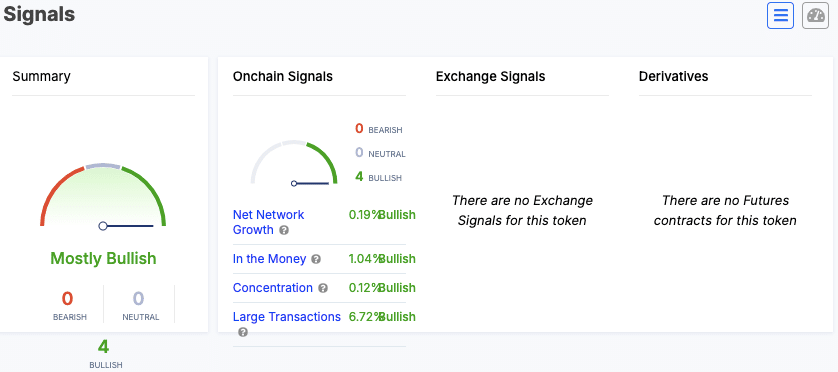

It’s important to mention that the analysis of Dogecoin based on on-chain signals generally indicated a bullish stance. Key indicators like the increase in network participants, the rise in profitable holders, the distribution of supply, and high transaction values all pointed towards optimistic trends.

Collectively, these findings suggest that the network is actively used, it generates profits, and there’s a significant occurrence of large transactions.

Recent activity in large transactions

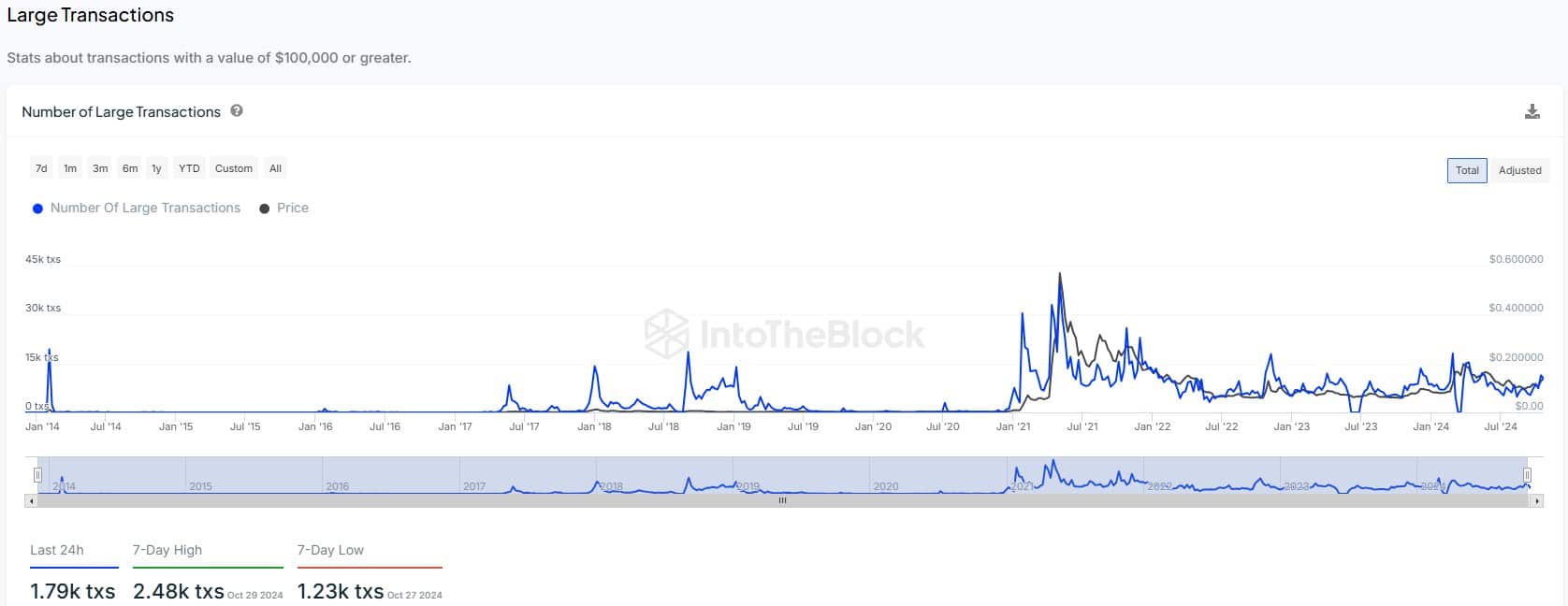

As per the latest figures, Dogecoin has consistently handled numerous significant transactions. To be specific, over 1,790 substantial transactions have been registered in just the past day, suggesting that bigger investors are actively participating in the market.

On October 29, 2024, we saw a peak in activity with 2,480 significant transactions, whereas the minimum was 1,230 on October 27. These figures suggest fluctuations in trading volumes during that particular week.

Examining past information, we found instances where big transaction surges coincided with substantial price fluctuations. In the beginning and middle of 2021, this pattern was particularly noticeable as DOGE’s price experienced a notable surge in value on the graphs.

Options market data

Ultimately, Data from Coinglass gave us more insight into the Dogecoin trading environment. Notably, the volume of Options traded recently fell by 88.62%, amounting to a total of $89,910.

Conversely, the Open Interest for Options increased by 14.60% to reach approximately $503,510. This significant rise in Open Interest could imply that traders are preparing to take positions in anticipation of potential shifts in Dogecoin’s price.

Read More

- DYM PREDICTION. DYM cryptocurrency

- CYBER PREDICTION. CYBER cryptocurrency

- ZK PREDICTION. ZK cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- POPCAT PREDICTION. POPCAT cryptocurrency

- TURBO PREDICTION. TURBO cryptocurrency

- Top gainers and losers

- SKEY PREDICTION. SKEY cryptocurrency

- ETH CAD PREDICTION. ETH cryptocurrency

- BNB PREDICTION. BNB cryptocurrency

2024-11-01 12:11