- PEPE was down 15% from its recent high

- Will short-sellers extend gains before the U.S election’s outcome?

As a seasoned crypto investor with battle-hardened nerves and an eye for trends, I find myself observing the current state of PEPE with a mixture of curiosity and caution. The 15% dip from its recent high has certainly caught my attention, and as I look to the U.S election’s outcome, I can’t help but wonder if short-sellers will extend their gains.

Over the course of the weekend, I’ve witnessed a thrilling surge for short-sellers as the weakening Bitcoin [BTC] presented an opportune moment for these investors to reap profits. Similarly, the meme coin PEPE didn’t escape this trend. Short-sellers who jumped into the market at $0.000010 have already secured a 15% return on their investment, as of press time.

Will the shorting yield more gains before the U.S election’s outcome is known?

PEPE teetering on October support

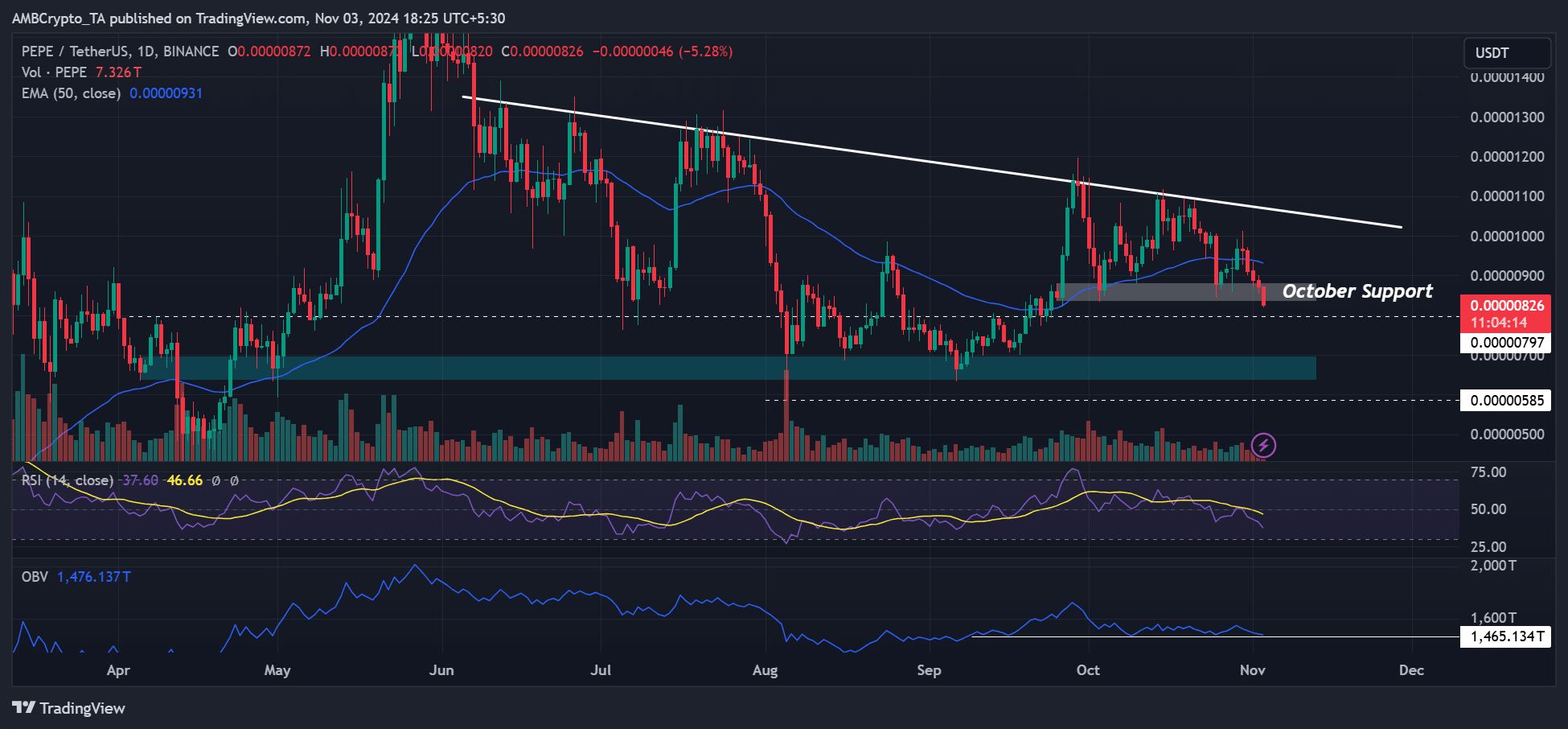

As I pen this down currently, PEPE’s 15% drop has nudged it back towards its October support level. If we were to break through this support, it might encourage bears to further drive down PEPE, potentially leading to additional losses.

