- Sui eclipsed Solana and Ethereum on net inflows.

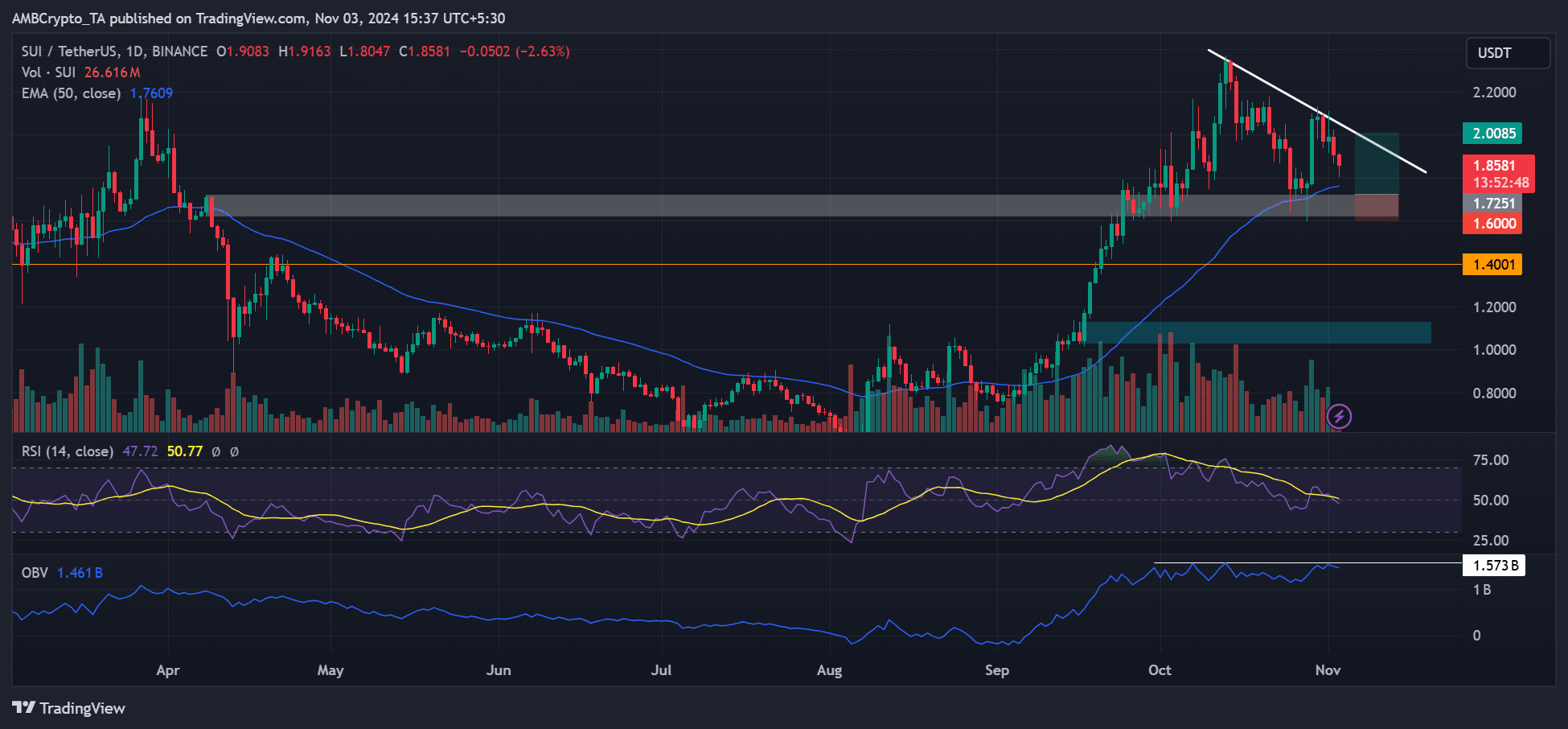

- But SUI’s pullback could extend lower to $1.7 if the weakening persisted.

As a seasoned crypto investor with over a decade of experience in this dynamic market, I must admit that Sui [SUI] has caught my attention lately. Having closely followed its meteoric rise and impressive net inflows surpassing Ethereum [ETH] and Solana [SOL], it’s clear that Sui is carving out a niche for itself as a serious contender in the blockchain space.

In 2024, Sui [Sui] is one of the leading up-and-coming blockchain platforms, poised to potentially carve out a significant portion of the market currently held by Ethereum [ETH] and Solana [SOL].