If October’s backing weakens, aggressive sellers who come in late and early bear investors might push PEPE down to $0.0000080 or the lower support level at $0.0000070 (cyan). This would represent a potential 30% profit for short-sellers if this pullback reaches the second target.

Given that the market’s future trajectory may hinge on the results of the U.S election and might potentially change course, it’d be prudent to consider locking in some profits ahead of time.

In other words, a low RSI value strengthened the position of bears (those betting on a decrease in price), and a moderate On-Balance Volume (OBV) provided some support for the bearish argument.

Instead of a sudden Bitcoin (BTC) turnaround potentially canceling out your short position, keep an eye on the 50-day Exponential Moving Average (EMA) and the resistance trendline (marked white) as potential optimistic goals if a rally occurs.

PEPE active addresses dropped

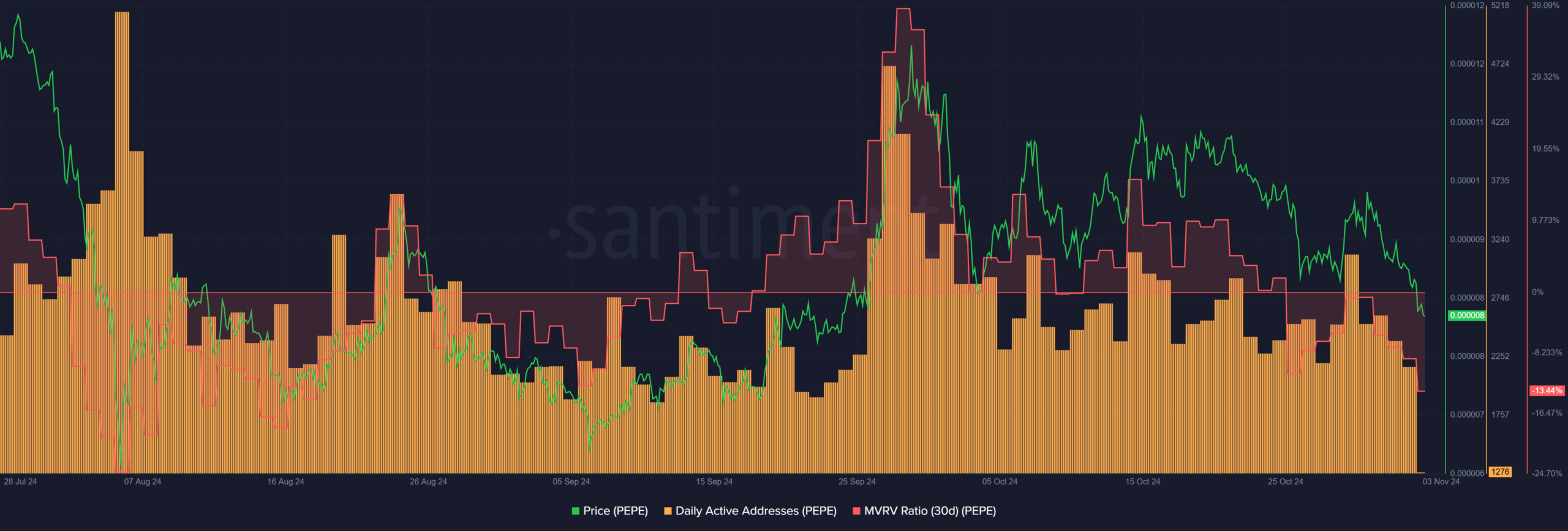

Since the end of October, there’s been a significant decrease in the number of active wallets associated with PEPE, suggesting a lack of enthusiasm and demand for it in the market. This trend has strengthened the case for bearish investors, particularly as we approached the announcement of the U.S election results.