In recent times, the chain has seen more net inflows compared to Ethereum (ETH) and Solana (SOL), according to Adeniyi Abiodun, a co-founder of Mysten Labs and the head of the team responsible for the Sui chain.

He said,

“Sui recorded higher net inflows than Solana and Ethereum combined with $24.3M”

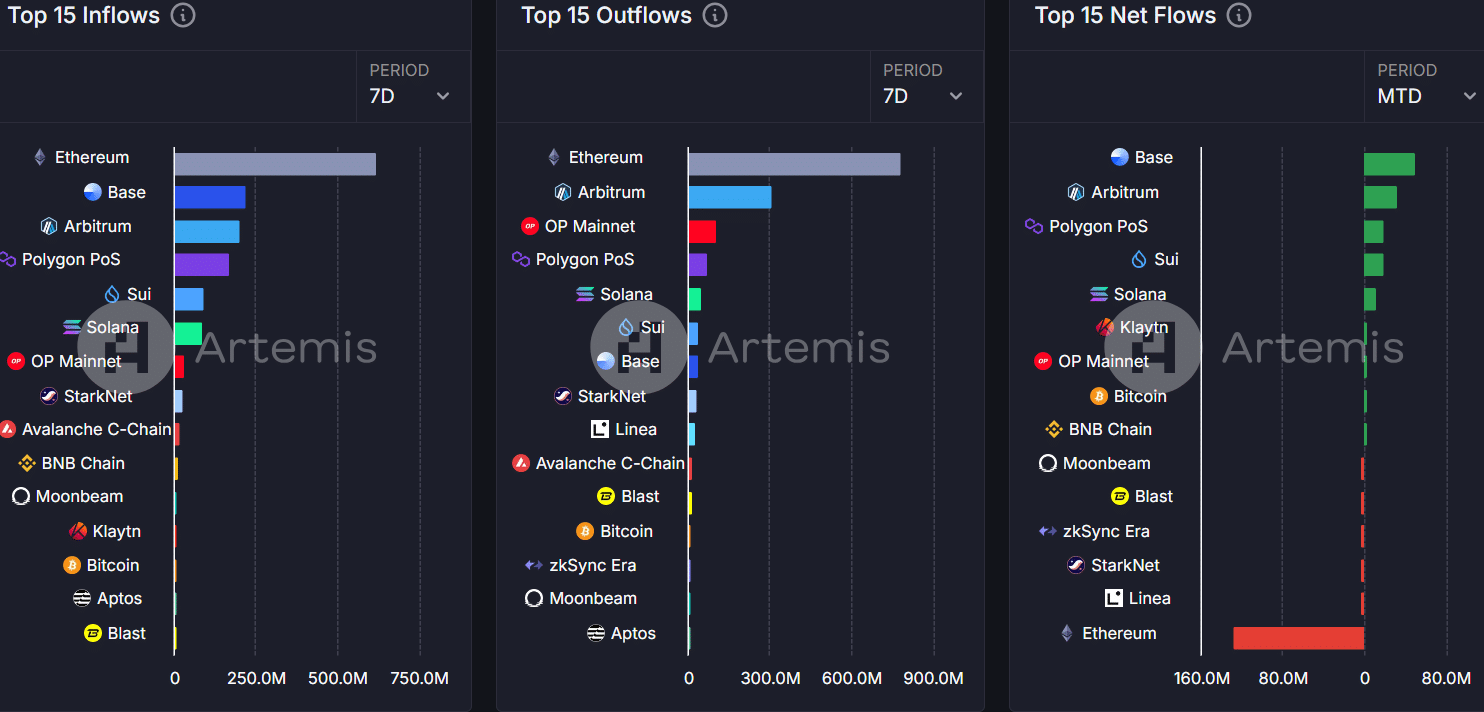

Over the last week, data from Artemis indicates that Sui consistently held a substantial advantage in terms of inflows, outflows, and net flows compared to other periods.

It saw more inflows than Solana on the weekly charts. On a month-to-date (MTD) basis, it had $19.3 million in net inflows compared to Solana’s $12.3 million as of the time of writing.

SUI vs SOL

It’s been suggested that SUI is an effective substitute for SOL, with certain experts predicting that the price trend of SUI might mirror that of SOL.

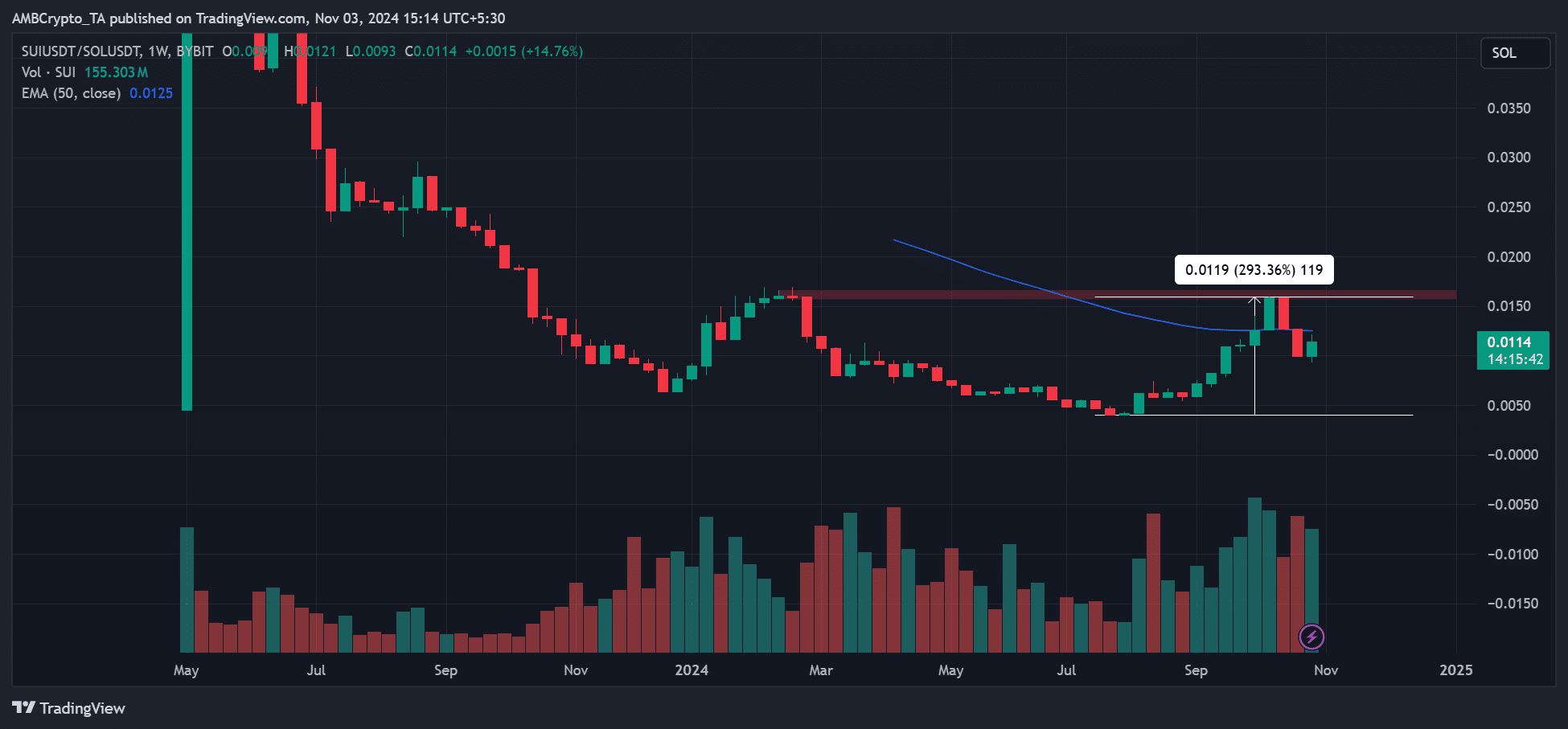

Indeed, SUI displayed superior performance compared to SOL during August and September, as evidenced by the dramatic surge of approximately 300% in the SUI/SOL value ratio on the price charts.

The SUI/SOL ratio tracks SUI’s relative performance to SOL. However, in October, the ratio declined, suggesting that SUI underperformed SOL.