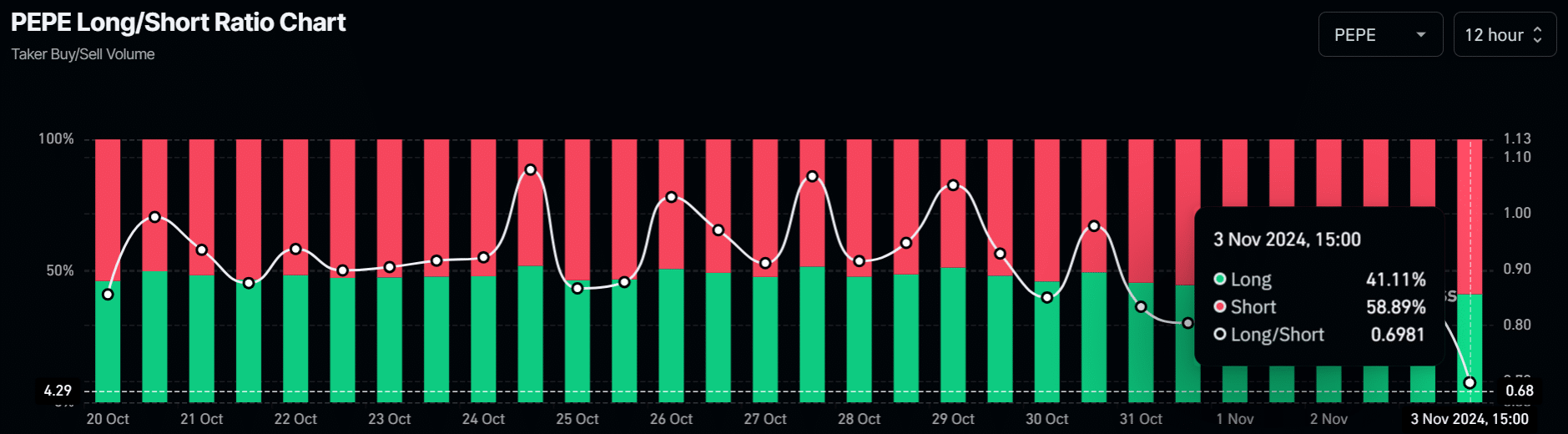

Ultimately, it was found that approximately 58% of PEPE positions were bets against (short) rather than for (long). This heavy short positioning suggests a predominantly negative outlook on the frog-themed memecoin, which could make it an attractive option to sell short.

Read PEPE [PEPE] Price Prediction 2024-2025

To summarize, the current market turmoil presents an opportunity for short-sellers to increase their profits, with stocks like PEPE not excluded. Yet, these gains can only be realized before the market settles following the outcome of the U.S election.

For investors and those looking to hold PEPE, grabbing it at discounted values during this panic period could pay off in the medium term. Especially if the market recovers strongly after the elections.

Read More

- AUCTION/USD

- Pregnant Woman’s Dish Soap Craving Blows Up on TikTok!

- Is Disney Faking Snow White Success with Orchestrated Reviews?

- Pokémon Destined Rivals: Release date, pre-order and what to expect

- Stephen A. Smith Responds to Backlash Over Serena Williams Comments

- JK Simmons Opens Up About Recording Omni-Man for Mortal Kombat 1

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- POL PREDICTION. POL cryptocurrency

- Daredevil: Born Again Spoiler – Is Foggy Nelson Alive? Fan Theory Explodes!

- `Cillian Murphy to Play Quirrell in New Harry Potter Reboot`

2024-11-04 10:15