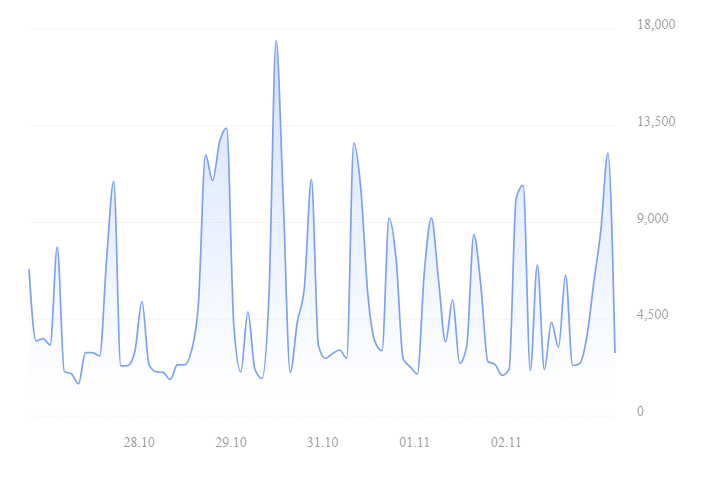

Nonetheless, the chain experienced a moderate increase in its network expansion, suggesting growing interest and potentially elevating SUI prices. Furthermore, the number of new accounts soared by 5% over the past week, reaching 862,700 – an indication of heightened market attention towards this altcoin.

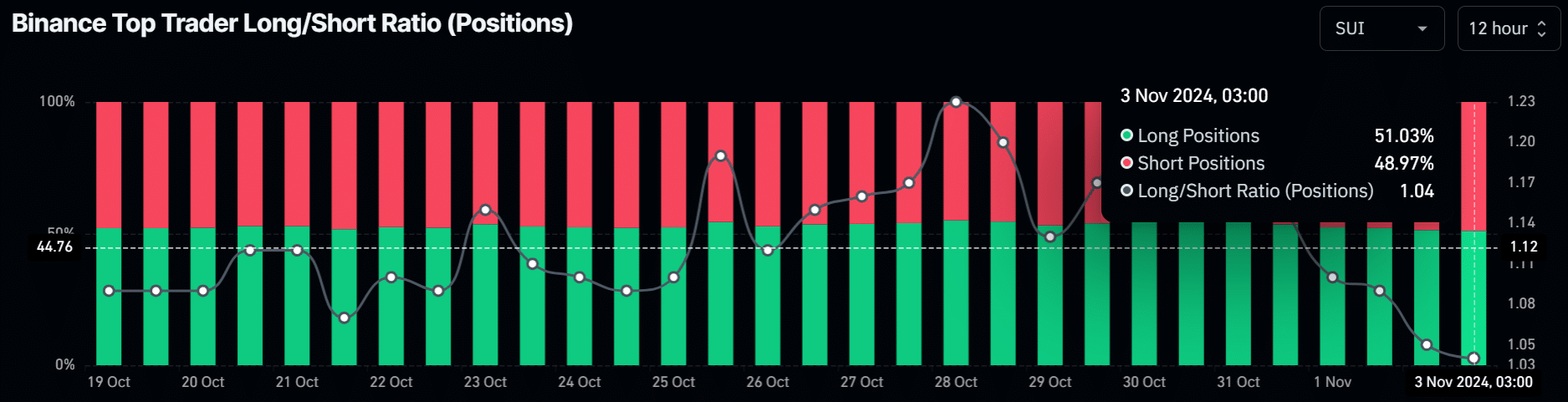

Regardless of the increased curiosity, SUI’s market stance was nearly neutral, reflecting a similar outlook as the overall market trend before the U.S. elections.

Read Sui [SUI] Price Prediction 2024-2025

In Binance, about half of the top traders (51%) were holding long positions, while slightly less (49%) were in short positions, indicating a close balance. This equilibrium signifies that the market’s immediate future could swing based on the election results, with either direction being possible.

Nevertheless, the graph indicated robust resistance above $1.6, leading to a bounce-back in prices during September and October when this level was hit.

If the pattern repeats, SUI could recover from it and eye the trendline resistance near $2. That would be a 16% potential recovery from the $1.6 – $1.7 support zone.

Read More

- AUCTION PREDICTION. AUCTION cryptocurrency

- POL PREDICTION. POL cryptocurrency

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Sabrina Carpenter, Bad Bunny, Pedro Pascal Star in Hilarious Domingo Remix

- Final Destinations Bloodlines – TRAILER

- Microsoft Stands Firm on Gulf of Mexico Name Amid Mapping Controversy

- GBP AED PREDICTION

- Can crypto traders out-predict Wall Street on Coinbase Q1 earnings?

- LINK PREDICTION. LINK cryptocurrency

2024-11-03 23:03